Wazzup!

We hope you had some time to rest yesterday. If you didn’t, TGIF! Get caught up on your favourite shows. Log off and enjoy your weekend.

Let’s get into it.

- Kenyan banks say no to CBK’s new loan pricing system

- Nigeria’s SEC warns against Tofro, another Ponzi scheme

- Oxygen X rakes in $501,000 profit in first year

- You could start paying more for your bank’s SMS alert charges

- World Wide Web 3

- Events

Banking

Kenyan banks say no to CBK’s new loan pricing system

Kenyan commercial banks have rejected the Central Bank’s proposed loan pricing model, arguing it risks reintroducing interest rate controls through the back door.

ICYMI: The CBK wants lenders to price credit using the Central Bank Rate (CBR) plus a regulated premium known as “K”—but banks prefer a market-driven benchmark like the interbank rate.

This standoff has big implications. The CBK aims to make interest rates more transparent and better aligned with monetary policy. But banks say the new formula could limit their ability to price risk effectively, especially when lending to small businesses. They argue that strict pricing rules would reduce credit flow to riskier sectors and undermine efforts to support economic growth.

Banks also noted the potential disruption to their existing SME loan commitments. The Kenya Bankers Association says lenders have pledged to disburse KES150 billion ($1.16 billion) annually to SMEs. Imposing a rigid pricing formula, they argue, could make those goals harder to meet.

The pushback highlights a growing tension between policy control and market flexibility. The CBK wants to improve how its rate decisions actually influence borrowing costs, especially in a market where past rate cuts haven’t made much difference. But banks are cautious—memories of the interest rate cap era, scrapped in 2019, still linger, and they’re not keen on repeating that experience. At the time, the CBK limited interest rates to 4% above CBR, and set a maximum rate of 13%. While the CBK was trying to stimulate economic activity by making loans cheaper, this squeezed banks’ profits as they couldn’t charge enough to cover rising costs or losses from bad loans.

Without a middle ground, the fallout could mean tighter credit for the very sectors these reforms are meant to help—just when businesses are already struggling to access capital.

Seamless Global Payments With Fincra.

Issue accounts in NGN, KES, EUR, USD & more with one integration. Send & receive funds seamlessly across borders; no more banking hassles or complex conversions. Create an account for free & go global today.

Cryptocurrency

Nigeria’s SEC warns against Tofro, another Ponzi scheme

If it smells like a scam, walks like a scam, and promises crypto riches overnight—it’s very likely a scam.

That’s the message from Nigeria’s capital markets regulator to every would-be investor, as the Nigerian Securities and Exchange Commission (SEC), the country’s capital markets regulator, steps up efforts to prevent Nigerians from falling prey to yet another Ponzi scheme.

The regulator has flagged Tofro, the latest sketchy “crypto trading platform” promising unsuspecting investors outsized returns on investments.

Tofro’s not registered. It’s got no app. No known team. And it’s definitely not an SEC-licenced asset manager. It’s just a hastily thrown-together website and vibes.

The SEC’s early warning is a win for consumer protection, especially as Ponzi schemes keep mushrooming across the country like rainy season weeds.

Reports say Tofro has been quietly operating since October 2024—and here’s the kicker—it looks an awful lot like CBEX, the now-infamous platform that vanished with millions of dollars in investor funds. Coincidence? Maybe. But the timing’s a little too perfect.

Meanwhile, law enforcement agencies have been working hard to arraign the suspects who promoted CBEX. The Economic and Financial Crimes Commission (EFCC), Nigeria’s anti-graft agency, declared nine persons wanted over the CBEX scam—four Nigerians, four Kenyans, and one mystery foreign national. Yet CBEX’s website is still up, and heartbroken investors are flocking to Telegram groups hoping to “recover” their money.

Spoiler alert: they’re probably just lining up for another scam.

So yes, kudos to the SEC for calling out Tofro early. But here’s a thought: maybe it’s time regulators start shutting down these fraud factories before they go viral. Because once the word spreads, Nigerians will swarm faster when they hear “guaranteed returns.”

To you reading this, here’s your warning.

Never miss an update from Paystack

Subscribe to Paystack for a curated dose of product updates, insights, event invites and more. Subscribe here →

Fintech

Oxygen X rakes in $501,000 profit in first year

For a newcomer, hitting these milestones in the first year is remarkable.

Since it launched last year, Oxygen X, the digital lending subsidiary of Access Holdings’, turned a pre-tax profit of ₦850 million ($501,000).

ICYMI: Last year, Access Holdings became the first major bank group to launch a standalone digital lending company, which meant that Oxygen X could acquire users who didn’t have accounts with Access Bank.

How did they pull it off? The digital lender, which offers loans to consumers and micro, small, and medium-sized enterprises (MSMEs), made revenue of about ₦4.1 billion ($2.6 million).

