Table of Links

Abstract/Zusammenfassung

Publications

Acknowledgements

CHAPTER 1: INTRODUCTION

-

Introduction

1.1 Overview of thesis contributions

1.2 Thesis outline

CHAPTER 2: BACKGROUND

2.1 Blockchains & smart contracts

2.2 Transaction prioritization norms

2.3 Transaction prioritization and contention transparency

2.4 Decentralized governance

2.5 Blockchain Scalability with Layer 2.0 Solutions

CHAPTER 3. TRANSACTION PRIORITIZATION NORMS

-

Transaction Prioritization Norms

3.1 Methodology

3.2 Analyzing norm adherence

3.3 Investigating norm violations

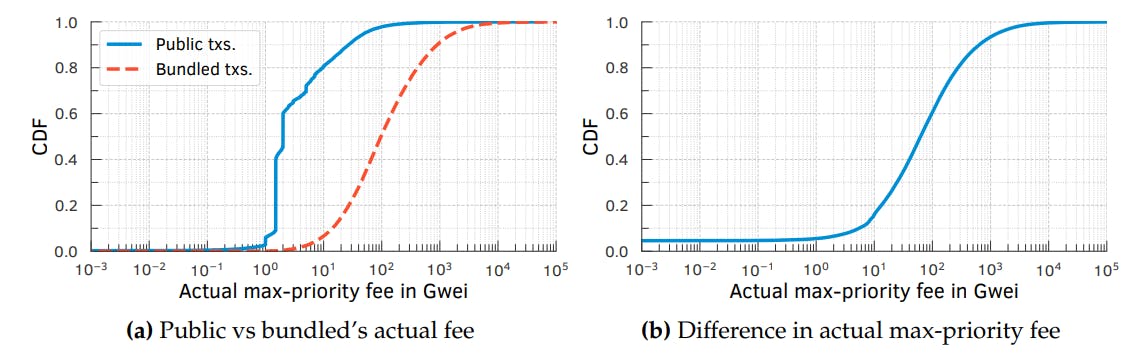

3.4 Dark-fee transactions

3.5 Concluding remarks

CHAPTER 4. TRANSACTION PRIORITIZATION AND CONTENTION TRANSPARENCY

-

Transaction Prioritization and Contention Transparency

4.1 Methodology

4.2 On contention transparency

4.3 On prioritization transparency

4.4 Concluding remarks

CHAPTER 5. DECENTRALIZED GOVERNANCE

-

Decentralized Governance

5.1 Methodology

5.2 Attacks on governance

5.3 Compound’s governance

5.4 Concluding remarks

CHAPTER 6. RELATED WORK

6.1 Transaction prioritization norms

6.2 Transaction prioritization and contention transparency

6.3 Decentralized governance

CHAPTER 7. DISCUSSION, LIMITATIONS & FUTURE WORK

7.1 Transaction ordering

7.2 Transaction transparency

7.3 Voting power distribution to amend smart contracts

Conclusion

Appendices

APPENDIX A: Additional Analysis of Transactions Prioritization Norms

APPENDIX B: Additional analysis of transactions prioritization and contention transparency

APPENDIX C: Additional Analysis of Distribution of Voting Power

Bibliography

5.3 Compound’s governance

Compound (Leshner and Hayes, 2019) is a decentralized lending protocol that allows users to lend and borrow tokens or assets via smart contracts. Lenders earn interest (yield) by supplying liquidity to the protocol, while borrowers obtain tokens from the protocol and pay interest on the borrowed tokens.

Compound protocol has two versions of its governance contract: Alpha and Bravo. Compound Governor Alpha, the first version of the governance contract, was deployed on March 4, 2020 (block number 9,601,459) and was active until March 28, 2021 (block number 12,126,254).[16] The improved version, Compound Governor Bravo, was deployed on March 9, 2021 (block number 12,006,099) and has been active since April 14, 2021 (block number 12,235,671).[17] Brave introduced several improvements such as smart-contract upgradability (through proxies), a new option for voters to abstain from voting, and the ability for voters to state the reasons behind their voting choices through text comments attached to on-chain votes. The Bravo contract was proposed in proposal #42,

and it received 1,438,679.86 votes from 59 voters—all but one vote was in favor of its implementation (Labs, 2021).

5.3.1 Control of governance tokens

The voting power of a user in Compound is proportional to the amount of (delegated) tokens held by that user—one token equals one vote. Below, we examine how these tokens are distributed over time among Compound participants.

