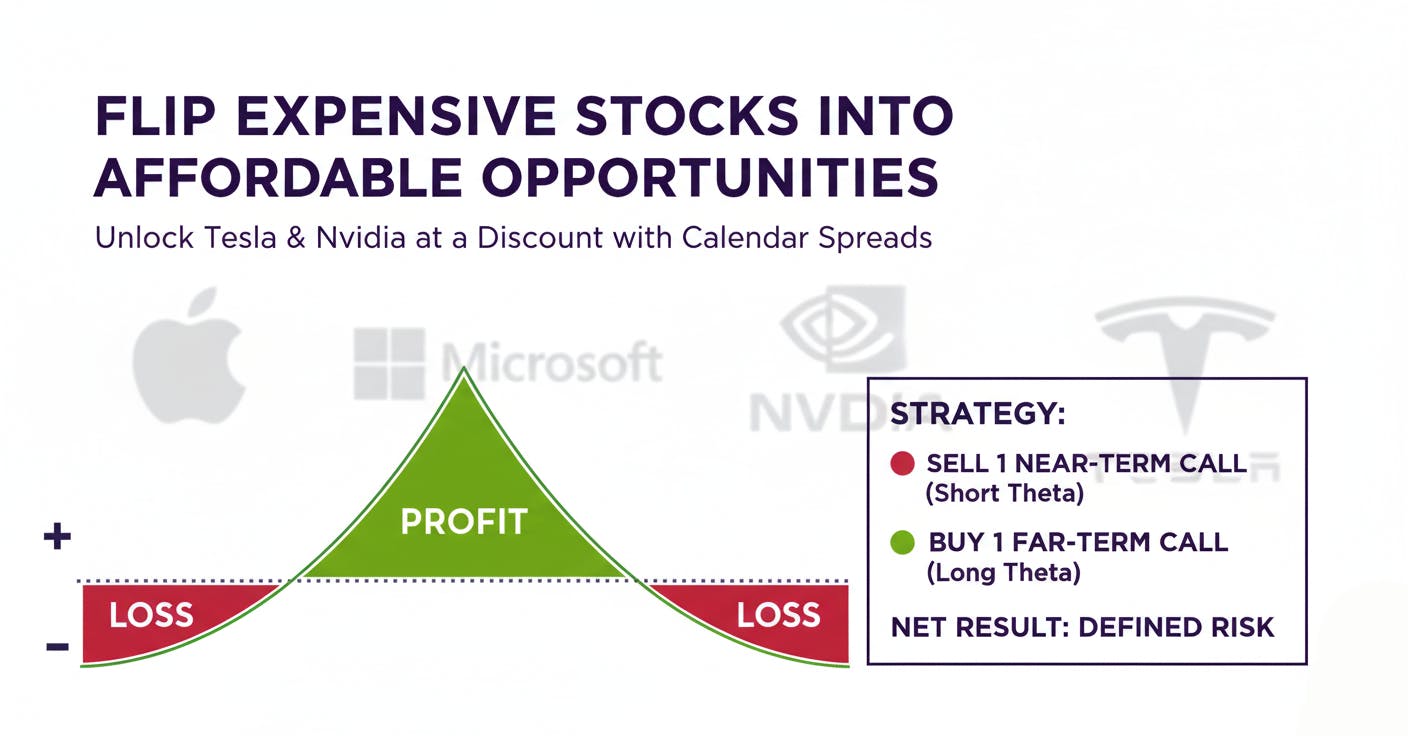

Every investor knows the frustration. You watch Apple, Microsoft, Nvidia, or Tesla rocket higher. You want a position, but the price tag feels insane. Buying 100 shares of Tesla (TSLA) today sets you back well over $40,000. Even a small stake burns through capital quickly. Most traders simply give up these names or just buy a few shares, which severely limits their hedging ability.

But here’s the truth: there’s an alternative. You don’t need to sink your portfolio into overpriced shares just to participate. In fact, there’s a way to step into the same names at a steep discount. You won’t see it advertised on CNBC or plastered across financial news feeds, but professional traders use it constantly. The tactic is called a calendar spread.

And once you understand why it works, you’ll see that it’s one of the few strategies that flips expensive stocks into affordable opportunities.

