NVIDIA has unveiled its Drive AGX Hyperion 10 platform, a computing and sensor system designed for any manufacturer to produce Level 4 autonomous vehicles. Uber has already signed an agreement to deploy 100,000 units on its global network starting in 2027, and Stellantis, Lucid and Mercedes-Benz have also joined the project.

Why is it important. For years, autonomous driving has been a persistent promise often wrapped in marketing. NVIDIA has turned that promise into an industrial offering with standardized architecture, certified chips, and out-of-the-box simulations. It does not sell autonomous cars, but it does sell the operating system that will make them possible.

The contrast. Tesla has been selling autonomy as a leap of faith for a decade, with permanent updates, its own fleet and promises of “millions of autonomous Teslas” every year. NVIDIA, on the other hand, offers an open platform where any manufacturer can plug in their hardware.

- Tesla wants to be an equivalent to Apple in cars.

- NVIDIA prefers to be something more similar to Windows.

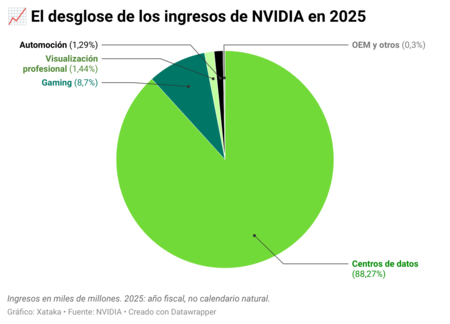

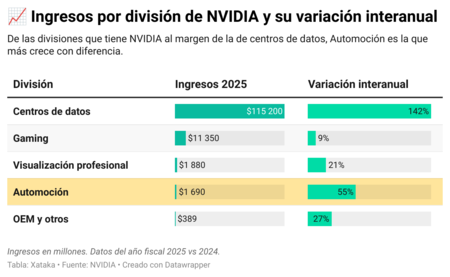

Between the lines. Automotive only accounts for NVIDIA 1.3% of its revenue, but that segment is growing faster than the rest. In any case, Uber’s announcement has no real timetable for those 100,000 units unless it has been made public.

Waymo, which has been developing its robotaxis for years, is now in its sixth generation and has the financial muscle of Alphabet behind it, it barely operates 2,000 of them. There is a considerable gap between ambition and reality.

The backdrop. Drive Hyperion 10 is based on two Thor chips (2,000 teraflops each), fourteen cameras, nine radars, one LiDAR and twelve ultrasonic sensors. NVIDIA has designed it with full redundancy: if a component fails, the vehicle stops safely to avoid chain errors that multiply the potential damage.

Lucid will be one of the first to offer Level 4 autonomous driving to individual customers and not just fleets. Its interim CEO has admitted that so far they have disappointed in terms of driving assistance. Their commitment to NVIDIA is the classic implicit recognition: it is better to Buy the brain than to build it.

The money trail. NVIDIA will not continue building robotaxis for now, but for now it sells infrastructure: chips, simulation software, synthetic data… And it charges for each vehicle that uses its platform. It’s a more predictable revenue model than depending on full autonomy to arrive one day.

Huang, in any case, has said that that moment is near. The interesting thing is not whether he is right, but that his definition no longer depends on blind faith. It depends on regulators, certifications and industrial tests. Autonomy has ceased to be science fiction and has become an engineering problem. And those problems are solved with processes, not with promises.

In WorldOfSoftware | China has turned the electric car market into a crazy race. And Porsche pays for it with billion-dollar losses

Featured image | WorldOfSoftware