TGIF!

Today, the US will announce its “crypto strategic reserve,” a carefully selected collection of digital assets, including altcoins like Cardano and Ripple, developed under a federal regulatory framework. It marks the first time the US will include these alternative cryptocurrencies in its reserve.

Let’s get into it.

- Quick Fire

with Solomon Ayodele

with Solomon Ayodele - Nigeria’s treasury payment shake-up: Remita’s grip loosens but not lost

- Nigerian ride-hailing drivers launch SimpliRide to challenge industry giants

- Chowdeck slashes contract staff by 68%, fast-tracks its Ghana expansion plans

- Funding Tracker

- World Wide Web 3

- Events

Features

Quick Fire  with Solomon Ayodele

with Solomon Ayodele

Solomon is Head of Innovation at WEMA Bank, overseeing Ventures, R&D, Programs, and Product Innovation. He led the establishment of IDEAX Labs, the bank’s first Innovation Labs since 1945. Beyond Finance & Technology, he advises several African startups and creates multi-generational social impact through Boys Quarters Africa, a leading transformational movement for boys. With expertise in Innovation & Strategy, his mission is to catalyze Africa’s future through his voice & the enabling power of technology.

Imagine the bank is a big, cool playground, and my job is to find new toys and games that everyone will love to play with. These toys and games help people save money, buy things, and have fun while using them. So, I make sure the playground is always exciting and useful for everyone!

I never applied or got a Tech Role.

I joined a Core Banking Project as a contract staff in 2014, whilst my role was mostly administrative[i.e buying Shawarma], but I was curious. I stayed late, learning to code and shadowing technical teams, just really eager to understand how people, processes, and technology intersected.– this was how my accidental foray into tech began. Ultimately, the organization offered me the sandbox to grow across different roles and I experimented with multiple gigs outside of my 9-5

I think I have not started rising. It is still Day Zero for me. However, I’ll unapologetically say God is the most important ingredient.

I have also just been privileged to have worked with great bosses and leaders.- Shout to people like Baba T, Adeoluwa Akomolafe, Ruby, TJ Bakare, Wole Adeniyi, and Mr. Moruf Oseni. There’s a way the world amplifies horrible bosses but having a great boss is beyond a breakthrough. I’ve worked and still work with many of them.

I also think I am a very stubborn hard worker. I am not always the best in the room but you’ll always find me burning the extra candle when the room is empty. I knew early in life that I have no one except God and the work of my hand.

Well, I fight fire and I spend some more time explaining to stakeholders who want breakthrough ideas that I am in no way related to Albert Einstein. I am just an Ekiti Man who grew up in Agege. LOL

My role is a Beyond-Tech-Innovation one. I manage the bank’s innovation ventures, including our newly built Incubation and Acceleration lab. I steer all innovation goals and efforts with organizational objectives, overseeing idea pipelines using frameworks like design thinking, and I manage innovative projects from ideation to execution. I also evaluate emerging technologies and lead prototyping for scalable, impactful solutions.

By the way, we are the first commercial bank in Nigeria who has been able to build something like this. However, It is hard to say ‘I built’ the product. WEMA Bank/ALAT is a community of rockstars whose core value is Partnership. Whilst the refining and implementation of the product came from the Innovation team I lead, I think the most euphoric moment is seeing it come to life through ‘Collaboration’ between the different Product, Business and Engineering teams across the Bank. Additionally, seeing a fresh Product Manager [Eseohe], grow under my wings to deliver such a solid product is the biggest deal.

By day, I’m a wannabe Tech Bro; by night, a Social Impact leader. In 2018, I founded Boys Quarters Africa, and we’ve engaged over 500k+ boys and men across 5 African countries to promote healthy masculinity. I’ve partnered with the Netherlands’ Ministry of Foreign Affairs to mobilize over 10k men as allies in ending gender-based violence. I also run Out of Office, a budding community supporting young professionals.

Finally, I share some ‘aspire to perspire’ videos across my social media platforms too. Beyond all of this, it’s been a really exciting journey of being able to give back and do purposeful work.

I ride my Bicycle. Analyse VDM’s analysis and sit/argue with my suya guy at night.

