I’m starting a series of articles where I will decode, in detail, Go-to-Market strategies and marketing solutions of the biggest crypto and Web3 projects.

Uniswap has solidified its place as the leading decentralized exchange in the DeFi space, boasting a total value locked (TVL) that hit $3+bn in 2025 and making UNI one of the most prominent governance tokens in crypto.

Since its launch in 2018 by Hayden Adams, this Ethereum-based protocol revolutionized trading with its Automated Market Maker (AMM) model, doing away with traditional order books and enabling seamless token swaps.

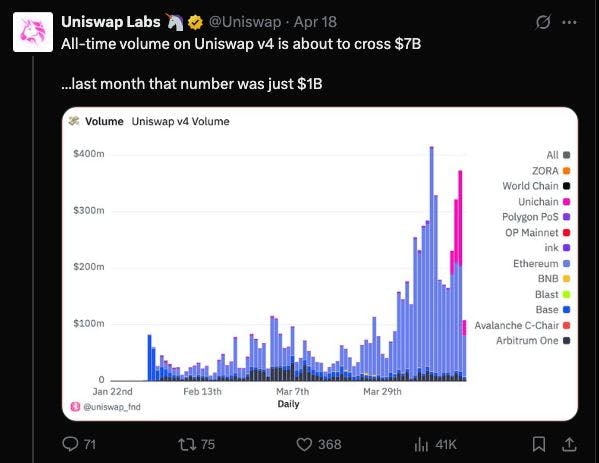

Today, in 2025, Uniswap handles over $3bn in daily trading volume, surpassing many centralized exchanges, and has expanded to layer-2 networks like Arbitrum and Optimism to make transactions faster and more affordable.

I’ve spent weeks researching Uniswap’s blog posts, governance proposals, and interviews with Hayden Adams to understand what fueled their rise from 2018 to 2025.

This analysis explores Uniswap’s growth, go-to-market strategy, focusing on how they positioned themselves, formed partnerships, and leveraged the iconic UNI airdrop. Everything here is based on publicly available information.

A Quick Primer on Uniswap

At its core, Uniswap is a DEX on Ethereum that lets users swap tokens without intermediaries by using liquidity pools powered by AMMs.

- Users can add liquidity to pools (like ETH/USDT) and earn a share of trading fees.

- UNI, the governance token, allows holders to vote on protocol changes.

- Unlike centralized exchanges such as Binance, Uniswap is permissionless—no KYC or middlemen required.

- The protocol has scaled through layer-2 solutions, significantly lowering costs for users.

Strategy Breakdown

**If you’re pressed for time, here’s the gist:

Uniswap established itself as the go-to DeFi trading platform by being open, transparent, and developer-centric. Their growth was driven by:

- The 2020 UNI airdrop, which gave 400 UNI (valued at $1,200 then) to early users.

- Layer-2 deployments on Arbitrum and Optimism, cutting gas fees by up to 50x.

- A developer-first mindset, with tools like the Uniswap SDK and v4 hooks for customization.

Key strategies:

- Community Engagement: The UNI airdrop and governance model fostered loyalty.

- Developer Support: Open-source code and tools made Uniswap a foundation for DeFi innovation.

- Trusted Leadership: Hayden Adams (@haydenzadams) emerged as a respected DeFi figure.

- Scalability Vision: With v4 and their own chain, Unichain, Uniswap is aiming to onboard billions of users.

Btw, if you’re building a Web3/crypto project and want to explore strategies like Uniswap’s – marketing, GTM, community, or KOLs—I’m offering 1:1 free sessions to dive into your needs and connect you with my network of partners. Book a call with me or hit me up on X.

Strategic Objectives

Uniswap’s goals were clear:

-

Build deep liquidity across the DeFi ecosystem.

-

Attract both retail users and developers.

-

Establish itself as the antithesis of centralized exchanges, emphasizing user freedom.

Back in 2018, Vitalik Buterin’s writings on “on-chain market makers” inspired Hayden Adams to create Uniswap. At the time, centralized exchanges like Coinbase dominated crypto trading, with high fees and KYC requirements. Uniswap introduced a new model: trustless, permissionless trading where users could become market makers by providing liquidity—a direct challenge to the CeFi status quo.

