Startups On Our Radar spotlights African startups solving African challenges with innovation. In our previous edition, we featured three game-changing startups pioneering HRTech, e-commerce, and mobility. Expect the next dispatch on January 9, 2026.

This week, we explore five African startups in the e-commerce, data management, legal, and artificial intelligence sectors and why they should be on your watchlist. Let’s dive into it:

Yelen is building an e-commerce ecosystem for Francophone Africa (E-commerce, Côte d’Ivoire)

Founded by Ibrahima Sylla in June 2025, Yelen is building an e-commerce ecosystem for small and medium-sized businesses across Francophone Africa that are excluded from online commerce. Although SMEs are important to Francophone African economies, as they make up over 90% of firms, fewer than half currently sell online. The founder observed that while platforms like Shopify exist, they often lack integration with local payment methods like mobile money, which forces merchants to constantly juggle informal logistics and disconnected tools.

Yelen allows sellers to create an online storefront without writing code. Vendors can sell both physical and digital products from a single store, accept payments through mobile money or cards, and manage orders and customers on the same dashboard. The platform integrates local payment rails through partners like PowerPay to enable cross-border payments across Côte d’Ivoire, Mali, Benin, Senegal, Burkina Faso, Niger, and Togo, with operators such as MTN, Wave, Moov, and Orange displayed based on the buyer’s location.

For logistics, Yelen supports local delivery handled by merchants themselves, while international shipping is facilitated through a DHL partnership. Buyers of physical goods can be required to pay either the full amount upfront or a 10% commitment fee to reduce failed deliveries. Funds are held in a digital wallet and are only accessible to the seller after the customer receives the product.

Yelen operates a tiered business model. On its starter plan, the platform takes a 10% commission per transaction. On its business plan, which costs about $200 monthly, Yelen reduces its commission to 3.5% and offers advanced features like custom domains, deeper store customisation, order management, and customer support tools. The company also earns 2–5% commission on logistics for shipments handled through its partners. Additional revenue streams include paid social media advertising services, dubbed Yelen Ads, SMS and email marketing campaigns, and an Instagram integration that allows sellers to import posts directly into their storefronts. Since its launch, Yelen says it has onboarded over 3,000 vendors and processed about $40,000 in transaction volume.

Why we’re watching: In 2024, the Ivorian e-commerce market generated a revenue of $534 million, a market where Sylla has 70% of its users. Yelen aims to tap into this market and accommodate both physical and digital commerce. It wants to solve the trust problem by allowing a 10% pre-payment commitment to reduce delivery failure. The startup handles cross-border mobile money payments and integrates local payment rails in Francophone Africa, adding a layer of trust for buyers and sellers operating across informal channels.

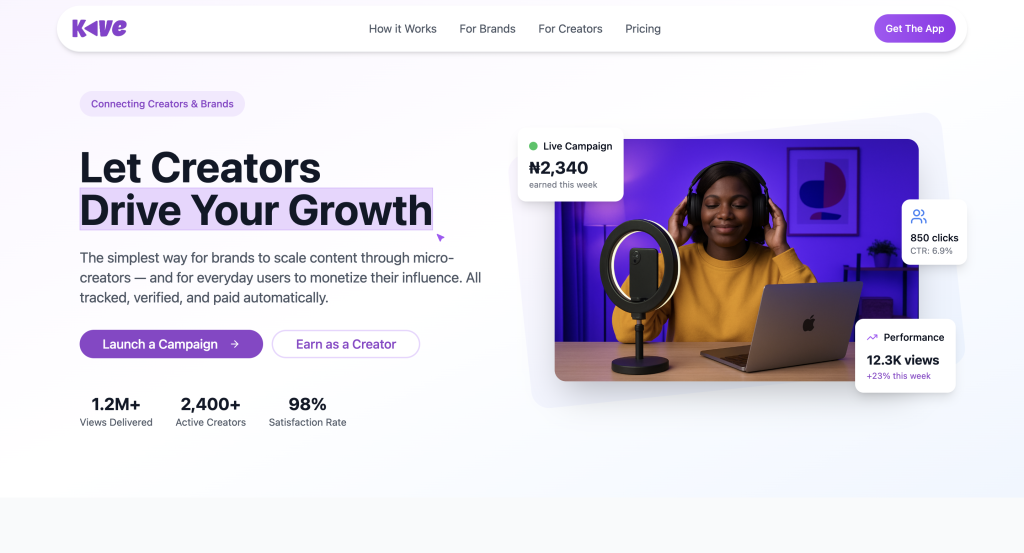

Kave Africa wants to automate influencer marketing for brands (MarketingTech, Nigeria)

Launched in October 2025 by Faith Aminu, Kave Africa is a creator marketing platform built to help brands work more effectively with nano and microcreators. Aminu, who has spent over five years in marketing and worked with product-led tech companies, said the idea for Kave came from repeated firsthand experience. She observed that Nigerian brands often default to celebrity influencer marketing and overlook smaller creators who dominate the creator ecosystem. She also saw that brands struggle with sourcing creators, negotiating rates, tracking performance, and managing campaigns, all of which are typically handled through spreadsheets.