I serve as the Ministry Director for Media and Information Systems, alongside my Pastor & Mentor, Damilola Oluwatoyinbo, at KINGS [Kingdom Influencers in Nations, Generations and System]. We are a global community of Kingdom Influencers touching and transforming individuals and communities with the love and light of Jesus Christ.

Asides this, I run a BoyChild Transformation Movement, where I educate, empower & advocate for a new tribe of boys who will deliberately & purposefully transition from boyhood to manhood.

Beyond all of these activities, my overarching objective is to catalyze the future of Africa, through my voice and the enabling power of technology.

Are you a freelancer or a remote worker?

Fincra wants to understand the challenges and opportunities related to cross-border work payments for freelancers and remote workers in Nigeria. Please take just a few minutes to complete this survey.

Fintech

Nigeria’s treasury payment shake-up: Remita’s grip loosens but not lost

Nigeria’s federal government is restructuring its Treasury Single Account (TSA) payment system, but contrary to reports, it has not abandoned Remita, the long-standing electronic payment platform. Instead, a new system—Treasury Management & Revenue Assurance System (TMRAS)—will operate alongside Remita, marking yet another attempt to reduce its dominance in public revenue collection.

For nearly a decade, Remita, a subsidiary of SystemSpecs, has been the sole aggregator for TSA payments, despite multiple efforts to introduce competition. The latest move follows a 2023 directive from the Office of the Accountant General of the Federation (OAGF), which authorised Simplify International Synergy Limited to build a new FGN Treasury Portal and requested TSA transaction data. While this suggests a shift in government strategy, a Remita executive insists that the new system will still rely on Remita’s infrastructure, rather than replacing it.

This isn’t the first time authorities have attempted to unbundle Remita’s grip. The Senate investigated the company in 2016 over alleged corruption but later cleared it. Regulators, including the Central Bank of Nigeria (CBN), have also explored alternative payment models, though these have repeatedly failed due to technical challenges.

Despite recent reforms allowing four additional Payment Solution Service Providers (PSSPs) to process government payments, Remita has remained the single aggregator, remitting funds to the CBN. The key question now is whether TMRAS will significantly alter this arrangement.

With Remita’s 1% transaction fee split between the CBN, commercial banks, and PSSPs, the introduction of a competing system could change revenue dynamics—but only if the government is serious about following through on its latest push for competition.

For now, Remita’s dominance remains intact, but the pressure is building

YouA startup’s guide to understanding data privacy

Discover tactical tips for African startups on building a strong foundation for data privacy and protection. Learn more→

Ride-hailing

Nigerian ride-hailing drivers launch SimpliRide to challenge industry giants

When ride-hailing apps first entered Nigeria ten years ago, they were seen as disruptors of the yellow-and-black colourful bus transport system that dotted Lagos roads. Drivers made as much as ₦300,000 ($1,840 at the time) weekly from completing rides; the rates were good, and everybody stayed happy.

However, times have changed. Inflation and the rising cost of fuel has upended how this model works, and drivers are having to spend far more than they used to. One driver told that it costs ₦180,000 ($120) to fuel his car weekly. This macroeconomic difficulty has also forced ride-hailing apps to constantly review their ride fares and driver commissions to stay in business. But drivers have never been in agreement. As a result, protests, strikes, and gaming the system have become features, not bugs, of the gig-driving economy.

Drivers are now tired and want to give their own platform a shot. A group of Nigerian ride-hailing drivers have launched SimpliRide, a homegrown alternative to Uber, Bolt, LagRide, and InDrive, offering drivers a fairer deal. The app, which operates on a flat subscription model of ₦500 ($0.33) per day, is cheaper than the commission-based deductions that can reach ₦15,000 ($10.03) monthly.

The App-Based Transporters of Nigeria (AUATON), a drivers union body, has endorsed SimpliRide but denies direct involvement. However, industry insiders claim a 40% ownership stake from within AUATON, raising questions about the union’s real role in the project. Some members, including General Secretary Ibrahim Ayoade, remain sceptical about drivers’ ability to develop and manage such a platform, citing financial and technical hurdles.

“I am perplexed by the idea of drivers creating an app. This is a recurring issue, and the question remains: can drivers develop an app, and if so, in what capacity? According to our constitution and laws, AUATON is a regulatory body, not a competitor,” Ayoade told Condia.

