Table of Links

Abstract/Zusammenfassung

Publications

Acknowledgements

CHAPTER 1: INTRODUCTION

-

Introduction

1.1 Overview of thesis contributions

1.2 Thesis outline

CHAPTER 2: BACKGROUND

2.1 Blockchains & smart contracts

2.2 Transaction prioritization norms

2.3 Transaction prioritization and contention transparency

2.4 Decentralized governance

2.5 Blockchain Scalability with Layer 2.0 Solutions

CHAPTER 3. TRANSACTION PRIORITIZATION NORMS

-

Transaction Prioritization Norms

3.1 Methodology

3.2 Analyzing norm adherence

3.3 Investigating norm violations

3.4 Dark-fee transactions

3.5 Concluding remarks

CHAPTER 4. TRANSACTION PRIORITIZATION AND CONTENTION TRANSPARENCY

-

Transaction Prioritization and Contention Transparency

4.1 Methodology

4.2 On contention transparency

4.3 On prioritization transparency

4.4 Concluding remarks

CHAPTER 5. DECENTRALIZED GOVERNANCE

-

Decentralized Governance

5.1 Methodology

5.2 Attacks on governance

5.3 Compound’s governance

5.4 Concluding remarks

CHAPTER 6. RELATED WORK

6.1 Transaction prioritization norms

6.2 Transaction prioritization and contention transparency

6.3 Decentralized governance

CHAPTER 7. DISCUSSION, LIMITATIONS & FUTURE WORK

7.1 Transaction ordering

7.2 Transaction transparency

7.3 Voting power distribution to amend smart contracts

Conclusion

Appendices

APPENDIX A: Additional Analysis of Transactions Prioritization Norms

APPENDIX B: Additional analysis of transactions prioritization and contention transparency

APPENDIX C: Additional Analysis of Distribution of Voting Power

Bibliography

4.1 Methodology

In this section, we outline our methodology for evaluating the lack of transparency in transaction contention and prioritization. First, we provide an overview of our Bitcoin and Ethereum data sets utilized in our analysis. Subsequently, we offer detailed information on the active experiments employed to assess preferential treatment of transactions and the aggregated power of colluding miners.

