We recently published a list of 15 AI News Updates Wall Street Is Monitoring. In this article, we are going to take a look at where Analog Devices, Inc. (NASDAQ:ADI) stands against other AI news updates that Wall Street is monitoring.

AI companies in the United States, many of whom have extensive business relations in China, are waiting anxiously for President-elect Donald Trump to assume office and announce possible changes to American policies towards China that will provide greater clarity on future US trade with the Asian country. Top executives from US-based firms were in China recently to meet with Chinese business leaders amid rumors of a massive spike in tariffs on goods being imported to Washington from Beijing. Latest reports from news platform Axios contend that Donald Trump is considering the appointment of an AI czar in the White House to coordinate federal policy and governmental use of artificial intelligence

Read more about these developments by accessing 10 Best AI Data Center Stocks and 10 Buzzing AI Stocks According to Goldman Sachs.

Per the report, billionaire Elon Musk, who has publicly backed Trump during the 2024 election and is rumored to have a key influence over the President-elect on AI policy, will not be the AI czar. However, the report adds that Musk is nevertheless expected to be involved in shaping the future of the debate and use cases related to AI. xAI, the AI startup Musk founded in 2023, recently raised $5 billion in a funding round. The latest round of funding brought the valuation of the startup to over $50 billion. xAI is competing with OpenAI, the ChatGPT maker with a valuation of more than $157 billion.

READ ALSO: 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

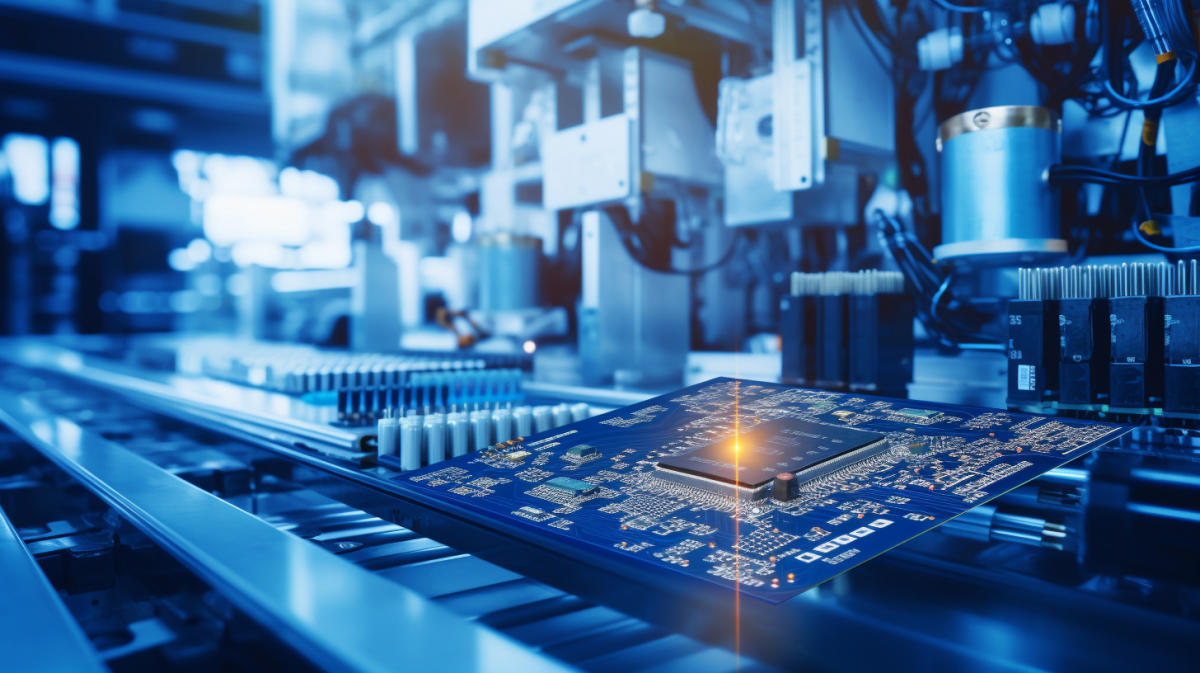

A technician working on power management in a semiconductor factory.

Number of Hedge Fund Holders: 63

Analog Devices, Inc. (NASDAQ:ADI) designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products. The firm recently posted earnings for the fourth fiscal quarter, beating analyst expectations on earnings per share and revenue. Looking ahead, Analog Devices forecast first quarter fiscal 2025 revenue at a mid-point of $2.35 billion, plus or minus $100 million. The firm showed stronger-than-expected results in the auto, consumer and comms segment, but industrial demand continued to lag for semiconductor companies.