More than two-thirds of startups never deliver a positive return to investors. And it’s not necessarily because of a flawed idea or business model. Sometimes, money management is the problem.

It usually starts small. A few business expenses you didn’t expect. A stretch on hiring. A marketing bill that hits too early. Before long, you’re watching your balance shrink with no clear way to stop it.

That’s where a solid startup budget template comes in. It helps you map out what you’ll spend, what you’ll earn, and what it’ll take to keep going. You don’t need to build it from scratch, and you don’t need to guess.

In this guide, you’ll find the top free, easy-to-use startup budget templates to track expenses, plan for growth, and stay one step ahead of the chaos.

🧠 Fun Fact: The word budget comes from the Latin bulga, meaning “small pouch.” This led to the Old French bougette, diminutive of bouge, meaning ‘leather bag’.

Free Startup Budget Templates to Plan, Track & Optimize Finances

What Are Startup Budget Templates?

A startup budget template is a format to organize your startup costs, forecast revenue, and keep track of actual expenses. It includes common line items like rent, software, payroll, and marketing. You can use a startup budget template to help build a business budget that reflects your priorities.

For early-stage founders, it’s a practical way to estimate burn rate, monitor overhead expenses, and stay aligned with long-term financial goals.

Many templates also support building a profit and loss statement and spotting gaps before they become problems.

Whether you’re in pre-launch mode or scaling fast, a budget gives your startup the discipline to grow with focus. And with the right template, you can spend less time building spreadsheets and more time building your business.

What Makes a Good Startup Budget Template?

To get the most out of your startup budget template, make sure the one you choose includes the following capabilities:

- Core line items: Include essential categories like rent, salaries, software, sales, and marketing to cover all typical startup expenses

- Startup cost breakdown: Separate one-time estimated startup costs from recurring crucial expenses for better clarity and long-term planning

- Revenue projections: Estimate expected income across different sources to track growth potential

- Actual vs. projected comparison: Show side-by-side data to evaluate financial accuracy and adjust plans quickly

- Profit and loss statement section: Summarize income, expenses, and net result to understand financial health at a glance

- Cash flow tracker: Monitor when money is coming in and going out to avoid shortfalls

- Customization options: Edit categories and fields to reflect your unique business model and priorities

- Big picture summary: Offer a clear monthly or quarterly overview so you can spot trends and make informed decisions

👀 Did You Know? Undercapitalization is one of the top reasons startups fail. So, when building a startup budget, don’t just focus on units of goods sold—zoom out and consider the big picture. Factor in loans, overhead, and how you’ll allocate resources over time. Ensuring you have access to flexible funding and a clear view of your cash flow runway is key to staying afloat and scaling smart.

Startup Budget Templates

The following templates will help you track costs, plan ahead, and stay lean. Use them to see where your money’s going and how long it will last. Pick the one that suits you best and start budgeting!

1. Simple Budget Template

If you’re starting from zero, the Simple Budget Template gives you a clean way to build your startup budget without overcomplicating things. It breaks your finances down into just what you need: income, expenses, and monthly totals.

Add Custom Fields for details like budgeted amounts, actual spend, vendor information, and payment dates, so you always know exactly where your money is being

Use this template to:

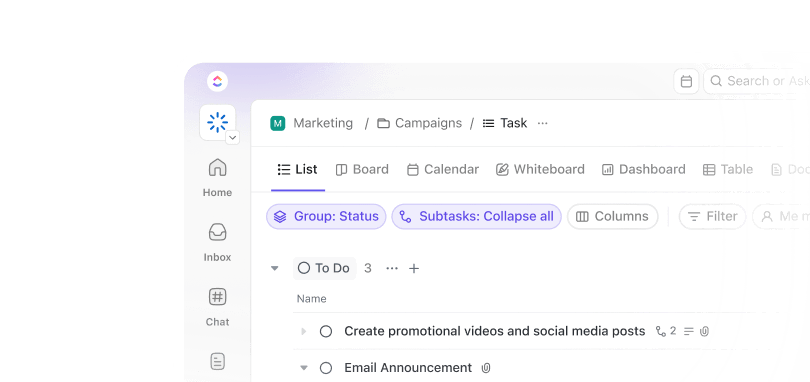

- Build a clean budget from scratch using five focused Custom Views—Budget Plan, Income, Expenses, Net Cash, and Getting Started

- Edit 16 Custom Fields for income and expense tracking across your business

- Track actual vs. projected cash flow to stay ahead of monthly burn

- Organize and track tasks with ‘Complete’ and ‘New Entry’ Custom Statuses

- Update Statuses to keep your stakeholders in the loop

🔑 Ideal for: Founders who need a basic, editable budget template to stay in control from day one.