The lender, which has about 1,211 users, received 685 loan applications in the previous year, disbursing ₦152 million ($95,000) in consumer loans. Its ₦4.1 billion ($2.6 million) revenue was largely driven by the launch of its cash loan offerings and the rollout of its Credit Lifecycle Management Product (CLMP) in Q4 of 2024. Oxygen X also reported total assets of ₦7.5 billion ($4.7 million) and liabilities of ₦2 billion ($1.2 million).

While Oxygen X revenue is impressive for a first timer, it dwarfs established incumbents like Fairmoney which made ₦7.9 billion ($5 million) profits after tax in 2024 and disbursed ₦68.5 billion ($43 million) loans to its customers in the same year.

Oxygen X: Built on the backbone of Access Bank’s earlier Quickbucks platform, which served around seven million users, Oxygen X was Access Holding’s answer to growing competition in Nigeria’s digital lending space. The lender now goes head-to-head with digital lenders like FairMoney, Carbon, and OPay. Its services now target individual consumers and micro, small, and medium-sized enterprises (MSMEs), with lending options including personal loans, solar and device financing, car loans, and payday advances.

As a part of Access Corporation subsidiaries—ARM pensions, Hydrogen, Access Bank, and Access Insurance Brokers Limited—the digital lender is contributing its own share to the group&rsq uo;s overall profit, albeit on a smaller scale. While the group posted ₦4.88 trillion ($3 billion) in gross earnings for 2024, Oxygen X’s revenue was the smallest at ₦4.1 billion ($2.6 million). In comparison, Hydrogen recorded ₦5.7 billion ($3.6 million) in operating income, Access ARM Pensions generated ₦16.1 billion ($10 million), and Access Insurance Brokers brought in ₦8.3 billion ($5.2 million) in gross written premium.

However, with a strong first year result, OxygenX is showing signs that it can outpace some subsidiaries in revenue contribution as it scales.

Be the First to Access the Nigerian Payment Report 2025

The Nigerian Payment Report 2025 dives into the trends, challenges, and innovations shaping the future of digital payments. Join the waitlist today to get early access to the report when it goes live!

Join the waitlist

Banking

You could start paying more for your bank’s SMS alert charges

In a not-so-rare showing of solidarity, Nigerian commercial banks have announced that SMS alerts will now be charged at ₦6 ($0.003) per text message, up from ₦4 ($0.002).

At least three banks—GTBank, Fidelity, and Union Bank—have implemented this increase. This follows the telecom tariff hike from mid-February that increased the cost of data, voice calls, and SMS across telecom networks in the country. The charge will apply to every SMS alert you receive, but it is optional; you can opt out of SMS alerts from your bank.

What does this mean for you? You could start paying more in SMS alert charges, which are billed monthly by your bank. The fees from SMS alerts are typically collected by banks and remitted to telecom operators. Alert fees are minor sources of revenue for banks; they typically don’t itemise it in their financial reports, unless it is significant.

For example, in GTBank’s half-year 2024 financial report, revenue from SMS charges was reported under “account services, maintenance, and ancillary bank charges,” which brought in ₦16.18 billion ($10 million)—however, this was a combination of multiple services, not just SMS alerts. The real cake for banks comes from transfers, especially as e-payments are becoming the norm in this digital world.

The move was possibly designed by regulators to ensure banks remit the full amounts to telecom operators and avoid another prolonged debt fiasco, like the pending one over unpaid USSD fees.

Why now? One reason could be that the Central Bank of Nigeria (CBN) only recently approved the new rate for banks to implement. It’s also likely that banks waited to avoid customer outrage, especially after the backlash over the cybersecurity levy and the EMTL fee from 2024. Although inflation accelerated to 24.4% in March 2025, the small fee increase of ₦2 ($0.0012) may not immediately impact customers, at least in the short-term.

On the flip side, the extra cost, if summed up annually, could still weigh on wallets already strained by rising prices. Yet, banks are not expected to lose customers to fintechs like OPay, which charge no SMS or maintenance fees, since the fee hike isn’t significant—and customers can even opt out of it. What keeps people loyal, in the end, is trust, and banks have that edge.

Moreover, a hike in telecom service charges from banks was expected, as it’s simply a ripple effect of the telecom tariff increase.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $96,946 |

+ 2.12% |

+ 14.71% |

|

| $1,841 |

+ 1.74% |

– 1.99% |

|

| $0.05978 |

+ 1.95% |

+ 42.22% |

|

| $150.21 |

+ 1.15% |

+ 20.41% |

* Data as of 06.00 AM WAT, May 2, 2025.