Distribution of token holding

Initially, 42.15% of the total Compound supply (10 million COMP tokens) was allocated to liquidity mining,[18] 23.95% to shareholders, 22.46% to the founders and the Compound team, 7.73% to the community, and 3.71% to future team members (CoinGecko, 2023). The public release of COMP tokens started only after proposal #7 was executed on June 15, 2020 (Labs, 2020). This proposal enabled the continued distribution of COMP tokens to the protocol users over time (see Figure 5.2). At the time of our analysis (November 7, 2022), the 10 million COMP tokens were distributed among 210,573 accounts. The largest holder is Compound Reservoir with 19.24% (1,924,344.52) of the tokens followed by Binance (5.97% or 397,289.78 tokens) and cComp (5.73% or 572,723.77 tokens) as shown in Figure 5.3. The Compound Team holds 2.28% (228,061.62) and Compound Timelock 1.84% (184,258.39) of the tokens.

Of the total supply, only 7.3 million COMP tokens are, however, in circulation (Figure 5.2), and we characterize their distribution among a few top token holders in Figure 5.4. In calculating the tokens in circulation, we only included tokens that can be traded or exchanged between users. We excluded locked tokens from the Compound Reservoir, Comptroller, and Timelock contracts from our analysis (Compound Labs, Inc., 2022a; kybx86, 2020), which are not in circulation. These locked tokens require a governance proposal to be released, although some of them are released daily through the Comptroller as an incentive for users to use the protocol, by lending or borrowing these tokens.

We plot the cumulative distributions of all available COMP tokens along with the locked, delegated, and in-circulation tokens, i.e., the tokens available for users to buy, trade, or sell, in Figure 5.5. The top-15 accounts (in terms of the amount of tokens held) together account for 43.83% of all tokens in circulation (Figure 5.4). Binance (Binance, 2023), a popular centralized cryptocurrency exchange, leads this ranking with 8.12% of the available tokens. It is technically feasible for them to delegate these tokens to themselves to vote or propose changes to the protocol (refer §5.2), but Binance stated that it will not use these tokens to vote on behalf of its users (Shaurya Malwa, 2022).

Takeaway: A significant number of tokens were released at the start, and the amount of unlocked tokens continues to increase over time. A small number of token holders hold the vast majority of all tokens in Compound.

Distribution of token delegation

Delegation is a prerequisite for voting (refer §2.4.1), and Compound allows its participants to delegate their voting rights to others. This ability enables users to delegate their voting power to individuals who share their interests, and allows participants with less voting power to pool their votes together and have a significant voting impact. Users, however, can only delegate all, not a fraction, of their tokens. The protocol, nevertheless, enforces this limitation at the wallet address level. Users can own multiple wallet addresses and divide their tokens into them, thereby allowing them to delegate a subset of their tokens to others (Amico, 2023; Fritsch et al., 2022). To determine if delegated tokens are held by a few voters, we group together all inferred addresses (as discussed in §5.1.3) that belong to the same entity and then count the total number of delegated tokens held by each group. We observe, per Figure 5.5, that delegated tokens are concentrated among few voters, and we show the distribution of delegated tokens across several top token holder accounts in Figure 5.6. Out of 4186 COMP delegatee accounts (or accounts with voting rights), the top 50 (1.19%) hold 99.23% of all delegated tokens, giving them significant decision-making power when voting on proposals. On November 7, 2022, Polychain Capital held the most delegated tokens, with 12.15% (330,986.09) followed by

Bain Capital Ventures with 11.85% (322,763.87) and a16z with 9.40% (256,046.13). These three addresses together held 33.41% (909,796.10) of all the 2,723,123.73 delegated tokens in our analysis.

We note that only approximately half of the tokens in circulation are delegated (Figure 5.2). If we investigate token delegation among the top token holders in Figure 5.4, we observe that many of them are crypto exchanges (e.g., Binance and Uniswap V3:COMP) that do not delegate their tokens. This observation assuages concerns that crypto exchanges that hold their users token could abuse their users’ trust (§5.2). Binance publicly stated that they will not abuse their users’ voting rights by voting on behalf of them, and our empirical observations, so far, lend credence to that claim.

5.3.2 Voting on governance proposals

To propose changes to the Compound protocol, an address must have at least 25,000 COMP tokens delegated to it to create a proposal.[19] However, as of September 18, 2021, proposal #60 introduced an exception to this rule, allowing also whitelisted-addresses to create proposals even if they do not have 25,000 delegated tokens (Capital, 2021).

