Let’s be honest—budgeting sounds about as fun as organizing your sock drawer (which you’ve definitely been avoiding, too). But what if managing your money didn’t require a finance degree, 10 spreadsheets, and a minor existential crisis?

Enter: the magical 50/30/20 budget rule.

It’s as simple as pie: 50% for needs, 30% for wants, and 20% for savings. To make things even easier, we’ve got 50/30/20 budget templates that offer a structure to help you organize finances and build a long-term financial plan.

Whether living off a student loan, salary, or side hustle cash, this budgeting system can fit into your routine without flipping your life upside down. Keep reading for free templates, smart strategies, and tips to get your spending on track—starting next month.

Free 50/30/20 Budget Templates to Manage Your Finances with Ease

50/30/20 Budget Templates at a Glance

Here’s a summary table for all the 50/30/20 budget templates listed below:

| Template Name | Template Link | Ideal For | Best Features | Visual Format |

| Simple Budget Template | Get free template | People wanting a simple, visual budget | Custom Fields for categories, dynamic table views, status updates, and dashboards | Table, Board, Dashboard |

| Personal Budget Template | Get free template | Individuals seeking customizable, all-in-one budgeting | Docs for goals, recurring tasks, Board/List/Calendar views, payment schedules | Board, List, Calendar, Docs |

| Personal Budget Plan Template | Get free template | Users wanting a clean, guided layout | 50/30/20 Custom Fields, tagging, task statuses, multiple views | Table, List, Board |

| Budget Report Template | Get free template | Budgeters needing actionable reports | Multi-month tracking, reusable templates, Custom Fields, goal vs. performance | Doc, Table, Task Views |

| Finance Management Template | Get free template | Managing multiple financial streams | 28 statuses, automations, reminders, calendar/list views | List, Calendar, Board |

| College Budget Template | Get free template | College students tracking varied expenses | Cost Board, payment status tags, Custom Fields, drag-and-drop | Board, Form, Table |

| Ally Monthly 50/30/20 Budget Worksheet | Download This Template | Printable, pen-and-paper budgeters | Income/expense breakdown, percentage targets, manual tracking | Printable PDF Worksheet |

| Simple 50/30/20 Budget Spreadsheet | Download this template | Spreadsheet users wanting clarity | Editable fields, preset categories, instant calculations, reminders | Spreadsheet (Excel/Google Sheets) |

| ProjectManager 50/30/20 Budget Template | Download this template | Excel users, shared/household budgets | Auto-calculations, actual vs. planned, duplicate tabs, preset categories | Spreadsheet (Excel) |

| Simple Weekly Budget Template | Download This Template | Weekly budgeters, short-term tracking | Planned vs. actual, live balance updates, weekly totals, portability | People want a simple, visual budget |

What Are 50/30/20 Budget Templates?

Morgan Housel writes in The Psychology of Money:

A 50/30/20 budget template helps shape that behavior by offering a simple method to manage your income. It divides your net income into three parts:

- 50% for needs like health insurance and bills

- 30% for wants like entertainment

- 20% for savings and debt repayment

Instead of tracking every penny, you categorize your monthly expenses based on priorities. These templates act as ready-to-use frameworks to organize finances, making it easier to start budgeting, monitor actual spending, and reach financial goals without overcomplicating the process.

What Makes a Good 50/30/20 Budget Template?

A strong 50/30/20 budget template helps you track, adjust, and plan for real-life expenses and goals. The right template should break down monthly income clearly and guide your financial decisions month after month. Key features to look for:

- Clear allocation sections: Track your needs, wants, and savings at a glance, based on your real monthly income

- Built-in formulas: Let the template automatically calculate how much you should spend and save from your net income

- Sections for fixed expenses: Ensure your essentials, like rent, utilities, and health insurance, are always prioritized

- Customizable fields: Adjust your plan easily when focusing on debt repayment, emergency funds, or investments

- Actual vs. planned spending trackers: Compare what you intended to spend versus what you spent to spot leaks fast

- Visual summaries: See your savings goals and progress of expenditures with charts that make your money story obvious

- Space for future planning: Set aside money from bonuses, refunds, or extra earnings toward your bigger financial goals

Best 50/30/20 Budget Template Options

Managing your monthly budget gets a lot easier when you have the right tools by your side.

Here are some top 50/30/20 budget templates that can help you allocate your income, track your expenses, and grow your savings goals precisely.

