To wrap up the second quarter results, we look at the numbers and key takeaways for e-commerce software stocks, including Wix (NASDAQ:WIX) and peers.

Although eCommerce has been around for over two decades and has seen significant growth, overall retail penetration is still low. Only about $1 out of every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market ripe for online disruption. It is these large parts of the retail industry where eCommerce has not yet taken hold that are driving the demand for various eCommerce software solutions.

The 6 e-commerce software stocks we track reported a decent second quarter. As a group, revenues topped analysts’ consensus estimates by 0.9%, while revenue forecasts for the next quarter were in line.

Stocks, particularly those trading at higher multiples, had a strong end to 2023, but this year has seen periods of volatility. Mixed signals on inflation have led to uncertainty around rate cuts. Fortunately, e-commerce software stocks have proven resilient, with share prices up an average of 6.3% since the last earnings report.

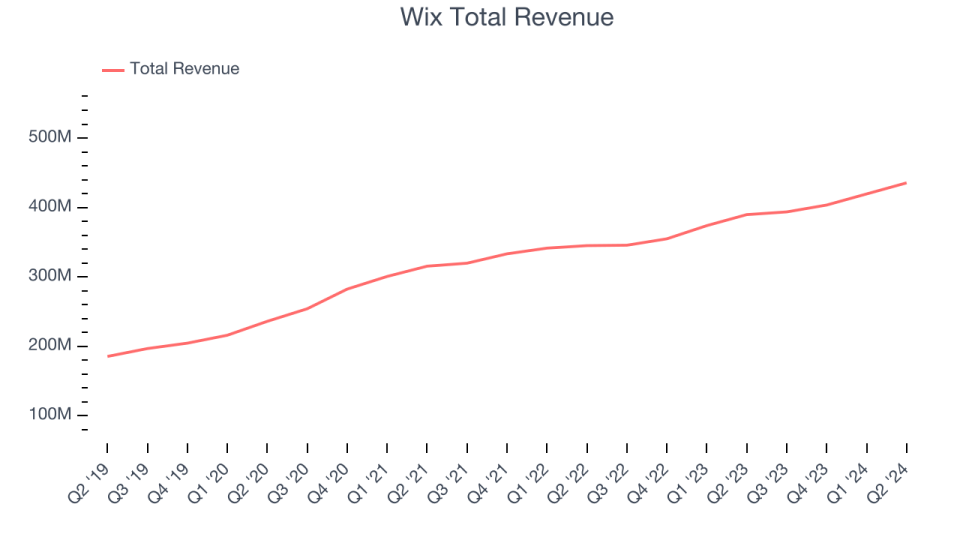

Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy-to-use website building platform.

Wix reported revenue of $435.7 million, up 11.7% year-over-year. The print was in line with analyst expectations, and overall it was a decent quarter for the company with a solid beating of analyst billings estimates, but the full-year revenue forecast fell short of analysts’ expectations.

“Excellent second quarter results cap a strong first half of 2024, driven by successful execution of our strategic initiatives, solid business fundamentals, and continued product innovation,” said Avishai Abrahami, co-founder and CEO of Wix.

Interestingly, the stock is up 6.9% since the report and is currently trading at $168.

Is now the time to buy Wix? Check out our full analysis of the profit results here, it’s free.

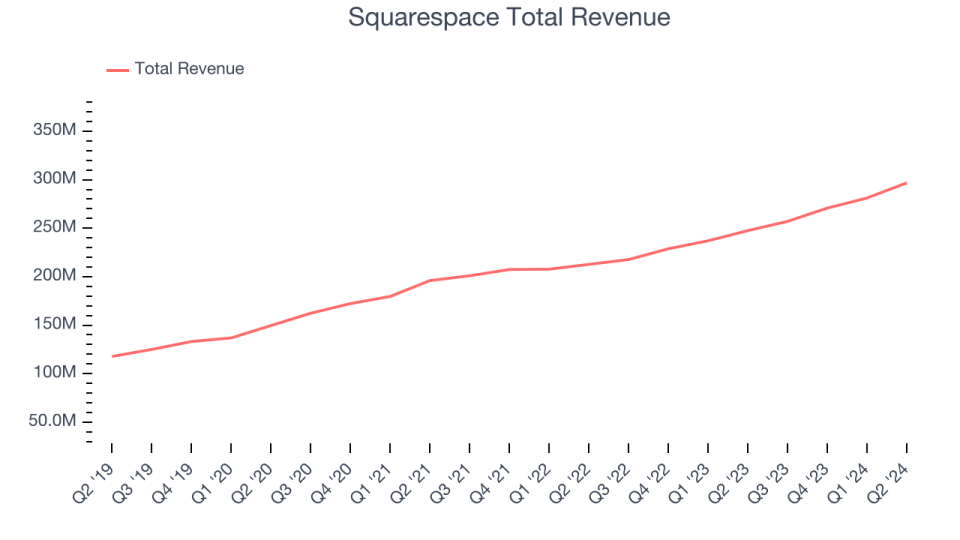

Best Q2: Squarespace (NYSE:SQSP)

Founded in 2003 in New York City, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presence online.

Squarespace reported revenue of $296.8 million, up 19.9% year over year, beating analyst expectations by 1.2%. It was a strong quarter for the company, impressively beating analyst billings estimates and significantly beating analysts’ annual recurring revenue (ARR) estimates.

The market seems pleased with the results, as the stock is up 2.1% since the report. It is currently trading at $45.

Is now the time to buy Squarespace? Check out our full analysis of its earnings results here, it’s free.

Slowest Q2: VeriSign (NASDAQ:VRSN)

While the company is not a domain registrar and does not sell domain names directly to end users, Verisign (NASDAQ:VRSN) manages and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenue of $387.1 million, up 4.1% year over year, in line with analyst expectations. It was a mixed quarter for the company, with gross margin improving.

VeriSign had the weakest performance compared to analyst estimates and the slowest revenue growth in the group. Interestingly, the stock is up 1.9% since the results and is currently trading at $180.

Read our full analysis of VeriSign’s results here.

Shopify (NYSE:SHOP)

Originally developed as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and managing e-commerce businesses.

Shopify reported revenue of $2.05 billion, up 20.7% year over year, beating analysts’ expectations by 1.7%. Zooming out, it was a strong quarter for the company, with a solid win in analysts’ total payment volume estimates and a decent win in analysts’ gross merchandise value (GMV) estimates.

Shopify topped analyst estimates and posted the fastest revenue growth among its peers. The stock has risen 40.6% since the report and is currently trading at $76.23.

Read our full, actionable report on Shopify here. It’s free.

GoDaddy (NYSE:GDDY)

GoDaddy (NYSE:GDDY) was founded by Bob Parsons after selling his first company to Intuit. The company offers small and medium-sized businesses the ability to purchase a web domain and tools to create and manage a website.

GoDaddy reported revenue of $1.12 billion, up 7.3% year-over-year, in line with analyst expectations. Taking a step back, it was a solid quarter for the company, with a significant beating of analysts’ booking estimates.

GoDaddy delivered the biggest full-year guidance increase among its peers. The stock is up 14.8% since the report and currently trades at $162.25.

Read our full, actionable report on GoDaddy here. It’s free.

Join Paid Stock Investor Research

Help us make StockStory more useful to investors like you. Join our paid user research session and receive a $50 Amazon gift card for your opinion. Sign up here.