Per Figure 1.2, when a proposal is created, there is an approximately 2-day voting delay period (or 13,140 blocks) that is used to allow the community to discuss the proposal before the voting period begins. During the approximately 3-day voting period (or 19,710 blocks),[20] voters can cast their votes. In order for a proposal to be executed, it needs to meet two requirements. Firstly, it must receive a minimum of 400,000 votes in favor of the proposal. This number corresponds to 4% of the total supply and is known as the quorum. Secondly, the majority of the votes cast must be in favor of the proposal. The number of votes each voter has is determined by the number of delegated tokens they held in the block before the voting period began. This prevents voters from changing their delegated tokens after the voting has begun, which could potentially lead to sudden changes in the outcome of the election. After a proposal is approved, it is placed in the TimeLock for a minimum period of 2 days before it can be implemented (or executed) (Compound Labs, Inc., 2022a). A proposal can be cancelled at any time by the proposer prior to its execution, or by anyone if the proposer fails to maintain at least 25,000 delegated tokens.

In total, 3335 voters cast their votes through 9500 transactions with 8769 (92.31%) for in-favor votes, 644 (6.78%) for against votes, and finally 87 (0.91%) for abstained votes. The majority of voters (51.36%) only voted for 1 proposal. 1% of participants voted for at least 26.66 proposals. On average, participants voted on 2.85 proposals with a standard deviation (std.) of 5.23. The address 0x84e3· · · 5a95 voted on the maximum number of proposals (100), followed by MonetSupply and blck who voted on 96 and 88 proposals, respectively.

Creation of proposals

In total, 33 proposers created the 133 proposals. Of these proposers, 16 (48.48%) created one proposal, while 10% of the proposers created at least 8 proposals. The average number of proposals created per proposer is 4.03 proposals, with a std. of 5.27 and a median of 2. The highest number of proposals was created by Gauntlet, who created 24 proposals, followed by blck, who created 20 proposals.

The maximum number of proposals were created in March 2022, 11 proposals created (from #86 to #96). However, of those, only 5 were executed, as 1 was defeated and 5 were cancelled (see Figure 5.7). Proposals were submitted, on average, every 6.95 days (std. of 6.41), with a median of 5.08 days. This may be because the proposal lifecycle lasts 7 days, and the voters might not want to consider multiple active proposals at once. The shortest and longest interval between proposals was 0 and 31.14 days, respectively. Additionally

proposals typically take 1.64 days (std. of 0.72 days) to reach the quorum, as depicted in Figure C.2 in §C.6.

Takeaway: Compound is actively and regularly used: It received a constant stream of proposals over the course of our study period.

Participation in voting

Next, we computed the voting participation per proposal (see Figure 5.8). This metric is calculated by dividing the number of votes (or delegated tokens) cast on a proposal by the total number of delegated tokens eligible to vote on that proposal at the start of the voting period. This is a crucial measurement as it shows the proportion of all delegated tokens that are used in the governance election process by the voters on proposals. Also, protocols with low voter turnout are more susceptible to vote-buying, as non-voting users may sell their voting rights to others (Daian et al., 2018). Our results show that the average Compound voter turnout is 33.25% (with a std. of 17.61%), the median is 32.10%, and the maximum 80.80%. Based on Figure 5.8, we observe higher voting participation for early proposals compared to recent ones, likely due to the limited availability of tokens to a select few in the beginning.

On average, the 133 proposals had 71.43 voters participating in their election, with a standard deviation of 98.97 voters. 50% of the proposals received votes from 38 voters, while the numbers of voters varied between 0 (when proposals are cancelled before the voting period begins) and a maximum of 619, as seen in proposal #111. This particular proposal received a total of 686,289.04 votes from 615 voters in favor, 3 against, and 1 abstention. The next proposals with higher number of voters are proposals #115 and #105 that received votes from 579 and 404 voters, respectively.

Each time a voter casts a vote in the Compound governance protocol by issuing a transaction, an event is triggered, as described in §5.1.1. We analyzed 9500 transactions with events triggered by voters during the voting process. Of these events, 1732 (18.23%)

were votes cast by voters who did not have any delegated tokens available, resulting in zero voting power or useless vote. Although this is allowed by the protocol, it does not count for or against a proposal. However, it shows support for the proposal, as these voters still participate in the election despite not having any delegated tokens available. Therefore, the average number of votes cast (or tokens used to vote) was 10,961.73, with a std. of 39,212.17 and a median of 0.1. The range of votes cast was from 0 to 345,067.49 as shown in Figure 5.9. This indicates that most of the voters are small players (or accounts with a low amount of delegated tokens).