1. Simple Budget Template

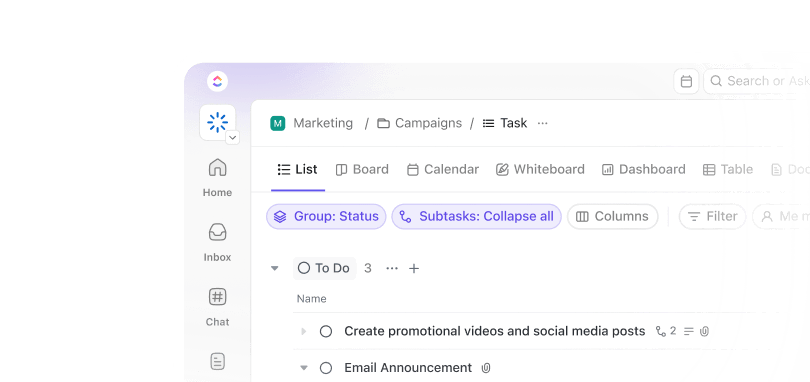

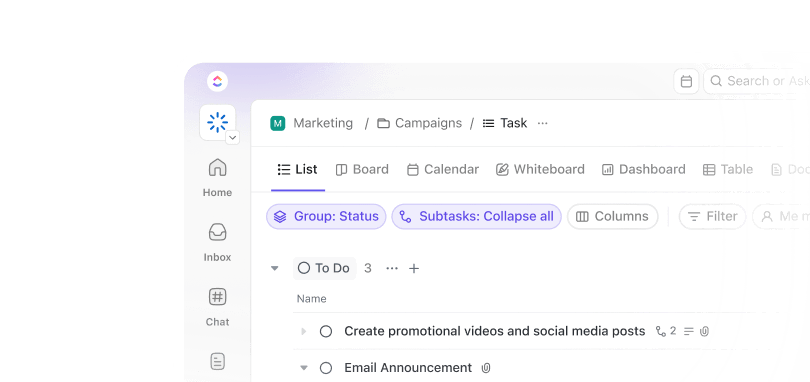

The Simple Budget Template strips budgeting down to exactly what it should be—simple. Instead of endless tabs and hidden formulas, you get a visual-first system that neatly maps out your needs, wants, savings, and debt repayment areas.

You can easily enter new transactions, track net income, and plan monthly expenses without much manual work.

Plus, you can shift focus between budgeting views like Net Cash, Income Tracking, and Expenses Management whenever you want to sharpen your financial picture. You don’t have to figure it out alone— guides you with a built-in Getting Started view.

⭐ Key features you’ll love

- Set up Custom Fields to categorize expenses month-by-month

- Track actual vs. planned spending using dynamic table views

- Use project management features like status updates for each financial entry

- Monitor your savings goals and project budget progress visually with dashboards

🔑 Ideal for: People who want a structured, no-fuss way to organize their 50/30/20 budget and keep it updated with minimal effort.

📹 Watch how to streamline your budget in :

2. Personal Budget Template

’s Personal Budget Template is designed for people who want more control without the complexity of traditional budgeting apps. It focuses on building smart habits by helping you capture everything from your monthly income to discretionary spending in one easy-to-use workspace.

You’ll find Board, List, and Calendar views that lay out your income, fixed expenses, and goals. It’s more than just a tracker—it’s a full financial planning system where you can brainstorm savings strategies, plan debt repayment, and prioritize your money based on your life stage.

If you’re serious about mastering your 50/30/20 splits, this template keeps it structured but flexible.

⭐ Key features you’ll love

- Brainstorm financial goals and track them in Docs view

- Categorize all spending into fixed expenses, variable costs, and savings

- Set up recurring tasks to review expenditures and adjust allocations

- Visualize payment schedules and due dates through a Calendar view

🔑 Ideal for: Anyone looking for a personal and customizable approach to applying the 50/30/20 rule while keeping future financial priorities in sight.

💡Pro Tip: Use the 50/30/20 budget not just for monthly spending but to fund your one-year, five-year, and ten-year goals—aligning daily habits with bigger milestones makes hitting those long-term targets a lot easier.

3. Personal Budget Plan Template

’s Personal Budget Plan Template is built for people who want to see everything from income to monthly expenses in one clear view, minus the spreadsheet headaches.

This isn’t a bloated finance dashboard—it’s direct and minimal by design. You can move through the budgeting process quickly, using clear task statuses and six Custom Fields that let you sort by date, category, or budget type.

Whether planning time budgeting, monthly savings, budgeting for debt, or just trying to make smarter choices about your actual spending, this tool gives you the structure to get there.

