TGIF!

Botswana just sent its first satellite, BOTSAT-1, into space—because why should the usual space giants have all the fun?

Beyond the cool factor, this means better data for precision agriculture—helping farmers monitor crops and optimise yields—along with improved climate monitoring and expanded internet access in remote areas. The latter is the key driver behind Botswana’s partnership with SpaceX, as African countries seem to find a way into the space technology chat, even if it means teaming up with bigger players to get there.

+1 for Africa!

- Quick Fire

with Tumilara Hassan

with Tumilara Hassan - Is a $2,000 penalty enough to stop rogue digital lenders?

- Hybrid finance apps are creating a safe space for non-knowledgeable crypto users

- Funding Tracker

- World Wide Web 3

- Events

Features

Quick Fire  with Tumilara Hassan

with Tumilara Hassan

Tumilara Hassan is a tech leader, product development expert, AI advocate and a Perplexity AI Business Fellow with a career spanning fintech, digital banking, and AI-driven innovation. From managing the Cowry Card expansion at Touch and Pay Technologies to leading mobile banking at Fast Credit Limited, she has played a key role in shaping Nigeria’s tech ecosystem. As co-founder of NucleusIS Africa, she is building innovative financial solutions for the healthcare sector. Beyond her work, Tumilara is a thought leader, mentor, and event host, driving conversations on AI, product management, and the future of technology.

I started my career as a Relationship Manager at Cooperative Mortgage Bank, focusing on client management and business development. That role opened my eyes to the potential of technology in transforming financial services. My interest in business analysis grew from there, eventually pulling me into product management and fintech.

It was incredibly rewarding. The Cowry Card is a tap-payment system used in over 55,000 buses across Lagos State, and I was responsible for overseeing its product development. Managing a product at that scale meant tackling issues like user adoption, security, and overseeing transaction successes—all while ensuring it could scale across different transportation modes.

As Head of Mobile Banking, I led the development of several digital banking solutions, including fund transfers, biometric KYC verification, and account onboarding. These features helped improve accessibility and security for users, making banking more efficient.

At NucleusIS Africa, we’re revolutionizing financial services for the healthcare sector. Our platform provides loans, cross-border payments, and collections, helping hospitals and healthcare providers manage their finances more efficiently. It’s exciting to see how fintech can create real impact beyond traditional banking.

AI is a game-changer! I’ve integrated AI into predictive analytics, fraud detection, and customer insights to enhance operational efficiency. The ability of AI to automate processes, improve decision-making, and personalise user experiences is something every product leader should be paying attention to.

I wanted to bridge the gap between tech builders, tech newbies, regulators, and industry leaders. My fireside chats have covered topics like “The AI Advantage for Product Management”, “Innovation or Regulation: Which Way for AI?” and AI and the Future of Finance.

I’ve had the privilege of hosting incredible speakers from Paystack, Busha, Sabi, and Interswitch. Distinguished speakers like Laolu Samuel-Biyi, Co-founder of Busha; Olumide Okubadejo, Head of Products, Artificial Intelligence & Machine Learning at Sabi; Dapo Awobokun, Startup Partner at Paystack; Eyituoyo Mogbeyi, Head of Compliance and Risk at Budpay; Demola Adeniran, Divisional Head for Paytoken Business at Interswitch; and Ayo Popoola, Lead Product Manager at 54 Collective.

These discussions are important and the goal is to make them global.

In 2024, I was a panel speaker at Lagos Startup Week, one of Nigeria’s most influential events for the startup ecosystem, where I shared insights on the evolving tech landscape as it relates to the synergy between designers and developers in creating innovative solutions.

Nigeria’s tech ecosystem is fast-moving and resilient. I’ve seen startups tackle financial inclusion, digital identity, and AI adoption in impressive ways. We’ve come a long way and we can do even more.

I also spend my time between mentoring and advisory roles. I have facilitated design thinking advisory sessions for young entrepreneurs as part of the Orange Corners initiative, a program supported by the government of the Netherlands. Additionally, I led and coordinated an innovative team of forward-thinking students that won the Hult Prize Nigeria finals in 2018 and qualified for the global regional finals in Boston, USA.

