Nigerians are seeking more effective ways to grow their wealth, and the stock market is capturing their attention. You’ve likely seen stories online about people turning small investments into significant gains, or heard about companies on the Nigerian Exchange (NGX) that more than doubled their investors’ money in just a few months.

Image Source: Screenshot of X post by @oyinbby_ highlighting Honeywell stock gains

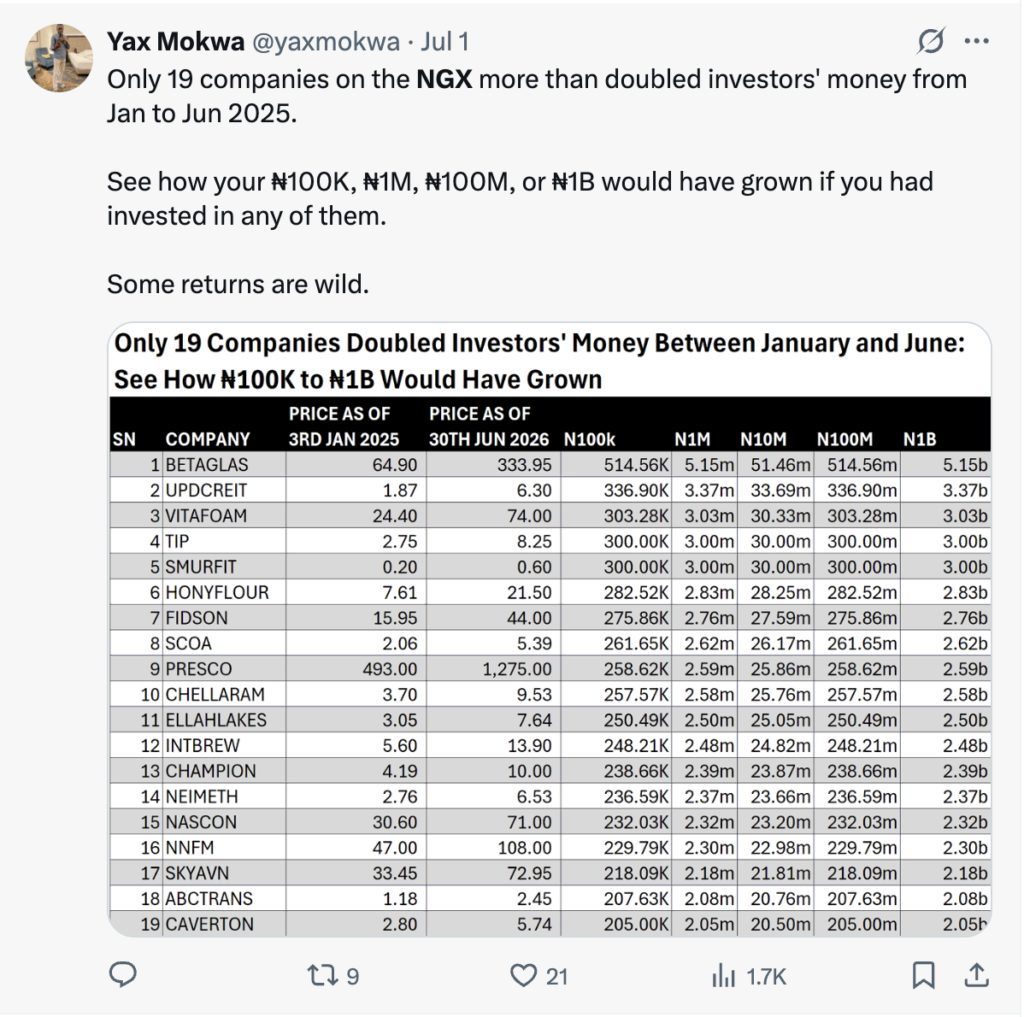

For example, imagine investing ₦1 million in Honeywell stocks a year ago; today, that investment could be worth over ₦5.4 million. Or consider the companies on the NGX that have doubled or more than doubled in value between January and June 2025 – some returns are truly significant.