Why Calendar Spreads Work

Markets have shifted. For the past two years, traders lived under the weight of relentless rate hikes. Now, after the Fed signaled this summer that it’s done tightening, interest rates are easing. Volatility, which spiked in 2022 and 2023, has calmed down. Stocks are expensive, but the big indexes are drifting sideways more often than not.

That backdrop is perfect for a calendar spread. Why? Because this strategy thrives in low-volatility environments where stocks move modestly or stay flat.

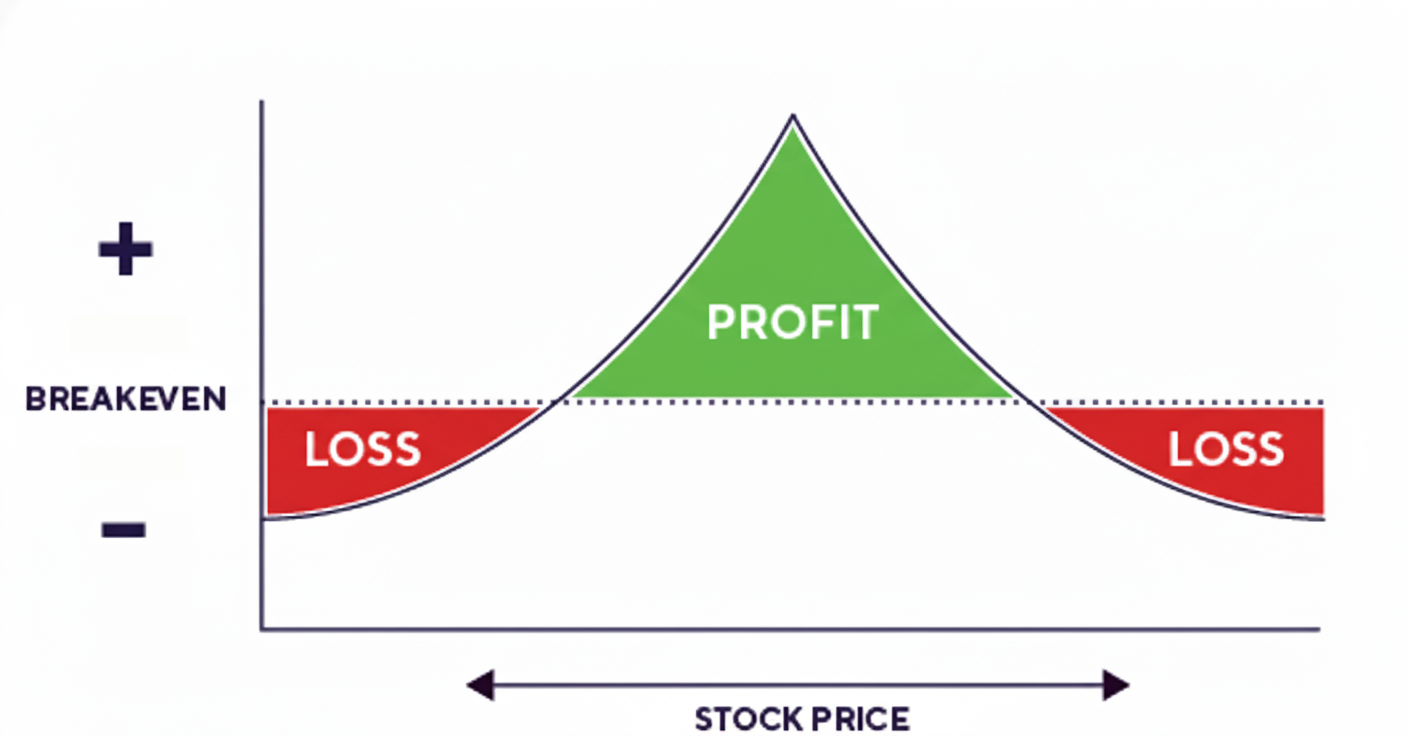

Unlike buying stock outright, where you need a directional move to make money, a calendar spread lets time itself do the heavy lifting. With every day that ticks by, short-term options lose value faster than long-term ones. If you position yourself correctly, you capture that difference.

Think about it: when you buy shares of Apple (AAP) at $260, the only way you profit is if the stock climbs. When you buy a calendar spread, you can profit even if the stock goes nowhere. That’s a huge advantage in a market that keeps stalling out.