Positioning

-

Accessible DeFi: No KYC, no restrictions—just connect a wallet and trade.

-

Developer-Centric: Open-source code and SDKs positioned Uniswap as a DeFi cornerstone.

-

Cost-Effective Scaling: Layer-2 integrations tackled Ethereum’s high gas fees.

-

Passive Income: Liquidity providers earn fees, drawing in yield-focused users.

Uniswap’s communication avoids direct comparisons with centralized exchanges, instead emphasizing “decentralized liquidity” and “community ownership.” My take: this approach appeals to DeFi enthusiasts and developers while subtly positioning Uniswap for institutional interest in on-chain trading.

And here’s the positioning and wording for their new product:

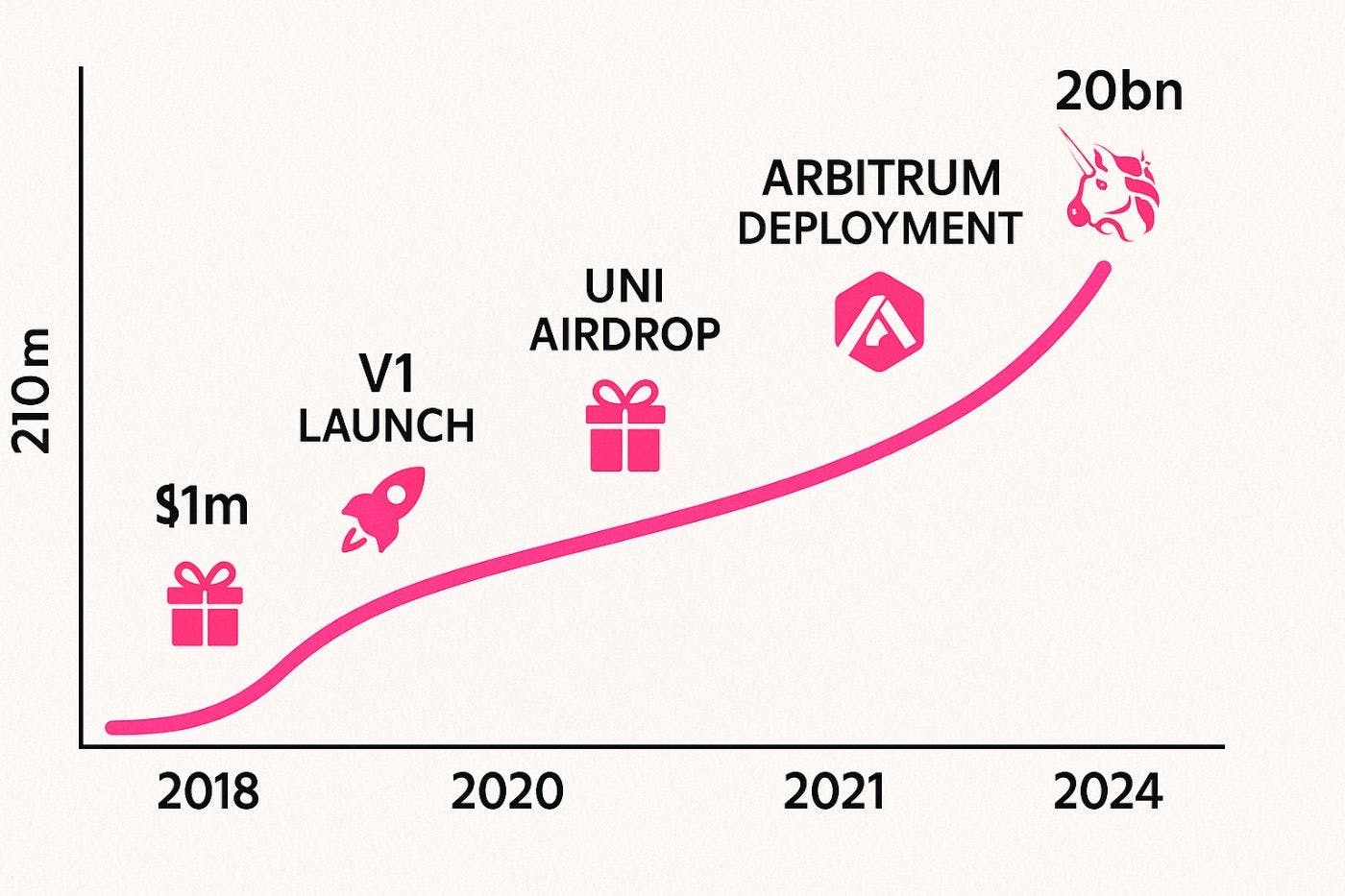

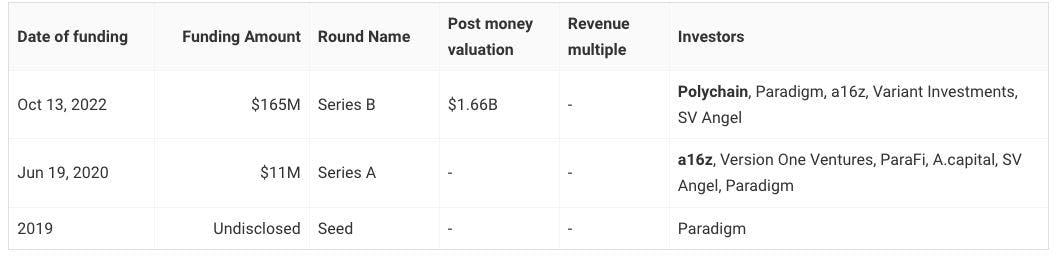

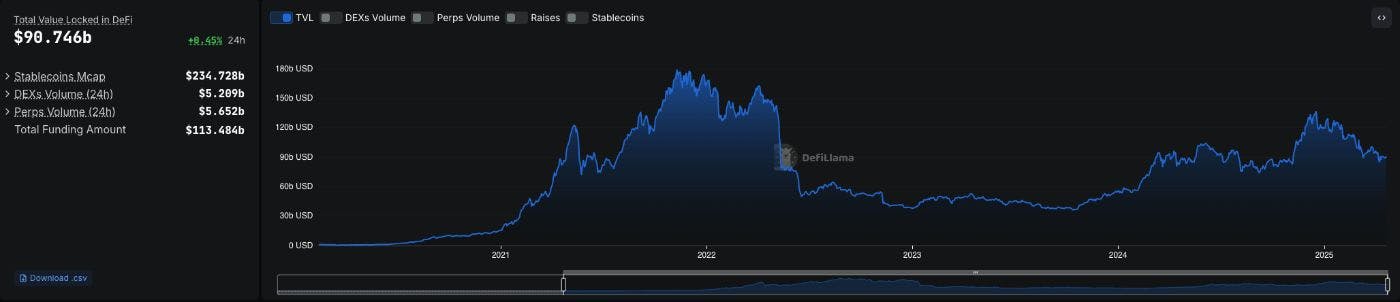

Milestones and TVL Growth

Uniswap’s ascent unfolded over several years. Here’s a timeline of key moments and TVL increases:

-

Nov 2018: Uniswap v1 launches—$1m TVL within 6 months.

-

May 2020: Uniswap v2 enables token-token swaps—$100m TVL.

-

Sep 2020: UNI airdrop—$1bn TVL in 30 days.

-

May 2021: Uniswap v3 rolls out concentrated liquidity—$5bn TVL.

-

May 2021: Arbitrum deployment—$8bn TVL by July.

-

Jan 2022: Optimism integration—$10bn TVL.

-

Jun 2023: v4 announced with hooks—$15bn TVL.

-

Sep 2024: Unichain (Uniswap’s layer-2) teased—$20bn TVL peak.

The UNI airdrop and layer-2 rollouts were major catalysts. The v3 upgrade with concentrated liquidity let LPs focus their capital in specific price ranges, boosting efficiency. Meanwhile, v4’s hooks allowed developers to customize pools, further driving innovation in DeFi.

- Influencers: Hayden Adams and DeFi accounts like @defipulse helped spread the word.

- Partnerships: Integrations with Aave, Compound, and layer-2s like Arbitrum, plus Twitter Spaces with Optimism and Polygon teams.

- Media Appearances: Hayden featured on podcasts like Bankless, The Defiant, and Unchained.

- Press Coverage: Fundraises and upgrades were reported by CoinDesk, The Block, and Decrypt.

