This article was originally published on Insights.

In just six years, the total market capitalisation of Nigerian commercial banks has more than tripled from ₦3.2 trillion in 2020 to ₦10.5 trillion in 2025. This reflects a combination of digital transformation, monetary policy shifts, and strategic banking reforms that have reshaped Nigeria’s financial sector. The Central Bank of Nigeria’s (CBN) aggressive monetary policies are a key driver behind this growth. As of February 2025, the Monetary Policy Rate (MPR) stands at 27.5%, following a series of hikes to stabilise the naira and curb inflation. While high interest rates have made borrowing costlier for businesses, they have also boosted banks’ profitability by increasing lending margins.

At the same time, Nigeria has witnessed a boom in digital payments. The Nigeria Inter-Bank Settlement System (NIBSS) reported that in 2024 alone, the total value of electronic transactions hit ₦1.07 quadrillion, a 79.6% increase from ₦600 trillion in 2023. This surge in cashless transactions has significantly boosted banks’ revenues through transaction fees, fintech partnerships, and digital banking services.

The role of commercial banks in Nigeria’s digital economy

Nigerian banks have been at the heart of the country’s transition to a cashless economy. Investments in digital payment infrastructure, mobile banking apps, and fintech collaborations have driven financial inclusion and enhanced transaction efficiency. One of the biggest indicators of this shift is the growth of Point-of-Sale (PoS) transactions, which reached ₦19.4 trillion in 2024—an 81% jump from ₦10.73 trillion in 2023. This increase not only reflects changing consumer behavior but has also strengthened banks’ revenue streams through transaction fees and partnerships with fintech startups like Flutterwave, OPay, and Moniepoint. By capitalising on the digital boom, Nigerian banks have positioned themselves as key players in Africa’s evolving financial ecosystem.

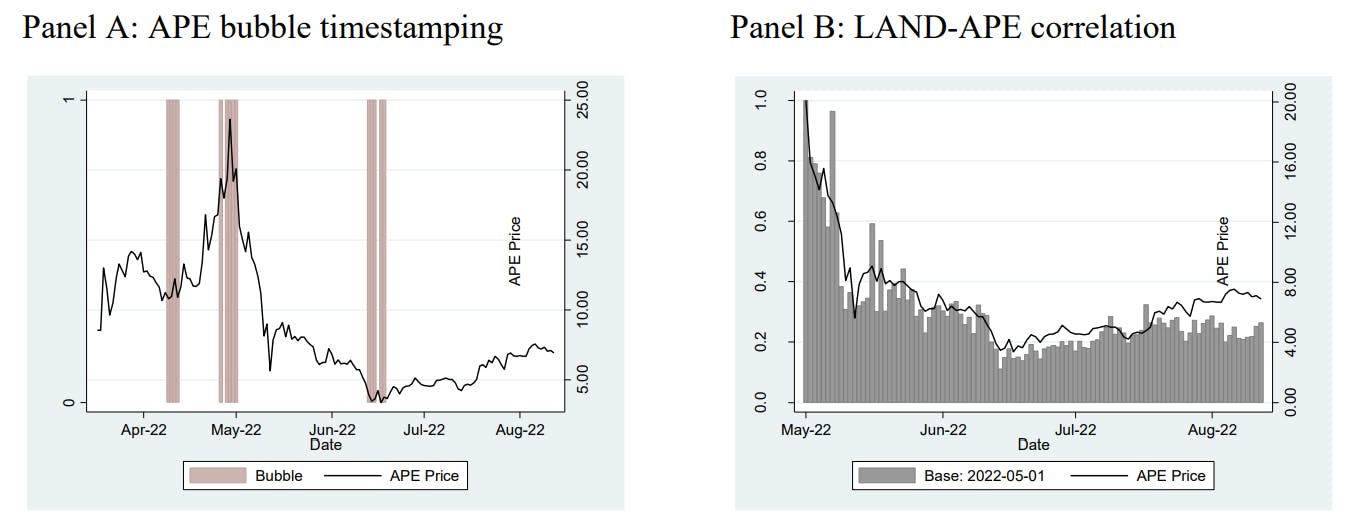

Market capitalisation shifts over the last six years

Between 2020 and 2025, the market capitalisation of Nigerian commercial banks has seen significant shifts. The years before President Bola Ahmed Tinubu’s administration were marked by steady growth with occasional market corrections. However, post-2023, the sector witnessed accelerated growth, reflecting increased investor confidence and supportive policies to strengthen financial institutions.

For example, in 2020, Zenith Bank and GTCO led the market with valuations around ₦740 to ₦780 billion. By 2023, these figures had surged, with Zenith Bank crossing the ₦1 trillion mark. The Tinubu administration’s emphasis on relative macroeconomic stability, fiscal reforms, and support for digital finance created an environment where banks thrived. Post-2023, commercial banks experienced robust growth as investors responded positively to economic reforms and increased digital payment adoption.

The 2025 market capitalisation of Nigerian commercial banks

As of March 22, 2025, the combined market capitalisation of Nigeria’s top commercial banks reached a historic ₦10.5 trillion. GTCO leads the sector with a valuation of ₦1.99 trillion, followed closely by Zenith Bank at ₦1.87 trillion. UBA commands a market cap of ₦1.26 trillion, while Access Bank stands at ₦1.15 trillion. FirstHoldCo follows at ₦969.2 billion, with Fidelity Bank reaching ₦898.7 billion and Stanbic IBTC at ₦796.9 billion. Among these, Fidelity Bank has been one of the most impressive climbers, skyrocketing from a market cap of just ₦73 billion in 2021 to ₦898.7 billion in 2025—an astonishing 1,100% increase. These gains reflect a mix of sound financial management, increased adoption of digital banking, and regulatory policies that have strengthened the financial sector.

Key challenges exist

Despite this impressive growth, Nigerian banks face challenges such as failed transactions, settlement delays, and high transaction fees. Other critical issues include a high Non-Performing Loans (NPL) ratio, limited access to finance for SMEs, weak regulatory environments, cybersecurity threats, and infrastructure gaps. These pain points highlight the need for reforms and technological upgrades to sustain growth. Amid these challenges, Nigerian commercial banks are expanding across other African countries, increasing their footprints and regional influence. Strategic collaborations with fintech platforms have further eased transactions and enhanced customer experience, positioning Nigerian banks as key players in Africa’s financial future.

Want deeper insights or a custom report on this topic? Fill out our quick form, and the Insights team will get in touch with you.