Over the past few decades, the U.S. has processed over 120 million tax returns annually, and in 2023 alone, that number surged to 160 million.

That’s a lot of paperwork. But for tax professionals handling it all? The workload is even bigger. And here’s the real challenge: time and efficiency.

According to our recent survey, the average professional spends 30+ minutes a day searching for work-related information—that’s over 120 hours a year lost to digging through emails, Slack threads, and scattered files.

Now, add a missed follow-up to that. For tax professionals, its penalties are loss of trust and chaos.

This is where CRM (customer relationship management) software can make a difference. CRMs for accounting businesses and tax professionals streamline bookkeeping, document management, workflow automation, and client relationship management.

Looking to introduce the above benefits into your business? Here’s a compiled list of the 11 best CRM systems for tax professionals to help you make the right choice.

⏰ 60-Second Summary

Here’s a quick overview of our picks for the 11 top integrated CRM platforms for tax professionals:

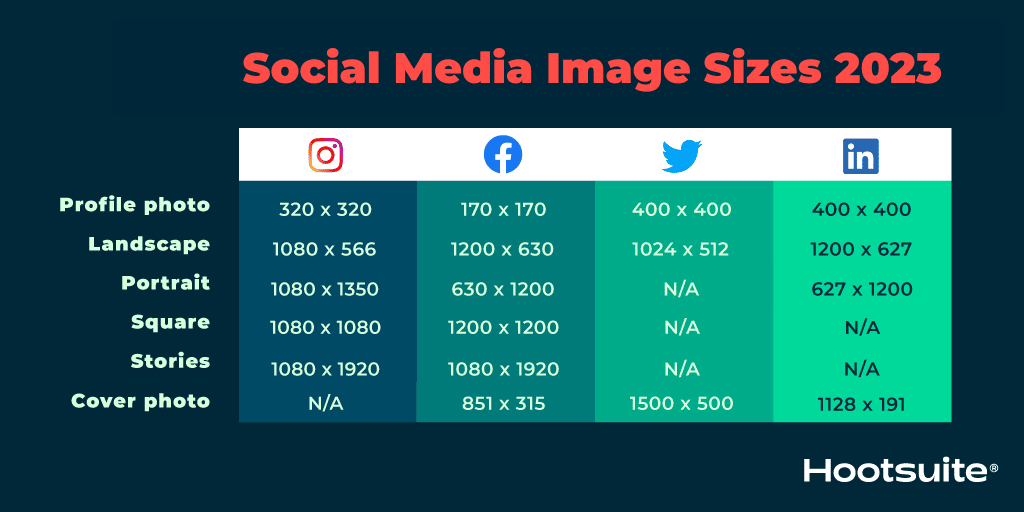

| Tool | Best for | Key features | Pricing |

| Customizable client management & workflow automation | AI-powered automation, client portal, 50+ custom dashboard cards | Free, $7–$12/user/month; custom quotes for enterprises | |

| HubSpot | Small tax firms that need all-in-one sales, marketing & CRM | Custom forms, email templates, onboarding workflows | Starts at $15/user/month; up to $3,600/user/month |

| TaxDome | All-in-one practice management with a client portal | E-signature automation, secure client portal, visual pipelines | $800–$1,200/year per user |

| Liscio | Secure client communication & workflow automation | Secure messaging, recurring task automation, communication timeline | Pro: $75/user/month; custom quotes for enterprises |

| Pipedrive | Sales-driven tax firms that need a visual pipeline | Drag-and-drop pipeline, follow-up automation, email tracking | $14–$79/user/month |

| Zoho CRM | Highly customizable tax workflows with built-in accounting integrations | Zoho Books/Payroll integration, automated tax rules, tax reporting | $20–$65/user/month |

| Insightly | Strong pipeline management & task automation | Structured pipelines, custom tax fields, deadline-based automation | $29–$99/user/month |

| Accelo | Automating client management & service delivery in tax firms | Time tracking + billing, full client history, searchable record system | Custom pricing |

| Nimble | Social media-integrated client management and engagement | Social profile enrichment, email tracking, social lead capture | $29.90/user/month |

| Salesforce | Enterprise-level tax firms that need advanced automation & analytics | AI analytics, deadline alerts, robust accounting integrations | $165–$500/user/month |

| Method CRM | QuickBooks & Xero-integrated client/billing management | Real-time billing sync, client self-service portal, automated follow-ups | $25–$74/user/month |

What Should You Look for in a CRM for Tax Professionals?