2. Marketing Budget Template

Every marketing campaign costs something. The Marketing Budget Template helps you stay sharp by breaking your budget down by type, goal, and return. This template is your way to see what and how each campaign is doing.

Use this template to:

- Track spend across five Views: Timeline, Cost Tracker, Campaign Type Spend, Marketing Goals, and Getting Started

- Categorize line items by platform, campaign type, and impact using Custom Fields

- Update budget Statuses—Done, Running, On Hold, Not Live—so your team knows what’s active

- Spot which campaigns are over or under budget before results come in

- Align every dollar with Goals to avoid budget drift

🔑 Ideal for: Startups running lean campaigns across multiple channels who need to stay focused on ROI.

💡Bonus: for Finance Teams offers a streamlined solution for managing and forecasting budgets. You can build custom Dashboards to get a high-level view of where your money is going, track budget allocations, monitor actual spending, and see profits all in one place and in real time.

3. Project Budget Template with WBS

Running a project without a clear structure is risky—costs pile up, timelines slip, and no one knows where things stand. The Project Budget with WBS Template gives you the structure you need to manage budgets without losing track of the work.

Use this template to:

- Break your project goals into smaller, trackable Tasks using the Work Breakdown Structure (WBS)

- Assign each Task with a fixed cost or variable cost, timeline, and owner, so nothing slips

- Use Custom Fields for project phase, task type, and budget details to stay organized

- Align the team with Statuses like To Do, In Progress, and Done

- Brainstorm on ideas in collaboration with stakeholders and turn them into coordinated action using Whiteboards

🔑 Ideal for: Startup founders and project managers who want to control costs and hit deadlines without overcomplicating the process.

4. Business Budget Template

The Business Budget Template is built for founders who need a clear view of what’s coming in, going out, and falling behind. It allows you to track projected and actual expenses across teams, stores, or departments.

Use this template to:

- Determine how much money you need to allocate to different areas of your business in Docs

- Track budgets by store, department, or team with preset Views like Getting Started Guide, Budget Tracker, and Overall Budget

- Categorize entries with Custom Fields for Expense Type, Product Type, Employment Type, and Projection Status

- Monitor performance with Statuses like Open, For Review, and Approved

- Catch financial gaps early by viewing totals by team, product, and category

- Improve budget tracking with actions like comment reactions, automated reminders, and multi-location tracking

🔑 Ideal for: Business owners who need a simple way to manage company finances without digging through spreadsheets.

💡 Bonus: If you want to make things faster and easier for your team by—

- Instantly searching , Google Drive, GitHub, OneDrive, SharePoint, and the web for files

- Using Talk to Text to ask, dictate, and command your work by voice—hands-free, anywhere

- Replacing disconnected AI tools like ChatGPT, Claude, and Perplexity with a single, LLM-agnostic, enterprise-ready solution

Try Brain MAX—the AI Super App that truly understands you, because it knows your work. This isn’t another AI tool to add to your collection. This is the first Contextual AI app that replaces them all.

5. Event Budget Template

Events bleed money if you’re not careful. The Event Budget Template helps you stay ahead by tracking costs line by line. It’s built for planners who need to see the whole thing at a macro and micro level together—what’s spent, what’s pending, and what’s left.

Use this template to:

- Log every expense in a clean List View—planned and actual

- Tag line items by type—catering, logistics, venues, marketing

- Flag entries with Custom Fields to manage expenses and visualize the budget

- Track Statuses with clear labels like To Do, In Progress, and Complete to track progress

- Stay aware of pending costs so nothing catches you off guard

🔑 Ideal for: Startup teams or solo planners managing events with tight margins and no room for surprises.

6. Budgeted Project Management Template

Running a project without tight budget control? Risky. The Budgeted Project Management Template gives you structure to manage costs, timelines, and tasks without losing track.