Image Source: Screenshot of X post by @yaxmokwa displaying NGX companies that doubled investor money (Jan-Jun 2025)

This growing interest isn’t surprising. With prices constantly rising, simply saving money is no longer enough. People are looking for more innovative ways to make their money work harder. That’s where stock investing comes in. Instead of just keeping your cash in a bank account, you can now easily put it into shares of companies you believe in.

Apps make this shift straightforward. You no longer need a traditional broker or a suit and tie. All you need is your smartphone and internet to get started.

Nigeria’s fintech sector is also experiencing significant growth. There are over 430 fintech startups in the country, and many of these apps offer stock trading as a core feature. At the same time, the Nigerian Exchange (NGX) is performing well, despite economic challenges. The local stock market has recently reached record highs, attracting local and international investors.

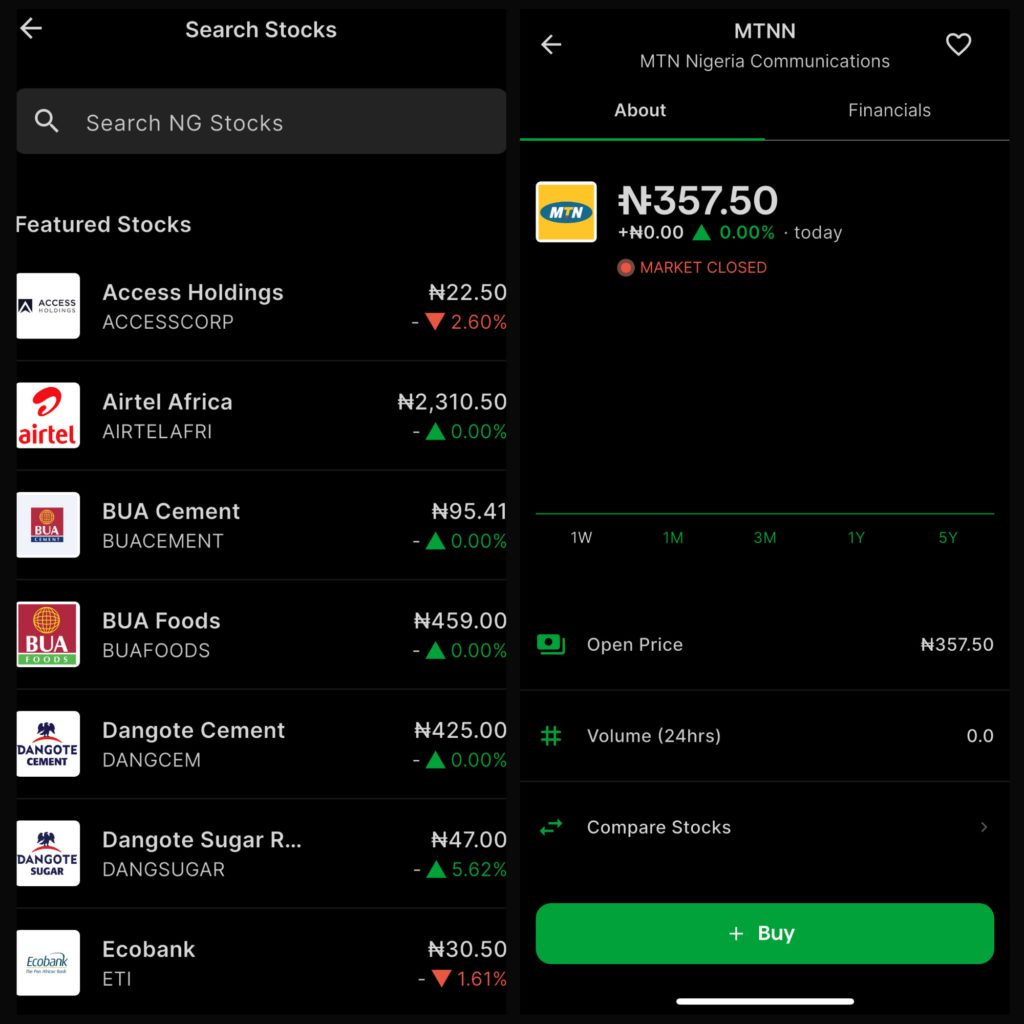

Many Nigerians we spoke with told us they aren’t waiting for the “perfect time” to start investing. As Tolu in Lagos put it: “Once I saw MTN shares going up, I just opened an account and bought a small amount. That ₦5,000 is now like ₦8,000. It’s not a huge amount, but it feels good.”

