British tech companies are keen to accelerate their innovation with new research and development (R&D) projects despite recent challenges, according to fresh figures.

A survey of 500 scaleup leaders and 250 venture capital and private equity decision-makers in the UK by EmpowerRD found that 80% planned to claim R&D tax relief in 2025 to fuel new projects.

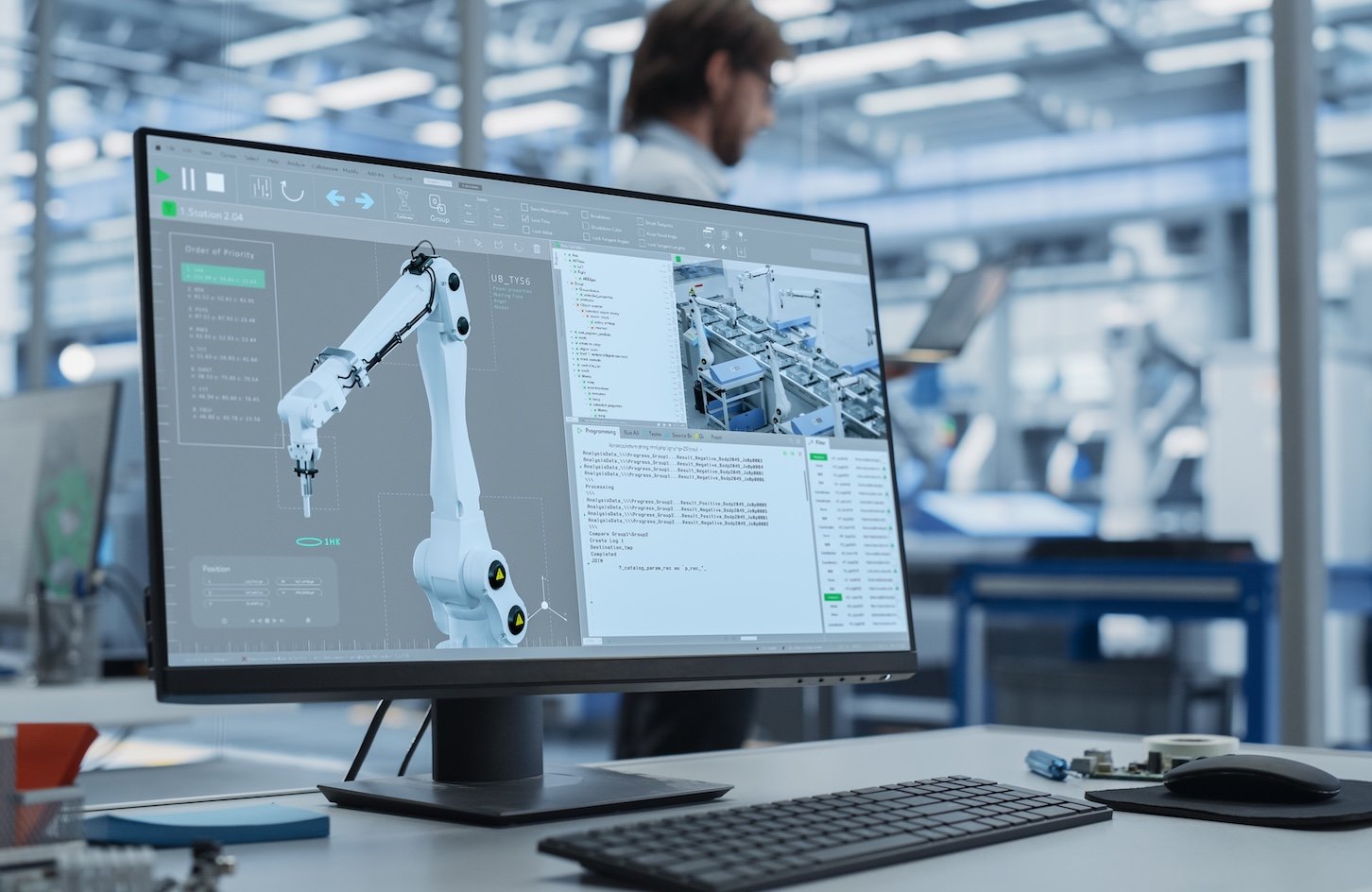

The R&D tax credit scheme provides relief for firms in the UK that invest money into the development of new technologies as an incentive to innovate.

Global financial challenges as well as difficult to track policy shifts regarding the credits prompted a 21% drop in R&D claims made in 2022-23.

Despite this, EmpowerRD has found renewed interest in the scheme, suggesting Britain’s businesses are once again ready to invest in innovation. As many as 82% of respondents said they would increase their R&D budgets over the next three years.

The survey found that among those businesses that have already claimed R&D tax relief in the past, three-quarters agreed it boosted their investment in innovation, while around half said it helped their ability to recruit and retain technical talent.

Though respondents felt positively about the scheme, a quarter expressed concern that a claim would prompt an enquiry from HMRC, which has in the past complained about fraudulent claims made through the scheme.

“UK founders are ready to innovate – but too often they’re blocked by red tape and a fear of HMRC enquiries,” said Robert Whiteside, chief executive at EmpowerRD.

“R&D tax credits have huge potential to power growth, but the process needs to be faster, simpler and more reassuring for both the claimants and the taxpayers. If we get that right, we won’t just close the gap between ambition and action – we’ll supercharge the UK’s innovation economy.”