Use this template to:

- Organize Tasks as Open or Complete to track the progress

- Track what’s left to spend using fields like Remaining Budget, Project Budget, and Within Budget

- Flag key details with Custom Fields for Notes, Team Members, and Project Phase

- Visualize the project timeline with a Gantt chart and pinpoint areas for improvement

- Switch between five clear Views: Getting Started Guide, Budget, Project Schedule, Phases of the Project, and Status of Activities

🔑 Ideal for: Project managers who need to maintain financial oversight while keeping projects on track.

7. Project Cost Management Template

Every project has moving parts, and each one costs money. Project Cost Management Template helps you stay ahead by tracking every expense, its approval status, and where it sits in the process. It’s made for teams juggling multiple budgets and sign-offs who need to prevent hold-ups and keep spending on track.

Use this startup budget template to:

- Log every cost in the Project Costs Table with fields for Estimated Cost, Actual Cost, and Variance

- Track approval Statuses on a dedicated board—Waiting, Approved, or Needs Changes

- Plan the start and finish of your Tasks with Calendar View

- Create custom Recurring Tasks to help you stay on top of payment deadlines (once you mark a bill as paid, automatically creates the next month’s task for you)

- Follow cost items from submission to sign-off, so nothing stalls progress

🔑 Ideal for: Project managers who need tighter control over spending, especially when multiple stakeholders need to review each item.

💡 Pro Tip: Want to keep your projects on budget and avoid financial surprises? Project budget software can help you track expenses, forecast costs, and stay financially organized from start to finish.

8. Budget Proposal Template

The Budget Proposal Template is for teams that need to pitch project costs with structure and speed. It lays out every line item—from one-time fees to overhead expenses—and keeps the approval process simple.

Use this template to:

- Outline detailed startup budget expenses using the List View for clarity

- Visualize timelines and dependencies with the Gantt Chart View

- Monitor proposal progress through Custom Statuses like Draft, Under Review, and Approved

- Customize Fields to include estimated costs, actual spend, and variance for precise tracking

- Collaborate with stakeholders by assigning Tasks and setting deadlines to keep everyone aligned

🔑 Ideal for: Project leads and startup teams creating budget requests that need to be sharp, fast, and ready for sign-off.

9. Monthly Expense Report Template

At a startup, small costs add up fast. Coffee runs, software subscriptions, travel receipts—if you don’t track them, you eventually lose them. The Monthly Expense Report Template helps you log all of it in one place.

Use this template to:

- Log every cost with Fields for date, amount, employee, category, and notes

- Categorize spends instantly using pre-built Task Tags like Transportation, Meals, and Software

- Track who’s spending what and why with a detailed breakdown by employee

- Flag duplicate or recurring charges so you can cut waste before it grows

- Review total spend by category or person at the end of each month for better decision-making

🔑 Ideal for: Founders and finance leads who need a clean, repeatable way to report team expenses.

👀 Did You Know? The first use of budget relative to financial planning comes from a 1733 pamphlet, The Budget Opened, by William Pulteney, the 1st Earl of Bath. Pulteney used the term budget to critique the government’s fiscal policy on wine, among other things.

10. Budget Report Template

Numbers don’t lie—but they can hide. The Budget Report Template brings them out into the open for transparency. It’s designed to review how your startup budget compares to real-world performance.

Use this template for:

- Log revenue and actual expenses across key categories, all in one place

- Compare planned vs. actual spend to highlight gaps before they grow

- Flag overruns, missed targets, or unexpected savings with Custom Fields

- Tag each item by department, reason for variance, or project to connect spend to outcomes

- View totals at the top and line-item details below—so nothing gets buried

🔑 Ideal for: Startup founders and finance leads who want a no-fuss way to review spending and keep goals in check.

11. Finance Management Template

When you manage finances, timing matters. A delay in one task can hold up a dozen more. This Finance Management Template helps you keep every step moving—from initial request to final sign-off.