- Social Media: @Uniswap and @haydenzadams drove community engagement on Twitter.

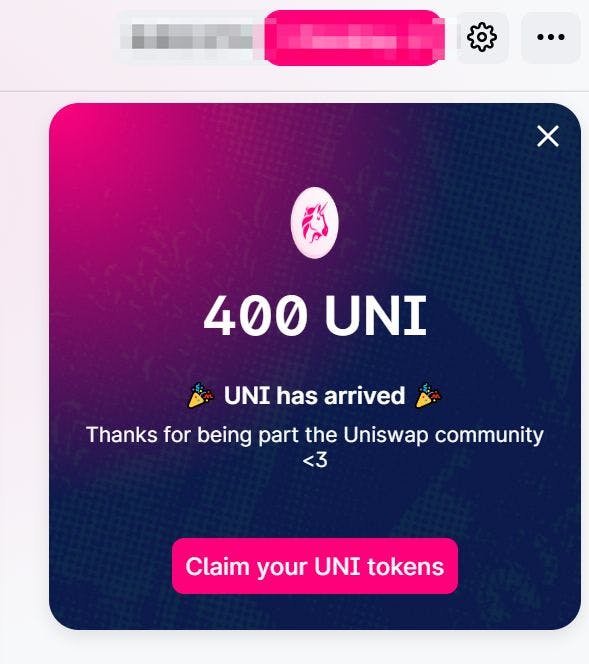

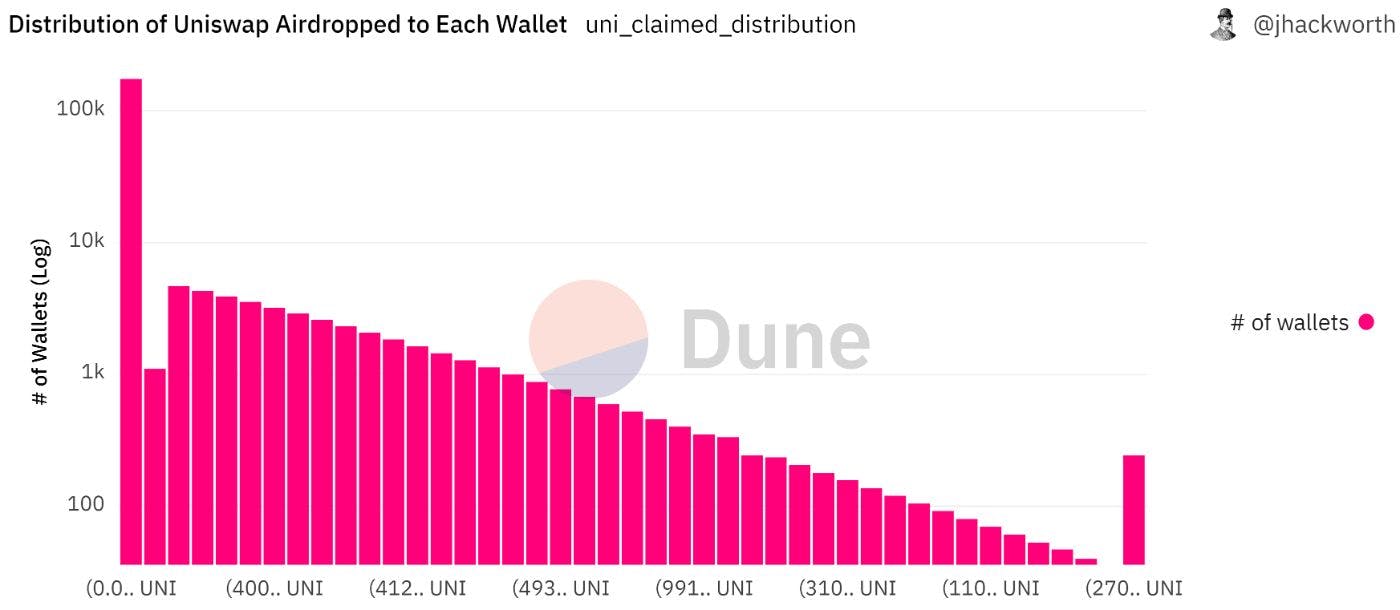

Airdrop and Incentive Programs

The 2020 UNI airdrop was a pivotal moment:

-

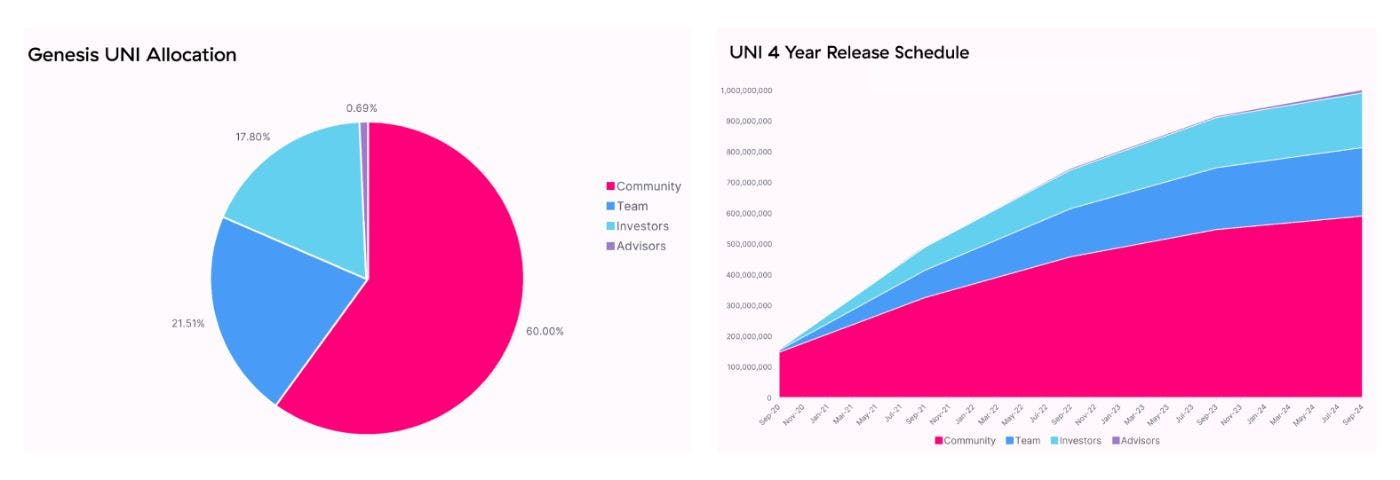

Initial Allocation: 15% of UNI supply (150m tokens) distributed to users who interacted with Uniswap before Sep 2020.

-

Impact: TVL surged from $300m to $1bn in a month as users rushed to claim UNI.

-

Governance Incentive: UNI holders gained voting rights, deepening community involvement.

-

Initiatives: The 2023 Genie NFT airdrop rewarded marketplace users, though on a smaller scale.

Uniswap dedicated 60% of UNI’s genesis supply to the community, with 15% for early users and liquidity providers. They also ran liquidity mining programs, rewarding pools like ETH/USDT with UNI to incentivize participation.

Looking Ahead: 2025 and Beyond

Uniswap continues to innovate:

- Unichain: Their own layer-2, teased in 2024, aims to make Uniswap a cross-chain DeFi hub.

- v4 Hooks: Developers can now add custom logic to pools (e.g., dynamic fees, TWAMM).

- Infinite Hackathon: Monthly grants for Unichain projects to encourage developer activity.

- Institutional Outreach: Partnerships with Fireblocks and Coinbase for custody solutions.

Lessons from Uniswap’s Success

Uniswap’s journey underscores the importance of community-driven strategies in DeFi. They excelled at:

-

Unique Positioning: Offering freedom from CeFi with a developer-first approach.

-

Clear Communication: Messages like “liquidity for all” resonated with users and builders.

-

User-Centric Solutions: Layer-2s addressed Ethereum’s gas fee challenges.

With DeFi’s TVL now at $90+bn and DEXes like Uniswap leading the way, their future looks bright as they scale Unichain and attract institutional players. I’m optimistic about UNI’s long-term potential.

What project would you like me to explore next? Let me know in the comments!

Want more crypto deep dives? Follow me on X for real-time thoughts or message me directly. Let’s keep the conversation going.