On August 7, 2025, I began a 45-day wind-down of Olympia, an AI “virtual staffing” app built in Ruby on Rails. Ending something you’ve poured time and care into is never easy. I’m proud of what my team shipped, grateful to the customers who trusted us, and clear about the lessons I’m taking forward.

This post is a debrief focused on product, go-to-market, and company-building lessons. It’s not a legal brief or a play-by-play of personal conflict. Different people experienced the same moments differently; what follows is my perspective as the technical founder and investor. The reason that I don’t name my co-founder when I write about this topic is simply to protect her online reputation, not to “erase” her from the story.

What Olympia Was

Olympia offered a small team of role-based AI consultants — strategist, copywriter, legal expert — working in a shared workspace with memory, web tools, and light autonomy (e.g., link-reading, outbound email). Customers liked that the “team” remembered context over time and produced outcomes, not just advice.

What Worked (Product)

- Role-based collaboration lowered friction. Starting from a role beat starting from a blank chat.

- Memory compounded value. Long-term context (brand voice, in-flight work) kept people coming back.

- “Do it for me” > “tell me how.” Features like outbound email and link-following moved us toward real assistance.

- Show, don’t tell. Case-study flows and tutorials converted better than positioning pages.

What Didn’t Work (Reality Check)

-

Distribution gravity favored incumbents. As soon as platform players shipped “build your own assistant,” much of the discovery surface moved inside their ecosystems.

-

Platform velocity outran wrapper moats. Improvements in base models turned our differentiators into table stakes fast.

-

Horizontal promise, vertical purchase. Our best stories were narrow (policy ops, launches, niche marketing), but our message stayed broad.

-

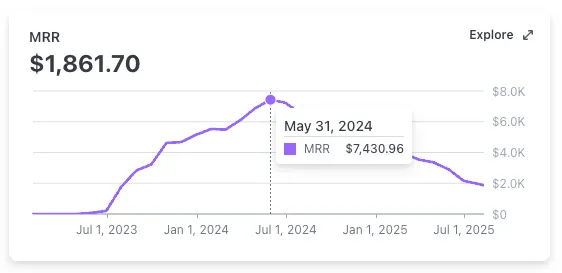

First-mover advantage evaporated. We launched into the hype and peaked around $7.4k MRR (May 2024), then slid toward ~$1.9k by mid-2025 as the market flooded and our acquisition slowed.

Where I Set Us Up Poorly (Company-Building)

I optimized for convenience over structure. We ran through my existing LLC instead of forming a new company. That shortcut avoided legal overhead early but created ambiguity later: no vesting, no board, no tie-breaks, no written decision rights. I eventually signed a revenue-sharing agreement tied to a potential asset sale (50% of net sale proceeds if a sale closed) with her, but never replaced that with proper governance. Lesson: paper the company you intend to run, not the hope you intend to feel.

Titles outpaced scaffolding. Because I was in love with her at the time, I gave my collaborator a CEO title only to build her confidence (and resume). Nothing she ever showed me indicated that she was qualified for the role and without defined scope, decision rights, and coaching, the title became identity rather than accountability. That’s on me.

GTM doctrine stayed fuzzy. We needed a repeatable performance engine. Early paid tests fizzled; so she defaulted to the easier organic/community route. Those channels matter over long horizons, but they were mismatched to an AI land-grab. If the thesis requires paid acquisition, instrument CAC/LTV, time-box spend, and staff it — or narrow the wedge and lower the burn.

Unequal draws + unclear expectations = friction. Any deviation from equal founder compensation should be explicit (salary, loan, or distribution) with terms. Otherwise, strategy debates feel personal.

Why We Wound Down (Short Version)

Recently a potential asset transaction fell through due to legal diligence cost/complexity. Even though we had been colloquially referring to deal as an “acquihire”, it was not. The potential buyer was another startup (that had already purchased a snapshot of our source code earlier in the year) trying to buy the remaining assets of the project from my LLC. They were also separately considering hiring my co-founder on as their first employee. As we worked on a letter of intent for the asset deal, the buyer discovered that the estimated legal costs for diligence would be approximately 50 thousand dollars on their end. For an asset for which they were offering only a symbolic single dollar, so they decided the legal cost of the transaction was not worth it. In parallel, they also decided not to hire my co-founder. To be crystal clear, they absolutely could have hired her without doing the Olympia deal. They’ve since told me their reasons, but I won’t divulge them here for privacy reasons.

Instead of accepting the outcome and doing some introspection about her role in the failure, my co-founder blamed me publicly on social media for sabotaging the deal. The resulting shit show was the straw that broke the camel’s back for me.

Leadership alignment and trust fully disintegrated, and juggling full-time obligations elsewhere, I was forced to make a very difficult decision. Keeping Olympia in further limbo, just so that my co-founder could keep collecting a meager (sub-$1k) monthly profit would have been unfair to customers. So I did what I had to do: end her contract and proceed with winding the product down: disable auto-renewals, pause new charges, provide export tools, set support timelines, and close accounts cleanly.

What I’d Do Differently Next Time

Form an entity on day one. Issue founder stock with four-year vesting and a one-year cliff. Put IP and contracts in the company, not a personal LLC.

Define roles and decisions early. Write down scope, decision rights, and tie-break mechanisms (e.g., an advisory board or named mediator). Titles follow the work.

Separate generosity from governance. If you help a collaborator financially, document it (salary/contract/loan) and keep it distinct from founder economics.

Declare GTM doctrine. If paid growth is required, staff it and time-box experiments. If you won’t fund that motion, right-size the ambition or focus on a narrow vertical with clear activation.

Set pivot gates. 30/60/90-day checkpoints tied to retention/activation. If the metrics miss, either narrow the wedge or sunset gracefully.

Ship plumbing early. Memory, retrieval, logging, export — make them boring and dependable. Trust compounds quietly; bugs spend it loudly.

Design for defaults. Meet users in the tools they already live in, or give a 10× reason to leave.

Assume the platform will ship your roadmap. Your edge must survive the next model release and the next store announcement.

Drift, Named Honestly

By late 2024 our cadence told the truth: sporadic posting, fewer launches, slipping focus. We didn’t fund a pivot, hibernate with integrity, sell quickly, or sunset on a timeline. That wasn’t malice; it was conflict-avoidance dressed as hope. The compassionate move would have been to decide — earlier.

A Word on Disputed Narratives

Different accounts exist about why the aforementioned transaction and a related hiring discussion didn’t proceed. I’m not litigating that here or anywhere else on social media. The only piece that matters to customers is this: I closed Olympia with care. If a journalist or mediator needs verification about the business sequence (diligence cost, dates, notices), I’ll provide documentation confidentially.

Gratitude

To everyone who tried Olympia, sent feedback at odd hours, and trusted an AI “team” with real work — thank you. To my co-founder and other collaborators: we pushed something super ambitious into the world. That’s worth celebrating. Even when we disagreed on direction, we were united by the hope that work could feel lighter.

What’s Next

I’m currently focusing on a vertical platform for specific industry workflows and a few tightly scoped Rails-plus-AI experiments. Same brief as always: pick a chronic pain, solve it end-to-end, and stay human about it. If that resonates, I’d love to talk.

Onward.