⭐ Key features you’ll love

- Break your monthly income into the 50/30/20 rule using Custom Fields

- Tag entries based on spending category, due date, or priority

- Monitor progress with task statuses like ‘Complete’ and ‘New Entry’

- Use multiple views to switch between income tracking and savings goals

🔑 Ideal for: Individuals who want a clean, guided layout to apply the 50/30/20 rule without distractions or complex configurations.

4. Budget Report Template

’s Budget Report Template focuses on turning financial chaos into clarity. Unlike basic budget trackers, this one is built for deeper insight. It helps you explain discrepancies between your planned and actual spending and pinpoint where your 50/30/20 allocations fall short.

It’s structured as a Doc template, meaning you’re not locked into rows and cells. You can build out reports, insert breakdowns, and track changes over time in a format that feels more natural.

This tool is especially useful for anyone who needs to communicate a financial plan or justify debt repayment adjustments. It’s a reporting tool first, but a strategic planning tool underneath.

⭐ Key features you’ll love

- Document income and expenses across multiple months with reusable templates

- Use task views to assign updates and due dates to budget-related items

- Categorize and review entries using Custom Fields and statuses

- Break down goals vs. performance to optimize your monthly budget

🔑 Ideal for: Budgeters who want to translate their 50/30/20 data into actionable reports for better tracking, smarter decisions, and long-term financial clarity.

Pro Tip: Brain can help you create a personalized budget using the 50-30-20 rule, tailored to your income and goals. It can also track your spending, set reminders for savings milestones, and suggest adjustments to keep you on target. Here’s how:

5. Finance Management Template

’s Finance Management Template isn’t just about budgeting but building a system around your money. Unlike simpler tools, this one gives you full visibility across income, monthly budget, cash flow, and long-term financial goals.

Whether planning a large expense, organizing regular fixed expenses, or breaking down contributions toward a savings account, this workspace adapts to your setup.

With 28 customizable statuses and automation options, you can manage multiple financial priorities without jumping between apps.

⭐ Key features you’ll love

- Break your monthly income into detailed budgeting tasks and categories

- Set up automated reminders for due dates, reviews, or payments

- Visualize financial performance over time with calendar and list views

- Track complex projects like emergency fund planning or investing goals

🔑 Ideal for: Those managing multiple financial streams who need more than a tracker—a full system to keep all parts of their financial plan connected and in sync.

🔎 Did you know: Here are some stats on money goals, according to an Intuit survey:

- 58% of Americans have made money management part of their self-care routine, and it’s paying off

- 36% report feeling less financial stress since starting a routine

- 41% say creating and sticking to a budget has had the biggest impact on improving their relationship with money

- 28% of people still haven’t created a financial wellness routine

The growing trend of open money discussions is making it easier to talk about finances with friends, family, and coworkers.

6. College Budget Template

’s College Budget Template makes budgeting as a student manageable. Designed with everyday student life in mind—think tuition, groceries, loans, and entertainment—this template gives you a solid grip on your monthly income and spending without requiring a finance degree.

You’ll find flexible views (including Cost Board and Budget Form) that help you sort through fixed payments and spontaneous expense management.

The template lets you mark transactions by payment status, so you’re always clear on what’s pending and what’s been covered. Whether allocating your student loan refund or part-time income using the 50/30/20 rule, this setup keeps you in control without burying you in admin work.

⭐ Key features you’ll love

- Break down expenses by type—like tuition, books, or subscriptions

- Tag payments as Pending, Partial, or Fully Paid to track status

- Calculate monthly spend vs. income using Custom Fields

- Plan for upcoming costs with a drag-and-drop Cost Board

🔑 Ideal for: College students managing multiple categories of expenses who need a visual, organized system to stay within their 50/30/20 budget and avoid overspending.

7. Ally Monthly 50/30/20 Budget Worksheet

Ally’s Monthly 50/30/20 Budget Worksheet is a printable, no-login-needed tool that keeps budgeting refreshingly simple. It’s ideal if you prefer pen-and-paper tracking or want a clean digital worksheet alongside your online tools.

The template breaks your monthly income into needs, wants, savings, and debt repayment, giving you space to list individual items under each section.

It’s especially useful for staying disciplined month-over-month because it highlights percentage targets and keeps your totals in check. Whether you’re budgeting for rent, weekend concerts, or your savings account, this worksheet lets you track everything without the distractions of an app.

