Broadcom is expected to report fourth-quarter results next month.

As big tech continues to pour record levels of capital into building data centers and purchasing chips, semiconductor stocks are still one of the strongest themes in artificial intelligence (AI) trading.

While Nvidia is still the star of the show, rival platform Advanced micro devices has also seen its share of investor enthusiasm. Moreover, Intel seems to be experiencing something of a renaissance, while the shares of Micron technology are skyrocketing as investors wake up to the importance of high-bandwidth memory solutions for AI workloads.

Considering all these moving pieces, Broadcom‘S (AVGO +1.27%) Its 55% gain so far this year seems overlooked compared to some of its peers in the chip landscape.

Let’s explore how Broadcom is quietly benefiting from the AI revolution, and assess why the company’s long-term prospects look attractive. From there, I’ll break down why growth investors might want to consider a position in Broadcom as December approaches.

Broadcom is building momentum among the largest AI publishers

Broadcom divides its financial services into two categories: semiconductor solutions and infrastructure software. Each of these markets is benefiting from the rising demand for AI.

On the semiconductor side, Broadcom is seeing unprecedented demand for its custom application-specific integrated circuits (ASICs). Essentially, GPUs designed by Nvidia and AMD are purpose-built to perform a variety of tasks. Broadcom’s ASICs come into the picture when developers need robust chipsets for application-specific functions.

Broadcom has already attracted the attention of several hyperscalers for its custom silicon solutions. About a month ago, OpenAI and Broadcom announced a partnership to deploy 10 gigawatts of custom AI accelerators over the next few years.

Moreover, Metaplatforms has reportedly worked with Broadcom on its own custom chip designs. With Meta CEO Mark Zuckerberg recently telling investors that the company will continue to accelerate its capital expenditures (capex), Broadcom appears well-positioned to benefit from its ongoing relationship with the social media giant.

In addition, Broadcom also collaborates with Alphabet, plays a crucial role in building the custom hardware for the internet giant’s tensor processing unit (TPU).

Finally, Broadcom management recently revealed that the company has secured a new chip deal worth $10 billion, on top of its existing hyperscaler book. While the name of this customer remains a mystery, I recently outlined why I think it could be OpenAI rival Anthropic.

Given Broadcom’s strong preference for semiconductor solutions, it’s no wonder the company has an estimated 75% market share for custom ASICs.

Image source: Getty Images.

The AI infrastructure is still in its infancy

From a macro perspective, investors have already gotten a detailed taste of how important infrastructure is to the broader AI movement. Earlier this year, OpenAI CEO Sam Altman said, Oracle founder Larry Ellison and Japanese billionaire Masayoshi Son of Soft Sofa announced a joint venture called Project Stargate. The goal of this initiative is to increase investment in U.S. AI infrastructure over the next four years.

When it comes to big tech specifically, research is key Goldman Sachs predicts that cloud hyperscalers Alphabet, MicrosoftAnd Amazonwill, combined with Meta, spend nearly $500 billion in AI capex next year alone. Perhaps even more optimistic are analysts at McKinsey & Company, who published a report suggesting that the total market size for AI infrastructure – from chips, networking equipment and energy solutions – could reach $7 trillion by the next decade.

This prediction is more in line with Nvidia CEO Jensen Huang, who has also suggested that AI infrastructure is a multi-billion dollar market.

Against this backdrop, it could be argued that Broadcom’s existing hyperscaler deals are small relative to the expected size of its overall AI infrastructure capabilities. Viewed through a different lens, Broadcom appears well-positioned to expand its relationships with developers as AI workloads grow larger and more complex, demanding more and more custom solutions.

Today’s change

(1.27%)$4.33

Current price

$344.31

Key data points

Market capitalization

$1606 billion

Day range

$329.11 -$344.70

Range of 52 weeks

$138.10 -$386.48

Volume

501K

Avg. full

23M

Gross margin

63.13%

Dividend yield

0.01%

Why Broadcom seems like a great buy right now

With earnings season coming to a close in the coming weeks, Broadcom is expected to report fourth-quarter fiscal 2025 financial results in mid-December.

Using the ‘Magnificent Seven’ as a proxy, it appears that spending on AI infrastructure remains a major priority among hyperscalers. Given these long-term tailwinds, I think Broadcom is well positioned to accelerate both revenue and profit growth in the AI infrastructure era.

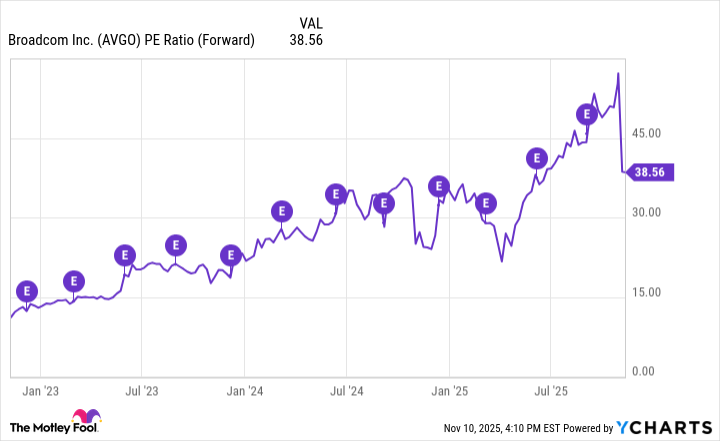

Furthermore, Broadcom’s stock has consistently risen during the AI revolution. If these trends are any indication, investors will continue to place a premium on Broadcom stock following the earnings reports (shown in the purple circles above).

Broadcom stock may not seem like much of a bargain with forward earnings of 38x. But when you consider that the AI infrastructure is still scaling, coupled with the company’s overall resilience over the past few years, Broadcom becomes a more attractive buy-and-hold opportunity for long-term investors – making now an interesting time to consider jumping into the stock.

Adam Spatacco holds positions at Alphabet, Amazon, Meta Platforms, Microsoft and Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Goldman Sachs Group, Intel, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 calls $395 on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 calls on Intel. The Motley Fool has a disclosure policy.