You’re probably familiar with the question, ‘savings or current?’ from a Point of Sales (POS) agent when you want to withdraw money. When you deposit your money in a savings account with a traditional bank, you are promised an accrued interest, averaging 8% per annum, depending on the bank. However, savings accounts with fintechs such as Cowrywise and Piggyvest, Kuda, Fairmoney, and PalmPay offer higher interest rates, ranging from 14% to 22% per annum.

Regardless, every savings product (and loan product) comes with an interest rate—the percentage return set by the platform or asset you’re investing in. But beyond interest, each savings app has its own features and limitations, depending on your goals and lifestyle. Here are the Nigerian savings apps offering the best rates, and the key features to consider.

Which fintechs have the best savings interest rates?

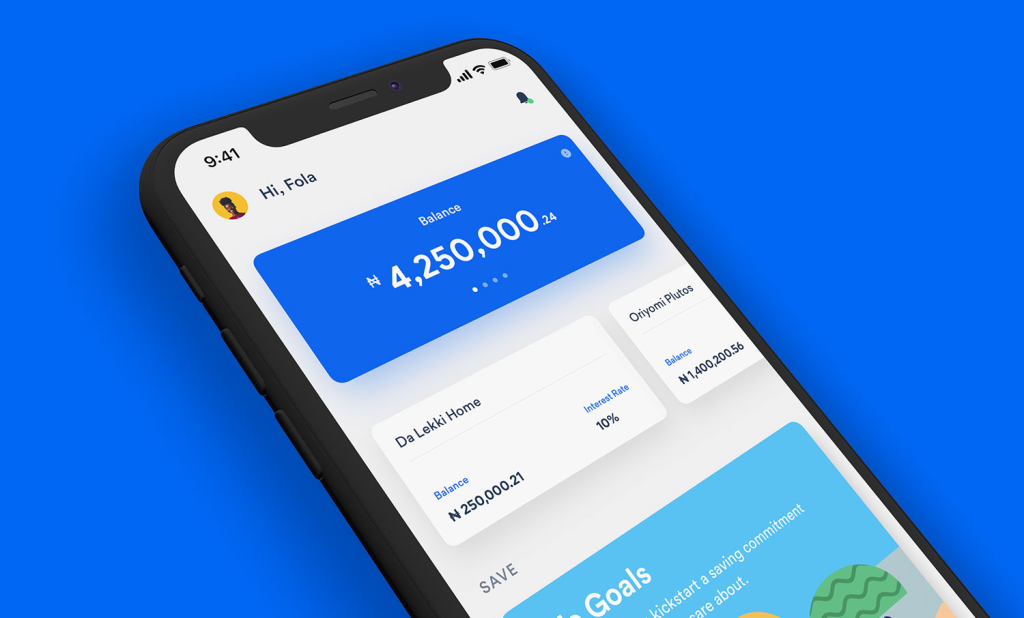

- Piggyvest

Founded in 2016, Piggyvest was the first West African savings app. Now a popular digital savings platform, here are the savings plans they offer and their rates.

- Safelock (Fixed Savings): Focus on disciplinary savings. Rates are determined by the locked duration (14%-20% for 10-365 days). While you can lock your funds for up to 1,000 days, interest on any Safelock over 365 days will be paid at maturity.

- Piggybank: Automatic daily, weekly or monthly savings with interest that accrues daily. Free withdrawals happen once every 90 days. Interest is at 17% per annum.

- Target Savings: Automated goal-based and core savings, typically 12% per annum. This plan can be private or public, which is done with others. Savings have a minimum duration of 30 days and cannot be accessed till maturity. However, if you break a target before the due date, you will pay a 1% fee and forfeit its accrued interest.

- HouseMoney: A semi-strict plan for saving towards a house, where you will only be allowed to move your funds from the account during the month the savings mature. Interest is 14% per annum.

