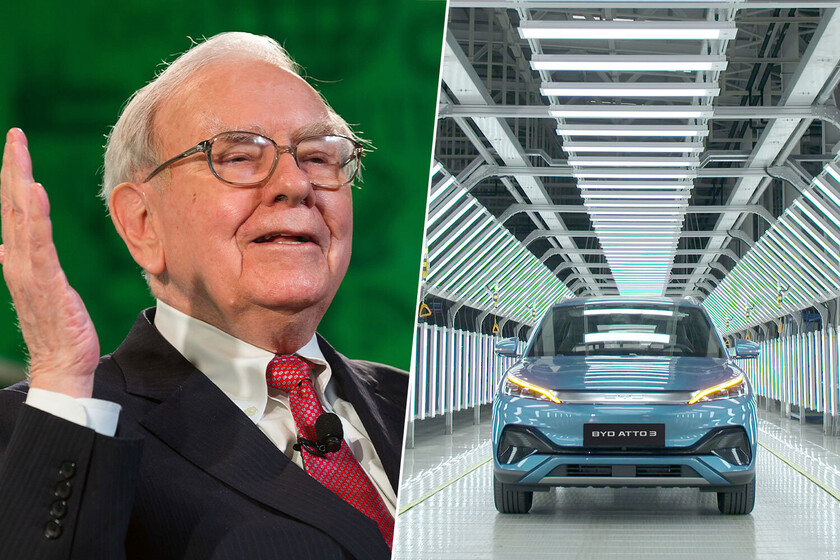

For more than 17 years, the investment firm Berkshire Hathaway led by Warren Buffett and his partner Charlie Muger, maintained one of his most profitable bets in the car sector: Byd, the Chinese manufacturer of electric vehicles.

As reported Reutersin recent months the veteran investor has been undone of his shares until he sells them all, as confirmed CNBC. The markets have reacted sinking the value of their shares by 3.4%.

Warren Buffett always wins. In 2008, few investors were interested in the future of the electric car, Berkshire acquired 225 million shares of an unknown Chinese company called byd for about 230 million dollars. The equivalent of 10% of the company.

Since then, the value of that investment has fired more than 4,500% until March 2024, confirming as one of the many investment successes of the American billionaire. With this long -term operation, the veteran investor confirms his good eye for profitability since the 230 million would have become about 7,000 million dollars, multiplying his money in just 17 years.

The impact on the byd Price. However, not everything is good news in Buffett’s withdrawal from Byd’s shareholders. The news caused an immediate reaction in the markets: the value of Byd’s shares fell 3.4% in the Hong Kong Stock Exchange, in what is its greatest setback in three weeks.

At the stock level, the last months have been convulsive for the electric car manufacturer, which in July carried out a unfolding shares (stock split) After which his price fell 16%. To this scenario, the drop in the stock market that occurred after the news of the output of a “trust” investor such as Berkshire Hathaway, chaining up to 30% fall from its annual registered in May.

Tranquility is what is most sought. Berkshire Hathaway’s departure from Byd has been taking shape since 2022, when the electric car war began to give its first measures, but has stepped on the accelerator as the uncertainty that surrounds the electric vehicle market in China was growing.

In the context of overproduction of the Chinese factories, and the braking in the demand for electric cars, a scenario opens where the strong competition is deriving in a price war that threatens to erode the margins of the manufacturers. Several analysts point out that this perspective of instability could have been a weight factor in Berkshire’s decision to completely liquidate their position in Byd.

Byd reactions. On the other hand, from the Chinese manufacturer, the movement of the Buffett company has been responded with thanks to Berkshire Hathaway and its historical leaders. According to what was published by BloombergLi Yunfei, general director of brand and public relations at Byd, published a message on the Chinese social network Weibo: “We are grateful to Muger and Buffett for their recognition to Byd, and for their 17 years of investment, support and company. In investment in shares, Buy and sell are normal practices,” he explained trying to calm the uncertainty of the shareholders for the departure of Buffet.

This message reflects the symbolic importance that Buffett had as an early investor in ByD for almost two decades. In addition, Charlie Muger played a crucial role in the initial decision to invest in Byd, when he recommended the operation with the president of Himalayas Capital, Li Lu.

In WorldOfSoftware | In his effort for not leaving fortune, Warren Buffett made a unique decision: to deny a loan to his daughter

Image | Flickr (Fortune Live Media), Byd