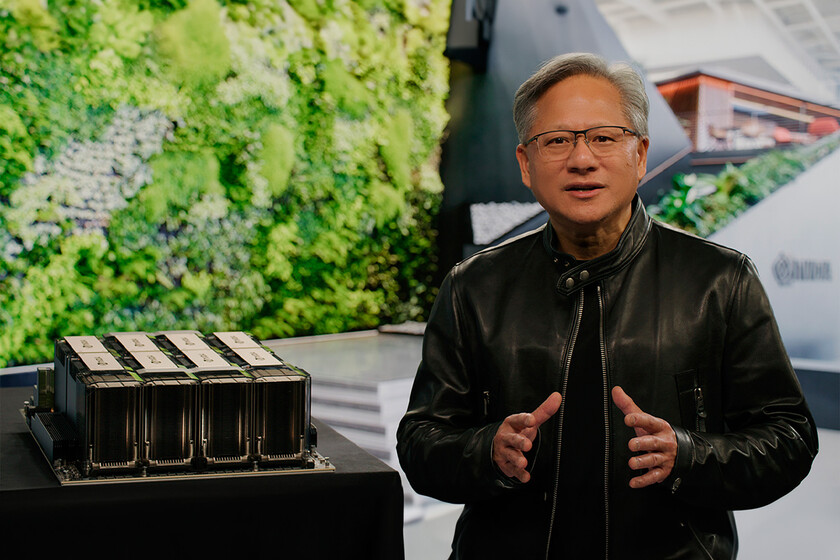

The agreement with Washington had allowed Nvidia to sell its H20 chip again in China. It was a door that opened after months of restrictions. Now, the Chinese authorities have begun to close it slowly: according to Financial Timesy Reuters, they have summoned Alibaba, ByteDance, Tencent and other companies to explain why they Buy H20 instead of using local processors. The gesture is not symbolic, several of them are rethinking their orders, and the new scrutiny comes while Beijing encourages a prioritize domestic alternatives.

Nvidia developed the H20 in direct response to the export limitations that the United States imposed at the end of 2023. For a time it was its star product for Chinese clients, until this year it was again blocked by a new Washington decision. In July 2025, the veto rose after an agreement with the Trump administration for NVIDIA to transfer 15% of the income of some advanced chips sales in China, according to Reuters. That turn reopened the door, but also unleashed criticism in the United States for its supposed impact on China’s capabilities.

A historical agreement that now faces resistance

Authorities such as the Ministry of Industry and Information Technology, Mits, people aware of the situation, and the administration of the cyberspace of China, CAC, according to Reuters, have held meetings with companies such as Alibaba, Bytedance, Tencent and Baidu. They have asked them Why don’t they turn to national alternatives and have expressed their disapproval for the use of H20 in government or security areas. They have also raised doubts about the information that Nvidia asks to send to Washington for review. As a result, several companies have begun to reconsider their orders, according to Financial Times, although Reuters points out that it was not ordered to stop shopping.

Concerns are not limited to preference for local chips. The Internet regulator asked NVIDIA to clarify whether H20 could involve risks for Chinese user data, including the possibility of “backdoors.” In this sense, Beijing has expressed concern for functions such as remote shutdown or location tracking. Nvidia, as we have seen before, denies those capabilities and argues that H20 is not a military product or for government infrastructure.

According to Financial Times, Huawei, Cambricon and other Chinese manufacturers have increased their presence in the market since the H20 was subject to restrictions. Beijing has reinforced the message of technological self -sufficiency and encourage large platforms to opt for local suppliers. Now, it is no secret that the lack of access to advanced manufacturing equipment, such as the latest generation lithography, remains an obstacle. Despite this, the demand for national chips grows thanks to political support and the need to reduce external dependence.

But not everything plays in favor of the local giant Huawei. The great Chinese technology, such as Tencent, Alibaba or Bytedance, continue to prefer NVIDIA GPUs for their greatest performance and, above all, by CUDA, the NVIDIA parallel programming platform that allows the most to take full advantage of its GPU for artificial intelligence and other complex calculations. Replacing it with alternatives such as Cann implies overcoming technical and compatibility barriers. Li Guojie, from the Chinese Academy of Sciences, warns that China needs its own tools that exceed Cuda to achieve self -sufficiency.

The great Chinese technology, such as Tencent, Alibaba or Bytedance, continue to prefer Nvidia GPUs.

Bernstein, includes FT, estimates that the Nvidia market share in China will go from 66% in 2024 to 55% this year. In parallel, Trump has suggested that he could authorize a Limited version of Blackwell -based processorsthe most advanced of the company. In any case, Nvidia generated 17,000 million dollars in sales in China in its last year, 13% of its total income. In this environment, each regulatory decision weighs as much as the technological road map itself.

What in July was presented as an advance for Nvidia has become an uncertain scenario. Beijing’s pressure, added to the impulse to national manufacturers, redefines the company’s possibilities in a market that was strategic for years. According to the aforementioned means, the outcome will mark not only the future of Nvidia in China, but also the way in which both powers manage artificial intelligence when politics, security and trade intersect.

Images | Nvidia

In WorldOfSoftware | China’s first avant -garde lithography machine is not the biggest US problem. They will be the other two that are on their way

In WorldOfSoftware | China is an essential market for Nvidia. Little by little it is becoming something else: a nightmare