Withdrawal Policy: Strict quarterly free withdrawal dates apply to core savings, and interest forfeiture (such as 1%) for breaking Safelocks and Target Savings

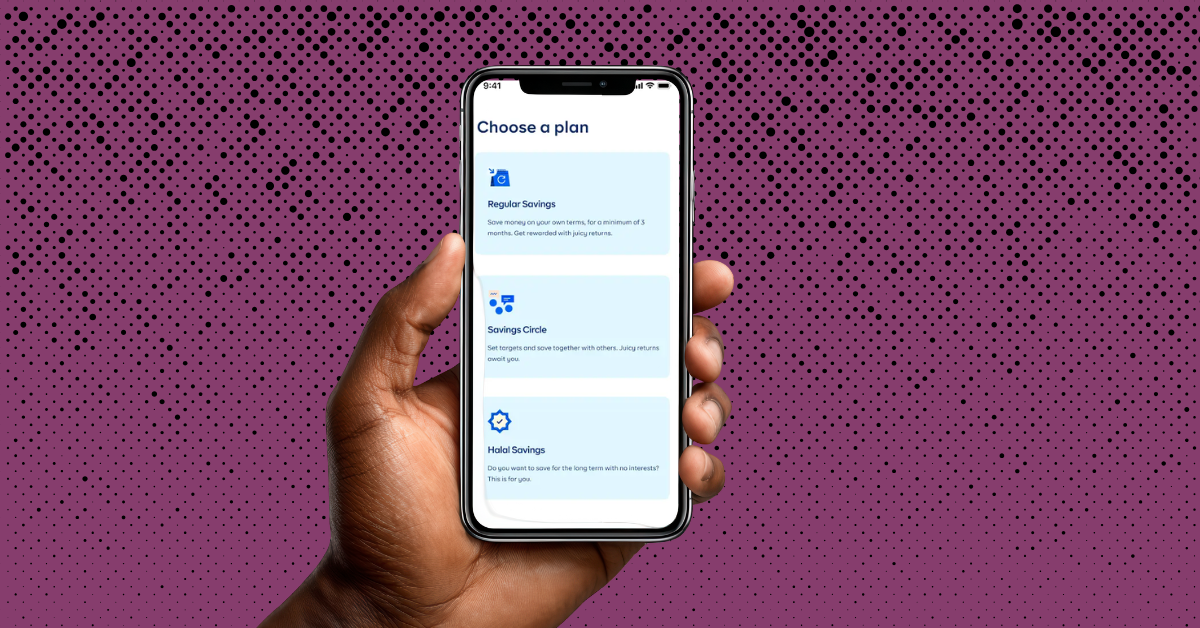

B. Cowrywise

Cowrywise has plans driven by communities and social circles.

- Regular Savings/Life Goals: Goal-oriented savings with a minimum lock-in (e.g., 3 months). Rates are typically tied to underlying money market funds. Emergency funds have an interest rate of 13.27%, while the House Rent saving plan, Study plan (for tuition and study goals), and car plan (savings towards a vehicle) feature an interest rate of 13.85%

- Money Duo: This plan allows you to build wealth together with your partner.

- Football & Basketball circles: These plans are powered by real-life triggers, such as saving money whenever your team scores, with an average interest rate of 13.27%

Withdrawal Policy: Stricter adherence to maturity dates on fixed plans; designed for maximum discipline and investment focus.