I recently served as a judge for the Artificial Intelligence for Social Impact Hackathon, an event dedicated to harnessing AI solutions to address pressing societal challenges. This allowed me to evaluate groundbreaking projects aimed at creating meaningful social impact through AI. I am also contributing as a judge for the 2025 Hult Prize competition at the University of Ibadan, assessing innovative solutions proposed by emerging leaders committed to effecting positive change.

For me, a product-winning idea is all about impact, scalability, and execution. I love seeing ideas that use technology to solve real problems, whether it’s in finance, healthcare, or sustainability. Startups need to think beyond just innovation—they must be practical, sustainable, and user-focused.

I love contributing to women-led initiatives that empower them to just do things. I am an active member of Women in AI, a nonprofit community-driven initiative bringing awareness and knowledge through education and events, and Women in Tech Global, a community that connects, shares, and grows with fellow members passionate about tech and empowerment.

So yes, women empowerment causes are also a big deal to me.

I’m focused on growing NucleusIS Africa and expanding my fireside chat series globally. I’m also looking to build partnerships that drive AI and fintech conversations forward. The goal is to shape the future of technology while creating meaningful impact.

Are you a freelancer or a remote worker?

Fincra wants to understand the challenges and opportunities related to cross-border work payments for freelancers and remote workers in Nigeria. Please take just a few minutes to complete this survey.

Fintech

Is a $2,000 penalty enough to stop rogue digital lenders?

Kenyan digital lender Whitepath is back in the spotlight—for all the wrong reasons. The lender, which operates the Instarcash and Zuricash loan apps, has been fined KES 250,000 ($2,000) for violating data privacy laws. This time, the company was found guilty of listing an individual as a guarantor without their consent, resulting in a barrage of debt collection calls.

This isn’t Whitepath’s first run-in with regulators. In March 2023, the Office of the Data Protection Commissioner (ODPC) slapped the lender with a KES 5 million ($39,000) fine after nearly 150 complaints of unauthorised access to borrowers’ contact lists and spamming their friends and family with debt collection messages. Yet, despite the larger fine, Whitepath is still playing fast and loose with user data.

So, will a $2,000 fine change anything? Probably not. For a repeat offender, it feels like a slap on the wrist and raises the question: Should the regulator escalate penalties to something more serious, like licence revocation?

That said, Kenya’s crackdown on rogue digital lenders is showing signs of progress. Since the Central Bank of Kenya (CBK) began licensing digital lenders in 2021, it has received over 700 applications—but only approved around 80 in five years. The message is clear: while some lenders are still testing the system, the regulatory grip is tightening and it’s becoming harder to get away with unethical practices.

Paystack is inviting you to an exclusive reveal

Paystack has been working on something new and exciting, and on March 24, they’ll finally reveal it. Want to be among the first to know? Sign up here to learn more

Cryptocurrency

Hybrid finance apps are creating a safe space for non-knowledgeable crypto users

Like most sectors, crypto has evolved so much that we often overlook how far digital technology has come. If you’re not caught up or only know parts of the story, here’s a quick recap using Nigeria as a case study.

While the concept of cryptocurrency owes its origins to the pioneering work of cryptographers and computer scientists from the 80s, the first real breakthrough was Bitcoin’s launch in 2009—the world’s first crypto. When Bitcoin launched, there were fewer use cases for this digital “money.” It faced challenges like a lack of trust, awareness, or simply being dismissed as a waste of time.

Slowly but surely, Bitcoin’s value began to climb until it miraculously exploded. The concept of Bitcoin and using an alternative form of money sparked other ideas, leading to the numerous altcoins and stablecoins we have today. Yet, for Nigerians, buying crypto was ridiculously hard.

Then came peer-to-peer (P2P) trading in 2019, which was a game-changer for the average Nigerian. It simplified the process of buying and selling crypto, making it the go-to method for many. But it also came with risks—those who couldn’t learn the ropes of the system became easy targets, inadvertently locking many out of using the digital money.

