What’s buzzin’?

How did your week go?

Have you gotten your Moonshot ticket just yet? We are bringing Ire Aderinokun and Odunayo Eweniyi to this year’s edition of Moonshot.

Recognised as Nigeria’s first female Google Developer Expert and co-founder of YC-backed Helicarrier, Ire Aderinokun brings bold lessons on product innovation and navigating ecosystems.

Odunayo Eweniyi, award-winning co-founder and COO of PiggyVest, shares sharp insights on operational excellence and building with purpose. Two tech trailblazers, one Moonshot stage. You don’t want to miss it.

Let’s get into today’s dispatch.

- Zenith Bank, a Nigerian tier-1 bank, wants to test its might in Kenya

- Stanbic Kenya to raise $100 million to back startups

- Starlink now has an office in Lagos

- Funding Tracker

- World Wide Web 3

- Opportunities

Banking

Zenith Bank, a Nigerian tier-1 bank, wants to test its might in Kenya

After playing the status game and dominating home turf, Zenith Bank, Nigeria’s second-largest lender by assets—and the bank Nigerians unofficially call ‘the bank of the rich’—is ready to bring the competition to Silicon Savannah.

The bank is in advanced talks to acquire a Kenyan tier-2 lender, giving it a regulatory foothold in East Africa and expanding its rivalry with fellow FUGAZ members: GTBank, Access Bank, and UBA.

Unlike Access Bank, which has grown through a rapid-fire M&A strategy, Zenith has historically moved with restraint. Its international footprint includes the UK, UAE, Ghana, Sierra Leone, Gambia, a representative office in China, and most recently, a branch in Paris targeting Francophone Africa. A Kenyan acquisition would be its first expansion into East Africa and its first market entry by acquiring another bank.

Why now? Kenya’s new banking law requires all banks to raise their minimum capital from $21 million in 2025 to $77 million by 2029. Smaller banks, especially tier-2s, are under pressure to merge, recapitalise, or sell to avoid a bank run. This presents an opportunity for Zenith. With a ₦614.65 billion ($402 million) capital base following its oversubscribed rights issue in January, the bank has the financial strength to move quickly.

Porter’s Five Forces explains the logic: Kenya’s strict regulations make it hard for new banks to enter the market. Buying an existing bank gives Zenith a first-mover advantage among recap-hungry banks also looking to enter Kenya. Its strong balance sheet—being the most profitable bank in Nigeria—helps it to convince regulators, depositors, and insurers that it can operate in a terrain like Kenya.

Zenith isn’t trying to go global. It is picking its fights. Executives from Zenith will visit Nairobi in three months to finalise the acquisition deal.

Save more on every NGN transaction with Fincra

Stop overpaying for NGN payments. Fincra’s fees are more affordable than other payment platforms for collections & payouts. The bigger the transaction, the more you save. Create a free account in 3 minutes and start saving today.

Banking

Stanbic Kenya to raise $100 million to back startups

Stanbic Bank Kenya’s new side hustle is investing in startups, and it’s doing it boldly.

The bank wants in on the startup game and is looking to raise $100 million to invest in startups across East Africa.

Through its Catalytic Fund, Stanbic says it’s eyeing sectors that rarely get a seat at the venture capital table, like agritech, healthtech, manufacturing, and the creative economy..

Still, what’s the game plan? By shifting its focus to younger, riskier ventures, Stanbic Kenya is hoping to widen the pipeline and bring in the 80% of businesses that usually get left out. If you ask me, I think they’re trying to build loyalty early by betting on founders that might become big players tomorrow.

Stanbic’s strategy stands out because most commercial banks simply avoid startup investing altogether. These banks prefer safer bets, like SME loans with lower risks. Take South Africa’s Absa Bank, which secured a $150 million facility to support women and youth-led SMEs. Stanbic Kenya is going further, choosing to take on the real startup risk that other banks shy away from.

If they pull this off, they could rewrite the rules on how African banks engage startups.

Drive your business forward with Doroki

Whether you are a retail store, restaurant, pharmacy, supermarket, salon or spa, Doroki helps simplify your operations so you can focus on what matters most: your customers and your growth. Manage your business smarter, start here.

Internet

Starlink now has an office in Lagos

Starlink has resumed direct shipments of residential kits in Nigeria after a 7-month pause, and it’s doing so in style.

The Satellite ISP just opened a walk-in centre in Victoria Island. It’s the ISP’s way of saying: We’re here. For real.