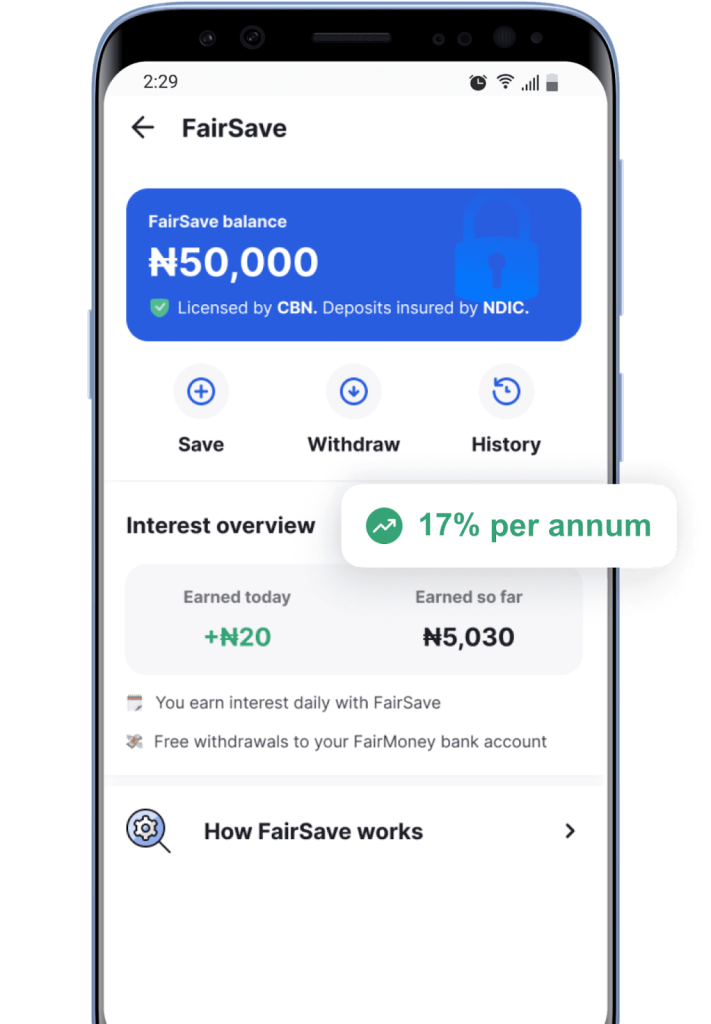

C. Fairmoney

The microfinance bank has held over ₦35 billion in savings for Nigerians. It offers a flexible savings plan and a fixed deposit plan.

- FairSave (Flexible Savings): Focus on high liquidity and reported competitive interest (17% per annum)

- FairLock (Fixed Deposits): One of the most competitive interest rates with up to 28% per annum. The plan is best for long-term savings.

- Integrated Banking: Seamless MFB operations (loans, accounts, etc.).

Withdrawal Policy: High flexibility and daily interest accrual for FairSave, while FairLock fixed deposit will be withdrawn automatically to your FairSave balance upon maturity.

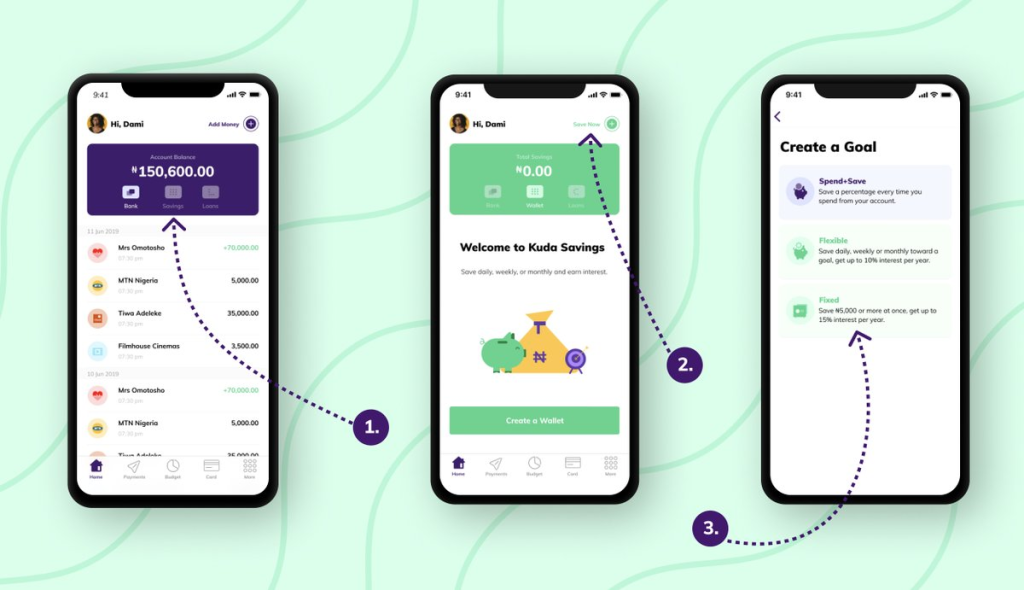

D. Kuda

Kuda offers a savings trigger called ‘Spend+Save’ where a percentage of your choice is saved automatically every time you spend. This has no interest rate.