This mindset is pushing more people to explore apps that offer Nigerian and international stocks. But with so many options, how do you choose the right one?

We examined the top stock investing apps in Nigeria, including Bamboo, Chaka, Trove, and i-invest. Our review covered their key features, fee structures, and current regulatory standing. More importantly, we engaged with Nigerian users across various states – from new investors to those active since 2020 – who candidly shared their experiences, highlighting what they appreciate, what needs improvement, and which platforms they confidently trust with their investments.

These stock investing apps let you buy stocks on the Nigerian Exchange

Nigerians can easily invest in local and foreign stocks via several apps. We reviewed the most popular ones, checking their licensing and, critically, getting direct feedback from users on how well these platforms truly perform.

1. Bamboo

Image Source: Screenshots from the Bamboo app displaying trades for select Nigerian stocks, including MTN

What it lets you do:

Bamboo gives you access to Nigerian and U.S. stocks, and you don’t need a lot of money to start. You can buy fractional shares, meaning you can invest in big companies like Amazon or Tesla with as little as ₦15,000 or $20.

How it’s regulated:

Bamboo is registered with Nigeria’sSecurities and Exchange Commission (SEC) and works with Lambeth Capital for local stock trades. For U.S. stocks, your account is protected by Securities Investor Protection Corporation (SIPC) and Financial Industry Regulatory Authority (FINRA), which means your investments are insured up to $500,000.

What Nigerians told us:

Most people we spoke to praised Bamboo’s clean design and simple setup. Kemi, a user based in Port Harcourt, said:

“Bamboo is my go-to. I started with ₦20k last year, and I’ve just been topping up small small. The app works well, and I’ve never had payment issues.”

However, some also recalled when Bamboo was flagged by regulators in 2021. It caused panic back then, but the company adjusted its model and is now fully licensed. They say they’ve had a better experience since that time.