Breaking Down the Mechanics

At first, calendar spreads look complicated. They’re not. You’re simply pairing two options with the same strike price but different expiration dates:

- Sell the near-term option (this is the one that decays fastest).

- Buy the longer-term option (this one holds value better).

Your risk is the small debit you pay upfront, and your potential payoff comes from the fact that your short option evaporates more quickly than the long one.

Here’s a clean example:

Suppose stock XYZ trades at $150. You could sell a two-month $160 call for $4 and buy a five-month $160 call for $8. Your net cost is $4. If the stock drifts sideways, the two-month call collapses toward zero, while the five-month call still has life left in it. That $4 spread might be worth $6 in a few weeks.

That’s a double, and it happens without the stock moving higher.

The Hidden Logic: Short the Loser, Own the Winner

Calendar spreads exploit a simple truth: time decay accelerates in the final weeks of an option’s life. That means short-term options are always the “losers” in this game. They bleed value the fastest. Long-term options, by contrast, decay slowly.

So when you short the near-term contract and buy the longer-term one, you’ve effectively sold the loser and bought the winner. It’s like betting against the weakest runner in a marathon while backing the competitor with fresher legs.

A Real-World Payoff Scenario

Let’s say Microsoft (MSFT) trades at $520. You set up a calendar spread at the $540 strike, selling a two-month call for $9 and buying a five-month call for $20. You’ve paid $11 for the position.

Fast-forward to the expiration of the short call. Microsoft closes at $535, up small. The short option expires worthless, which is exactly what you wanted. Meanwhile, your long option still carries about $15 of value because it has another three months until expiration. That means you pocketed $9 in cash, and your $11 long position is now worth $15 with unlimited upside for three more months.

That’s the magic of calendar spreads. You’re not chasing movement. You’re harvesting time.

Risks and Realities

Of course, nothing works all the time. If the stock breaks hard in either direction, your spread loses. The most you can ever lose, though, is the upfront debit you paid, and it’s easy to close the position on the upside for a profit before things move too much. That limited risk is why many traders prefer calendar spreads over outright long calls.

Assignment risk also exists if your short option goes deep in the money. But since your long option covers the strike, you’re protected from catastrophic loss. Still, most traders simply close the spread before expiration to avoid hassles.

Choosing the Right Spread

There are a few key rules:

-

Stick to at-the-money or out-of-the-money strikes. They almost always deliver the best probability of success.

-

Use near-term expirations for your short option. Two months is ideal. Four months for your long option is standard.

-

Want a bullish tilt? Place your strike slightly above the current price. Want bearish? Go slightly below.

You can even “roll” your short option if the setup works. When the first short option expires, sell another one-month contract against your long option. In this way, you’re collecting multiple rounds of premium against the same longer-dated call. Sometimes you can lock in a position that becomes essentially risk-free.

Figuring Returns and Probabilities

Traders often want hard numbers. With a calendar spread, calculating the cost is easy; it’s just the difference between what you pay for the long option and what you collect for the short.

Estimating payoff requires a little more work. You can shortcut it by looking at the current option chains. For example, if you buy a three-month call and want to know what it will be worth with two months left, check today’s two-month call. That’s a decent approximation.

For precise numbers, option calculators help. Enter the strike, volatility, and time to expiration, and you’ll get a clearer view of possible payoff ranges.

Why You Should Add This Tool Now

The key insight is this: when stocks are prohibitively expensive, calendar spreads open the door to participation. Instead of locking up tens of thousands to own shares of Nvidia (NVDA), you can control exposure for a fraction of the cost.

In addition, this strategy fits perfectly with today’s macro environment. Rates have topped out. Volatility has eased. Stocks are pricey and often range-bound. That’s fertile ground for calendar spreads.

We can still participate on the upside, but if there is a massive correction, the damage we suffer will be limited compared to owning the stock itself.

While not “free money,” the structure tilts the probability in your favor. You don’t need a massive move. You just need time to pass.

Final Thoughts

For many investors, buying expensive stocks outright feels like standing outside a luxury store with no way to get in. Calendar spreads are the key that unlocks the door. They’re affordable, defined-risk, and designed for markets exactly like this one.

The big funds already know this. The question is: do you want to keep watching stocks from the sidewalk, or do you want to walk inside without emptying your wallet?

This is just one of many option strategies that allow investors to get an edge on the market, if you want to know more about options, pick up the free beginner options course and start getting ahead of the game.