Preparing and filing your taxes online is much easier and more convenient than doing it on paper. It’s like writing: Even if you write only an occasional letter or work memo, your composition skills probably improve when you use a computer. Catching and fixing errors is simply easier and more efficient. The same concept applies to tax preparation. And when it comes to taxes, having no errors is the key to getting any money the IRS owes you and avoiding audits down the line.

Online tax preparation software is custom-built for that task. The best apps are compliant with the current IRS tax code and have three objectives:

-

Help you file an accurate return.

-

Make the filing process as quick and painless as possible.

-

Ensure you pay only what you owe and don’t miss deductions and credits—no matter how strange they might seem—that can lower your tax bill.

If you’re a paper-based tax preparer who refuses to go online, I have to ask: Why would you want to sit at a table surrounded by a mound of papers you have to fill in manually when you can do the same task at your computer or even on your phone?

The developers behind tax apps know how much most people loathe tax preparation, so they make their software as approachable as possible. You’re also likely to do a more thorough job when you’re interacting with an easy-to-use, friendly, and visually appealing application. Instead of giving up in frustration when you can’t figure out whether you can claim a particular credit or deduction and how to do it, you just follow an app’s simple instructions through to the end.

Here, we explain how tax apps help you find deductions and credits you might miss if you do your own taxes by hand.

The Best Tax Software We’ve Tested

1. Software Simplifies the Tax Preparation Process

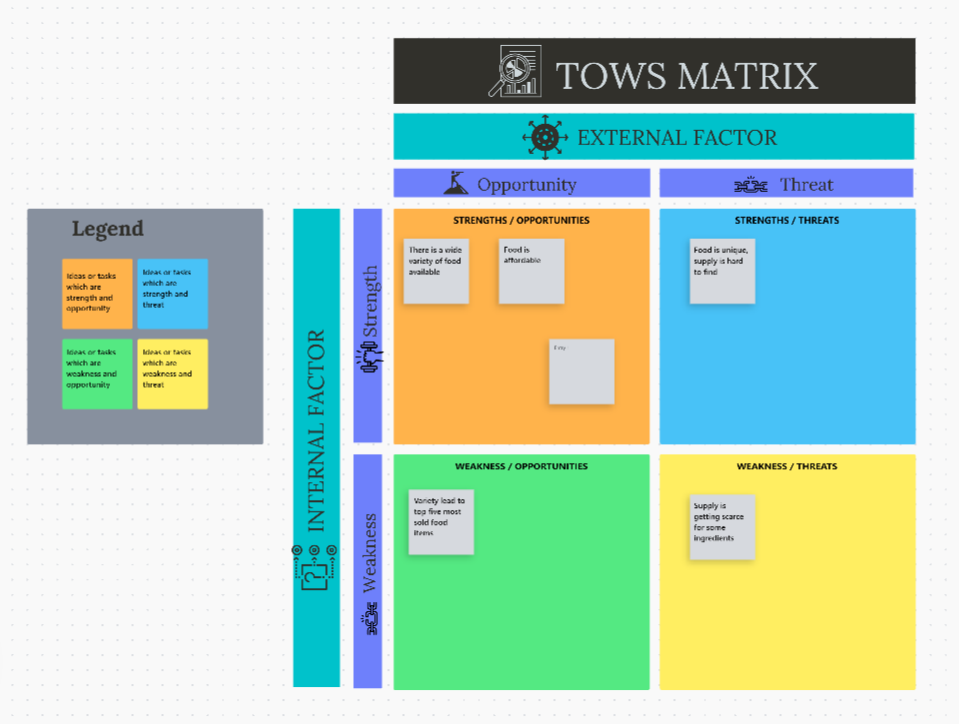

Tax apps use several strategies to streamline the convoluted and complex filing process and help ensure you account for every aspect of your tax-related finances. Below are some of the main techniques:

Walk-Throughs

You don’t have to deal with official IRS and state forms and schedules. All tax prep applications guide you through the entire process using a series of interactive wizards. They ask straightforward questions, and you provide answers by clicking buttons, choosing from lists, and entering data. The site does all the calculations and completes the required documents for your return without you ever having to see an official IRS or state form. Because they touch on every major tax topic (and many minor ones), it’s more difficult for you to miss something that could save you money.