Managing client data is already time-consuming, and tax season only makes it worse. When managing countless deadlines, emails, and documents, tax professionals need to go digital.

That’s why a CRM for tax professionals is essential—it organizes client information, automates tasks, and ensures nothing slips through the cracks.

📌 But not all CRMs are the same for tax pros. So here’s a list of the “must-have” features to look for while choosing the right CRM software:

- Organize client management: Store tax history, filing status, deductions, and key financial data

- Track tasks and deadlines: Send automated reminders for filings, audits, and follow-ups

- Store and secure documents: Maintain tax returns and supporting files in a centralized location

- Log communication history: Record emails, calls, and meetings for complete client interactions

- Automate workflows: Handle document requests, follow-ups, and client onboarding with minimal effort

- Integrate with tax software: Sync with accounting software like QuickBooks Online for real-time data updates

- Customize fields and reporting: Generate insights on client trends, sales processes, and business performance

- Set up the right client portal: Offer secure self-service access for tax documents, invoices, payments, and communication

The 11 Best CRM for Tax Professionals

With the right CRM, tax firms can manage client interactions, automate repetitive tasks, and focus on what matters—helping clients navigate tax season stress-free. Here are our picks for the 11 best CRM software to help you make tax season manageable.

1. (Best for customizable client management and workflow automation)

If you want to stay on your client’s “10/10, would recommend” list, you’ve to try ’s CRM for tax professionals. As the everything app for work, combines project management, document storage, and team communication in one AI-powered platform.

Let’s see how that’s helpful for your workflow!

First things first: Chasing clients is exhausting—and it’s the part no one teaches you in tax school.

So, what can you do differently? Forms simplify client data collection and automate intake within your CRM system.

They also allow you to instantly create actionable tasks based on submissions—whether you’re gathering client onboarding details, expense reports, or compliance data.

Using Custom Fields in the CRM, accounting, finance, and tax professionals like you can track key client data like filing status, tax year, invoice status, and document deadlines—all in one place. You can filter tasks by client type (e.g., business vs. individual), tag urgent cases, and create tailored workflows. It’s a flexible way to organize and prioritize work without getting buried in spreadsheets.

for Accounting further allows professionals to store tax returns, financial statements, and compliance documents in a centralized, searchable system that can be shared with clients, using the Docs hub.

Better yet, all your Docs aren’t static, they’re actionable. You can collaborate live with your team and turn comments, feedback, and updates inside a document into new tasks.

Whether it’s updating a tax estimate or following up on missing data, every piece of stored info can become a step forward with Tasks.

💡 Pro Tip: Using Automations, you can instantly trigger follow-up tasks without manual effort. For example, if a client’s invoice is overdue or a budget exceeds limits, a task can be auto-created and assigned using simple when-then triggers.

Here’s a quick guide on how to use AI to automate tasks 👇🏻

Now, for one of the most important features.

Sifting through client information manually is a one-way ticket to tax-season burnout.

for Finance Teams lets professionals create high-level reports, perform key calculations instantly using Formula Fields, and always be ahead of payment dues with real-time monitoring tools like Dashboards.

Plus, ’s Integrations with 1000+ tools like QuickBooks and Xero make it that one all-inclusive platform you need to tick through all your tax-related tasks.

best features

- Customize tax dashboards: Visualize client data, tax filing progress, revenue insights, and compliance status with 50+ dashboard widgets

- Sync deadlines with Calendar View: Track tax filing dates, client meetings, and compliance tasks by integrating with Google Calendar and Outlook

- Centralize emails for seamless client communication: Manage client emails, tax inquiries, and project updates directly within

- Enable self-service with a client portal: Provide clients with real-time access to tax documents, invoices, and filing statuses

- Accelerate processes with AI-powered automation: Use 100+ automation templates, and AI-driven triggers to assign tasks, send deadline alerts, and update tax filing statuses instantly

limitations

- New users may take some time to learn all the features

pricing

free forever

Best for personal use

Free Free

Key Features:

unlimited

Best for small teams

$7 $10

Everything in Free Forever plus:

business

Best for mid-sized teams

$12 $19

Everything in Unlimited, plus:

enterprise

Best for many large teams

Get a custom demo and see how aligns with your goals.

