If you think trust is an important concept applicable only to interpersonal relationships and is only nominally important in business, it’s time to think again. In the crypto industry, it may be the deciding factor for the success of your startup. Users need to believe that you have their best interest in mind, and you need to show in every aspect the user has contact with. Plus, crypto enthusiasts are highly knowledgeable: they can dig into the tech, analyze security, and assess the platform’s reliability all on their own.

On one hand, they will scrutinize your product inside and out. They’ll be skeptical — fake it until you make it and flashy marketing won’t fly here. That’s a straight ticket to being labeled a scam. On the other hand, this is an opportunity for founders who aren’t just building yet another Tier 1 trading tool but are actually bringing real value to the market — doing it safely, transparently, and with respect for their users.

But let’s be real — startups need an MVP, and MVPs rarely come with full licenses, audits, and all the shiny badges of legitimacy. Unless, of course, you’ve raised massive funding from day one (but let’s get back to reality real quick). In this article, we’ll break down what a crypto startup founder CAN do to build trust from day one — without massive budgets or overpromising things you can’t deliver.

1. Transparent communication

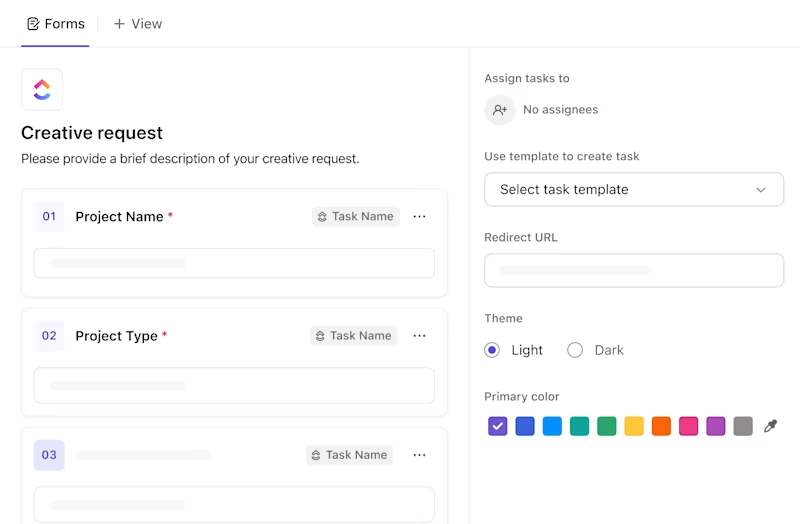

Transparency is not just a nice thing to have — it’s a practical way to enter the market and define your positioning. Especially in crypto. The Build in Public approach is well-known: developers share their progress to gain industry attention. Something similar works for trust-building in crypto, but the focus is different. It’s about clearly communicating how the product works, where it provides value, and where it doesn’t.

Spoiler: if you can’t explain this to yourself, you won’t be able to convince anyone else.

For example, if an exchange tries to compete with Binance or Bybit but has higher fees, worse liquidity, and no real advantages, users won’t switch. That’s why every crypto project needs to define its niche early and make it explicit. We figured this out quickly and focused on Tier 3 tokens instead of trying to compete on Tier 1 assets.

Transparency is also about clarifying risks. If an exchange is non-custodial and a licensed custodian holds funds, it’s not enough to mention this in the docs — you have to explain why it matters. Experienced users know the difference between custodians, which ones are reliable and which ones might disappear along with their funds. If this isn’t addressed clearly, it raises red flags.

In crypto, people don’t trust brands as much as they trust technical implementations. The more precisely you explain how things work, the more likely users are to take your project seriously.

2. Security and Regulation

Cryptocurrency security isn’t just about protecting user funds — it’s about making sure users believe you won’t disappear with their money. How this is achieved depends on whether the project is DeFi-based or centralized, as each operates under different security models and user expectations.

DeFi: Code as the Only Guarantee

In DeFi, code is law, and security relies on open-source transparency and smart contract audits. Major protocols have their contracts audited by specialized firms like CertiK. It’s expensive, but users won’t trust a project without an audit. If the team is unknown and lacks a track record, an audit is often the only way to prove that the code isn’t riddled with vulnerabilities.

However, even audits aren’t foolproof. Exploits still happen because once a contract is deployed, it can’t be patched, and attackers get more sophisticated over time. DeFi projects must go beyond audits and build security measures into their architecture. For example, they can implement withdrawal limits or emergency shutdown mechanisms to reduce damage in case of an exploit.

Centralized Platforms: Licenses or Trust?

DeFi projects rely on code for security – сentralized platforms rely on legal and institutional protections. Ideally, they should be licensed. But here’s the catch: licensed exchanges typically only cover spot trading and normally don’t offer the full range of features that users are seeking out.

As a result, many centralized exchanges partner with third-party custodians for fund storage. Doing this allows them to minimize risks since user funds aren’t controlled directly by the exchange but are held by regulated custodial services. A centralized platform not having a license or a trusted custodian is a major red flag for users.

In Short:

- DeFi projects rely on audits and transparent code for security.

- Centralized platforms need licenses or trusted custodians to gain user trust.

- If a project doesn’t clearly explain its security measures, users will assume it’s unsafe.

3. Real People Behind the Business

The crypto industry remains one of the most anonymous spaces. Many projects operate without known teams or public leaders, which might be convenient for founders but doesn’t help build trust.

When a project has no recognizable face, users are left with more questions than answers:

— Who is behind this?

— Will it still exist a year from now?

— Can it be trusted?

Anyone with crypto as the main occupation doesn’t rely on flashy websites or big promises. They look for people who stand behind the product and take responsibility for the results.