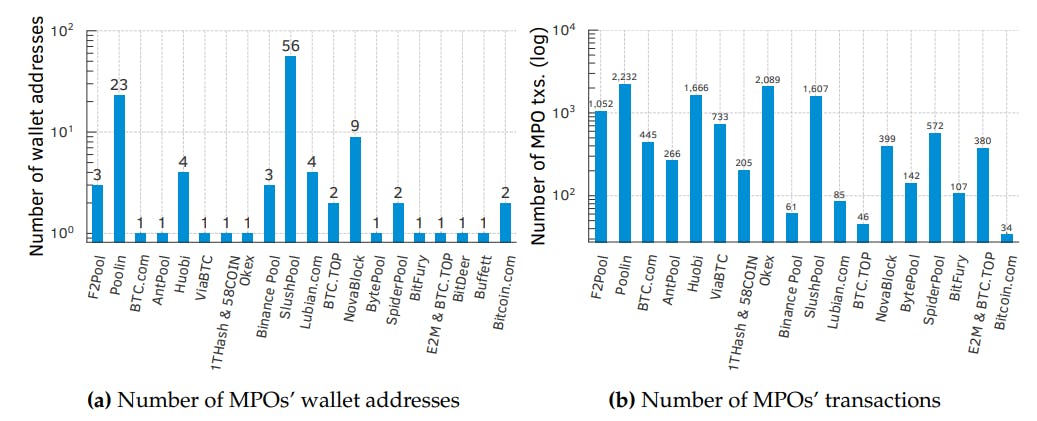

4.1.1 Data set collection

Data set D. To identify accelerated transactions, we gathered all Bitcoin blocks mined from January 1 st 2018 to December 31st 2020. In total, per Table 4.1, there are 161,954 blocks from block height 501,951 to 663,904, and 313,575,387 transactions. In Bitcoin, mining pools may indicate their ownership of the block by including a signature or marker in the Coinbase transaction (i.e., the first transaction of every block). We used such markers for identifying the mining pool (owner) of each block following techniques from prior work (Judmayer et al., 2017; Messias et al., 2021; Romiti et al., 2019). We failed to identify, however, the owners of 4911 blocks (approximately 3% of the blocks) and grouped these blocks under the label “Unknown.” Figure 4.1a shows the distribution of the count of blocks mined and transactions confirmed by the top-20 mining pools. We further removed 65,902,514 (21.02%) child-pays-for-parent (CPFP) transactions from our acceleration analyses. If we rank the MPOs by the number of blocks (B) mined (which essentially approximate the hashing capacity h of the MPOs), the top five MPOs are BTC.com (B: 27,534; h: 17.00%), F2Pool (B: 20,665; h: 12.76%), AntPool (B: 20,188; h: 12.47%), Poolin (B: 15,096; h: 9.32%), and ViaBTC (B: 13,419; h: 8.29%). But, unsurprisingly, the MPOs’ hash rates significantly varied over the years (refer Figure B.1 in §B.3). Furthermore, we rely on our SPPE metric to infer whether a transaction was likely accelerated.

Data set E. We gathered all Ethereum blocks mined over a 9-month time period—from September 8 th, 2021 to June 30th, 2022—to investigate the behavior of Ethereum mining pools (refer to Table 4.1). This data set contains 347,629,393 issued transactions and 1,867,000 blocks (from block number 13,183,000 to 15,049,999). We used miners’ wallet addresses to infer the block owners, but we failed to identify the owners of 46,895 blocks (or 2.51% of the total); we grouped the latter into one category, “Unknown.” Figure 4.1b shows the distribution of blocks and transactions mined in Ethereum by the top-20 mining pools. If we rank the mining pools by the number of blocks (B) mined (which approximate the hashing capacity h of the mining pools), the top five mining pools are Ethermine (B: 523,633; h: 28.05%), F2Pool (B: 299,418; h: 16.04%), Hiveon (B: 185,495; h: 9.94%), Poolin (B: 147,983; h: 7.93%), and 2Miners (B: 97,308; h: 5.21%) that together account for 67.17% of all blocks mined. We also report the weekly Ethereum’s hash rate in Figure B.2 in §B.3. Hash rates of mining pools in Ethereum across the study period did not vary as much as in Bitcoin (refer to Figure B.1 in §B.3).

Additionally, we also retrieved 6,937,292 transactions (2% of all issued transactions in Ethereum) contained in 3,284,886 bundles from Flashbots; these are transactions sent privately to miners.

4.1.2 Bundling public transactions

To identify bundles likely sent through the public P2P network, we use a simple heuristic. We concentrate on transaction bundles of sizes 2 and 3, seeking transactions that probably contributed to a publicly transmitted transaction being bundled and signs of sandwich attacks (Qin et al., 2022).

The underlying idea is that miners have no incentive to include transactions offering zero fees, as there is no reward for mining such transactions—unless they receive additional payment via Flashbots coinbase transfer. Consequently, transactions with a non-zero max-priority fee likely underwent public sending.

We discuss the details and our results in §4.3.1.

4.1.3 Aggregated power of colluding miners

Collusion among mining pools directly challenges the fundamental principle of truly decentralized blockchains. For instance, when powerful mining pools collude to give preference to certain transactions, and they collectively have a hash rate surpassing 50% of the network, there is no barrier preventing them from also censoring the validation of other transactions. As a result, they could potentially gain substantial control over which transactions are included in the blockchain, creating a significant risk of centralization.

To assess the real-world occurrence of mining pool collusion, we conducted an active experiment within the Bitcoin network. In this experiment, we paid a single mining pool to accelerate a set of public-low-fee-rate transactions. This was done during periods of high congestion in the Mempool. Without this acceleration, these transactions would have faced long delays before being included in the blockchain, due to their public low fees. However, although we paid just one mining pool to accelerate these transactions, our findings unveiled a concerning revelation: these accelerated transactions were also included and prioritized within a block by other powerful mining pools. Collectively, these mining pools possess a hash rate exceeding 50%. This situation raises significant concerns that reverberate across the entire blockchain ecosystem.

In §4.3.2, we delve into a comprehensive discussion of our findings and implications of the mining pool collusion.

Author:

(1) Johnnatan Messias Peixoto Afonso