Events

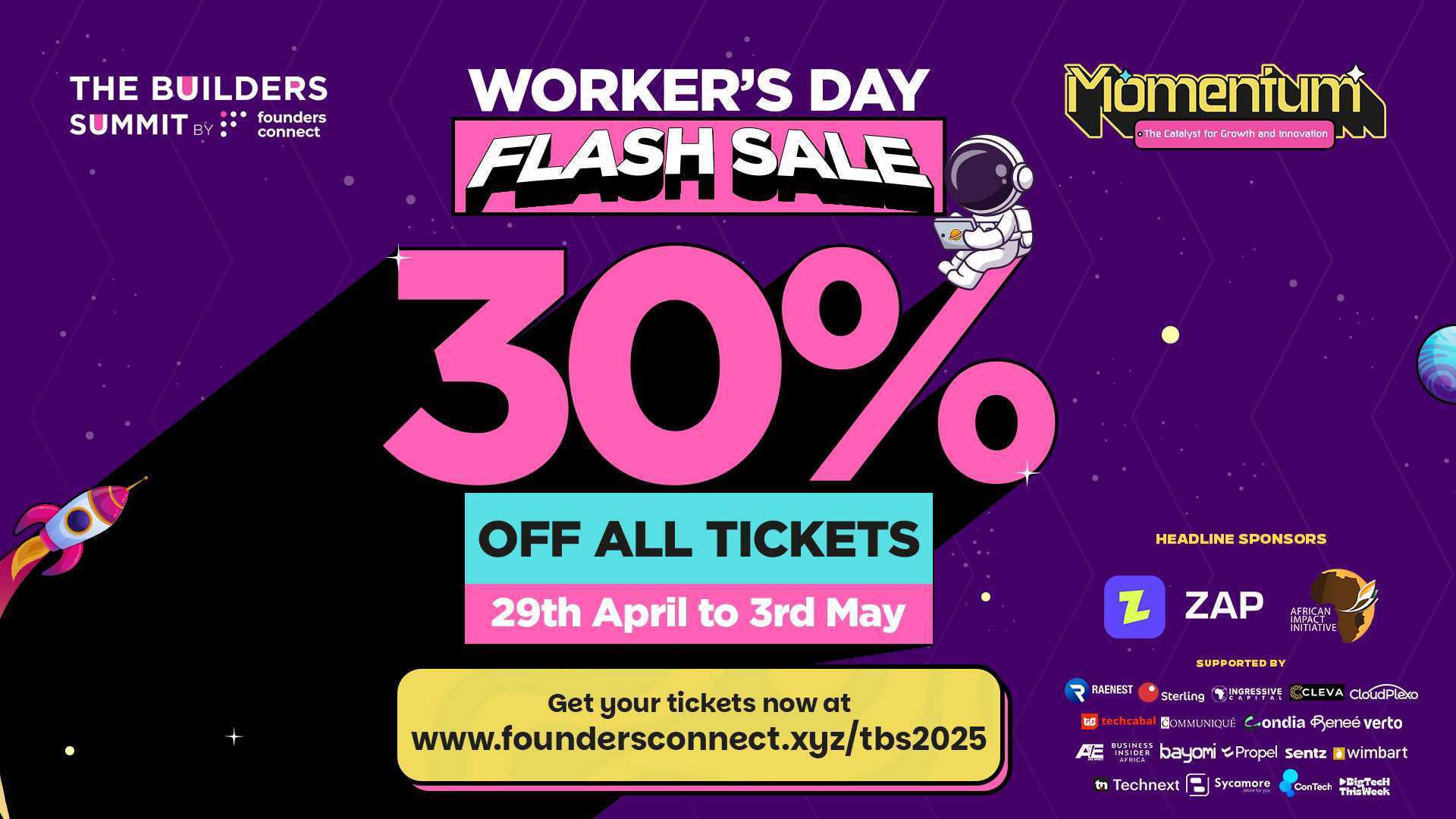

- Our friends at Founders Connect are bringing something BIG to Lagos this month. The Builders Summit is back—gathering startup founders, tech professionals, creatives, and industry leaders for a high-energy day of growth, innovation, and connections that matter. Expect hands-on masterclasses, keynotes, exhibitions, and Pitch2Win—a live pitching contest with a $9,500 prize up for grabs. Don’t miss the chance to network, learn, and build with the best. Plus, there’s a 30% discount on tickets from April 29 to May 3, 2025. Grab yours now.

- “Tech has become an equaliser in the industry”: Chocolate City Music’s CEO on AI, virality, and the future of music

- In a sparse fintech landscape, two new startups prepare to make their mark in Botswana

- Why Nigerian banks keep suffering system glitches—and what’s at stake

- Ethiopia’s state-owned Ethio Telecom records lackluster IPO

Written by: Emmanuel Nwosu and Opeyemi Kareem

Edited by: Faith Omoniyi

Want more of ?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.