But why did they pause direct shipments? It was a power move. After the regulator blocked Starlink’s attempt to raise prices of its product offerings by 97%, the satellite ISP responded by halting new residential kit orders entirely, a strategic pause to force the regulator’s hand.

ICYMI: Starlink did the same thing in Malawi after a similar price hike was blocked by the Malawi Communications Regulatory Authority (MACRA).

What does this new centre mean? Starlink’s physical space boosts the brand’s legitimacy and improves customer support. It signals long-term commitment to the market—important in earning regulatory goodwill. The centre will enable hardware servicing and partner engagement. It can also double as a community hub for events, education, and deepening local connections beyond just internet access.

But here’s the twist: despite being Nigeria’s second-largest ISP, Starlink lost 6,000 subscribers over six months. Still, they’re not slowing down. With a physical office in Kenya already, and licenses across places like the Democratic Republic of Congo and Mozambique, Starlink is clearly laying bricks for something bigger.

Starlink is staking territory. Despite regulatory pushback and subscriber losses, they’re not backing down.

Accept in-person payments with Paystack Virtual Terminal!

Anyone can sell in-person. With Paystack Virtual Terminal, you can accept secure payments anywhere using just a QR code. No hardware needed.

Learn more here →

Insights

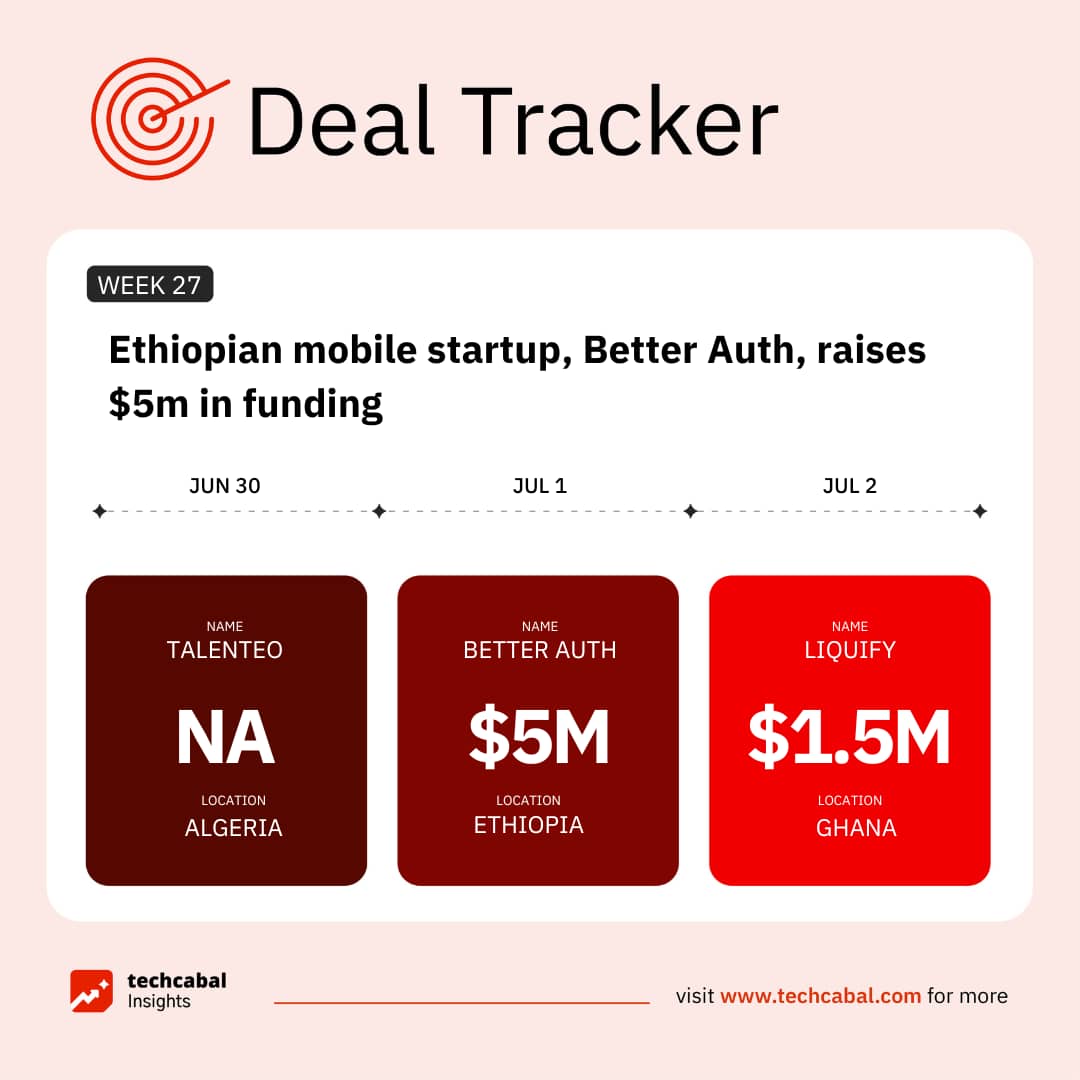

Funding Tracker

This week, Better Auth, an Ethiopian startup, secured $5M in seed funding to expand its authentication framework. The round was led by Peak XV Partners (formerly Sequoia Capital India & SEA), with participation from Y Combinator, Chapter One, P1 Ventures, among others. (Jul 1)

Here are the other deals for the week:

- Algerian HR-tech Talenteo raised an undisclosed six-figure round of funding. (June 30)

- Ghanaian startup Liquify, a digital invoice finance platform, raised an oversubscribed $1.5 million seed round of funding led by Future Africa with participation from Launch Africa, 54 Collective, Digital Africa and Equitable Ventures, alongside several strategic angel investors. (July 2)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, what are the strategic exits reshaping Africa’s fintech future? Read here.

Get a dependable energy solution tailored to your everyday needs

Tired of blackouts and fuel costs? Power your home or business with clean, affordable energy from Altpower. No upfront payment. Just reliable power, paid in instalments. Get started here→

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $109,267 |

+ 0.27% |

+ 3.45% |

|

| $2,580 |

+ 0.45% |

– 1.82% |

|

| $0.128 |

+ 60.66% |

+ 153.65% |

|

| $152.30 |

– 1.01% |

– 2.69% |

* Data as of 05.30 AM WAT, July 4, 2025.

Introducing, The Naira Life Conference by Zikoko

This August, the Naira Life Con will bring together wealth builders, entrepreneurs, financial leaders, and everyday Nigerians to share their experiences with earning, managing, and spending money. Think: bold conversations, immersive workshops, and content tracks that hand you a playbook for building real wealth. Get early bird tickets now at 30% off only for a limited time.

