Cross-border payments are still costly and slow in 2025, even after years of tech improvements and policy changes. Sending $200 internationally costs 6.2 percent on average, which is more than twice the United Nations goal of 3 percent by 2030. For migrant workers who send money home every month, these costs add up, leaving less money for important needs like healthcare, education, and housing.

The high costs and slow processing times in cross-border payments show deeper issues in the global financial system. Traditional banking networks, based on old messaging systems from the 1970s, involve many middlemen, which increases cost, complexity, and delays. Each bank in the chain charges fees, adds currency exchange costs, and brings in operational risks, while different regulatory rules in various countries add more complications and uncertainty.

The Status Quo: SWIFT, Remittance Giants, and Hidden Fees

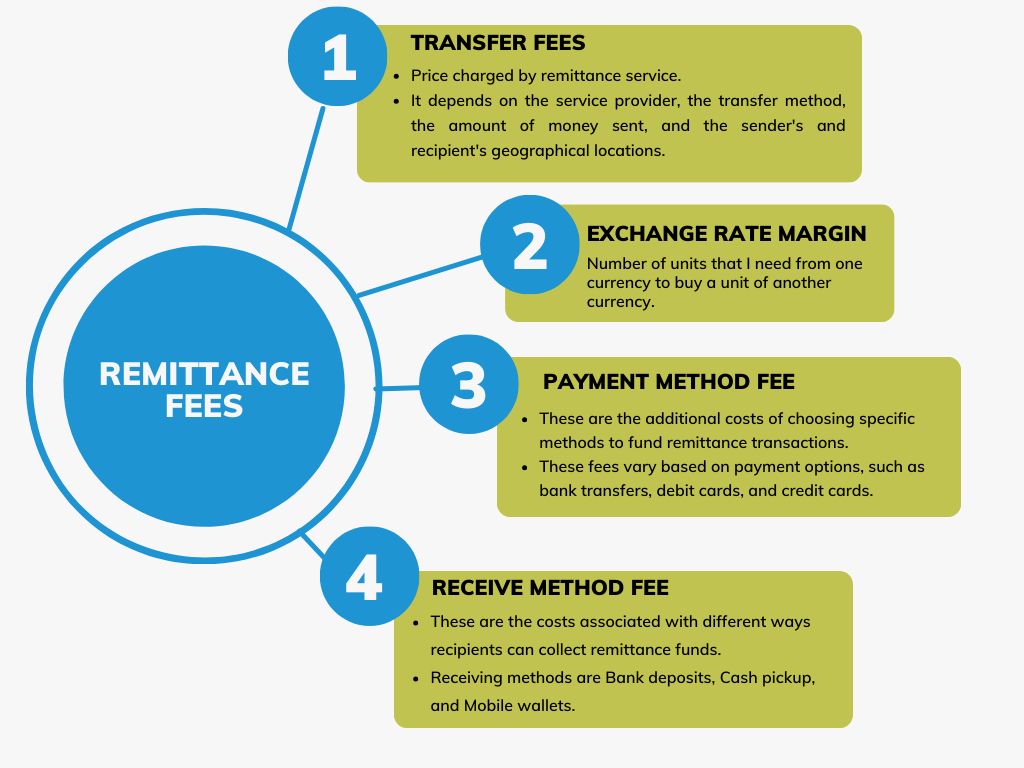

The current cross-border payments system uses a complicated network of banks through SWIFT. Even though SWIFT plans to use blockchain by 2026, it now uses messaging systems that can lead to delays, mistakes, and extra costs. Money transfer services like Western Union and MoneyGram have large agent networks but charge high fees and use exchange rates that benefit them. The average cost of sending money is between 5 to 15 percent, with hidden exchange rate costs that aren’t clear to customers.

Traditional banks might have lower fees for cross-border transfers, but they often require a minimum amount, process slowly, and need complex paperwork, making them difficult for many to use. Different rules add extra costs, raising fees. In 2023, money sent home reached $669 billion, with $540 billion going to low- and middle-income countries. Reducing fees from 6.2% to 3% could save senders $16 billion each year, helping the economies of recipient countries.

How Gluwa Redefines Borders

Gluwa’s method for cross-border payments shows how blockchain can solve the problems of traditional banking while staying within regulations and protecting consumers. The platform uses three technologies: wallet-to-wallet stablecoin transfers for quick settlement, Creditcoin blockchain for clear transaction records, and API integration to easily connect with current financial systems.

Wallet-to-Wallet Stablecoin Transfers

Using stablecoins for cross-border transfers allows direct peer-to-peer transactions on blockchain networks, eliminating the need for multiple banking relationships. Transactions are completed in minutes instead of days, with costs based on network fees rather than complex bank fees. For a typical $200 transfer, blockchain can cut costs from $12-30 to under $2, saving 80-90% compared to traditional methods. Stablecoin transfers are also more transparent, as blockchain records create unchangeable transaction histories that both senders and receivers can verify. This transparency includes foreign exchange rates, which are set by the market instead of the rates set by traditional money transfer services. However, using stablecoins requires recipients to have digital wallets and enough technical knowledge to handle blockchain transactions safely. Gluwa addresses these challenges with user-friendly interfaces and partnerships with local financial institutions that offer cash-out services in recipient countries.

Creditcoin Records for Trust Across Jurisdictions

The Creditcoin blockchain serves as a global credit system by recording lending and repayment activities, creating verifiable credit histories. This helps financial institutions recognize credit records across borders, addressing a major barrier to financial inclusion in emerging markets. Creditcoin records enhance security for cross-border payments and simplify compliance. Financial institutions can verify identities and transaction histories through blockchain, reducing processing times and costs. Portable credit histories enable new financial services, like international lending and investment, opening economic opportunities for individuals and small businesses in emerging markets.

