After four decades of enterprise asset management dominance, IBM’s latest Maximo Application Suite 9.1 release represents more than an incremental upgrade—it’s a fundamental reimagining of how organizations converse with their physical assets. The June 2025 launch introduces capabilities that could transform maintenance from reactive scrambling to predictive conversations, but the real question isn’t whether the technology works—it’s whether organizations are ready to listen.

The standout feature of Maximo 9.1 is its generative AI assistant, built on watsonx.ai technology. Unlike the clunky chatbots that have disappointed users across industries, this assistant aims to democratize asset intelligence. Picture a maintenance manager asking, “Which work orders are missing job plans?” in plain English and receiving actionable insights within seconds, without navigating through multiple screens or running complex reports.

The assistant represents IBM’s attempt to solve a persistent problem in enterprise asset management: the expertise gap. With experienced technicians retiring and younger workers expecting iPhone-like interfaces, the traditional learning curve for complex EAM systems has become a business liability. Maximo has been considered #1 by industry analysts for decades and has the largest market share of Asset Life-Cycle Management applications, but market leadership means little if users can’t access that power efficiently.

Beyond Maintenance: The Investment Planning Revolution

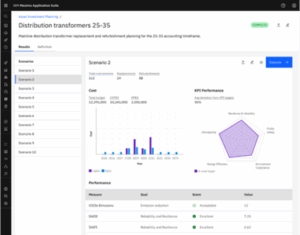

Perhaps more significant than the AI assistant is Maximo Asset Investment Planning (AIP), which tackles the perennial challenge of capital allocation. Most organizations struggle with the “what if” scenarios that keep CFOs awake at night. Should we replace that aging HVAC system now or wait two more years? How do we balance cost, risk, and performance across thousands of assets?

AIP promises to transform these gut-feeling decisions into data-driven strategies through rapid weighted analysis and multi-objective optimization. The tool enables users to generate and compare multiple investment scenarios, potentially saving organizations from costly miscalculations. In an era where the global asset lifecycle management market is expected to reach $8.1B by 2033, getting investment decisions right has become a competitive advantage.

The integration of real estate and facilities management within MAS 9.1 signals IBM’s recognition that modern asset management transcends traditional boundaries. Organizations increasingly view their physical spaces as dynamic assets requiring the same strategic attention as manufacturing equipment. Space optimization, condition assessments, and lease administration might seem mundane, but they represent significant cost centers for most enterprises.

This consolidation addresses a real pain point: the typical large organization manages these functions through disparate systems, creating data silos and inefficiencies. By bringing everything under the Maximo umbrella, IBM is betting that unified visibility will drive better decisions.

While IBM touts impressive case study results, the broader market tells a more nuanced story. Sund & Bælt achieved a 15-25% increase in maintenance productivity and extended the Great Belt Bridge’s lifespan by 100 years while negating 750,000 tons of CO2 emissions. Similarly, Downer effectively doubled the number of trains it could maintain from its Auburn facility while achieving a 20% improvement in efficiency.

These results sound transformative, but they come from organizations with significant technical expertise and substantial implementation resources. Interviewed companies in a recent study realized average annual benefits of $14.6 million per organization from IBM Maximo, yet success stories often gloss over the complexity and cost of achieving these outcomes.

The market data reveals both opportunity and challenge. Based on a group of over 100 customer reviews, IBM Maximo earned an overall rating of 4.3 out of 5 stars, with positive feedback highlighting comprehensive capabilities but negative feedback centering around initial implementation challenges and complex user interfaces.

The AI Timing Question

IBM’s AI integration comes at a crucial moment. IBM’s 2025 CEO Study revealed that 68% of CEOs say AI changes aspects of their business they consider core, and 61% say competitive advantage depends on who has the most advanced generative AI. However, there’s a difference between AI that impresses in demos and AI that delivers measurable value in complex industrial environments.

The Maximo Assistant faces the classic enterprise AI challenge: it must understand not just natural language, but the context, urgency, and implications of asset-related queries. A question about missing job plans might seem straightforward, but the answer’s value depends on understanding priority levels, resource availability, and operational constraints.

What IBM’s announcement doesn’t emphasize is the implementation reality. Subscription pricing starts at $39 per user/month for basic Work Execution, with the standard Asset Management edition at $65 per user/month, plus additional fees for add-ons like analytics, mobility, and ERP integration. For large organizations, total cost of ownership quickly escalates when factoring in implementation, training, customization, and ongoing support.

The containerized architecture running on IBM Red Hat OpenShift offers deployment flexibility but requires significant infrastructure considerations. Organizations moving from legacy systems face not just software migration challenges but fundamental changes in how they approach asset data architecture.

What this means for ERP Insiders

Start with AI pilot programs, not full deployments. The generative AI assistant represents genuine innovation, but smart organizations should approach it strategically rather than enthusiastically. IBM has 1,591 generative AI patent applications, a third more than Google, positioning them well ahead in this space. However, successful AI implementation requires high-quality data and clearly defined use cases. Begin with specific, measurable pilot programs focusing on common maintenance queries where AI can demonstrate clear value. Organizations like Toyota’s Indiana Assembly are already using IBM Maximo Health and Predict to create smarter, more digital factories, but they started with targeted applications before scaling. The key is establishing baselines for productivity metrics, then measuring actual improvements rather than assuming AI will automatically deliver value. Companies that rush into full AI deployment without data quality foundations often experience disappointing results that sour stakeholders on the technology’s potential.

Leverage asset investment planning as strategic differentiator. With the global asset lifecycle management market growing at 9.6% CAGR and reaching $8.1 billion by 2033, organizations that master capital allocation will gain substantial competitive advantages. Maximo’s AIP capability addresses a critical gap: most organizations make investment decisions based on incomplete data and intuition rather than comprehensive scenario analysis. The multi-objective optimization feature enables organizations to balance cost, risk, and performance in ways that spreadsheet-based approaches cannot match. However, success requires standardized asset data and clear business objectives. Organizations should begin by identifying their highest-value assets and developing consistent condition assessment methodologies.

Embrace unified platform strategy for operational excellence. The integration of real estate and facilities management within MAS 9.1 reflects a broader industry trend toward platform consolidation. The Enterprise Asset Management market is expected to grow from $4.56 billion in 2024 to $8.37 billion by 2032, driven largely by organizations seeking integrated solutions rather than point products. Organizations currently managing assets through multiple systems should evaluate Maximo’s unified approach against their existing technology stack. The platform’s strength lies in its ability to provide single-source-of-truth visibility across diverse asset types, from manufacturing equipment to office spaces. Downer’s success with IBM Maximo, where they use it as “the Bible – the one source of truth – for all data from 1,500+ carriages in their system”, demonstrates the value of consolidated asset intelligence. However, migration planning should account for the complexity of data integration and the need for comprehensive change management to ensure user adoption across different functional teams.