Kave Africa streamlines this by connecting brands with vetted creators and managing the entire campaign lifecycle. Creators sign up on the platform and specify their niche, and then they are rated using a scoring system that considers posting consistency, video quality, and audience authenticity, as some creators use bots to boost their follower count. A key part of this system is Kave’s integration with TikTok’s API, which allows the platform to access backend metrics, like fake followers and ad-driven engagement that are not visible on the frontend.

Brands can either search for creators directly on the platform or publish a campaign with a fixed budget and brief. Interested creators will then apply to allow brands to select from the pool based on their ratings. The platform operates an escrow payment system where brands deposit the campaign funds upfront, but money is only released to the creator’s wallet after the content is delivered and approved. Kave also provides detailed campaign analytics, such as link clicks, traffic driven to brand pages, views, and follower growth.

Kave monetises by taking 20% of each campaign budget as a processing and service fee. Since its launch, Kave says it has built a database of about 6,000 creators and has worked with brands such as Tolaram Group, the parent company of Indomie, Colgate, and other consumer brands.

Why we’re watching: The African creator economy is expected to reach $29.84 billion by 2032 at a compound annual growth rate (CAGR) of 28.7%. To accelerate this growth and tap into this market value, Kave is tackling an inefficient process in creator marketing by replacing spreadsheets and manual sourcing with structured workflows and verified data. Its biggest differentiator is its use of TikTok’s backend API to rate creators based on real engagement rather than surface-level metrics, to give brands more confidence in performance. The startup is also building a community: it says it hosted 3,500 creators at its Kave Creator Fest in December 2025.

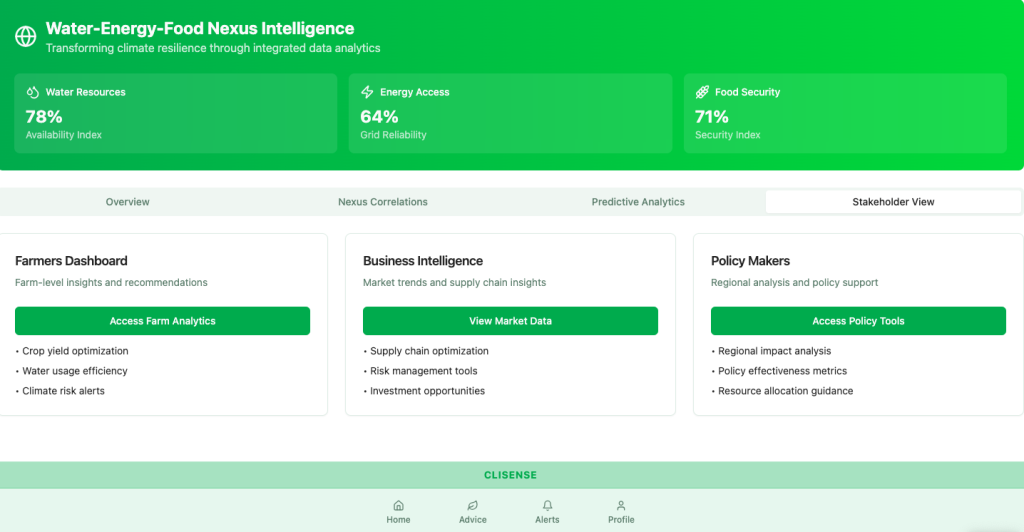

Clisense wants to help African farmers stay ahead of climate shocks with predictive insights (Agritech, Rwanda/Nigeria)

Clisense is an agritech startup using data science and climate analytics to help smallholder farmers anticipate and adapt to climate-related risks such as flooding and disease outbreaks. Founded by Ayomide Agbaje in December 2023, he noticed that overnight rainfall frequently led to floods that wiped out crops in the hilly community where he grew up in Nigeria. After relocating to Rwanda in 2023, he observed similar climate-related challenges among farmers there.

His solution is Clisense, a digital platform that turns satellite and climate data into actionable insights that are tailored specifically to agriculture. The startup uses satellite flood data to predict weather patterns and translate them into recommendations, like when to delay planting or harvesting crops. Although Clisense has a mobile application that provides hourly forecasts and an AI-powered assistant, the startup discovered during pilots that many farmers do not own smartphones or have reliable internet access. To solve this, Clisense built SMS alerts and interactive voice messaging as alert delivery channels, and supports local languages such as Kinyarwanda, Yoruba, and Igbo.

Clisense operates a dual B2C and B2B business model. Individual farmers can access basic alerts for free and upgrade to a premium subscription that offers more detailed insights for 2,000 Rwandan francs ($1.37) monthly. The startup says it has onboarded 100 users and converted about 20 users into paying customers as it prepares for a seed round in 2026.

