Table of Links

Abstract and 1. Introduction

2. Data and Methodology

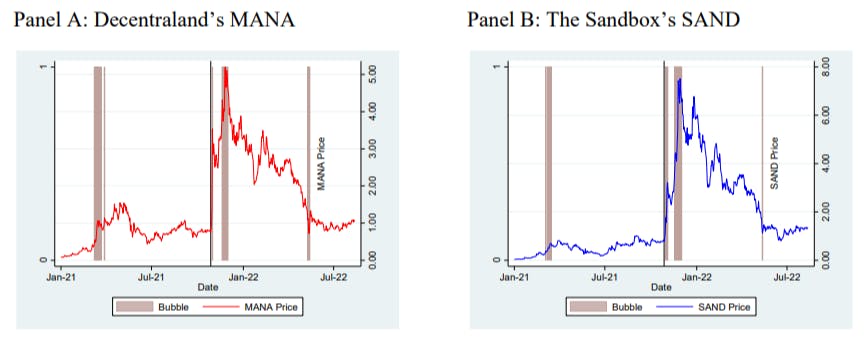

2.1 Bubble Timestamping

2.2 Cryptocurrency-LAND Wealth Effect

3. Results

3.1 Bubble Timestamping

3.2 Cryptocurrency-LAND Wealth Effect

3.3 Granger Causality Test

4. Conclusion and References

Appendix: Bored Ape Yacht Club’s Otherside

2. Data and Methodology

Daily cryptocurrency price data is obtained from CoinGecko. Prices quoted in USD are used in the bubble timestamping analysis and as exchange rates to convert the price of LAND NFT transactions which commonly occur in non-USD denomination. Summary statistics of cryptocurrency prices are reported in Table 1.

We obtain secondary LAND transactions of Decentraland and The Sandbox directly from Ethereum.[5] Transactions occurred from August 2018 for Decentraland and December 2019 for The Sandbox to August 2022. While blockchains allow users to directly interact with one another, the inherent anonymity makes peer-to-peer exchanges challenging. Decentraland maintains its own marketplace, while The Sandbox relies on Internet-based third-party providers, where OpenSea is the dominant marketplace: 21% and 96% of transactions on Decentraland and The Sandbox during the sample period occur on OpenSea. Each recorded transaction on the blockchain may involve transfers of multiple of LAND plots for a single payment. Consequently, we count the number of plots involved in the transaction and include it as a control variable. Transaction prices are winsorized at thresholds of 0.1% and 99.9% to limit the influence of outliers. There are 17,118 and 47,385 unique transactions in Decentraland and The Sandbox respectively.

Transactions paid in wETH – a “wrapped” version of ETH – are flagged as they represent a different type of transaction. OpenSea allows both direct purchases (fixed-price NFTs) and bidding on auctions (offers). Ether (ETH) is Ethereum’s native coin created via the consensus algorithm that secures the integrity of the blockchain similar to Bitcoin (BTC), and wETH is a digital “token” created by smart contract program and issued by depositing ETH in exchange for wETH. While ETH and wETH are 1:1 pegged, the nature of the data is not the same. Sellers on OpenSea have choices regarding which cryptocurrency to list their NFTs in, but buyers must use wETH to “make an offer on an ETH item” because of this technical difference. [6] Consequently, transactions conducted in wETH (rather than ETH) are more likely to be from auction bids rather than fixed-price purchases, and thus may have different prices. Table 2 summarizes LAND transactions used in the study: 7.3% of Decentraland’s transactions are settled in wETH, while the proportion is higher at 20.1% for The Sandbox, reflecting the greater reliance of The Sandbox on Opensea.

2.1 Bubble Timestamping

To identify phases of bubble, we use the Phillips, Shi and Yu (2015) (PSY) bubble timestamping algorithm which conducts a series of augmented Dickey and Fuller (1979) (ADF) unit root test on a time series. The algorithm calculates the ADF test statistic from the regression:

2.2 Cryptocurrency-LAND Wealth Effect

Author:

(1) Kanis Saengchote, Chulalongkorn Business School, Chulalongkorn University, Phayathai Road, Pathumwan, Bangkok 10330, Thailand. (email: [email protected]).

[5] The Ethereum addresses for the LAND contracts are ‘0xf87e31492faf9a91b02ee0deaad50d51d56d5d4d’ for Decentraland and ‘0x50f5474724e0ee42d9a4e711ccfb275809fd6d4a’ (the legacy contract created in December 2019) and ‘0x5cc5b05a8a13e3fbdb0bb9fccd98d38e50f90c38’ (the new address with upgraded functionality created in January 2022) for The Sandbox.

[6] https://support.opensea.io/hc/en-us/articles/360063518053-How-do-I-make-an-offer-on-NFTs-