- Save frequently pocket: You can save daily, weekly, or monthly and get up to 8% per annum.

- Fixed Savings: You can get up to 12% annual interest on Fixed Savings.

Withdrawal Policy: If you withdraw from your fixed savings plan before maturity, the plan is automatically deleted, your ‘spend’ account is credited, and 10% of the accrued interest is deducted from your returns.

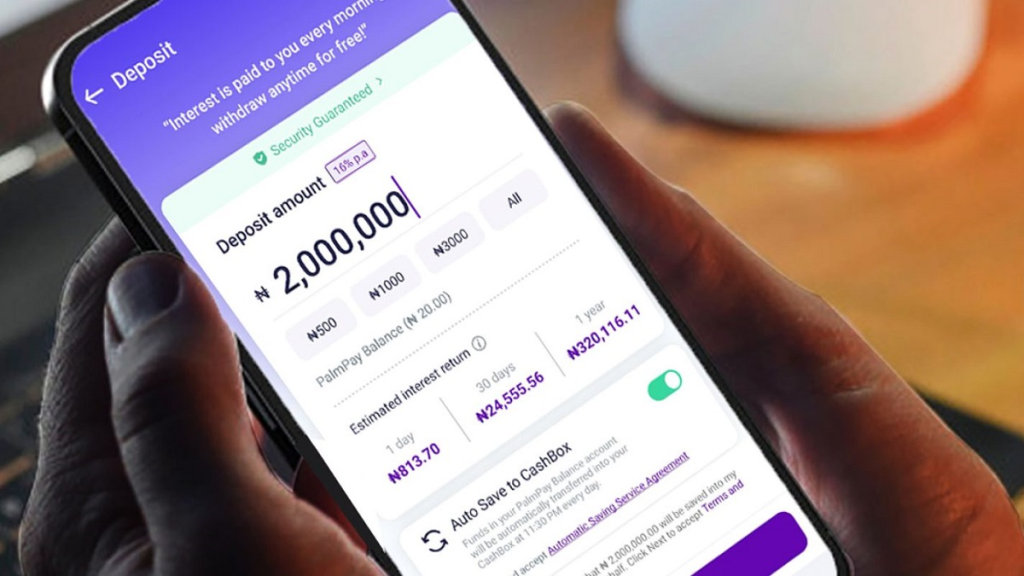

E. PalmPay

- Cashbox/SmartEarn (Savings): Offers high interest for flexible savings products for up to 20% per annum for Cashbox, and 22% per annum for SmartEarn.

- Target Savings: Goal-based savings with a 12% interest rate per annum. You can customise your savings frequency and goal. Payout is upon maturity.

- Spend and Save: Palmpay’s spend and save feature automatically deducts a pre-decided amount (e.g, 10%, 50%, 70% or 100%) from every transaction to your savings account. Your savings also accrue a 20% interest rate.

Withdrawal policy: With SmartEarn, you can have 24/7 instant withdrawals with no redemption fees.