Beyond its ownership questions, there are questions around SimpliRide’s ability to rally the support of the group it wants to save from the peanut commissions. The theory is that these drivers will likely not be motivated by who—if at all it is the AUATON—is behind the app, but what it incentivises them to get from it. Some of these gig drivers have their ride-hailing business as their only source of income, so they’d easily go where they’re wanted.

Ride-hailing is a network-effects business—without a critical mass of users, even lower driver fees may not be enough to compete with established players offering larger customer bases. This puts SimpliRide in an underdog position. Does it have the fight in it? The drivers could rally around it, but first, the upstart has to really show it means business.

Kredi bank Job Opportunity

Kredi Bank is hiring! We’re looking for a dynamic Growth & Development Lead to drive adoption of our payment products and a Liability Generation Manager to grow our deposit base. If you have a strong fintech or sales background, apply now!

Startups

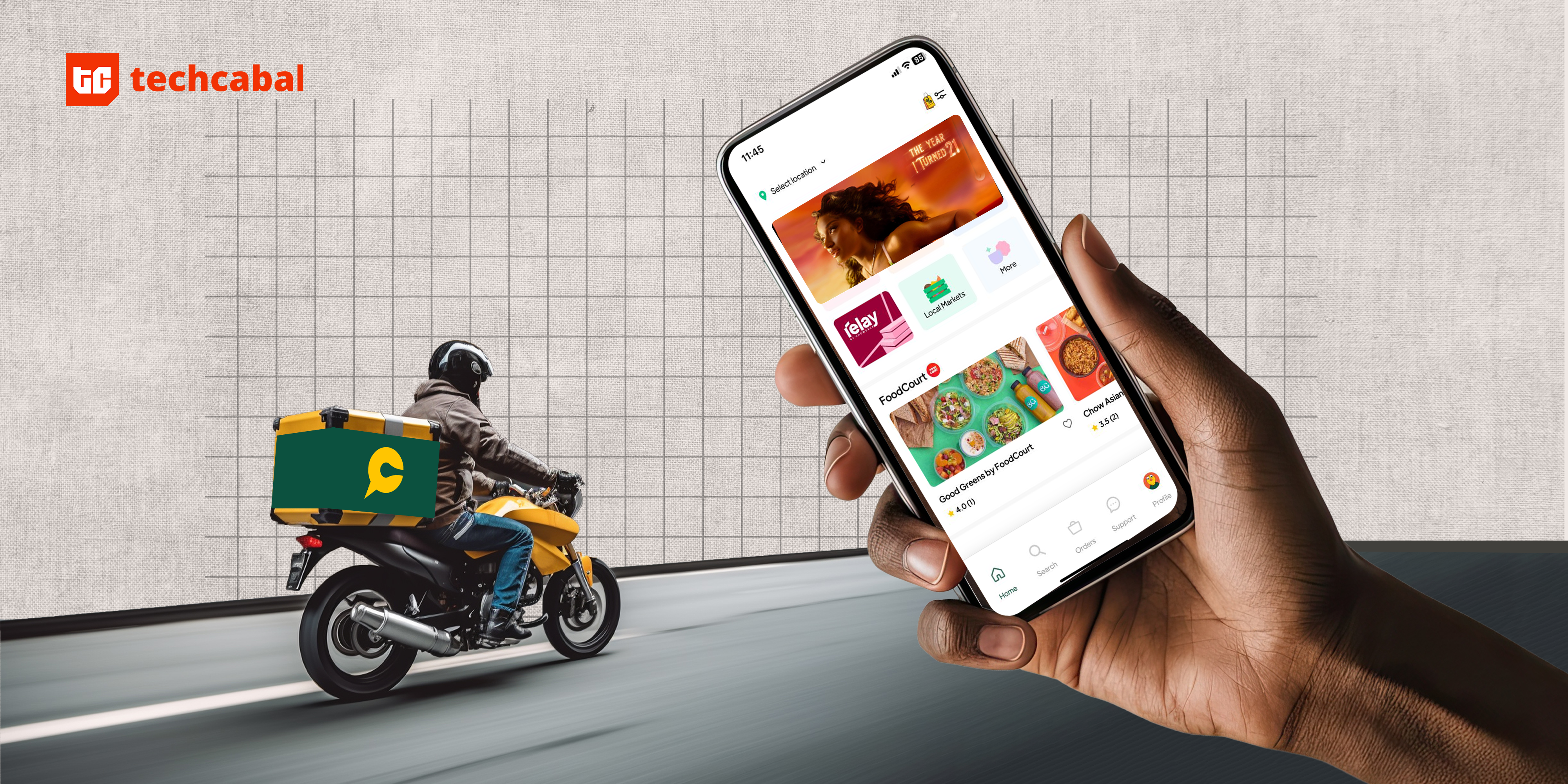

Chowdeck slashes contract staff by 68%, fast-tracks its Ghana expansion plans

Chowdeck, a Nigerian food delivery startup is cutting 68% of its contract staff—86 of its temporary workforce—after optimising logistics. CEO Femi Aluko insists the layoffs aren’t due to financial distress but rather a shift towards automation and operational efficiency. The company, which claims it expanded its operations team sixfold in 2024, found its headcount unsustainable as it plans to quintuple its growth in 2025.

The affected workers will receive three months’ salary and health coverage, with Chowdeck offering them job placement assistance. No full-time employees are impacted.

Chowdeck’s momentum isn’t slowing. Fresh off its 10 millionth delivery, the startup is setting its sights on Ghana, starting with Accra next week, it told TechPoint. Chowdeck claims it has launched in Kaduna and Owerri, already listing fast-food chains operating in both cities on its platform. For its Ghana expansion, the startup has also hired a country manager to lead operations.

Chowdeck is aggressively exporting its technology to unlock more growth, by replicating its model in cities and a country where it has previously found market-fit. Aluko emphasises that expansion will be city-focused rather than country-wide, ensuring sustainable scaling.