Everything in Business, plus:

* Prices when billed annually

ratings and reviews

- G2: 4.7/5 (9,000+ reviews)

- Capterra: 4.6/5 (4,000+ reviews)

What are real-life users saying about ?

💡 Pro Tip: If setting up a CRM from scratch seems too daunting, start with free, customizable CRM templates. They’ll help you get the basics right and develop the confidence to work with more sophisticated CRM tools.

2. HubSpot (Best for small tax firms that need an all-in-one sales, marketing, and CRM solution)

Nobody talks about this enough, but most tax professionals spend most of their time hunting down client information. Of course, this is not the best practice in a deadline-sensitive sector.

HubSpot CRM understands, though. It neatly organizes every tax record, lead interaction, and follow-up so you’re not scrambling for details at the last minute.

Now, instead of chasing paperwork, you can actually focus on helping clients with built-in customer communication management features.

HubSpot best features

- Track client onboarding, proposals, and tax service deals in a single dashboard

- Convert leads using customizable forms, email templates, and automated workflows

- Schedule client meetings and deadlines with built-in calendars and reminders

HubSpot limitations

- Advanced tools require higher-tier plans

- Custom reports are limited on the lower-tier plans

HubSpot pricing

- Marketing Hub Starter: $15/month per user

- Starter Customer Platform: $15/month per user

- Marketing Hub Professional: $800/month per user

- Marketing Hub Enterprise: $3,600/month per user

HubSpot ratings and reviews

- G2: 4.4/5 (12,200+ reviews)

- Capterra: 4.5/5 (4,300+ reviews)

What are real-life users saying about HubSpot?

3. TaxDome (Best for tax professionals seeking an all-in-one practice management solution with a client portal)

The whole point of having access to advanced CRM tech is being able to dial back on some of those repetitive manual tasks.

Manual busywork, such as follow-ups or document-sharing requests, adds up fast in a tax firm. TaxDome takes that off your plate with built-in automation designed specifically for CRM workflows.

From client intake to e-signatures, it moves tasks forward without constant hand-holding—so your team can focus on tasks that actually require a human touch.

TaxDome best features

- Automate tax tasks like document collection, follow-ups, and e-signature workflows

- Offer secure client communication and document sharing via portal + mobile app

- Organize client pipelines to visualize progress across tax services

TaxDome limitations

- Limited workflow customization compared to broader CRMs

- Not ideal for firms with large, complex client databases

TaxDome pricing

- Solo: $800/year per user

- Pro: $1000/year per user

- Business: $1,200/year per user

TaxDome ratings and reviews

- G2: 4.7/5 (600+ reviews)

- Capterra: 4.7/5 (3,000+ reviews)

What are real-life users saying about TaxDome?

📮 Insight: Time management is an added stress on your workforce

92% of knowledge workers rely on personalized time management strategies, yet most workflow management tools lack strong built-in time tracking and prioritization features. This gap can make it harder to manage tasks efficiently.

’s Automations, AI-powered scheduling, and time-tracking tools eliminate the guesswork by offering data-driven recommendations.

4. Liscio (Best for tax professionals prioritizing secure client communication and workflow automation)

Liscio CRM for tax professionals eliminates the back-and-forth between your sales team and clients by centralizing client interactions in one secure platform.

This accounting CRM software offers a dedicated client portal with customer tracking and communication features—making client engagement more efficient.

Liscio best features

- Secure client communication and document sharing in one portal

- Automate recurring tasks like reminders, form submissions, and tax return approvals

- Track all client communication across email, calls, and messages in one timeline

Liscio limitations

- Two-way texting incurs additional costs

Liscio pricing

- Pro: $75/month per user

- Enterprise: Contact pricing

Liscio ratings and reviews

- G2: Not enough reviews

- Capterra: 4.7/5 (40+ reviews)

5. Pipedrive (Best for sales-driven tax firms needing a visual pipeline and lead tracking)

During tax season, you are already up to your neck in client onboarding and lead management. So, how do you even consider upsell opportunities?

