The Kenya Revenue Authority (KRA) has introduced the Electronic Rental Income Tax System (eRITS), a digital platform that lets landlords register properties, file returns, and pay Monthly Rental Income (MRI) tax online. Launched in April 2025, the system requires full compliance by September 2025.

KRA built eRITS to address a significant issue: rental income tax collections generate approximately KES 17 billion annually ($131,629,810), but the potential is estimated to exceed KES 100 billion ($774,293,000). That gap means most landlords are not paying what they should.

With eRITS, landlords are required to register their property details, including their tenants’ PINs. This provides KRA with better visibility into rental transactions, making it more difficult to avoid paying taxes. For those who fail to comply, penalties can include fines, backdated tax claims, frozen bank accounts, and even court cases.

In simple terms, eRITS is KRA’s way of closing loopholes in the rental market and ensuring landlords meet their tax obligations.

What is eRITS?

The Electronic Rental Income Tax System (eRITS) is a digital platform launched by the KRA in April 2025, designed to simplify the registration of properties, filing of returns, and payment of Monthly Rental Income (MRI) tax for landlords. By September 2025, KRA required all property owners to update their details and onboard their properties onto the system.

You can access eRITS through erits.kra.go.ke or via the eCitizen portal. It runs on the government’s integration platform, Gava Connect, which enables KRA to process tax filings and payments in real-time.

The Monthly Rental Income (MRI) Tax

eRITS is not a new tax, but a tool to enforce the existing Monthly Rental Income (MRI) tax, which has been in place since 2016. This tax applies to individuals or companies earning between KES 288,000 ($2,229) and KES 15 million ($116,144) in annual rental income from residential property.

The current tax rate is 7.5% of gross rent, reduced from 10% to encourage better compliance. It is a final tax, which means you cannot claim expenses or deductions against the rental income.

As a landlord, you must file your MRI return and make payment by the 20th of the following month, even if you received no rent (in that case, you file a NIL return).

Why KRA introduced eRITS

1. Closing the rental tax gap

The Kenya Revenue Authority (KRA) collects approximately KES 17 billion ($131,629,810) annually from rental income tax, yet experts estimate the potential to be over KES 100 billion ($774,293,000). This means most landlords are not paying what they should. Previous systems, such as iTax and tax amnesties, did little to solve the problem.

With eRITS, the government hopes to bring more landlords into the tax net and raise collections to support Kenya’s growing budget needs. For example, in 2023/2024, KRA collected Ksh 14.4 billion, representing a modest increase from the previous year.

2. Expanding the Tax Base

eRITS is part of KRA’s long-term plan to capture untaxed property income. The real estate sector has been challenging to regulate because many landlords operate informally. By combining digital tools like GavaConnect, data analytics, and geo-mapping strategies, KRA can now identify properties, verify ownership, and ensure that more landlords comply.

3. Better data, stronger enforcement

One of the strengths of eRITS is its ability to connect with other government systems. For example, linking eRITS with the Ministry of Lands’ Ardhisasa platform will allow KRA to match rental income declarations with official land and property records. This makes it harder for landlords to hide ownership or under-declare rent.

The system also supports taxation at source. Property managers can be appointed as tax agents, deducting the 7.5% Monthly Rental Income (MRI) tax directly and sending it to KRA. This way, revenue is collected quickly and more efficiently.

How eRITS works for landlords

1. Registering your property

If you earn rental income in Kenya, you are required to register your property on the Electronic Rental Income Tax System (eRITS). Registration is done through the iTax portal or the eCitizen platform. You’ll need to update details such as property type, monthly rent, and most importantly, your tenant’s Personal Identification Number (PIN).

The tenant PIN is not optional. It links your property to the person renting it, allowing the Kenya Revenue Authority (KRA) to verify that the rent you declare matches actual rental activity. This requirement provides KRA with stronger tools to verify and challenge false declarations.

2. Filing and paying tax

Once your property is registered, you must file a Monthly Rental Income (MRI) return through eRITS. The system automatically calculates the 7.5% tax based on the rent you report. If you have credits or withholding certificates, the system adjusts the amount payable.

After filing, you’ll receive a Payment Registration Number (PRN), which you use to pay via mobile money or bank transfer. Returns and payments are due by the 20th of the following month. Even if you collect no rent, you still need to file a NIL return.

