Vendease, a Partech and YC-backed food procurement startup operating in six Nigerian cities, has implemented its second round of layoffs in five months, according to a company spokesperson. The cuts, which begin today, are part of a restructuring effort aimed at achieving profitability and extending the company’s runway as it seeks to close a Series A extension round.

The first, in September 2024, impacted 86 employees, about 20% of the staff. About 120, 35% of staff, will be let go in the recent second round.

“Streamlining isn’t one bite of a cherry. You have to do it in stages,” Mohamed Chaudry, the company’s chief financial officer told . While declining to specify the number of employees impacted by the current cuts, Chaudhry stated that the reductions will result in a “lean team.”

Like many Nigerian startups, Vendease—which has raised $72 million since its founding—is grappling with macroeconomic headwinds including Naira devaluation and rising inflation, which have increased operational costs across its supply chain. Despite growing revenue by 600% year-on-year in the past two years, the company’s growth remains stunted in dollar terms. Beyond layoffs, these pressures have also forced the company to reassess its business model.

A key change has been the repurposing of its buy-now-pay-later (BNPL) product from a loss leader to a revenue generator. Previously, Vendease offered flat-fee financing for food purchases, absorbing interest costs for long-term loan payments. The company now charges daily interest, allowing it to profit from lending while customers pay pro-rata interest. “Vendors were willing to wait four days for goods from Vendease, even with instant-purchase options from other suppliers, because of the access to credit,” Chaudhry explained.

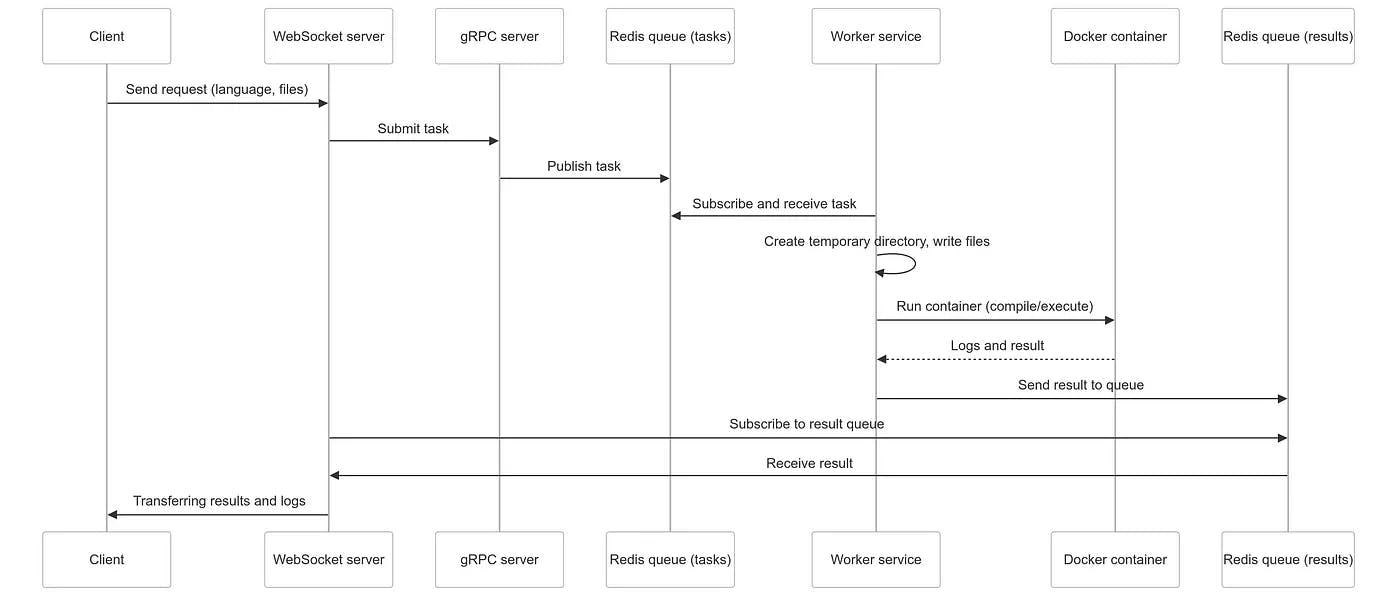

Vendease has also implemented in-house AI technology to automate previously manual processes like demand and resource planning, in a bid to improve capital efficiency.

Vendease’s investors, including Greenlights Ventures, Partech, Realm Capital Ventures, TLcom Capital, VentureSouq, Hustle Fund, and Hack VC, are supportive of the company’s pivot, Chaudhry said, adding that many have committed to participating in the ongoing Series A extension. The company declined to disclose the target extension raise but noted that the extended runway, coupled with the new funding, will enable the company to achieve the milestones necessary for a Series B round.