| Platform | Piggyvest | Cowrywise | Fairmoney | Kuda | PalmPay |

| Primary High-Yield Product(s) | Safelock (Fixed Savings), Piggybank | Emergency Funds, House Rent/Study/Car Plans, Football & Basketball circles | FairLock (Fixed Deposits), FairSave (Flexible Savings) | Fixed Savings | SmartEarn, Cashbox (Flexible Savings) |

| Estimated Interest Range | 14% – 20% (for 10-365 days Safelock) | sim 13.31% – 13.85% (Goal/Circle Savings) | Up to 28% (FairLock) | Up to 12% (Fixed Savings) | Up to 22% (SmartEarn) |

| Liquidity of Core Savings | Low: Strict quarterly free withdrawal dates (Piggybank/Target Savings) | Low: Stricter adherence to maturity dates on fixed plans | High: FairSave (Flexible Savings) offers high liquidity and daily interest accrual | Moderate: Spend+Save (No interest), Save frequently pocket | High: SmartEarn offers 24/7 instant withdrawals (no redemption fees) |

| Key Withdrawal Restriction / Penalty | Interest forfeiture (e.g., 1%) for breaking Safelocks. Strict quarterly free withdrawal dates for core savings. | Designed for maximum discipline; strict adherence to maturity dates. | FairLock automatically deposits to FairSave upon maturity; FairSave is highly flexible. | 10% of accrued interest deducted for early withdrawal from Fixed Savings. | None mentioned for SmartEarn/Cashbox; Payout upon maturity for Target Savings. |

Choosing the right platform for your financial goals

While fintechs typically offer higher returns than commercial banks, each platform has its benefits, depending on your goals or what you prioritise.

1. You can choose Piggyvest if you

- Need strong discipline: Your primary goal is to enforce savings discipline using tools like Safelock (fixed savings) and HouseMoney.

- Want low liquidity: You are comfortable with strict quarterly free withdrawal dates for your core savings (Piggybank/Target Savings).

- Seek competitive fixed rates: You want high interest rates in the 14% – 20% range and are prepared for a small interest forfeiture (e.g., 1%) for breaking the fixed plan early.

Key differentiator: Core strength is providing tools that enforce strict, mandatory savings discipline (Safelock).*

2. You can choose Cowrywise if you

- Are highly goal-oriented: You want to save towards specific life goals (House Rent, Study, Car) or participate in community-driven or social savings circles.

- Prioritise an investment focus: You are willing to strictly adhere to the maturity dates of your plans.

Key Differentiator: Focuses on social, community-driven savings and maximising returns through plans directly tied to underlying money market funds.*

3. You can choose Fairmoney if you

- Want high fixed returns: You are focused on long-term savings and want the highest potential interest rate available, up to 28% with their FairLock (Fixed Deposits).

- Need flexible high-yield savings: Alternatively, you require a highly liquid account (FairSave) that offers competitive rates and daily interest accrual while maintaining the ability to withdraw easily.

- Prefer integrated banking: You value having seamless access to Microfinance Bank (MFB) operations, including loans and accounts, alongside your savings.

Key differentiator: Offers the highest potential fixed interest rate (up to 28%) and provides the convenience of integrated Microfinance Bank (MFB) services.

4. You can choose Kuda if you

- Value automated passive saving: You want to automatically save a percentage every time you spend using the unique ‘Spend+Save’ feature (Note: This feature accrues no interest).

- Are certain about maturity: Choose Kuda if you can commit to the lock period, as early withdrawals will lead to forfeiture of your accrued interest.

Key Differentiator: Its unique ‘Spend+Save’ feature automatically saves money based on spending triggers, offering passive savings integration into daily life.*

5. You can choose PalmPay if you

- Want high liquidity with a high interest: Your top priority is maximising the interest rate (up to 22% with SmartEarn/Cashbox) while retaining the ability to access your funds instantly (24/7 withdrawals) without penalty fees.

- Want spending-triggered savings: You want to link a savings feature to your transactions (Spend and Save) and still earn a high interest rate on those automated savings (20% per annum)*.

- Prefer flexibility: If you want flexible, goal-based savings (Target Savings) where you customise frequency and payout is upon maturity, then PalmPay might be a good fit for your savings.

Key Differentiator: Provides the best combination of maximum liquidity (24/7 instant withdrawals with no fees) and high interest rate (up to 22% per annum).*

*These interest rates were sourced from the savings app’s mobile and web apps, and are up-to-date as of November 20, 2025.