Why we’re watching: Research shows that if global temperatures rise by 4°C by 2100, maize yields in some African countries can decline by more than 20%. Data suggests that agriculture contributes 32% to Africa’s GDP and provides employment to 65% of the continent’s labour force. Clisense is ensuring that such value does not depreciate by providing early warning systems to farmers. Clisense differentiates itself by translating climate data into agriculture-specific recommendations and delivering them through SMS, voice, and apps. The startup plans to deepen its accuracy by developing ground sensors for hyper-local data collection.

IntaOps wants to unify patient data with a decentralised ID system (Data Infrastructure, Nigeria)

IntaOps, formerly Verificare, was founded by statistician Azeez Bayo Nojeemdeen as a decentralised data interoperability platform designed to help organisations securely share and access user data across institutions, starting with healthcare. Nojeemdeen realised that Nigeria’s digital economy is hampered by siloed databases. For instance, a patient moving from a hospital in Lagos to one abroad must often restart their registration process or verbally recount their medical history.

IntaOps works by connecting entities into a shared ecosystem while allowing individuals to retain control over their data. In a typical healthcare use case, a patient registered at one hospital is issued an IntaOps ID. If that patient later visits another hospital, the new provider can query their medical record using the ID.

Onboarding on the platform is split between entities and individuals. When organisations register on the web platform, they complete a KYB (Know Your Business) process and gain access to a dashboard tailored to their industry. Healthcare providers can create patient records, query existing records, manage appointments, and invite staff members with varying access levels.

Individuals, on the other hand, can access IntaOps primarily through a mobile app, where they can receive notifications when an entity wants to access their data. Data access is consent-based, just like accepting or rejecting a friend request. Users must explicitly approve requests before their data is shared.

IntaOps is not yet generating revenue; it is currently running pilot tests with six hospitals in the Ojo Local Government Area of Lagos. Monetisation is expected to begin after the pilot, using a mix of pay-per-query and subscription pricing. Organisations choosing pay-per-query pay a monthly access fee of ₦50,000 ($35), plus ₦750 ($0.53) per data query. Subscription plans bundle access with usage limits, starting from ₦249,500 ($175) monthly for 500 queries.

The company plans to begin full monetisation in February 2026. Nojeemdeen says IntaOps has received grant funding from the Tony Elumelu Foundation, and is raising $300,000 to support expansion and commercialisation.

Why we’re watching: IntaOps is attempting to solve the interoperability crisis in African healthcare by using blockchain technology. If IntaOps can successfully convert its hospital pilots into paying customers and prove that institutions are willing to pay for shared data access at scale, it could become how Nigerians carry their data across services, locally and abroad.

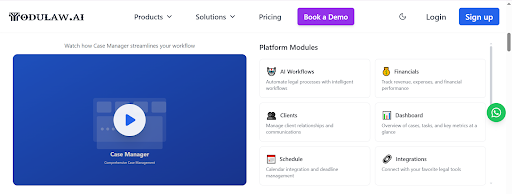

ModulawAI is building an operating system for African legal teams (Legaltech, Nigeria)

ModulawAI was inspired by its founder, Abiola Ogodo, who watched his father, a 37-year veteran lawyer, struggle with the manual inefficiencies of legal research and practice management. ModulawAI officially launched in August 2025, positioning itself as a legal operating system for lawyers.

ModulawAI combines case management, AI-powered legal research, and a secure client portal into one platform. Law firms can use the case manager to log matters, assign tasks to employees, manage documents, generate invoices, schedule meetings on Google Calendar or Zoom, and collaborate internally through notes and task assignments. The research module uses AI to answer legal questions by sourcing data from embedded Nigerian statutes and real court judgments, with citations and confidence scores designed to reduce hallucinations.

Clients interact through a separate portal where they can view case progress, upload sensitive documents securely, receive invoices, and make payments without waiting for WhatsApp or email attachments.

The startup monetises through subscriptions, AI usage credits, and invoicing fees. Its highest subscription tier costs ₦35,000 ($24.55), allowing three to four team members (additional seats attract extra charges). Invoicing attracts a flat platform fee, typically between ₦215 ($0.15) and ₦500 ($0.35) per transaction, depending on volume. Since its launch, ModulawAI says it has onboarded over 1,700 users and has over 100 paying customers.

Why we’re watching: While competitors like CaseRadar dominate legal research through established law reports and use AI to simplify legal research, ModulawAI differentiates itself with AI-driven case automation and client collaboration. Its use of multi-agent AI systems and layered checks against hallucination points to a future where legal work becomes less manual and more operationally intelligent. The startup says it has been developing its own law reporting system since September 2025, with a target delivery around March.

That’s all for today. Expect our next dispatch on January 9th. Know a startup we should feature next? Please nominate here.