Access Holdings Plc, the parent company of Access Bank, spent a record ₦193.5 billion ($120.5 million) on technology infrastructure and electronic business in 2024, even as its fraud-related losses dropped sharply by 73%, according to its latest full-year financial statement.

The tech spend—a 147% jump from 2023—is the highest in the banking sector, more than double the amount competitors such as Guaranty Trust Holding Company (GTCO) Plc, United Bank for Africa (UBA) Plc, and Zenith Bank Plc spent last year.

Several factors drove the surge in technology spending: inflation amplified by exchange rate volatility, major upgrades to its core banking software Flexcube, cybersecurity enhancements, and expansion into Tanzania, Namibia, and Hong Kong. Access Holdings says these moves were necessary to support its growing digital customer base and fend off competition from fintech companies like Opay, PalmPay, and Moniepoint.

“Our technology spend reflects a deliberate balance between capital investments in new capabilities and operating expenses that support existing systems, such as subscriptions and service licenses,” Access Holdings’ spokesperson said in an email to .

The spokesperson added that a significant portion of their IT spend remains vendor-driven, especially in areas like licensing, technical support, and niche services.

“Approximately 80% of our operational IT costs are tied to licensing, 15% to support services, and the remaining portion to consultancy and professional services.”

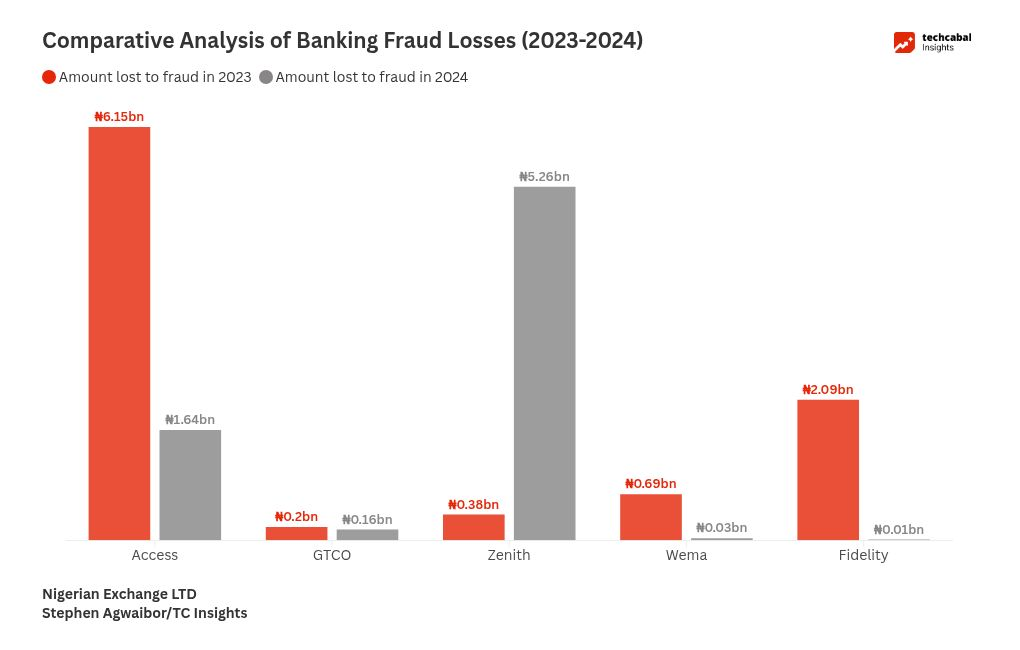

Analysts say the surge in tech spend may have slashed fraud losses by 73% from ₦6.15 billion ($3.8 million) to ₦1.64 billion ($1.0 million).

“I suspect that the group invested in some cybersecurity infrastructure, especially given that the amount lost to fraud declined significantly,” Mobifoluwa Adesina, investment research analyst at Afrinvest West Africa Limited, said.

Enhanced IT systems lead to fewer fraud incidents and financial losses for customers, according to Nabila Mohammed, a research analyst at Chapel Hill Denham, an investment banking firm in Lagos. “This increased security and seamlessness encourage customers to transact more, generating increased fee income for banks,” she said.

Access’s aggressive tech push leaves competitors trailing. GTCO reported a 48% rise in IT expenses to ₦88 billion ($56.8 million), Zenith doubled its budget to ₦67.3 billion ($43 million), while UBA grew its spend by 107% to ₦48 billion ($30.5 million).

Fraud losses across the sector show the impact of these investments. GTCO saw fraud losses fall slightly to ₦159.1 million ($99,421) from ₦198.8 million ($ 123,881). Zenith, however, recorded a spike, from ₦383.4 million ($238,914) to ₦5.26 billion ($3.3 million), underlining the urgent need for better fraud prevention tools.

The rise of digital payments in Nigeria has led to an increase in financial transactions, which has been accompanied by a growth in fraud cases within the financial system. According to the Nigeria Inter-Bank Settlement System (NIBSS), fraud incidents surged 112% between 2019 and 2023, while the value of losses spiked 496% to ₦17.67 billion ($11.1 million). Computer, mobile, and PoS fraud dominate, driven by increased digital activity and gaps in cybersecurity protocols.

Another report by the Financial Institutions Training Centre (FITC) noted that fraud-related losses in Nigeria rose to ₦10.1 billion across 19,007 cases in the third quarter of 2024, up from ₦1.18 billion across 12,066 cases in the same period of 2023. However, on a quarter-on-quarter basis, the total amount dropped from ₦42.8 billion, suggesting some recent gains.

“Increased trust and confidence in the banking system in this sector will lead to stronger growth in the coming years and quarters,” Mohammed of Chapel Hill Denham said.

Access Holdings, with a market capitalisation of ₦1.15 trillion, has not yet disclosed its tech budget for 2025, but it intends to deepen investment in staff training and advanced technology skill development to strengthen internal capacity and reduce exposure to foreign currency-driven costs.

“We will continue to invest in modernization, innovation, and customer experience, while maintaining tech expenditure in line with similar global financial institutions to balance innovation and operational efficiency,” the spokesperson added.