Yet, like P2P trading, we’re witnessing a trend that is making it easier to access crypto: hybrid finance apps. These apps allow users to experience crypto’s utility side, allowing them to convert crypto without exposing them to the dangers of P2P. Industry operators are optimistic about the practical use of crypto as everyday money, and they want you to indulge them as they build the future of money in this space.

Read our coverage to find out why hybrid finance apps are the new trend in Nigeria’s crypto space.

Get notified when the Moonshot Deal Book goes live

The Moonshot Book Dealbook is lauching very soon. Packed with a handpicked selection of the most promising startups, this exclusive resource is designed to connect top investors with high-potential opportunities. If you’re interested in being among the first to access the TC Dealbook, sign up on our waitlist today!

Insights

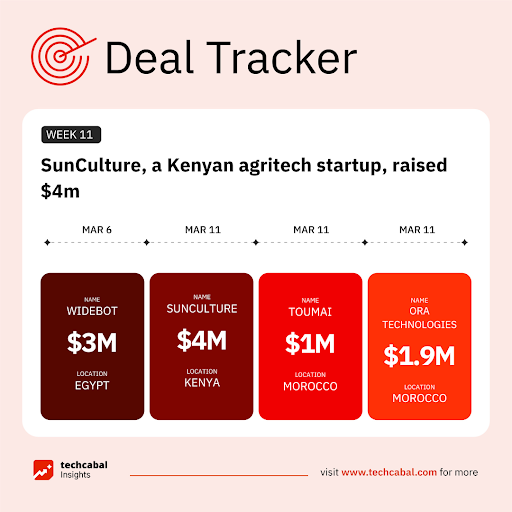

Funding Tracker

This week, Kenyan agritech startup SunCulture secured $4m in investment from British International Investment (BII). (March 11)

Here are other deals for the week:

- Egyptian artificial intelligence startup Widebot raised $3 million in pre-Series A funding. The round was led by Keheilan Asset Management II, backed by Saudi investment firm Wafra. It featured participation from Enza Capital, DisrupTech Ventures, LoftyInc Capital, Den VC, and SparkLabs Ventures. (March 6)

- Moroccan AI startup ToumAI raised $1m in pre-seed funding. The funding round was led by Launch Africa Ventures, with participation from Madica by Flourish Ventures, Orange Ventures, Digital Africa, GO Ventures, and business angel Bruno Akpaka, alongside support from Bpifrance. (March 11)

- Morocco-based superapp ORA Technologies has closed a $1.9 million pre-Series A round of funding. Witamax and Azur Innovation Fund led the round. (March 11)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, read our State of Tech in Africa review for 2024. Click this link to read it.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $82,065 |

– 1.42% |

– 14.35% |

|

| $1,895 |

+ 1.39% |

– 27.17% |

|

| $11.66 |

+ 8.72% |

– 24.19% |

|

| $126.74 |

+ 1.28% |

– 37.35% |

* Data as of 06.45 AM WAT, March 14, 2025.

Events

- GITEX AFRICA 3rd edition is NOW OPEN for registration. Africa’s largest tech and start-up event will be held from 14-16 April 2025 in Marrakech, Morocco. Attend to see the leading brands in tech, and the most innovative startups, and network with tech leaders, investors, speakers and government delegations from across Africa and across the globe. Register here.

- DICE 3.0 is back, bigger and bolder. On April 3, 2025, in Lagos, Nigeria, Africa’s top innovators, business leaders, and policymakers will gather to discuss regional expansion, market barriers, and cross-border collaboration. Convened by Beyond Limits, this exclusive, invite-only event will feature high-impact networking, strategic insights, and game-changing discussions. Media partners include , Guardian Nigeria, BusinessDay NG, and Channels Television, with Jameson Nigeria as the drinks partner. Register your interest for a chance to attend the event.

Written by: Faith Omoniyi, Kenn Abuya, Emmanuel Nwosu, and Stephen Agwaibor

Edited by: Ganiu Oloruntade

Want more of ?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.