The popular Solana DEX and automated market maker (AMM) Raydium recently announced the launch of its token launchpad, similar to

LaunchLab is said to offer linear, exponential, and logarithmic bonding curves that match the demand and price of a token. More so, it will allow third-party UIs to set their fees. Aside from offering new bonding curves and customizable fees, it’s said to support multiple quote tokens besides SOL and integrates with the Raydium liquidity provider locker, which lets issuers secure swap fees for tokens in perpetuity.

In this article, we will explore the architectural design of LaunchLab, including its bonding curve mechanism and core components. Before diving into the technical details, let’s first consider how LaunchLab would function if it were launched in the coming months.

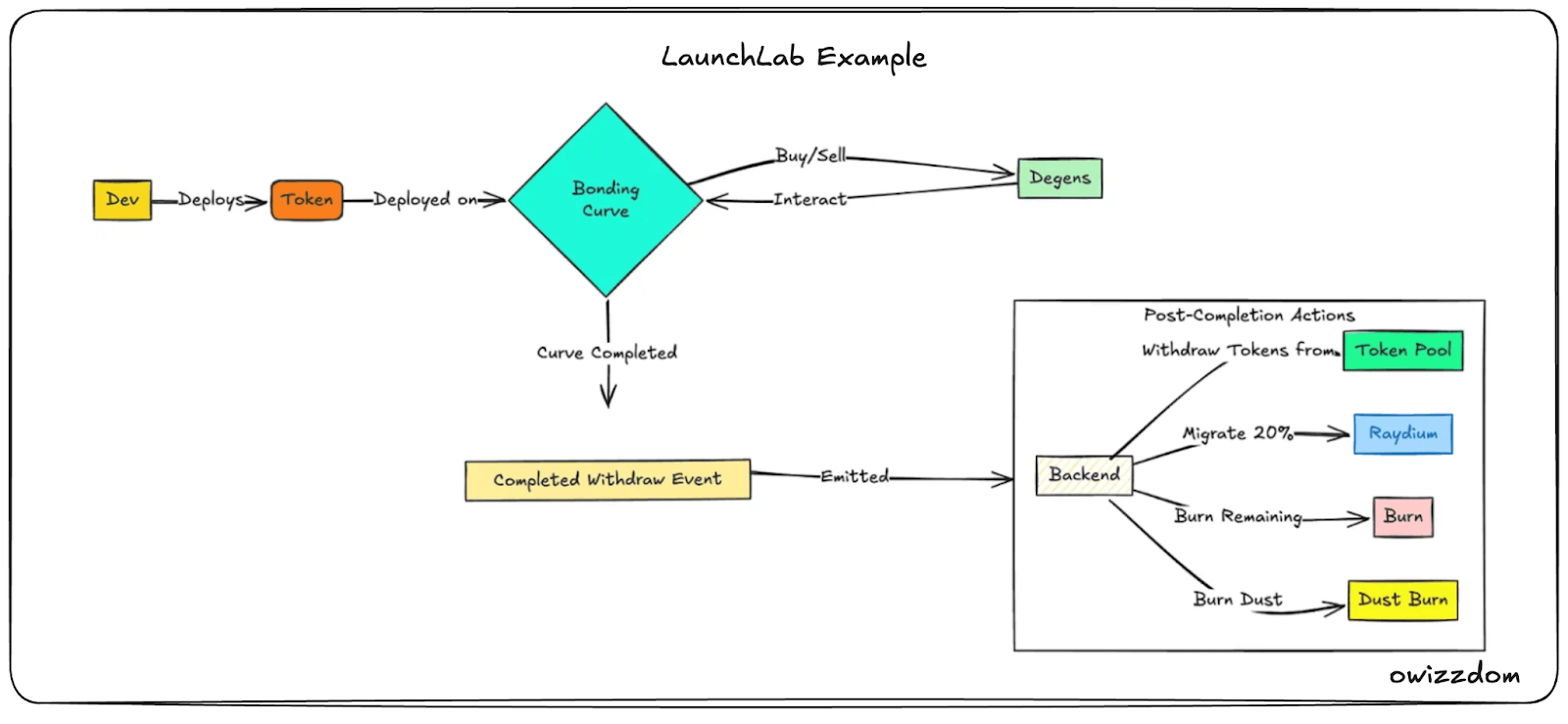

An Example of LaunchLab Usage

LaunchLab offers a seamless token launch experience by allowing deployers to quickly create a tradable asset. They simply choose a name, ticker, and JPEG image, after which the token is instantly available for trading on a bonding curve. Users can then purchase tokens directly from the bonding curve and sell them at any time, with prices dynamically adjusting based on demand. This eliminates the need for traditional liquidity provisioning, making token launches more accessible and efficient.

Once a user withdraws liquidity from the bonding curve, the system triggers a backend process to handle the remaining supply. The backend removes tokens from the pool, allocates 20% to Raydium to enhance market liquidity, burns the remaining tokens, and clears out any residual dust to maintain a clean token supply.

What are Bonding Curves and How do they Work?

A bonding curve is a mathematical concept that handles the pricing of cryptocurrencies or tokens based on their supply. This curve is predefined and algorithmically governed, ensuring the token price increases or decreases predictably with each purchase or sale.

According to the bonding curve principle, as the demand for a token increases (i.e., more tokens are bought), the price gradually rises according to the curve. Conversely, when tokens are sold, the price typically decreases. This relationship is algorithmically governed, ensuring a predictable and automated response to changes in supply and demand. The curve can take various shapes––such as linear, exponential, or logarithmic––each shaping the token’s economy differently. To illustrate further, imagine a project that issues a new cryptocurrency using a bonding curve. When the first token is bought, the price might be relatively low due to the high supply. As more traders buy-in, the supply decreases, and the price climbs along the curve.

Overview of LaunchLab Bonding Curve Model

The LaunchLab bonding curve is implemented in its program-based automated market maker (AMM) that adjusts token prices dynamically based on supply and demand. Based on personal views, this model ensures continuous liquidity through a predefined formula. This allows the program to self-recalculate the price, eliminating the need for external market makers. Furthermore, it supports linear, exponential, and logarithmic bonding curves, allowing deployers to choose a pricing model that fits their tokenomics strategy.

LaunchLab enables third-party UIs to integrate its bonding curve model while offering a customizable fee mechanism. External platforms, such as wallets, dApps, or dashboards, can facilitate token purchases and sales through LaunchLab’s programs while charging an additional service fee on each transaction. This allows third-party interfaces to monetize their integration without altering the bonding curve’s core pricing logic.

Lingering Thoughts

As

While Raydium’s war chest gives it room to maneuver, its ability to adapt in a rapidly evolving market is what will truly determine its long-term viability. As the Solana ecosystem continues to develop, the question remains: can Raydium diversify its offerings quickly enough to offset the expected drop in revenue? Only time will tell if this latest chapter in the Raydium-Pump.fun saga will propel the platform forward or leave it vulnerable to further market shifts.