If you’ve ever wondered what African VC firms are looking for when investing in startups, you’re not alone. There’s a lot of talk out there, but few resources break it down backed by data.

This piece is based on a deep analysis of the Investor Guide, a working document created by in partnership with investors across Africa to help founders and operators better understand how venture capital works on the continent. We pulled out eight key insights that show what really matters when African VCs decide to bet on a startup.

8 things African VC firms are looking for in an investment

1. Solve a real, local problem

VCs want startups that solve problems in their communities, not just copy-pasting a global trend. Products that deeply understand the local market and show traction in their environment are much more attractive to investors.

So, before considering raising money, ask yourself: Is this a real pain point, or just a nice-to-have?

2. Build in sectors that matter

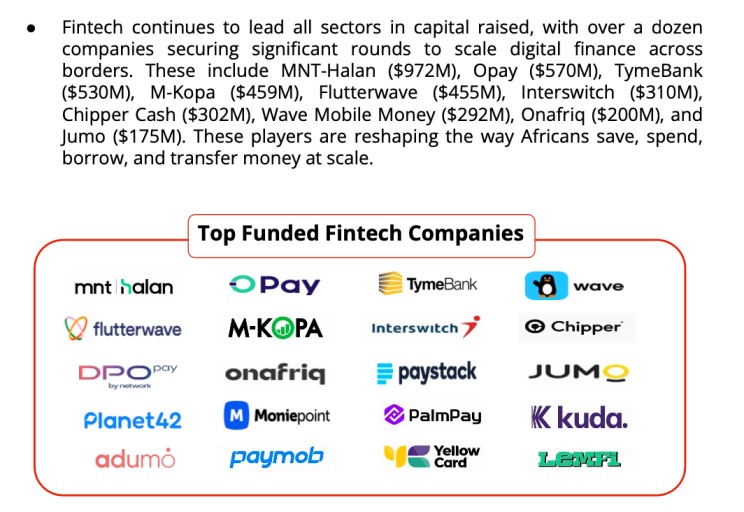

If you’re deciding what industry to build in, pay attention to where the capital is going. According to the Africa Investor Guide, the sectors with the most significant investment opportunities are those attracting the highest volumes of venture capital over the past five years. These “Big Six” sectors are:

- Fintech

- Logistics & Transport

- E-commerce & Retail

- Healthcare

- Agriculture & Food

- Energy & Water

The selection isn’t arbitrary. It’s based on disclosed venture funding data from 2019 to Q1 2025. For instance, fintech alone secured over $7.6 billion, nearly half of all funding during that period. Energy & Water followed with $2.8 billion, while Logistics & Transport drew in $1.8 billion. These numbers reflect where investor confidence and opportunity are most substantial.

These sectors don’t just raise capital, they solve foundational problems, which means they’re more likely to attract long-term investor backing.

3. Think beyond borders

VCs aren’t just funding ideas, they’re funding growth. African investors want to see that your business has the potential to grow across countries or even go global. Having a clear expansion plan can significantly increase your appeal.

4. Be ready for the long game

Unicorns don’t happen overnight, especially in Africa. It takes time, grit, and consistent growth. Investors are open to waiting but want a clear plan for long-term success.

So don’t just pitch short-term wins, show that you’re thinking about how to build something that lasts.

5. Show a clear path to returns

At the end of the day, investors want to know how they’ll make their money back. Whether it’s an acquisition, IPO, or a secondary sale, having an exit strategy is key.

Don’t wait till due diligence to figure this out; weave it into your story early.

6. Be smart with your spending

Several startups shut down recently due to weak operations and poor financial discipline. VCs are now placing a premium on founders who can manage resources well and make decisions based on data, not vibes.

Lean teams. Clear budgets. Realistic projections. That’s what wins trust now.

7. Get your governance right

It’s not just about the product. VCs also examine how you run your company, especially around governance, transparency, and leadership. Clean cap tables, resolved co-founder disputes, and defined roles all give investors peace of mind.

Start acting like a board-ready company from day one, even if you’re still early.

8. Choose the right partners

It’s not just about who gives you money but who builds with you. African investors want alignment. They’re not only putting in capital, but also their time, networks, and support. Make sure you’re choosing VCs who understand your market and your mission.

The right investor isn’t just a bank; they’re also a builder.

Related posts:

Final thoughts

Raising capital in Africa is tough, but not impossible. It requires more than a good idea; it takes clear execution, deep market knowledge, and the ability to build trust.

The investor guide gives a clear picture of what African VC firms are looking for right now, and hopefully, this piece has helped you understand those expectations more practically. If you’re currently raising or just preparing, revisit these eight points and ask yourself honestly: Am I building what investors are looking for?

And more importantly, am I building something people genuinely need?