In addition, when voting in Compound, there is a financial cost involved due to the on-chain transactions required to cast votes. To determine these costs, we collected the relevant transactions from the Ethereum blockchain and analyzed the fees paid by voters to issue the transactions and cast their votes. We report the voting cost in US dollars, using the ETH-USD Yahoo Finance data feed (Yahoo Finance, 2023b) to compute the exchange rate at the time the transaction was included in a block. In total, voting for the 133 Compound proposals, voters paid $74,865.74. The average voting cost per proposal is $7.88 with a std. of $22.29. The median voting cost is $1.48 with a range from $0.03 to $294.02. Figure 5.10 shows the voting cost distribution per proposal. We also computed

these metrics at proposal level, on average, each proposal costed $594.17 with a std. of $745.62 and a median of $291.92. The cost ranges from $2.39 to $4247.25.

Additionally, we analyzed the number of voters required for all 101 (75.94%) executed proposals in our data set to reach the quorum and pass. Our results show that, for 99 proposals, the average number of voters required for a proposal to reach the quorum and pass was 3.25, with a std. of 1.65. The median number of voters required was 2, and the range of voters required varied from 2 to 8. This sheds light on how centralized these delegated tokens are distributed among a few participants, where for half of the proposals only 2 voters casting their votes would be enough to pass (or execute) a proposal.

Furthermore, we analyzed the number of voters needed for proposals to reach 50% of the total votes cast. Out of 133 proposals, we excluded 7 proposals that were cancelled before the voting period, leaving us with 126 (94.74%) proposals for analysis. On average, those proposals required 2.84 voters with a std. of 0.97 and a median of 3 voters. The minimum and maximum number of voters were 1 and 5, respectively. This again suggests that the token distribution is concentrated among few voters who

hold a high voting power. We present the cumulative voting power for the top 10 most powerful voters for each of these 126 proposals in our data set in §C.5.

Margin of victory/defeat

During the analyzed period from March 3, 2020 (block number 9,600,000) to November 7, 2022 (block number 15,917,000), 133 proposals have been created. Of these, 17 (12.78%) were cancelled and 15 (11.28%) defeated, leaving 101 (75.94%) executed proposals. Figure 5.12 shows the percentage of in-favor, against, and abstain votes for each proposal. The majority of the proposals received significant support from the voters. On average, proposals received 89.39% of the votes in favor, with a std. of 23.98% votes and a median of 99.99%. We highlight the proposals’ outcome at each stage of their lifecycle in Figure 5.13. Our analyses show that 7 (5.26%) out of 133 proposals were cancelled right after they were created and, therefore, they had not reached the Voting Period meaning they were not available for voting. Next, 4 proposals were cancelled before the Voting

Ends stage, meaning they were pulled out before the election finished. 2 were also cancelled after they succeeded in the election (after the Voting Ends stage) but before they were queued in the Timelock. Further, 4 proposals were cancelled when in the Timelock. These proposals account for 6 cancelled proposals after they successfully passed, which could indicate a lack of community consensus (Sharma et al., 2023). Finally, 101 (75.94)% proposals were successfully executed. We gathered data from Messari (Messari, 2023) to categorize these executed proposals and report their importance level in §C.1.

Temporal dynamics of voting

Compound Governor does not allow voters to change their votes once they have been cast. This means that voters can only vote once on each proposal. Nevertheless, voters can view all votes that have been cast on-chain in real-time. Thus, understanding how long it takes voters to cast their votes is interesting because it can shed light on whether they want to wait until the last minute to cast their votes.

According to our analysis, voters take an average of 1.4 days (with a std. of 0.95 and a median of 1.34 days) to cast their votes after the voting period began. The shortest and longest recorded delays in our data set are 0 and 3.39 days, respectively. Figure 5.14 shows the distribution of the time it takes voters to cast their votes for each proposal. We also highlight the voting delays for all votes cast per proposal in §C.5.

When examining voting delay behavior, voters typically take longer to cast votes against proposals (1.58 days on average) in comparison to all other votes (see Figure 5.15a). Considering only executed proposals, voters take longer to abstain but are faster to vote against executed proposal (Figure 5.15b). For defeated proposals, on the contrary, they abstain faster and take longer to vote against defeated proposal (Figure 5.15c). Even for cancelled proposals, Figure 5.15d shows that voters take longer to vote against these proposals. We believe that the executed proposals must have been better discussed prior to the voting period, and therefore voters were more likely to vote for the proposal with high approval rates (Figure 5.12). Similarly, voters were more likely to vote against proposals that were defeated.

