Nigerian fintechs have had a mixed relationship with cards. In the past, some offered foreign-issued cards like Visa and Mastercard to acquire customers and encourage online spending. However, as Nigeria’s economy worsened and bank transfers grew, fintechs began ditching foreign card schemes in favour of local alternatives or stopped offering cards altogether to cut costs and adapt to shifting user behaviour.

Now, Nigerian fintech, Allawee, is building infrastructure to help fintechs offer cards to their customers. Allawee is aiding other fintechs like Piggyvest, Nomba, and Carbon to issue cards through its end-to-end card-issuing infrastructure, which includes core banking, card authorisation services, and direct integration with switches and card schemes like Mastercard and Verve.

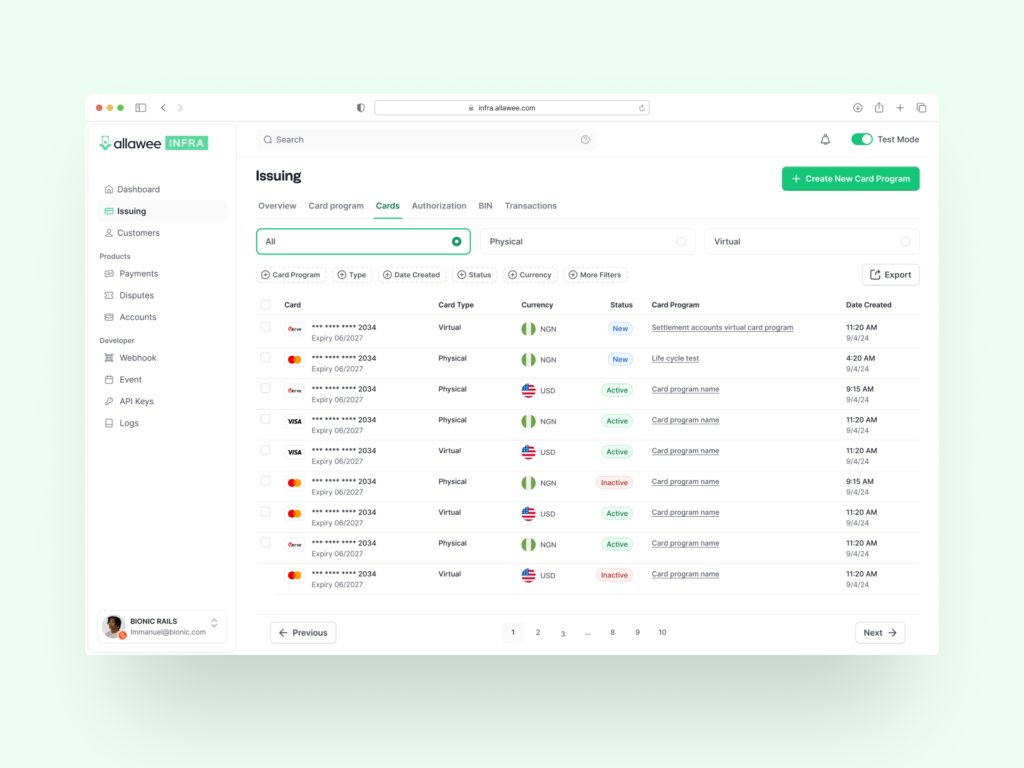

“We’ve wrapped all of that into a simple tool that can be accessed through a no-code dashboard or via an API,” Ikenna Enenwali, Allawee’s CEO, told .

Fintechs make money from card transactions through a fee known as interchange, a small percentage charged every time their customers pay with their cards. If cards are dormant, they continue to incur card-related costs, such as maintenance and compliance, without earning interchange revenue.

Allawee’s revenue model is three-pronged: a monthly fee on each active card, a 0.5% interchange fee, and a higher fee for processing foreign transactions.

Customers must use their cards frequently for a fintech to break even or turn a profit with cards. However, as bank transfers grew to account for over 51% of online payment transactions, customers transacted less with cards, making them a cost centre for fintechs. The higher margins with bank transfers also made fintechs deprioritise cards.

Despite these issues, cards remain one of the most effective channels for customers to access their funds. For many, cards offer an easy and fast option to access cash. If Allawee can consistently ensure that cards issued through its platform complete transactions reliably and make money for the fintechs, it could reverse their deprioritisation of cards.

How Allawee helped Carbon bring cards back

Carbon, a 13-year-old fintech known for its loan-led approach, stopped offering cards in 2024 because of the high costs tied to foreign cards. The company brought them back in February 2025 after rising demand from customers. This comeback was made possible through a partnership with Allawee, which helped Carbon solve its two biggest problems with offering cards: persistent failed transactions and the high transaction cost.

“The decision to partner with Allawee turned out to be one of the most effective moves we’ve made,” said Chijioke Dozie, Carbon CEO. “They moved with incredible speed, understood our needs, and delivered a seamless card infrastructure that surpassed our expectations.”

Allawee’s solution allowed Carbon to coordinate with several payment switches, card processors, banks, card personalisers, and manufacturers in its dashboard, which cut the time it takes to issue cards from months to weeks.

“With just three clicks, a fintech can configure, issue, and manage cards, “Enenwali said. “Launching a card program traditionally takes about one to two years, whether in Nigeria or elsewhere. We’ve cut that timeline down to just a few weeks. That speed has been a game-changer.”

The startup is also allowing its customers to bypass dollar-denominated fees that eat into margins on card transactions through an integration with Verve, Interswitch’s card service, which charges in naira.

“We rebuilt the commercial logic. Even when a customer makes a small ₦10,000 payment or withdraws ₦5,000 from an ATM, the fintech should not lose money on that transaction. With our infrastructure, they don’t,” Enenwali said.

Allawee’s customers can also issue Nigerian customers who make foreign transactions with Mastercard. In 2024, the global card issuer launched Naijacard, a Nigeria-focused card that charges in naira when making foreign transactions. Verve charges a flat rate lower than ₦10 per transaction, Enenwali said, compared to international card schemes that charge in dollars and are based on transaction amount.

“For global card acceptance, we worked directly with Mastercard for two years to negotiate a new pricing model. This model has made Mastercard issuance commercially viable for local fintechs again,” Enenwali said.

The startup claims its APIs have allowed its customers to successfully perform card transactions, leading to a 60% monthly growth rate on its platform over the past four months. “We’re trying to restore confidence in cards. We believe that if you give people a reliable card experience, they’ll prefer it,” Enenwali said.

The startup also has plans to expand to Francophone West Africa before the end of the year, thanks to a partnership with Mastercard.

“The Carbon case also validated something we have believed all along: most infrastructure problems are not about innovation; they are about execution,” Enenwali said. “The technology exists, but it’s often poorly integrated, poorly localised, and difficult to access. We made it simple. API-first, developer-friendly, and modular. That’s our edge.”

Enenwali believes that if his company can lower costs and make cards reliable, cards can grow to become a vital part of Nigeria’s digital payments market. If Allawee can succeed on that front, it could change how cards are viewed in Nigeria’s fintech industry.