Reduced Friction for Lenders and Borrowers Internationally

Gluwa’s integrated approach makes cross-border services easier for payment users and financial institutions. It provides API access to blockchain settlement, letting banks offer cross-border services without complicated banking connections or entering new markets directly. This makes it easier to follow regulations and supports international lending by offering verifiable credit data, helping borrowers create credit histories recognized worldwide.

Scenarios: Migrant Workers and SME Access

The real-world effect of better cross-border payment systems can be shown through two main examples: money sent home by migrant workers and small businesses getting access to international financial markets.

Migrant Worker Remittances

Imagine a construction worker in Germany sending €300 each month to family in Nigeria. Traditional money transfer services charge €18-45 in fees plus hidden exchange rate costs of 2-4 percent, totaling €24-57 per transfer. Over a year, this adds up to €288-684, or 8-19 percent of the total sent. With Gluwa’s stablecoin system, the transfer costs about €1-3 in network fees with clear market-based exchange rates, reducing costs to €3-9 per transfer or €36-108 annually. This saves €252-576 per year, giving more money for family support, education, or investments in the recipient’s country. Besides saving money, blockchain transfers are faster and more transparent, letting recipients get funds in minutes instead of days, which helps families manage their cash flow better. Clear transaction records also provide better documentation for financial planning and possible credit applications.

Small Business International Capital Access

Small and medium businesses in emerging markets find it hard to access international capital markets because of a lot of paperwork and long approval times. For example, a textile maker in Bangladesh faces challenges like letters of credit and banking ties, which can be expensive and slow. Gluwa’s platform addresses these problems by offering clear credit histories and quick payment settlement using blockchain. This allows European retailers to easily check suppliers and make payments instantly. This setup creates new types of international business relationships based on clear performance data instead of traditional banking ties or location. Small businesses can build international credit histories to reach bigger markets and capital sources, while international buyers can find reliable suppliers based on proven records.

Global Ripple Effect: Unlocking Trade, Entrepreneurship, and Investment

The changes in cross-border payment systems have bigger economic impacts than just saving money and improving efficiency. Lower transaction costs and better access to global markets can boost entrepreneurship, increase trade, and improve how capital is distributed across countries.

Enhanced Trade Facilitation:

Lower cross-border payment costs help international trade, especially for small and medium businesses. The World Bank says that cutting trade costs by 1% can increase trade volumes by 2-3%. Blockchain payments make transactions faster and clearer, reducing the need for costly trade finance and improving cash flow management. Better payment systems help trade between developed and emerging markets, supporting smaller economies and businesses.

Entrepreneurship and Innovation:

Efficient cross-border payment systems enable new entrepreneurship by overcoming payment constraints. Digital services and e-commerce can reach global markets more easily with fast, reliable, and cost-effective processing. Blockchain-based portable credit histories help migrant entrepreneurs by providing globally recognized credit records. Better payment infrastructure also boosts international investment in small businesses and startups, making capital more accessible and offering investors high-growth opportunities.

Capital Market Integration:

Efficient cross-border payment systems help connect international capital markets by reducing transaction costs and removing barriers that separate markets by location. This connection allows money to move more easily to where it can be used best, improving how capital is allocated no matter where it is. For emerging markets, better links with international capital markets mean more access to investment money and chances for local investors to invest abroad, which helps financial markets grow and boosts economic growth while reducing the risk from relying only on local capital. Also, the transparency of blockchain-based systems reduces information gaps that separate capital markets, leading to better pricing of international investments and lowering risk in cross-border transactions.

Policy Implications and Regulatory Considerations

The development of blockchain-based cross-border payment infrastructure raises important policy questions regarding financial regulation, monetary sovereignty, and international coordination. Policymakers must balance the potential benefits of improved payment efficiency with legitimate concerns about financial stability, consumer protection, and regulatory oversight.

Regulatory Harmonisation:

Blockchain payment systems need better coordination between national regulations to ensure consistent oversight and avoid gaps. Right now, regulations vary a lot, creating uncertainty for service providers and users. International groups like the Financial Stability Board are working on rules for stablecoins, but implementation is inconsistent. Aligning regulations could lower compliance costs and make cross-border payments more efficient. Creating common standards for blockchain payments could also improve interoperability and reduce fragmentation, especially for cross-border transactions.

Financial Inclusion and Consumer Protection:

Blockchain payment systems can help more people access financial services, but they also bring up worries about protecting users and understanding digital tools. Policymakers need to make sure that improvements don’t hurt users or leave out people who aren’t familiar with digital technology. Policies might be needed to make sure everyone benefits, not just those who are good with technology. Consumer protection needs to adjust to blockchain’s unique features, like transactions that can’t be undone. Education and rules might help guard against fraud and mistakes.

Gluwa’s Role in Financial Infrastructure Evolution

Gluwa uses blockchain for cross-border payments to make international finance more efficient while following regulations. By using stablecoin settlement, blockchain credit records, and traditional APIs, it tackles payment issues, improving speed, cost, and financial access, especially in emerging markets. Success depends on regulatory progress and digital access, needing a balance between new ideas and stability. Platforms like Gluwa are changing international finance, providing new chances for integration. Today’s policy choices will decide if these technologies lead to more inclusive finance or new problems. The stakes are high, but there is still a chance to shape the future.