2. Chaka

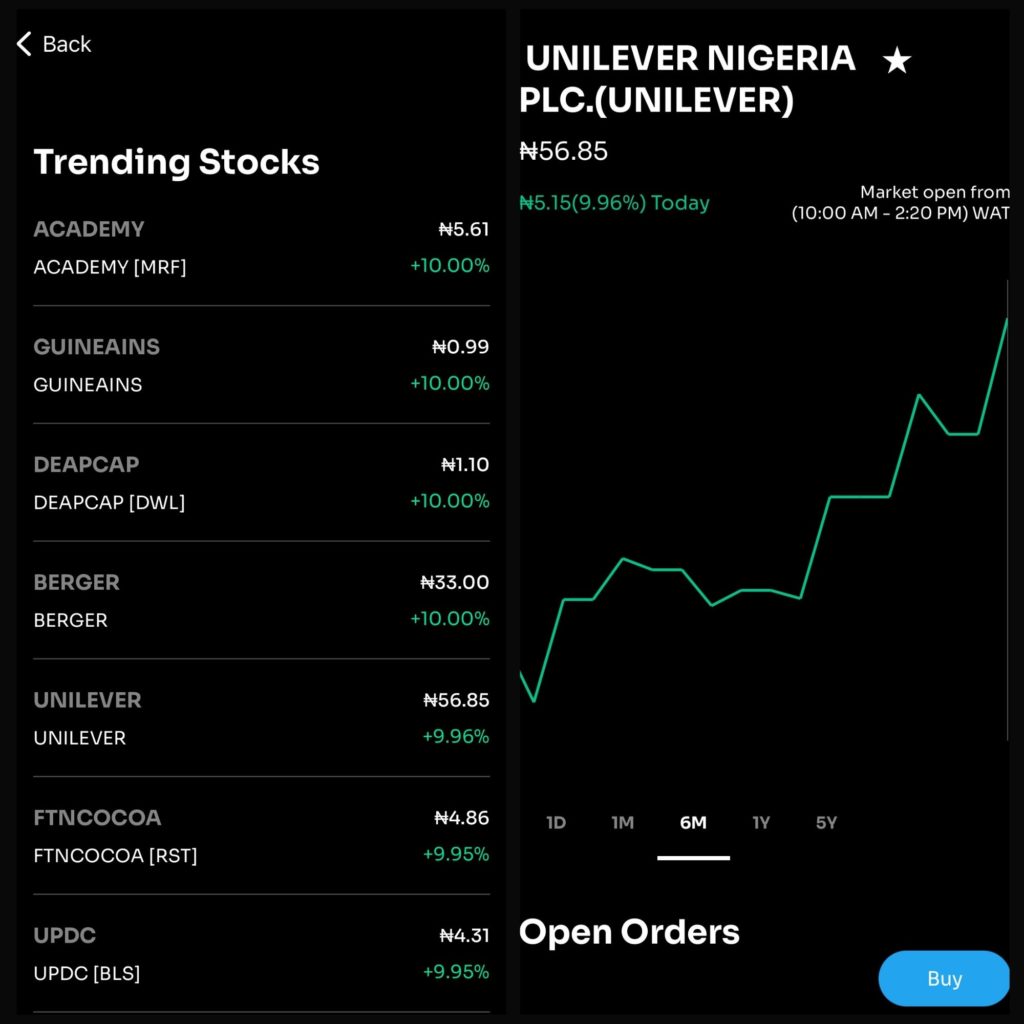

Image Source: Screenshots from the Chaka app displaying trades for select Nigerian stocks, including Unilever Nigeria PLC

What it lets you do:

Chaka gives you access to over 4,000 stocks, including both Nigerian and international ones. You can open a Naira or a Dollar account, depending on your preference. It also features a SmartInvest option, where experts help manage a ready-made portfolio on your behalf. You can start investing with as little as ₦1,000 or $10.

How it’s regulated:

Chaka was one of the first Nigerian apps to get a digital sub-broker license from the SEC. That means they’re legally allowed to offer stock trading to Nigerian users. Their local trades go through Citi Investment Capital.

Fees:

- Nigerian stocks: ₦100 or 0.5% per trade

- Foreign stocks: 0.69% to 1.5% per trade

- No charges for deposits or withdrawals

What Nigerians told us:

We heard mixed reviews. Deji in Ibadan said:

“I like Chaka because it looks serious, and they give regular updates. But getting verified took too long. I had to wait nearly two weeks to start investing.”

Another Lagos-based user, Amaka, added:

“I had to chase customer care for my withdrawal. They eventually sent it, but I switched to Bamboo after that.”

People like the app, but slow Know Your Customer (KYC) and delayed withdrawals are common complaints.

Big news:

Risevest acquired Chaka. Risevest previously faced significant regulatory issues with the Securities and Exchange Commission (SEC) in Nigeria, and is now using Chaka’s license to offer Nigerian stock trading legally. So technically, when you trade NGX stocks on Risevest now, you’re using Chaka’s backend.

3. Trove Finance

What you can do on Trove:

Trove provides access to both Nigerian and U.S. stocks, as well as ETFs, bonds, and ADRs. One of its key selling points is fractional investing, allowing you to start investing without needing to purchase whole shares. You can begin with as little as ₦1,000 or $10, and U.S. stock trades are commission-free. There’s also Trove University, a built-in section with market tips and beginner-friendly content.

How it’s licenced:

For Nigerian stocks, Trove works through Sigma Securities, which is registered with both the SEC and NGX. For U.S. investments, they use Trove Investment Advisers, LLC, a company registered with the U.S. SEC. Additionally, your U.S. account is protected by SIPC insurance, which covers up to $500,000.

Fees:

- Nigerian stocks: 1.35% per trade

- Foreign stocks: 1.00% per trade

- Some advisory accounts may attract a monthly subscription fee, depending on your market.