Use this template for:

- Track financial workflows with 28 Custom Statuses like Signed, In Review, and Pending Approval

- View Tasks in a format that fits—List, Calendar, or a step-by-step Start Here board

- Organize payments, budgets, and vendor follow-ups with tags, due dates, and categories

- Assign responsibilities and set reminders so nothing goes quiet

- Manage day-to-day operations with clarity using Project Time Tracking, dependencies, and automated alerts

🔑 Ideal for: Finance teams handling multiple approvals, payment cycles, and task deadlines—without the clutter

📮 Insight: More than half of employees struggle to find the information they need at work. While only 27% say it’s easy, the rest face some level of difficulty—with 23% finding it very difficult. When knowledge is scattered across emails, chats, and tools, wasted time adds up fast.

With , you can turn emails into trackable tasks, link chats to tasks, get answers from AI, and more within a single workspace.

💫 Real Results: Teams are able to reclaim 5+ hours every week using —that’s over 250 hours annually per person—by eliminating outdated knowledge management processes. Imagine what your team could create with an extra week of productivity every quarter!

12. Financial Analysis Report Template

The Financial Analysis Report Template helps you extract clarity from financial chaos. It’s designed for teams that need to pull numbers, spot patterns, and explain their meaning without building a report from scratch.

Use this template for:

- Track revenue, expenses, margins, and cash flow in a clean, editable List view

- Highlight shifts in performance using Custom Fields like Report Section, Trend Type, and Key Indicators

- Document insights, conclusions, and action items in one place—no more scattered notes

- Manage reporting cycles with Calendar and Gantt Views, so no deadline sneaks up

- Organize deep dives by tagging findings across time periods, teams, or financial goals

🔑 Ideal for: Financial analysts and startup teams who need to present clean, actionable insights to leadership or investors.

13. Account Management Template

The Account Management Template helps you keep tabs on your happy clients, and the ones who are churning. Track onboarding, renewals, and churn signals in one view. Prioritize accounts that matter most and make sure no relationship falls through the cracks. It’s proactive client management—built into your daily workflow.

Use this template for:

- Track where each account stands with Custom Statuses like Onboarding, Nurturing, Renewed, and Churned

- Log critical details using 10 Custom Fields—contact info, close date, demo notes, email activity, and more

- Spot at-risk clients early with dedicated Views like Priority Accounts and At Risk

- Standardize your process with the built-in Client Success Playbook so every team member follows the same steps

- Find and summarize key client information—like client status, recent communications, or upcoming renewals—by simply asking Brain in plain language

🔑 Ideal for: Customer success teams and account managers who need a clear, repeatable way to manage client relationships.

14. General Ledger Template

The General Ledger Template is your digital ledger—cleaner than a spreadsheet and built for teams that care about accuracy. Record every debit, credit, and reference in one place. Whether you’re reconciling statements or prepping for tax season, this keeps your records clear, searchable, and audit-ready.

Use this template for:

- Log every transaction with Fields for Account Title, Debit, Credit, Reference, and Receipt

- Track account activity in real time using Statuses like Open and Complete

- View key financial summaries in Transactions, Profit & Loss, Balance Sheet, and General Ledger Views

- Flag mismatched entries, duplicate charges, or gaps in your records fast

- Assign entries for review or follow-up so your team stays aligned

🔑 Ideal for: Finance leads and bookkeepers who need a reliable way to track cash flow without building a system from scratch.

15. Accounting Journal Template

If your books are off, this is where you look first. The Accounting Journal Template by gives you a structured place to record transactions—date, account, amount, and notes—all in one view.

Use this template for:

- Record each entry with fields for date, journal type, receipt, entry number, and debit

- Log line items with clean, audit-ready details—debits, credits, descriptions, and references

- Work in Table view for fast, spreadsheet-style entry

- Track progress with Statuses like Open and Complete

- Switch to the Journal View to see the full picture and spot errors fast

- Ask Brain for an overview of your recent journal entries, spot trends in your debits and credits, or generate quick summaries of your financial performance

🔑 Ideal for: Bookkeepers and finance teams who want a dependable way to track daily transactions and keep project accounting records clean.

If you’re used to Excel, you can also use Formula Fields, which feel familiar to Excel but lets you crunch numbers directly within your tasks! Check out the video below! 👇🏼

16. Balance Sheet Template

You don’t need a CFO only to understand your financial position. The Balance Sheet Template helps you list assets, liabilities, and equity in one structured view—so you can make informed decisions without the noise. It’s fast to use, easy to update, and made for teams who need a clear snapshot.

