In 2022, a crippling dollar shortage forced Nigerian banks to suspend or severely limit international transactions on Naira debit cards, making it nearly impossible for freelancers, digital marketers, students abroad, and remote workers to pay for global services.

Fintechs like Chipper, Payday, and Barter by Flutterwave quickly filled the gap with virtual dollar cards, providing short-term relief for subscribers to Canva Pro, Netflix, Upwork, and more. But regulatory scrutiny, funding delays, hidden FX spreads, and unpredictable fees soon turned many of these platforms into unreliable stopgaps.

In 2025, Nigerian commercial banks began reactivating international spending using Naira cards, though often with tight spending limits, some capped at $500 per month.

This guide blends research, firsthand testing, and user insights to help you navigate what remains a volatile landscape, where the key isn’t just finding a card that works, but one that will continue to work tomorrow.

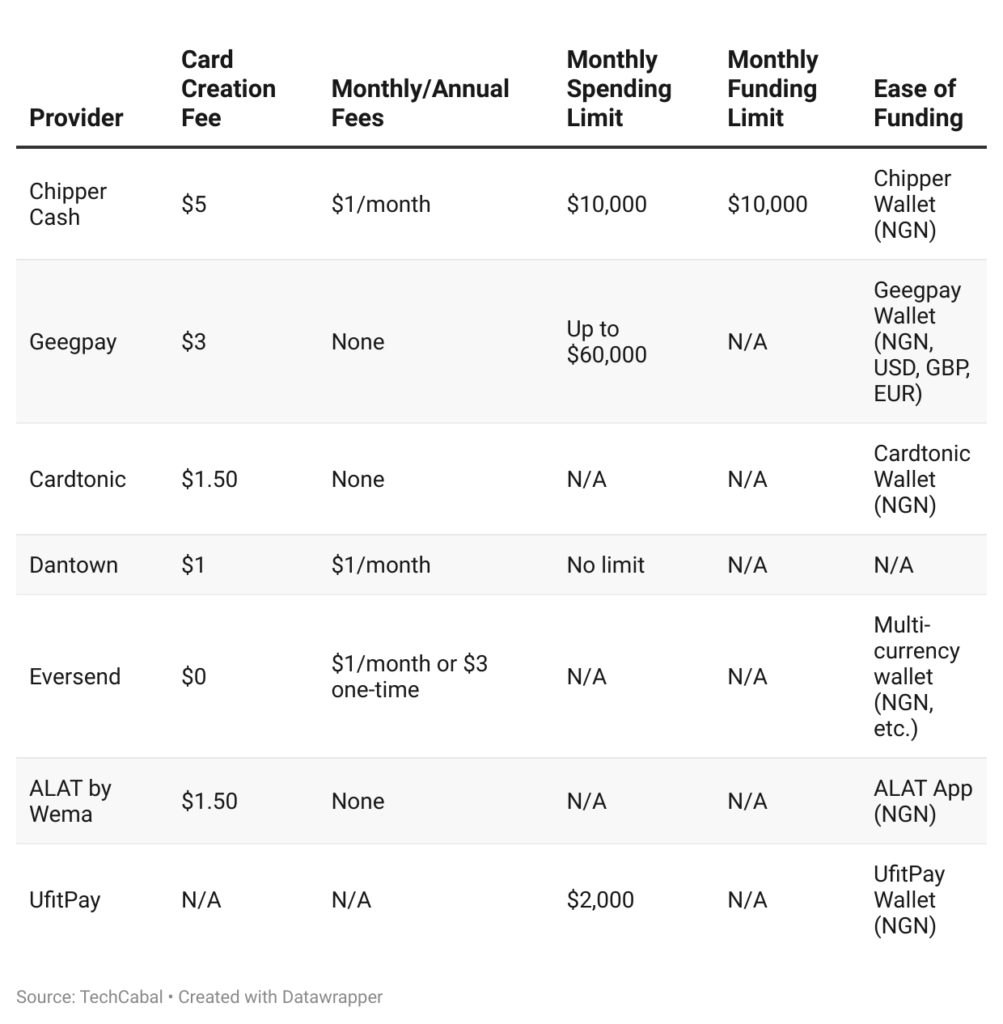

Virtual dollar card providers in Nigeria (2025)

Here’s a closer look at some of the top virtual dollar card options available in Nigeria, based on pricing, limits, user experience, and their compatibility with international platforms.

1. Chipper Cash

Chipper Cash is one of the most popular options in Nigeria. It charges a $5 card creation fee and a $1 monthly maintenance fee. The card is reloadable, with a daily limit of $2,500 and a monthly limit of $10,000. The card works for major platforms like Netflix, Apple, Google, Spotify, and AliExpress.