What Nigerians told us:

We spoke to several investors who said Trove offers one of the widest selections of assets in Nigeria. Kemi in Port Harcourt also said:

“Trove is great for variety. I use it mainly for U.S. stocks and ETFs. The interface works for me.”

But others weren’t as happy. A Lagos-based investor, Sola, shared:

“Their withdrawal process was annoying. It took over a week, and I didn’t get helpful responses from customer care.”

4. i-invest

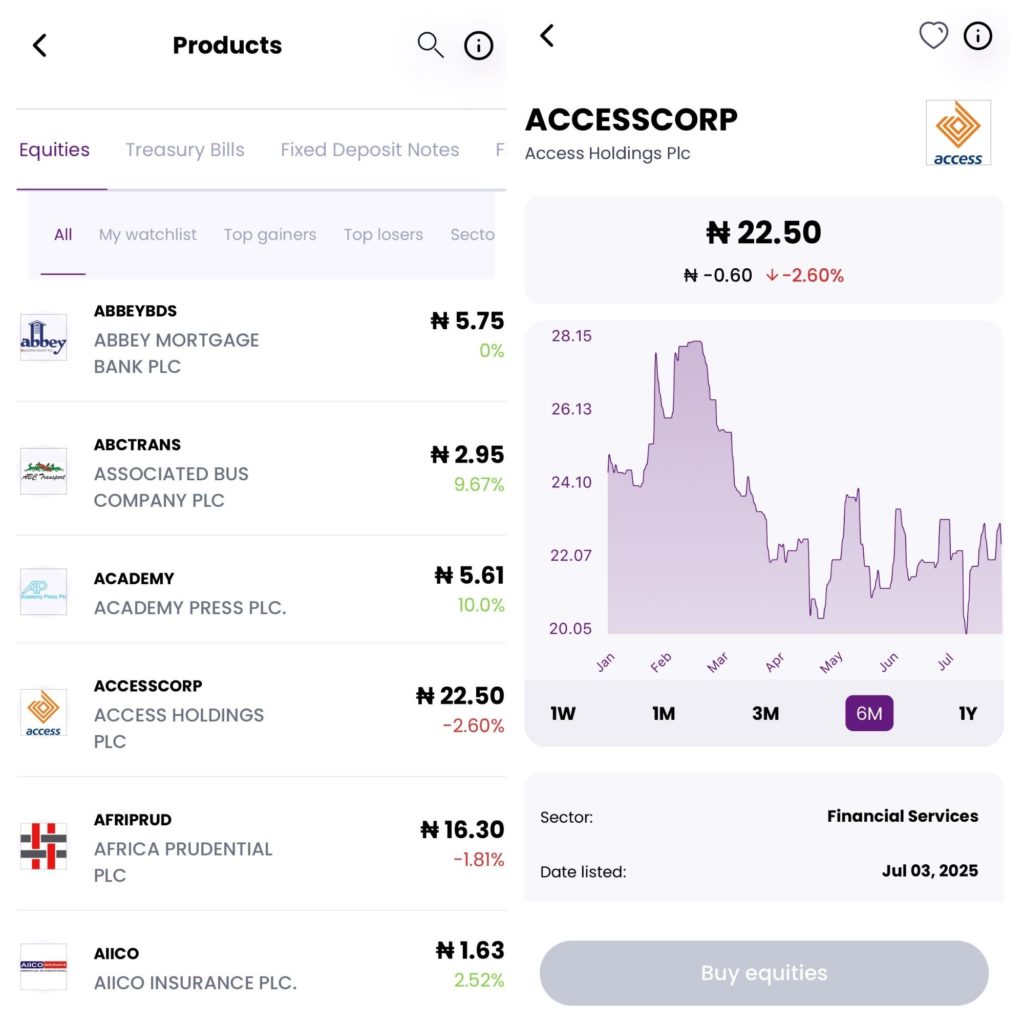

Image Source: Screenshots from the i-invest app displaying trades for select Nigerian stocks, including Access Holdings PLC

What you can do on i-invest:

I-Invest focuses primarily on Nigerian investments, including stocks, Treasury Bills, fixed deposits, commercial papers, and USD-denominated bonds. You can buy shares of companies listed on the Nigerian Exchange (NGX) straight from your phone.