3. Benefits of compliance

Using eRITS makes tax filing faster and reduces paperwork. Landlords who comply can avoid disputes with the KRA and plan their finances with certainty. The lower tax rate of 7.5% was introduced to encourage more landlords to stay compliant.

4. Penalties for Non-Compliance

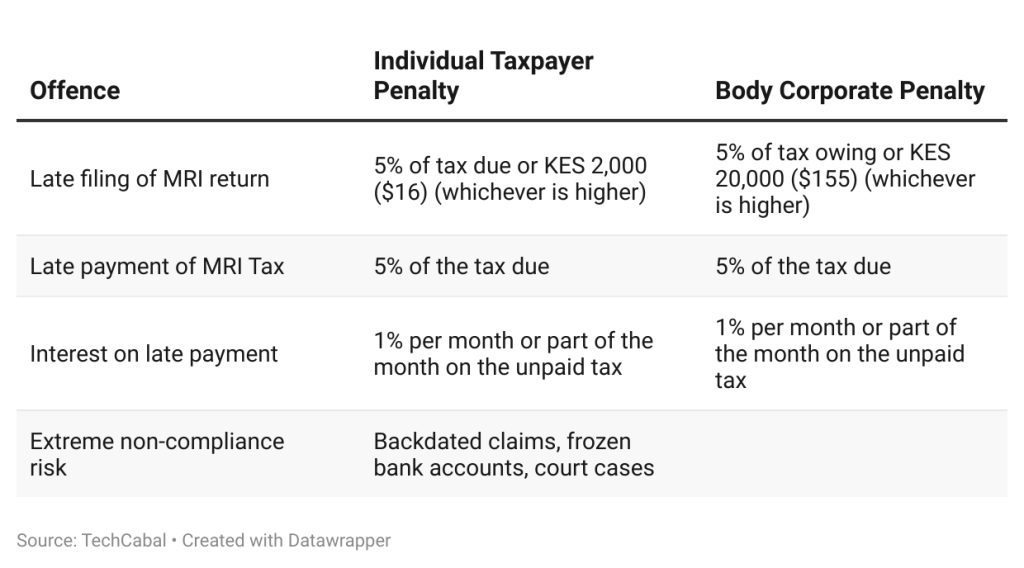

Ignoring eRITS comes with heavy costs. If you file your Monthly Rental Income (MRI) return late, you pay 5% of the tax due or Ksh 2,000 (for individuals) / Ksh 20,000 (for companies), whichever is higher. If you pay late, KRA charges 5% of the tax due plus 1% interest per month. Failing to deduct or remit withholding tax on rental income attracts a 10% penalty on the tax involved. Beyond the fines, KRA can backdate claims, freeze your bank accounts, or take you to court. Since KRA now cross-checks your data with other systems, its assessments stand unless you have solid records to dispute them. Poor bookkeeping will no longer shield you from penalties.

Penalties for non-compliance with MRI obligations

Impact on tenants and data privacy

One of the most debated parts of eRITS is the requirement for landlords to collect and submit their tenants’ KRA PINs. The Kenya Revenue Authority says this helps confirm rental relationships and cross-check declared income. For landlords, this gives KRA more power to detect under-reporting. For tenants, it raises questions about privacy.

Under the Data Protection Act, a PIN is personal data. Tenants have the right to know how their information is used, and KRA must provide clear safeguards to ensure this transparency. While KRA can still use this data if required by law, more transparency is needed so tenants understand whether their details are only used to confirm rent or for wider financial checks.

eRITS will also formalise the rental market. Landlords who previously operated informal, cash-based arrangements are now required to maintain proper records and register their tenants. This shift could reduce profits, since tax is charged on gross rent without deductions. In the long run, some landlords may pass this cost on to tenants through higher rent.

Final thoughts

The Electronic Rental Income Tax System is a significant step by KRA to close the gap in rental tax collections, which is estimated at KSh 83 billion annually. For compliant landlords, it offers a clearer system. For those who don’t comply, the risks are high penalties, backdated claims, and even frozen accounts.

Tenants, on the other hand, face privacy concerns around the mandatory PIN requirement. KRA must be transparent about how this data is stored and used.

What should happen next?

- For landlords: Register your property on eRITS promptly, maintain accurate financial records, and ensure your tenant details are up to date.

- For tenants: Know your rights under the Data Protection Act and ask KRA how your data is used.

- For KRA: Address technical reliability issues, publish clear guidelines for system downtime, and provide offline options such as USSD to facilitate compliance.