Being open creates trust. A visible founder makes the project seem more credible. Engaging in podcasts, answering community questions, and explaining key decisions fosters confidence. People see a real person behind it — not just another anonymous, faceless operation.

Building a personal brand doesn’t mean running a YouTube channel or aggressively marketing yourself. Sometimes, staying active in the community, participating in open AMA (Ask Me Anything) sessions, and speaking at industry events is more than enough.

A simple rule: if you’re not afraid to show yourself, you have something tangible to share.

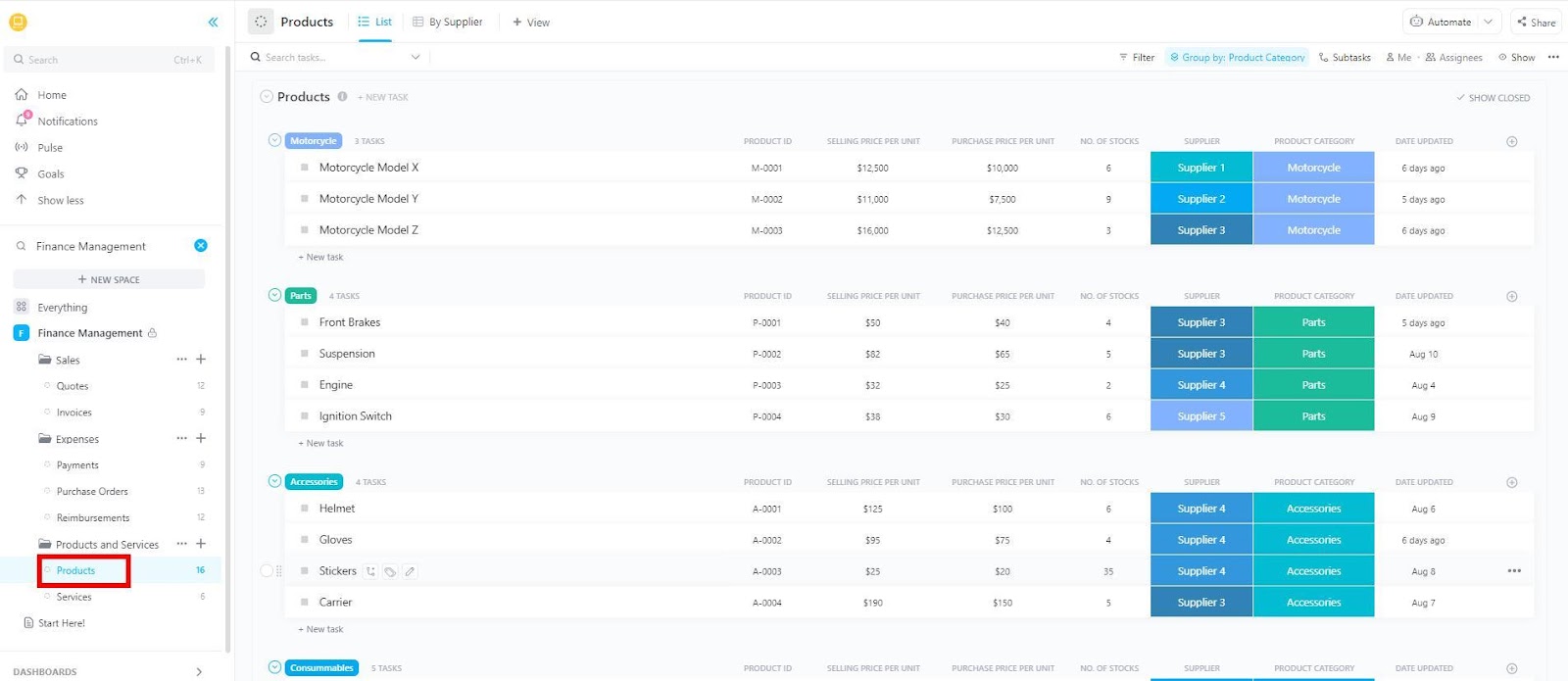

4. Technical Implementation

In crypto, security is not just a feature. It’s a fundamental requirement for a project’s survival. Users don’t take platforms at their word; they analyze how their funds are stored and how well the underlying mechanisms are protected.

One of the key questions is: **Where are the funds stored? If a platform is centralized but non-custodial, users need to know exactly who holds their assets. For example, mentioning the name won’t be enough if an exchange relies on a licensed custodian. It’s essential to explain what this means, including what licenses the custodian holds, its track record, and who operates it.

Technical aspects also matter. Users closely examine how the platform’s infrastructure is set up:

— What risk management mechanisms are in place?

— How reliable and user-friendly is the exchange API?

— Does the platform have access to liquidity from major exchanges?

The more transparent the technical implementation, the fewer doubts users have. When they see that a platform does not have direct access to their funds, that a licensed custodian manages assets, and that the project focuses purely on the technology — this builds trust.

Remember, transparency in technical implementation is not a marketing buzzword; it’s a necessity. Crypto projects with closed, opaque storage and operational schemes inevitably raise red flags, and users vote against them with their wallets.

Trust in crypto isn’t built on bold promises — it’s earned through real actions, transparency, and technological reliability. Unlike traditional fintech products, crypto users analyze risks themselves, assess the technical side, and deeply understand how platforms work. This sets a high bar for startups but also creates an opportunity to stand out through marketing and a thoughtful approach to building trust.

The formula is: Transparent communication + Security and regulation + Real people behind the project + Technical implementation.

If all variables align, you win.

I’ve tested all of this in my own products, and the key takeaway is simple: you can’t “sell” a crypto product if it doesn’t pass users’ scrutiny for honesty, security, and real value. If users see nothing but a sleek landing page and marketing buzzwords, they’ll vote with their wallets and move on to something that works.