To solve this, Pipedrive gives tax professionals a clear visual pipeline to manage every stage. From the first consultation to closing retainers, this tool makes it easy to see where each client stands and what needs attention next.

Pipedrive best features

- Visualize tax service pipelines and track progress between stages with effortless drag-and-drop features

- Automate client follow-ups with smart scheduling and reminders

- Send and track emails within the platform for engagement insights

Pipedrive limitations

- Reporting tools are basic compared to competitors

- Some integrations require manual setup

Pipedrive pricing

- Essential: $14/month per user

- Advanced: $24/month per user

- Professional: $49/month per user

- Power: $59/month per user

- Enterprise: $79/month per user

Pipedrive ratings and reviews

- G2: 4.3/5 (2,000+ reviews)

- Capterra: 4.5/5 (3,000+ reviews)

What are real-life users saying about Pipedrive?

6. Zoho CRM (Best for highly customizable tax workflows with built-in accounting integrations)

Zoho CRM’s plus point is that it is built with tax professionals in mind.

Zoho Books and Zoho Payroll feature built-in tax calculations, custom rules, and direct integrations, bringing client management and tax data under one roof.

That means fewer workarounds and more time spent serving clients instead of stitching systems together.

Zoho CRM best features

- Set up automated tax rules and apply specific rates to transactions

- Integrate directly with Zoho Books and Payroll to streamline accounting workflows

- Generate tax-focused reports like client demographics and filing trends

Zoho CRM limitations

- The interface has a steep learning curve for new users

- Entry-level plans limit access to advanced automation

Zoho CRM pricing

- Standard: $20/month per user

- Professional: $35/month per user

- Enterprise: $50/month per user

- Ultimate: $65/month per user

Zoho CRM ratings and reviews

- G2: 4.1/5 (2,500+ reviews)

- Capterra: 4.3/5 (6,800+ reviews)

What are real-life users saying about Zoho CRM?

💡 Pro Tip: Does balancing the books feel like an endless audit? Save time on manual bookkeeping with these free bookkeeping templates

7. Insightly CRM (Best for tax professionals who need strong pipeline management and task automation)

While you might handle hundreds of tax filings every week, it doesn’t take away the fact that every client’s tax return feels like its own mini-project.

That’s why Insightly CRM helps you manage them like one. Unlike traditional CRMs that focus just on the sales process, Insightly gives you structured pipelines built for task-heavy business processes—like prepping, reviewing, and filing returns.

Insightly CRM best features

- Visualize each client’s tax return progress through structured pipelines

- Customize tax-specific fields to track deductions, filing status, and income

- Automate client follow-ups and tax prep tasks with deadline triggers

Insightly CRM limitations

- There are record storage limits in base plans

- The setup can feel complex for smaller teams

Insightly CRM pricing

- Plus: $29/month per user

- Professional: $49/month per user

- Enterprise: $99/month per user

Insightly CRM ratings and reviews

- G2: 4.2/5 (900+ reviews)

- Capterra: 4.0/5 (600+ reviews)

What are real-life users saying about Insightly CRM?

8. Accelo (Best for automating client management and service delivery in tax firms)

In most CRMs, billing is an afterthought. With Accelo, it’s built into your workflow. Tax firms can track time, manage client work, and generate invoices—all in the same system.

That means less revenue slipping through the cracks and more clarity on what work is billable, what’s pending, and what’s overdue.

Accelo best features

- Automate billing, time tracking, and task assignments from one system

- View complete client history, including emails, invoices, and service updates

- Use advanced search to locate tax records and client files instantly

Accelo limitations

- Getting accustomed to the complex interface requires training

- Custom pricing may deter smaller firms

Accelo pricing

- Professional: Custom pricing

- Business: Custom pricing

- Advanced: Custom pricing

Accelo ratings and reviews

- G2: 4.4/5 (500+ reviews)

- Capterra: 4.5/5 (150+ reviews)

What are real-life users saying about Accelo?