“It’s fast and reliable. I’ve never had to wait long for transactions to go through,” says Boluwatife, a B2B and SaaS content writer.

But not everyone’s had it as smooth. Jemimah, a master’s student, recalls hitting a wall after deleting her card. “When I tried to create a new one, it wouldn’t let me. I ended up paying another $5 just for support to remove the old card,” she says.

2. Geegpay

Geegpay is built for freelancers, remote workers, and people who make international payments regularly. It offers very high spending limits, up to $20,000 per day and $60,000 per month for users at the highest KYC level.

- Card creation fee: $3

- No monthly fees

- Funding charge: $0.50 per top-up

“Compared to Payoneer, Geegpay’s rates are way better. Payoneer’s rates are just poor,” says Afolayan, a Lagos-based graphic designer.

Still, the onboarding process can be tough for some. “The signup and KYC process stressed me out. Then my funds were frozen temporarily. They explained it was anti-money laundering compliance, but it was still frustrating,” says Chinenye, a nutritionist in Abuja.

3. Cardtonic

Cardtonic started as a gift card platform but now offers a solid virtual dollar card service.

- Card creation fee: $1.5

- No monthly fees

- Funding fee: 2% per Naira deposit

Customers can fund their cards directly from their Naira wallet, and Cardtonic claims to use some of the best available exchange rates. “It takes me less than a minute to fund my card,” says Afolayan.

Boluwatife adds, “It works perfectly for paying for X (formerly Twitter) verification.”

4. Dantown

Dantown markets its card as the cheapest in Nigeria, and it might be right.

- Card creation fee: $1

- No funding fees

- No monthly fees

There are no official spending limits. Jemimah says: “Mine works fine on AliExpress, Amazon, Netflix, Spotify, and YouTube Premium without issues.”

Afolayan also likes the low activation cost:“I’ve rarely experienced card rejections. It’s a solid choice for everyday online payments.”

5. Eversend

Eversend gives you more flexibility with currencies, allowing you to hold USD, EUR, and GBP in one wallet.

- Card creation fee: Free

- Maintenance: $1/month or a one-time $3

- Penalty fee: $0.35 for failed transactions due to low balance

But there’s a catch: if your card fails 2–4 times, it may be revoked. “My card was revoked after a series of failed transactions. I wish there had been more warning,” says Chinenye, a nutritionist.

Reviews were mixed. Boluwatife praised the company’s support: “The team is responsive.”

But Jemimah noted: “Bank transfers can be slow, and exchange rates are sometimes higher than expected.”

6. ALAT by Wema Bank

ALAT, Wema Bank’s fully digital platform, lets users manage their finances and make international payments through a virtual dollar card.

- Card creation fee: ₦2,260 (around $1.5)

- Funding fee: 2% + ₦100

- No annual fees

- Max balance: $20,000

Afolayan says, “I use ALAT’s card mainly for Facebook Ads and Google Ads. I like knowing it’s backed by a bank, so there’s an extra layer of security.”

Chinenye adds, “I can manage everything online without having to visit a branch. For me, it’s the perfect mix of bank trust and fintech convenience.”

Other virtual dollar card providers

These providers offer alternative features that may fit your specific needs:

- Bitnob – Best for users who want to spend Bitcoin or convert it to USD.

- Payday – Good for freelancers and remote workers. It provides virtual accounts and a global Mastercard.

- Cleva – A new option offering quick card creation and affordable fees.

- Grey – Offers USD, GBP, and EUR accounts, but some users report slow funding and support issues.

- UfitPay – Allows international spending of up to $2,000/month and comes with API access for developers.

- Kuda – Offers only a virtual Naira card, not a dollar card. Be sure not to confuse it with other options.

How to choose the right virtual dollar card

Everyone has different needs, so the right virtual dollar card depends on how you spend.

For people who spend big monthly

If you’re a freelancer, remote worker, or digital marketer, look for cards with high monthly limits.

- Geegpay offers up to $60,000/month for verified users.

- Chipper Cash allows up to $10,000/month.

For people who shop or subscribe online sometimes

If you only make a few purchases or pay for subscriptions:

- Dantown and Cardtonic are great because they don’t charge monthly fees.

- Eversend charges a one-time fee of just $3.

For people who want full banking features

If you want more than just a card, ALAT by Wema Bank is a solid pick. A commercial bank backs it, so you also get access to regular banking features.

Table: Virtual dollar card fees, limits, and funding options