As global economic tensions escalate, gold has surged to an all-time high, while Bitcoin remains relatively stagnant. Despite its reputation as “digital gold,” Bitcoin has failed to respond to macroeconomic uncertainty in the same way as the precious metal.

Bitcoin Stagnates While Gold Shines

According to World Gold Council, gold crossed US$3,000/oz in intra-day trading during the early hours of Friday 14 March and then again on Monday 17 March. This historic milestone was largely driven by investor fears following new trade tariffs imposed by Donald Trump. Gold has long been regarded as the ultimate safe-haven asset, and with rising geopolitical tensions, institutional investors have turned to physical gold rather than Bitcoin as a hedge against inflation and economic instability.

While gold continues to break records, Bitcoin has been trading sideways, showing little reaction to the same economic forces. This raises questions about whether Bitcoin can truly be considered a hedge against financial turmoil or if investors still see it as a high-risk, speculative asset rather than a stable store of value.

Global Trade Wars Add to Market Volatility

The ongoing U.S.-EU trade dispute has intensified, adding further uncertainty to the global economy. The European Union recently imposed a 50% tariff on American whiskey, retaliating against U.S. tariffs on steel and aluminum. In response, Trump has threatened 200% tariffs on European wine and spirits. These developments have increased fears of a global trade war, which could slow economic growth and affect investor sentiment. Traditionally, such tensions drive safe-haven demand, benefiting assets like gold, while Bitcoin’s uncertain status leaves it in limbo.

A Bloomberg report suggests that the Federal Reserve is unlikely to adjust interest rates in the first half of the year. However, analysts expect that rate cuts could come in the second half, which could create more favorable conditions for risk assets like Bitcoin. Historically, lower interest rates have made riskier investments more attractive by reducing the appeal of fixed-income assets. This could potentially lead to greater institutional interest in Bitcoin if liquidity increases in financial markets.

Will Institutions Shift from Gold to Bitcoin?

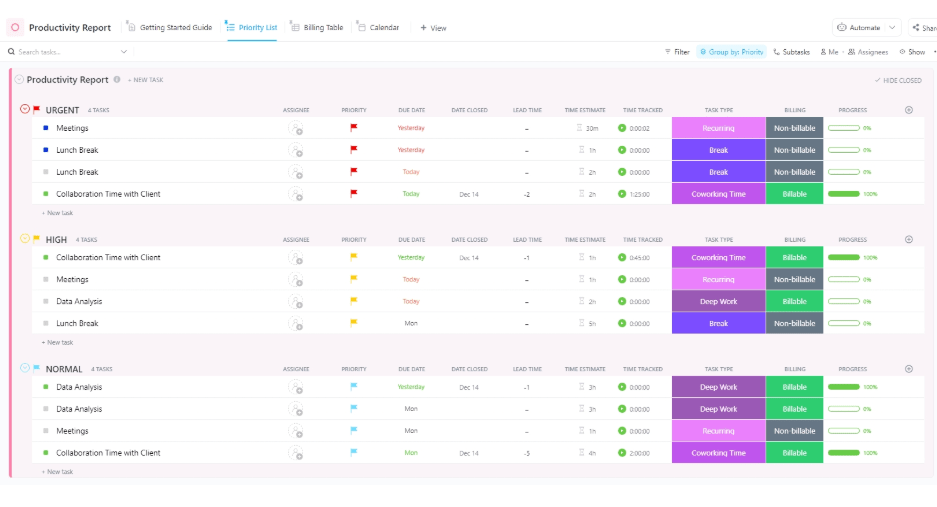

Despite the dominance of gold, institutional investors may eventually turn to Bitcoin, especially as physical gold supply chain delays stretch to 2-3 months. If inflation accelerates and access to gold becomes restricted, investors may diversify into digital assets.

However, the crypto market still faces regulatory uncertainty, and many funds remain cautious about moving significant capital into Bitcoin. Upcoming regulations and greater financial integration could be key catalysts for Bitcoin adoption among institutional players.

Despite its current stagnation, many experts believe Bitcoin still has room for growth. The combination of potential Federal Reserve rate cuts, increasing institutional adoption, and regulatory clarity could push Bitcoin toward a new all-time high (ATH) later this year.

For now, gold remains the top choice for investors seeking security, but Bitcoin’s role in the financial system continues to evolve. If economic conditions worsen, crypto could still emerge as an alternative hedge against inflation and financial instability.