How it’s licenced:

I-invest is registered with the Nigerian SEC, and a licensed custodian holds all investments. The app states that there are no extra charges, but, like every investment in Nigeria, a 10% withholding tax applies to dividend payouts.

What Nigerians told us:

Most people we heard from like how straightforward i-invest is. Deji in Ibadan also said:

“It’s clean and simple. I don’t need to guess what’s happening with my money.”

Another investor, Joy, added:

“I know it doesn’t do foreign stocks, but I use it for T-bills and NGX shares. I like that it doesn’t feel stressful.”

Unlike some other stock investing apps, we didn’t find many complaints about delays or poor service. Investors appreciate the clarity and focus on local assets.

Other platforms Nigerians use to access stocks

Aside from popular stock investing apps like Bamboo and Trove, some Nigerians utilise other tools to invest, particularly those seeking more control, access to multiple markets, or advanced technical features. However, these platforms have significant differences that you should be aware of before diving in.

1. MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

These two platforms are popular worldwide. If you’re deep into trading or have ever seen someone with candlestick charts and multiple indicators, chances are they’re using MT4 or MT5.

MT5 is the newer version, offering more timeframes, improved order execution, and supporting a broader range of assets. Both platforms allow you to use automated trading bots, set price alerts, and customise your trading setup.

But here’s the thing: MetaTrader itself is not a broker. It’s just the software. You still need a licensed broker, such as AvaTrade or NGCB Group, to place trades.

And this is where it gets tricky.

Most of these brokers offer CFD trading, which means you’re not buying actual stocks. You’re simply speculating on whether the price will go up or down. That comes with higher risks, and you’re not entitled to dividends or ownership in the company.

More importantly, many of these brokers are not registered with Nigeria’s SEC. For example, NGCB Group is licensed in Mauritius, not Nigeria. This means if anything goes wrong, you might not be protected under Nigerian investment laws.

A few advanced traders we spoke to in Lagos and Port Harcourt said they use MT5 for forex and global markets, but even they admitted the risks. As Deji, an advanced trader, warned:

“I use MT5 for forex. It’s powerful, but it’s not for everyone. You really need to know what you’re doing. I wouldn’t recommend it to beginners.”

2. EasyEquities

This app is based in South Africa and provides access to a wide range of stocks, including those listed on the JSE (Johannesburg Stock Exchange), as well as the NYSE and Nasdaq. You can also invest in cryptocurrencies, ETFs, and even real estate.

It’s loved for a few reasons:

- No minimum investment

- Fractional shares, so you don’t need to buy a whole stock

- Low brokerage fees — just 0.25% per trade

- Free EFT deposits, with a small 0.5% FX fee for currency conversion

Sounds great, right? But there’s a catch — EasyEquities is regulated by South Africa’s FSCA, not Nigeria’s SEC. So while Nigerians can open accounts, there are some limitations.

We spoke to a few investors who tried using it from Nigeria. Amaka said:

“I like their fees, but funding the account from Nigeria is stressful. I had to try three banks before my payment worked.”

An investor in Lagos, Tolu, added:

“They didn’t reject my registration, but getting my money back was a hassle. It’s easier to use apps that are made for Nigerians.”