Schedule C page in FreeTaxUSA (Credit: FreeTaxUSA/PCMag)

Comprehensive Coverage

The best tax preparation websites support all the forms and schedules you’re likely to need. They start each section (income, deductions, credits, and so on) by listing all the ways you could receive money and the ways you might have spent it that could be deductible. As long as you read every page carefully and visit all the tax topics that apply to you, you don’t have to worry about omitting a critical piece of information that could result in an incorrect return—and possible penalties. You also don’t have to scramble to find the right forms.

Error Checking

Most personal tax apps are good at preventing you from advancing to the next page until you complete the current one. And before you finalize your return and submit it, they conduct a final review that looks for errors or missing information. This final review helps minimize the chance you submit an error or miss out on potential savings. In some cases, an app won’t even allow you to e-file until you resolve a problem it found.

2. Tax Software Offers Easily Understandable Explanations and Guidance

There are many ways to file an incorrect income tax return. Forgetting to report income is one of the most serious errors, but you can also make other mistakes that might result in a higher tax bill or even a fine. Tax sites help you avoid both by providing simple and clear guidance that avoids the complex language of the IRS.

Help pane in TurboTax (Credit: Intuit/PCMag)

But what if you don’t understand a topic or aren’t sure it applies to your situation? For example, you might want to know whether you’re eligible for a certain deduction without risking a penalty if you’re not. Tax preparation services provide multiple types of help. For example, they might:

-

Explain a question in more depth.

-

Hyperlink a word or phrase and display a definition.

-

Include searchable help files.

-

Makes tax professionals available for questions about tax law.

-

Offer technical support by chat, phone, and email.

-

Show you FAQs and other context-sensitive information.

The better you understand the information your return requires, the more likely you are to knock some money off your tax bill and avoid attention from the IRS.

3. Tax Software Helps You Maximize Deductions and Credits

All the above tools make it more likely you claim every deduction and credit you’re legally allowed than if you were doing your taxes on paper. If you maximize your tax return’s deductible expenses, your refund will be larger.

Recommended by Our Editors

That’s really the point of tax prep services. They help you document your income and expenses carefully. Many, for example, let you import your W-2 and 1099 data, which helps prevent transposition errors. Most of them also import your return’s data from the previous year—even if you filed it using a competing service—and allow you to revise it as necessary.

When tax apps break down Form 1040 for you, they strive to be as comprehensive as possible, especially when it comes to deductions and credits. You might be surprised to find out just how many of each are allowable. In other words, don’t skip sections called something like “Uncommon Tax Situations.”

Mortgage interest deduction page in H&R Block (Credit: H&R Block/PCMag)

4. Tax Software (Usually) Costs Less Than an Accountant

Most tax apps have associated fees, anywhere from $14.99 to more than $100. However, there are some free options. You can prepare and e-file your federal and state taxes at no cost with Cash App Taxes (formerly Credit Karma Tax). FreeTaxUSA is free for federal returns but charges $14.99 per state. Both support all major IRS forms and schedules, even those necessary for gig workers and sole proprietors.

Business expenses page in Cash App Taxes (Credit: Cash App Taxes/PCMag)

A few services make tax professionals available to complete your return if it simply becomes too complicated for you to finish by yourself. This costs extra, but it might reduce your tax bill in the long run. H&R Block, Jackson Hewitt, Liberty Tax, and TurboTax all offer it. You can get help along the way from H&R Block and TurboTax experts via video screen-sharing, as well (for an extra fee). H&R Block, though, allows you to ask unlimited questions of a tax pro for free with all of its paid versions.

The bottom line: Using a tax app almost always costs less than hiring a CPA to do your taxes for you, and you get a lot more help than if you were to file your taxes on paper by yourself. It’s a win-win.

For more on getting the biggest return possible, see our tips on maximizing your credits and deductions.

Get Our Best Stories!

This newsletter may contain advertising, deals, or affiliate links.

By clicking the button, you confirm you are 16+ and agree to our

Terms of Use and

Privacy Policy.

You may unsubscribe from the newsletters at any time.

About Kathy Yakal

Contributor