Stanbic Bank Kenya, the country’s sixth biggest bank by assets, plans to raise $100 million (KES12.9 billion) to finance startups across East Africa, a rare move for a commercial bank in a sector dominated by venture capital and development finance institutions (DFIs).

Through its Catalytic Fund, the bank plans to back startups and small and medium enterprises (SMEs) in agritech, the creative economy, healthtech, and manufacturing sectors that typically struggle to raise capital.

Stanbic’s move signals a shift in Kenya’s banking sector, which has kept its distance from founders struggling to raise funds for government equities. By raising capital for onward lending to startups in the region, the bank could test whether commercial banks can support ventures requiring patience and local insights to grow.

“We are in the market for $100 million (KES12.9 billion),” Stanbic Bank CEO Joshua Oigara told . “We have learnt that if you keep just focusing on the businesses that are ready now, you are leaving 80% of the clients in the industry. We have to continue expanding the continuum by bringing such in.”

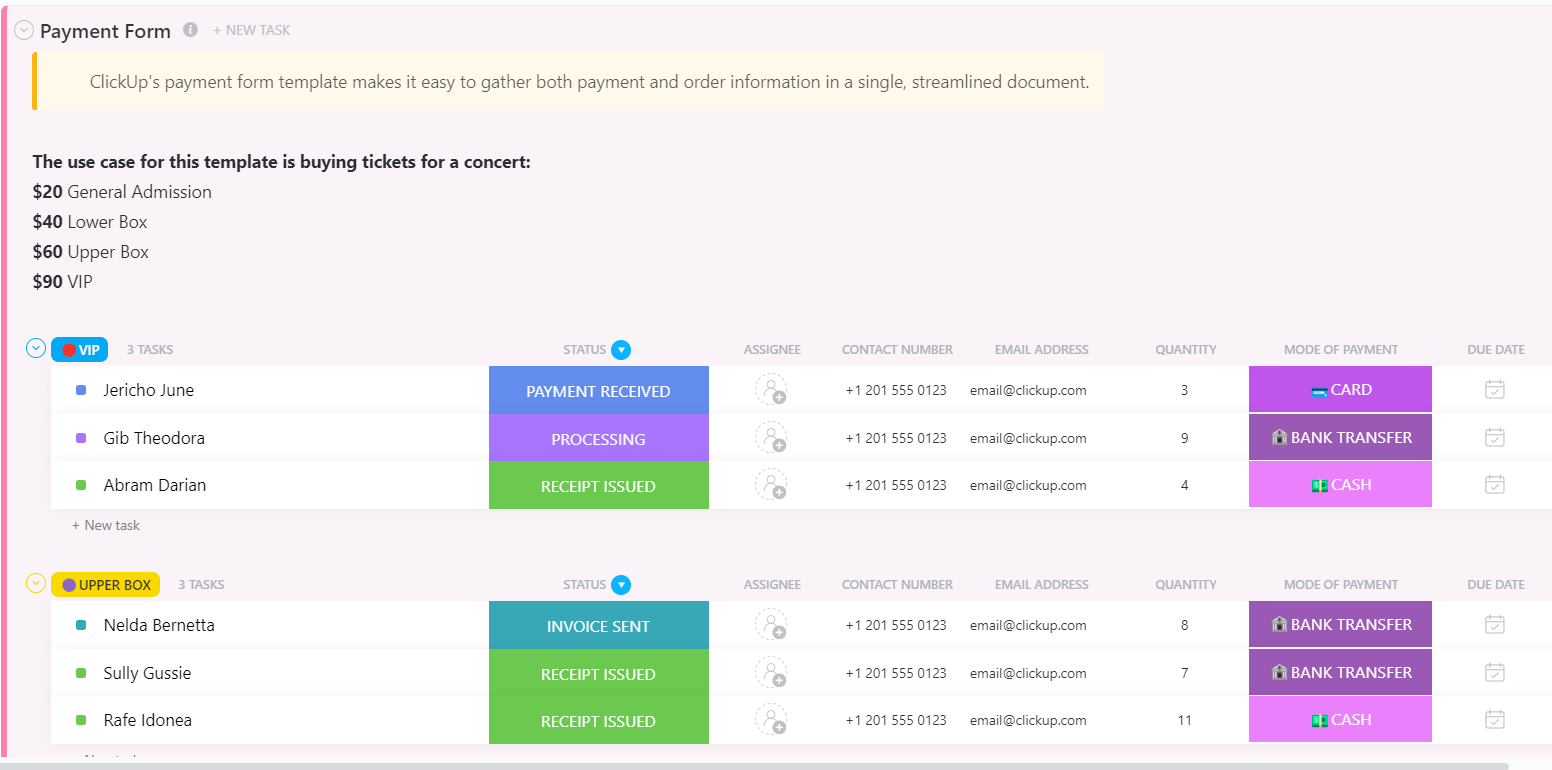

Stanbic launched the Catalytic Fund in 2020 as part of its social impact strategy. Unlike conventional lending, the fund offers grant-like patient capital designed to de-risk early-stage ventures and help them scale sustainably.

As of December 2024, the bank had disbursed KES182.4 million ($1.4 million) through the fund, with KES 63 million ($487,616) issued in 2024 alone, according to its disclosures.

While the funding is modest in absolute terms, it targets non-traditional sectors where access to credit is scarce or expensive. Stanbic now hopes to raise ten times that amount to amplify its impact.

“Energy projects tend to have the longest lead time from what we have seen, even 10 years. We’ve aligned with the biggest areas of the economy, like agriculture, because the model is similar, but energy projects tend to have the longest lead time,” Oigara said.

Stanbic’s strategy contrasts with most commercial banks, which remain risk-averse and largely absent from startup financing. Most local founders still lean on VC funds, DFIs, and philanthropic capital from institutions like the Gates Foundation, a model now under strain.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com