5.3.3 Real-world decision-making using Compound governance

Interestingly, Compound has also been utilized for real-world decision-making purposes, such as allocating grants to contributors (Gauntlet, 2021) or hiring an audit company to review the governance protocol through the Compound code (Sukernik, 2021). For instance, on September 29, a bug was introduced in the Comptroller of the Compound Protocol through proposal #62 that allowed users to claim more COMP tokens than they were entitled to, resulting in a loss of $50 million worth of COMP tokens (Loewen, 2021a; Nick Martitsch, 2021). The Compound community sought to hire, through the Compound governance protocol, a smart contract auditor to audit the protocol (Sukernik, 2021). Three companies, ChainSecurity, OpenZeppelin, and Trail of Bits, posted their business plans for discussion and then created proposals via the Compound Governor. Voters were able to vote for their preferred proposal, and the winning proposal was eventually implemented. The losing proposals would have been cancelled by the community’s multi-signature mechanism after the voting period ended, ensuring only one could pass.

OpenZeppelin was the only proposal to reach quorum and get the majority of votes to be implemented. They audited the Compound code, assisted proposers, participated in community discussions, and reviewed any new proposals formally created by the Compound community (OpenZeppelin, 2023).

Takeaway: We believe that these governance protocols will be used even more in the future for transparent decision-making in real-world applications like the ones mentioned above. This will have a positive impact on the use of governance protocols in the everyday life of society.

5.3.4 Voting patterns of delegates

In this section, we analyze the formation of coalitions among voters, where they cast their votes as a group. This analysis is crucial because such behavior may compromise the security of the governance protocol. Specifically, instead of expressing their individual opinions on a proposal, voters may choose to mimic the votes of their peers. The transparency of the Ethereum blockchain used for voting in Compound allows anyone to view the addresses of voters and their corresponding votes (e.g., their voting power and voting preference) during the election process, potentially facilitating this behavior. As a result, exploring the possibility of coalition formation could provide valuable insights into the decision-making patterns of voters. Figure 5.16 shows a heatmap of how each of the top 15 voters cast their votes across all 133 proposals in our data set.

Further, we use cosine similarity to quantify how similar the voting patterns of different voters are. Cosine similarity calculates the similarity between two vectors by determining the cosine of the angle between them (Scikit Learn, 2023; Xia et al., 2015). It is useful in the context of voting because it allows us to compare voting patterns and determine whether and which voters vote for the same proposals. The cosine similarity value ranges from −1 to 1, with a value of 1 indicating a high degree of similarity.

Our analysis shows that the top 3 voters (i.e., 0x84e3· · · 5a95, MonetSupply, and blck) have a strong cosine similarity in their voting behavior when casting a vote in favor of a proposal, meaning that they cast their votes similarly (see Figure 5.17). Moreover, Gauntlet, Dakeshi, Robert Leshner, and Arr00 also show a strong similarity with 0x84e3· · · 5a95. We also analyzed the voting similarity when voters cast a vote against a proposal. However, we cannot make definitive conclusions regarding abstained votes as they are infrequent: only 87 (0.91%) out of 9500 votes. Regarding votes against proposals, Blockchain at Michigan and Blockchain at Berkeley have the highest cosine similarity with 0.73 followed by blck and Dakeshi with 0.67. These results suggest that these voters have similar voting patterns when indicating their opposition to a proposal.

In this chapter, we analyzed data from the Ethereum blockchain related to Compound, a widely used smart contract. Our analysis is centered on the decentralized governance of Compound, with a particular focus on amendments to the smart contract. We found that the Compound contract is being actively amended—token holders continuously propose amendments that are then voted on by other token holders. We observed a striking concentration of tokens (be it in terms of their ownership, their delegation, or their voting participation) in the hands of a few participants, which raises serious concerns about the extent to which governance is decentralized in practice. For instance, our analysis shows that, on average, only 3.25 voters were needed for the proposals to reach quorum and pass, and only 2.84 voters were needed to reach 50% of the total votes. Our analysis also highlights issues with the Compound use of on-chain voting—in particular, the transaction fees voters must pay to cast an on-chain vote can make it prohibitively expensive for voters with fewer tokens. These costs have implications for voting participation and can affect how voters, proposers, and other stakeholders interact with these protocols.

Author:

(1) Johnnatan Messias Peixoto Afonso

[16] The Compound Governor Alpha was deployed at the Ethereum smart contract address 0xc0dA01a04C3f3E0be433606045bB7017A7323E38.

[17] The Compound Governor Bravo was deployed at the Ethereum smart contract address 0xc0Da02939E1441F497fd74F78cE7Decb17B66529.

[18] Liquidity mining is a process where users provide liquidity (i.e., tokens) to a protocol in exchange for rewards or interest.

[1] 9Prior proposal 89, an address should have at least 65,000 delegated tokens to create proposals (at Berkeley, 2021).

[20] The duration of the voting period is determined by the number of blocks added to the Ethereum blockchain (specifically, 19,710 blocks). The actual length of the voting period may be slightly longer than 3 days.