Tricentis Inc., a provider of tools that help developers test their software for bugs more quickly announced that it has raised $1.33 billion at a valuation of $4.5 billion.

Private equity firm GTCR led the investment. The deal comes six years after Insight Partners acquired a majority stake in Tricentis for $165 million. Reports that the software maker could first raise new financing arose in September.

Manually testing every single feature of an application for bugs, performance issues and vulnerabilities is often impractical. As a result, developers create testing workflows that automatically scan their software for faulty code. Tricentis offers tools that make it easier to create such automated workflows.

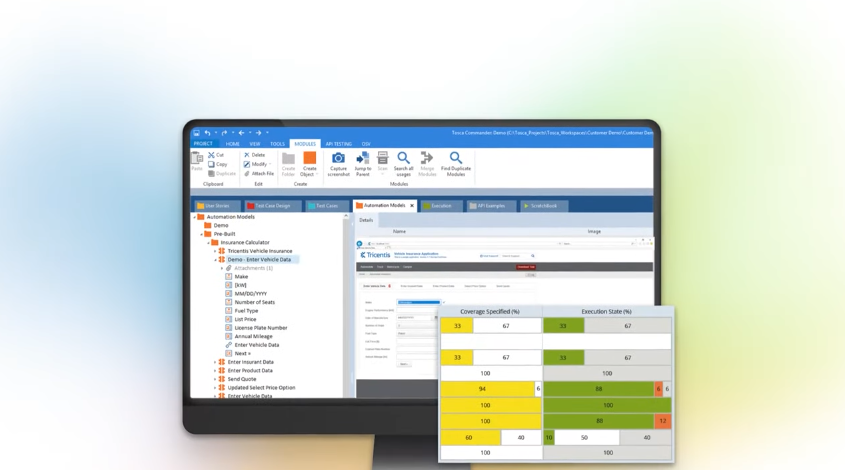

The company’s flagship product, Tosca, can test a wide range of programs, including web services, mobile apps and cloud workloads. The software finds bugs not only in an application’s user interface, but also in other components, such as the connectors that retrieve data from external systems. Companies can test whether each feature works as expected and measure how quickly the software responds to user input.

Tricentis sells Tosca alongside more specialized test automation tools. There’s LiveCompare, which allows companies to check changes to their SAP SE software environments for bugs. Another tool, Testim, facilitates testing of mobile and web applications.

The company also offers a number of other tools that make its major test automation products easier to use.

Software teams often maintain a library of automated tests, each configured to look for a different type of bug. When developers update an application, they typically only need to run a small portion of the automated tests created by their team. Tricentis offers a tool called SeaLights that identifies which tests are needed to evaluate a software update and skips the rest to save time.

SeaLights became part of Tricentis’ product portfolio in June when it acquired the startup that developed the tool. GTCR’s new $1.33 billion investment could allow the company to make more acquisitions to further expand its software offering.

The cash injection should enable Tricentis to accelerate its internal product development efforts. Last year, the company launched a service called Device Cloud that provides access to mobile devices from Apple Inc., Samsung Electronics Co. Ltd. and other smartphone manufacturers. Developers can use the hardware to test whether their mobile apps work consistently on different handsets.

Tricentis announced today’s financing milestone that it expects to end 2024 with $425 million in annual recurring revenues. That represents a year-over-year increase of 27%, which is better than the 20% growth the company posted in 2023. Tricentis derives its revenue from a customer base that includes more than 60% of the Fortune 500 and approximately 3,000 other organizations. .

Image: Three hundred

Your support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, in-depth, and relevant content.

Join our community on YouTube

Join the community of over 15,000 #CubeAlumni experts including Amazon.com CEO Andy Jassy, Dell Technologies Founder and CEO Michael Dell, Intel CEO Pat Gelsinger and many more celebrities and experts.

THANK YOU