Opportunities

- All Talentz, a Nigerian outsourcing and workforce solutions company, has Launched a tech Hackathon to uncover the next generation of talents. The tech product pitch will feature innovations in healthcare, fintech, Govtech, climatetech, and more. Registration starts July 4; the hackathon kicks off ten days later. The grand finale will take place on August 23. Got an idea that could change the world? Register for the hackathon here.

- MEST Africa has opened applications for its 2026 AI Startup Programme. The 12-month training and incubation programme will equip West African software developers aged 21–30 with the skills to build scalable AI startups. Selected participants will undergo seven months of hands-on training in Ghana starting January 2026, followed by a four-month incubation for the most promising teams. Applications close August 22, 2025. Apply here.

- Over 4,000 tech leaders from 15+ countries gathered in Lagos for the third Africa Technology Expo (ATE), a business-focused event spotlighting innovation and enterprise growth across the continent. Held at the Landmark Event Centre, the conference featured keynotes, investor sessions, and showcases on topics like 5G, cloud, IoT, infrastructure, and startup scaling. More than 85% of attendees were senior decision-makers, including speakers from Google, MTN, and Future Africa. MTN also hosted a closed-door C-suite chat on digital transformation. With growing global interest, ATE is eyeing future editions in cities like Kigali, Nairobi, and Barbados. Interested in partnering or attending the next ATE? Get involved.

- Applications are still open for the 2025 FATE Institute Fellowship, a two-year, part-time and virtual programme for experienced Nigerian professionals passionate about entrepreneurship and policy reform. The fellowship is open to candidates with at least 10 years of relevant experience and a completed or ongoing Master’s or PhD in fields like Economics, Law, or Political Science. Fellows will work remotely, contribute to research on Nigeria’s entrepreneurship ecosystem, engage with policymakers, and take part in virtual policy discussions, without needing to leave their current roles. Apply by July 25.

- We’re launching Insights Market Researcher

, a tool that helps you find and analyse African tech and business data in seconds. Whether you’re looking for startup funding numbers, market trends, or investor activity, it does the digging for you—fast and accurately. Be the first to try it. Join the waitlist.

, a tool that helps you find and analyse African tech and business data in seconds. Whether you’re looking for startup funding numbers, market trends, or investor activity, it does the digging for you—fast and accurately. Be the first to try it. Join the waitlist.

Written by: Opeyemi Kareem, Emmanuel Nwosu, and Stephen Agwaibor

Edited by: Faith Omoniyi

Want more of ?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.