⭐ Key features you’ll love

- Record income sources, including paychecks, interest, and side gigs

- Break down fixed expenses like rent, loans, and utilities under the 50% needs section

- Log discretionary purchases in the 30% wants section

- Track retirement, savings, and investment contributions under the 20% category

🔑 Ideal for: Budgeters who wish to have a physical or printable format to manually track and visualize their 50/30/20 splits and spending habits in one easy-to-reference sheet.

💡 Bonus: Level up your budget tracking by integrating AI accounting tools that automatically categorize expenses, flag unusual spending, and help you fine-tune your 50/30/20 plan with real-time insights.

8. Simple 50/30/20 Budget Spreadsheet

This Simple 50/30/20 Budget spreadsheet is built for clarity. It takes a single number—your monthly income—and breaks it down into essential needs, flexible wants, and targeted savings and debt repayment categories.

Each section includes real-world allocations like housing, transportation, dining out, and an emergency fund, with percentages and dollar amounts already calculated for a $4,000/month example.

This template stands out because it is ready-to-use: you don’t have to build anything, plug in your numbers.

⭐ Key features you’ll love

- Allocate income to needs, wants, and savings with editable percentage fields

- Adjust preset categories like insurance, groceries, or retirement savings to fit your life

- Calculate total spend by category instantly to stay within limits

- Use reminders and review prompts to reassess your budget regularly

🔑 Ideal for: Anyone looking for a structured spreadsheet to kick off their budgeting journey and enforce the 50/30/20 rule with zero guesswork.

📮 Insight: While 78% of our survey respondents are big on setting goals, only 34% take time to reflect when those goals don’t pan out. 🤔

That’s where growth often gets lost.

With Docs and Brain, a built-in AI assistant, reflection becomes part of the process, not an afterthought. Automatically generate weekly reviews, track wins and lessons, and make smarter, faster decisions moving forward.

💫 Real Results: users report a 2x increase in productivity because building a feedback loop is easy when you have an AI assistant to brainstorm with.

9. ProjectManager 50/30/20 Budget Template

ProjectManager’s 50/30/20 Budget Template is a smart pick for Excel users who want built-in automation without switching platforms. It’s a downloadable spreadsheet that does the heavy lifting: once you input your monthly income, the sheet automatically calculates allocations for needs, wants, savings, and debt repayment.

It features clear cost breakdowns for each category—like rent, insurance, travel, or retirement—along with totals that instantly flag overspending.

What sets this apart is the structure: the tool isn’t just for budgeting but also for spotting trends and making course corrections early. It even supports duplication for multi-user tracking, making it useful for shared household budgets or group financial planning.

⭐ Key features you’ll love

- Input your income and instantly see 50/30/20 breakdowns

- Compare actual spending to your budget with auto-summing fields

- Duplicate tabs for monthly tracking or shared household planning

- Use preset categories to log items like health insurance, debt, or discretionary buys

🔑 Ideal for: Users who want a downloadable, editable Excel tool that combines automation with a spreadsheet’s familiarity—great for individual and shared budget tracking.

10. Simple Weekly Budget Template

The Simple Weekly Budget Template is perfect for anyone who wants to keep a close eye on spending without the bulk of a full financial system. It’s a stripped-down, spreadsheet-based tool that helps you capture planned expenses or actual expenditures and automatically updates totals and balances as you go.

It works just as well for planning as it does for tracking in real-time, especially if you’re applying the 50/30/20 rule on a weekly scale. Whether you’re managing your groceries, a quick weekend trip, or daily coffee splurges, this sheet lets you monitor spending patterns before they spiral.

⭐ Key features you’ll love

- Log planned vs. actual spending in one editable space

- Enter your starting balance and track changes live as you spend

- Instantly see your weekly totals for better control

- Use Google Sheets or Excel for easy access and portability

🔑 Ideal for: Budgeters who want a fast, flexible way to monitor weekly spending, especially when applying the 50/30/20 method to shorter budgeting cycles.

Track, Plan & Achieve Your Financial Goals with

Mastering your finances doesn’t have to feel like a second job. With the right 50/30/20 budget template, you can simplify how you track spending, allocate income, and prioritize savings—whether for the next week or the next decade.

From printable sheets to dynamic dashboards, our templates give you various ways to stick to your budget and focus on your goals. Whether you’re managing a personal salary, student income, or shared household expenses, there’s a setup that works for your routine.

Ready to organize your money with less stress and more structure?

👉 Sign up for to start budgeting smarter—free templates included.

Everything you need to stay organized and get work done.