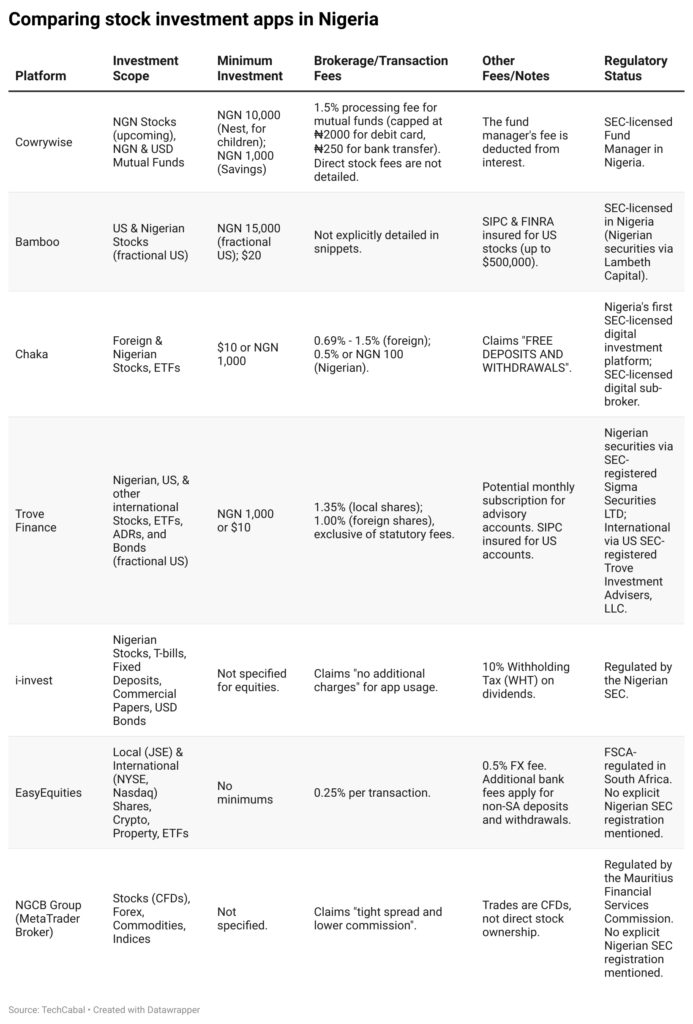

Head-to-head: Comparing stock investing apps in Nigeria

When choosing the right app for investing in stocks in Nigeria, it’s not just about the name or design; what matters most is access, cost, and ease of use. Let’s break it down:

Here is a comparative overview of the fee structures and minimum investments:

Note: Statutory fees for Nigerian stock transactions (NGX, CSCS, SEC, Stamp Duty, VAT) apply across all platforms facilitating NGN stock trading, regardless of platform-specific charges. These can total approximately 1.725% for buying and 2.025% for selling.

Final thoughts

Stock investing is no longer just for the few. Across Nigeria, more people are learning how to grow their money, not just save it, and stock investing apps are playing a significant role in that shift.

Here’s what we heard from Nigerians about what truly matters when choosing stock investing apps:

1. Nigerians want options — Local and Foreign

Stock investing apps like Bamboo, Chaka, and Trove already let you buy both Nigerian and U.S. stocks. For many investors we spoke to, this flexibility matters. Some want to invest in companies they see on the news (like Tesla or Apple), while others are focused on Nigerian brands they believe in.

“I like to mix it,” Tolu said. “GTBank is my go-to locally, but I also want to buy Apple shares. I just wish it didn’t take so long to fund my dollar wallet.”

2. Regulation is a big deal — and Nigerians know it

A lot of Nigerians told us they only trust platforms registered with Nigeria’s SEC. After seeing stories about frozen accounts and regulatory drama, many investors now double-check a platform’s license before signing up.

Platforms like i-invest, Chaka, and Bamboo have that stamp of approval. It gives people peace of mind.

“I don’t want to invest and hear tomorrow that the app has issues with the SEC,” Sola said. “That’s my money. I need to be sure it’s protected.”

3. Fees matter — but so does transparency

Nobody likes hidden charges. And while some apps claim “no fees,” Nigerians are becoming more discerning about reading the fine print.

Several investors mentioned confusion around FX fees, statutory taxes, and withdrawal charges. For example, the 10% tax on dividends surprised a few who were unaware that it was standard across all platforms.

“It’s not that I mind paying, I just want to know upfront,” Kemi, a trader we spoke to, said. “Don’t tell me it’s free, then take ₦1,200 from my withdrawal.”

Clear fee breakdowns, upfront costs, and honest communication are now essential for transparency and accountability.

Bottom line

The stock investing space in Nigeria is growing rapidly, and investors are becoming increasingly informed, vocal, and demanding. People want options, speed, and clarity, and the stock investing apps that provide all three will emerge as the winners.