🔮 Key Insights: Why juggle multiple tools when you can have do it all? Because CRM and project management together lead to seamless tax workflows and zero chaos.

9. Nimble (Best for social media-integrated client management and engagement)

Nimble CRM for tax professionals makes it easy to manage client relationships and automate follow-ups—all while pulling in client data from email, social media, and other platforms.

With contact enrichment and pipeline management, tax professionals and CPAs can capture leads, nurture client relationships, and stay on top of tax season deadlines without the manual hassle!

Nimble best features

- Auto-enrich client profiles using LinkedIn, Twitter, and Gmail integrations

- Track emails and automate tax season follow-ups from one dashboard

- Capture leads via social or email and assign them to tax workflows

Nimble limitations

- The file storage capacity is limited

- Few advanced reporting tools for accounting-specific insights

Nimble pricing

- Business Plan: $29.90/month per user

Nimble ratings and reviews

- G2: 4.5/5 (1,000+ reviews)

- Capterra: Not enough reviews

What are real-life users saying about Nimble?

10. Salesforce (Best for enterprise-level tax firms that need advanced automation and analytics)

If your firm handles a high volume of clients, staying organized can be challenging. Salesforce helps by combining client records, tax deadlines, and reporting into one system.

Additionally, custom dashboards and integrations with accounting project management software make it a good fit for firms that need more structure and better visibility as they grow.

Salesforce best features

- Set automated reminders for deadlines, document requests, and appointments

- Use AI-powered analytics for tax revenue forecasting and client insights

- Integrate with major accounting tools and document systems

Salesforce limitations

- Expensive for smaller firms

- Customization and setup can be complex

Salesforce pricing

- Enterprise: $165/month per user

- Unlimited: $330/month per user

- Einstein 1 Sales: $500/month per user

Salesforce ratings and reviews

- G2: 4.4/5 (23,000+ reviews)

- Capterra: 4.4/5 (18,000+ reviews)

🔮 Key Insights: Implementing a project accounting system doesn’t have to be a numbers nightmare—follow this step-by-step guide to get it right: How to Use Project Accounting.

11. Method CRM (Best for QuickBooks and Xero-integrated client and billing management)

When your CRM talks directly to your accounting software, everything runs more smoothly. Method CRM integrates seamlessly with QuickBooks and Xero, so client details, invoices, and payments stay in sync—no double entry, no missed billing.

Method CRM best features

- Sync billing and financial data with QuickBooks and Xero in real time

- Enable client self-service through a branded portal for invoices and payments

- Automate client follow-ups, proposal workflows, and service renewals

Method CRM limitations

- Requires training to implement automation effectively

- May have integration challenges with legacy systems

Method CRM pricing

- Contact Management: $25/month per user

- CRM Pro: $44/month per user

- CRM Enterprise: $74/month per user

Method CRM ratings and reviews

- G2: 4.4/5 (250+ reviews)

- Capterra: 4.1/5 (100+ reviews)

Additional helpful tools

Apart from our top 11 picks, here are a few more CRM software options for tax pros that might be a good fit for you:

- Calendly: Calendly lets clients book tax consultations directly into your calendar, so you can spend more time filing returns, making scheduling client meetings as easy as ever

- Dext: Dext can extract key data from pictures of receipts, categorize it, and sync it with your accounting software, helping in automated receipt and expense tracking

- Canopy: Canopy comes loaded with features like secure client portals, workflow automation, and document management that help CPAs and accounting firms with efficient tax management

CRM Helps You Manage Tax Season Stress-Free

77% of companies increased their budgets for tax transformation and automation in FY24, up from 67% in FY23—a clear sign that businesses are doubling down on technology-driven tax management.

So, it’s no surprise that tax professionals need to go digital to keep up. But why stop at one inadequate solution when you can have it all?

Trinetix’s Kateryna Sipakova, Portfolio Manager, puts it best:

That’s why ’s CRM for tax professionals is your ultimate workflow companion!

It allows you to track client interactions, automate tax deadlines, centralize documents, and integrate with accounting software like QuickBooks and Xero—all in one intuitive platform, offering the most comprehensive solution to a stressful tax season.

Want to stop drowning in tax-related distress? Sign up for today!

Everything you need to stay organized and get work done.