Use this template for:

- List current and fixed assets alongside short-term and long-term liabilities, all in a single structured view

- Break down financial data by department, location, or timeframe to spot trends and guide decisions

- Keep data clean with statuses like Draft, In Review, and Approved to flag work in progress vs. finalized reports

- Set up recurring reminders to review and update your balance sheet at regular intervals with Automations

🔑 Ideal for: Small business owners and finance teams seeking a straightforward way to manage and review financial positions.

💡 Pro Tip: Entrepreneurs should regularly review and verify their balance sheets for accuracy and completeness, not just at year-end but throughout the year.

This means checking for mathematical errors, ensuring all assets and liabilities are properly classified, and cross-referencing with other financial statements for consistency. By doing so, you’ll catch discrepancies early and maintain a clear understanding of your business’s financial health.

17. Spreadsheet Startup Budget Template by Coefficient

This Spreadsheet Startup Budget Template from Coefficient helps you lay it all out—startup costs, projected revenue, funding sources, and actual expenses—so you can see where your money’s going and how long it’ll last.

Use this template to:

- Automate budget allocation and financial forecasting, and calculations

- Track funding sources, expenses, and revenue

- Modify categories and fields to reflect your startup’s specific financial requirements

🔑 Ideal for: Founders building their first business budget and needing a clear, editable model to forecast cash flow and stay on track.

18. Excel Business Startup Costs Template by Vertex42

Unexpected costs can wreck a launch. This Excel Business Start-Up Costs Template helps you map out everything early—equipment, licenses, marketing, inventory, and more—so you’re not caught off guard when the bills hit.

It’s built for flexibility and clarity, whether you’re starting from your kitchen or opening a storefront.

Use this template for:

- Manage one-time and recurring expenses with pre-filled categories you can edit to fit your plan

- Track funding sources to see how your capital stacks up against actual needs

- Customize line items for specific industries, including a tailored worksheet for restaurants

- Skip irrelevant expenses—like office rent—if you’re launching from home

- Build a clear snapshot of your startup’s financial foundation to guide early decisions

🔑 Ideal for: Entrepreneurs who want a straightforward way to plan and manage their business launch expenses.

19. StartUp Budget Plan Template by Template.Net

Every startup needs a basic budget before making big moves. This Startup Budget Template gives you just enough structure to plan early expenses without overcomplicating things. This template is available in multiple formats, including Word, Excel, Google Docs, and Google Sheets.

Use this template for:

- List essential startup costs—equipment, rent, permits, legal fees, and early salaries

- Customize each line item to fit your industry, product, or location

- Track projected expenses and monthly estimates on one page

- Spot gaps in funding or overspending before they become a problem

- Use the template across Excel, Word, Google Docs, or Google Sheets—whichever fits your workflow

🔑 Ideal for: First-time founders building their business budget from scratch and looking for a printable, editable place to start.

20. Startup Financial Budget Template by Template.Net

Launching a startup demands clear financial planning. The Startup Financial Budget Template gives you a blank slate to outline your initial expenses, operational costs, and projected revenues. Designed for simplicity, it allows you to customize entries to fit your specific business model.

This template is available in Word, Excel, Google Docs, and Google Sheets formats and is easily editable and adaptable to your choice of platform.

Use this template to:

- Track one-time expenses such as setup costs and legal fees

- Project monthly operational costs, including rent, utilities, and salaries

- Estimate potential revenue streams and calculate expected profits

- Identify funding sources to cover your initial and ongoing expenses

🔑 Ideal for: Entrepreneurs who need a lightweight tool to organize their budget and stay focused on what matters.

Build Smarter Budgets from Day One—with

A solid budget isn’t just a nice-to-have—it’s a matter of survival, especially if you’re a startup. With , you don’t need to build one from scratch. You get ready-made startup budget templates to track expenses, estimate runway, and monitor cash flow—without juggling spreadsheets.

brings your planning, tracking, and reporting into one place. You can tag expenses, flag overruns, and compare projections to reality—fast. Whether you’re budgeting for a project, a team, or the whole company, helps you stay lean and make confident decisions.

And with 1,000+ free templates, you’ll find one that fits your style, your team, and your growth.

Ready to take control of your finances? Sign up with for free today.

Everything you need to stay organized and get work done.