Bitcoin’s “whales” are getting bigger. This is indicated by a recent study by Gemini and Glassnode in which there is talk of the great “centralized Bitcoin” treasury, which already control 30.9% of the bitcoins that currently circulate. The data is striking, but it is not entirely conclusive, and the decentralization of cryptocurrency remains high.

216 ballenatos. In 2021 we talked about how the 10,000 most important investors in Bitcoin controlled more than a third of all cryptocurrencies in circulation. They were the great whales of the market, people or entities that had accumulated huge amounts of cryptodivisas. That concentration was already worrying, but now it is more: according to the data of the aforementioned study, there are now 216 large centralized entities that controls a third of all bitcoin in circulation.

An upward trend. The report indicates how the total number of bitcoins that have ended up acquiring the great institutional and custody entities has grown up to 6,145,207 bitcoins. That represents an increase of 924% in the amount of bitcoins that such entities had a decade ago.

Of hate to institutional love. During the past decade the vast majority of the institutions remained away from Bitcoin, but in recent times we have lived a unique change in the mentality of these entities. Companies and governments have begun to invest in Bitcoins in an extraordinary way, and institutional love is today a clear exponent of the situation – and the Price – of Bitcoin.

Companies that bet strongly. Bitcoin’s value does not suffer great changes weeks, but the enthusiasm on the part of the great entities continues. Strategy, the firm led by Michael Saylor, continues to Buy as if there were no tomorrow and already has 592,000 of these cryptodivises. There are very far away such as Mara Holdings (49,179) or Twenty One Capital, which already has 37,230 bitcoins. Tesla, by the way, has 11,509 bitcoins, although that unusual interest seems to have stopped. Companies such as Exchange Coinbase (9,267) or the “Mining” Hut 8 mining corp (10,273) group also demonstrate that interest in monopolizing more and more bitcoins.

And the countries, too. Not only are companies: some governments have also made strong investments in this cryptocurrency or have obtained it from seizures. The US is a good example: almost all of its 207,189 bitcoins come from the operations carried out against Silk Road or what was recovered in 2022 after the Bitfinex hacking in 2016. The North American country is the one that has the most BTC ahead of China (194,000) or the United Kingdom (61,000). El Salvador, who was especially noticeable to end up turning Bitcoin into legal tender and then reversing, has much less, 6,089 bitcoins. They are still many.

A misleading concentration. Although Gemini’s data is striking, they are also somewhat confusing, especially because in their definition of large entities the large markets for the sale of cryptocurrencies and ETFs and Bitcoin financial products enter. But it is that in reality the cryptocurrencies that accumulate these centralized entities – which are certainly – are not one of those entities in their vast majority, but of the investors that use them and operate in this market through such financial products.

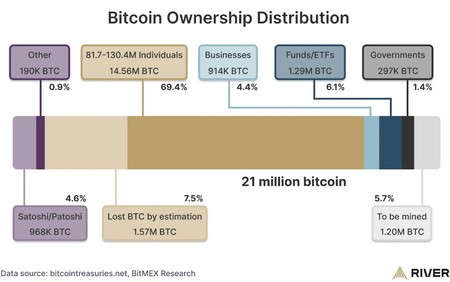

A more realistic figure. Similar studies such as Bitmex Research in April reveal a somewhat less worrying concentration. Of the 21 million bitcoin that will end up producing, 11.9% are in the hands of companies and governments, but above all of ETFs and funds, as Bitcintreasuries also indicates. The vast majority (69.4%) are in the hands of independent investors, and especially surprises how 7.5% of all bitcoins that have occurred have ended up being lost forever. That percentage was even greater in 2017, but since then it seems that those who invest in them have taken many measures to avoid losing them.

Imagen Destacada | Erling Løken Andersen

In WorldOfSoftware | A man threw his hard drive and lost 700 million euros in Bitcoins. Now you will have your own series