If you buy and hold a stock for many years, you hope to make a profit. Furthermore, you would generally like to see the stock price rise faster than the market. Unfortunately for shareholders, while the Take-Two Interactive Software, Inc. (NASDAQ:TTWO) The share price is up 52% in the last five years, which is less than the market return. However, some buyers are laughing at a 23% increase in the past year.

Now it’s worth also looking at the company’s fundamentals, as that will help us determine whether long-term shareholder returns match the performance of the underlying business.

Check out our latest analysis for Take-Two Interactive Software

Since Take-Two Interactive Software didn’t make a profit in the last twelve months, we’ll focus on revenue growth to get a quick view on its business development. In general, companies without profits are expected to grow their revenue every year, and at a good clip. That’s because rapid revenue growth can easily be extrapolated to profit forecasts, which are often of significant size.

Over the past five years, Take-Two Interactive Software has seen its revenue grow 15% per year. That’s a pretty good long-term growth rate. The 9% annual gain over five years is better than nothing, but lags the market. You could even argue that the stock price was previously too optimistic.

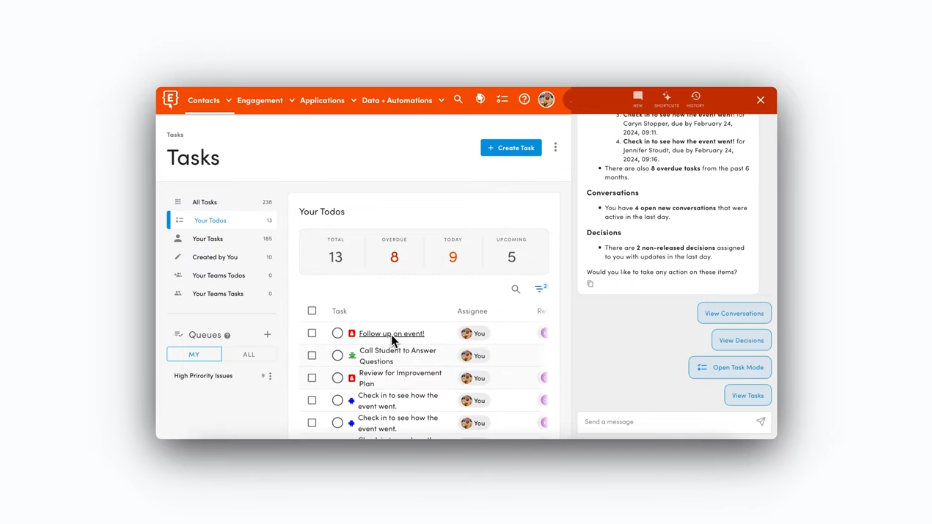

The graph below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We’re pleased to report that the CEO is more modestly compensated than most CEOs at similarly capitalized companies. It’s always worth keeping an eye on CEO pay, but the more important question is whether the company will grow profits over the years. So it makes a lot of sense to check what analysts think Take-Two Interactive Software will earn in the future (free earnings forecasts).

Take-Two Interactive Software shareholders achieved a total return of 23% during the year. But that was less than the market average. On the plus side, that’s still a gain, and even better than the 9% average return over half a decade. This could indicate that the company is winning over new investors as it continues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for example. Every company has them, and we’ve seen them 2 warning signs for Take-Two Interactive Software you should know.