Another aspect of its growth is its push for operational efficiency by prioritising automation to its customer support operations. While companies are betting on trends around souped-up agentic AI to lead business operations, there’s a real poser on how much the automated process can replace. Swiss fintech Klarna was one of the tech companies that bet on automation, replacing workers with AI. However, it soon made a U-turn when it saw how experimental at best automation is at this stage.

Yet, Chowdeck doesn’t seem to slow down. If its Ghana playbook succeeds, it could continue to export its food delivery service to more countries soon.

The Moonshot Deal Book is Coming!

The Moonshot Book Dealbook is lauching very soon. Packed with a handpicked selection of the most promising startups, this exclusive resource is designed to connect top investors with high-potential opportunities. If you’re interested in being among the first to access the TC Dealbook, sign up to our waitlist today! Join the waitlist.

Insights

Funding Tracker

This week, South African agritech startup Khula secured $6.7m in Series A funding from existing investors, including Absa Bank, AECI, E Squared, and PepsiCo’s Kgodiso Fund.. (March 4)

Here are other deals for the week:

- Egyptian AI startup WideBot AI raised $3m in pre-Series A funding. Keheilan Asset Management II led the round, which was backed by Wafra. Enza Capital, DisrupTech Ventures, LoftyInc Capital, Den VC, and SparkLabs Ventures also participated. (March 4)

- Badili, a Kenyan re-commerce startup, raised $400,000 in debt funding from Proparco, a French development organisation. (March 5)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, read our State of Tech in Africa review for 2024. Click this link to read it.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $88,159 |

– 4.64% |

– 9.88% |

|

| $2,169 |

– 6.21% |

– 20.15% |

|

| $2.51 |

+ 1.31% |

– 0.34% |

|

| $143.08 |

– 4.97% |

– 30.14% |

* Data as of 06.30 AM WAT, March 7, 2025.

Events

- GITEX AFRICA 3rd edition is NOW OPEN for registration. Africa’s largest tech and start-up event will be held from 14-16 April 2025 in Marrakech, Morocco. Attend to see the leading brands in tech, and the most innovative startups, and network with tech leaders, investors, speakers and government delegations from across Africa and across the globe. Register here.

Written by: Faith Omoniyi, Emmanuel Nwosu, and Stephen Agwaibor

Edited by: Olumuyiwa Olowogboyega

Want more of ?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.