The sell-off in software stocks could be an incredible buying opportunity for long-term investors.

Last year, technology outperformed the other 10 sectors of the stock market and the S&P 500delivering a 24.7% total return. A lot of those gains were driven by semiconductor stocks like Nvidia, Broadcom, Micron Technology, Advanced Micro Devices, Lam Researchand Applied Materials.

In fact, software stocks, which used to be a driving force of tech-sector gains, are in a downturn amid investor concerns that artificial intelligence (AI) will disrupt the industry, especially the enterprise software-as-a-service (SaaS) model. Investors looking for a catch-all way to buy the dip on software stocks may want to consider an exchange-traded fund (ETF).

Here’s why BlackRock‘s iShares Expanded Tech Software Sector ETF (IGV 4.93%) has been beaten down, why it is distinctly different from a broader tech ETF like the iShares U.S. Technology ETF (Iyw 1.38%)and why investors specifically looking to buy the dip in software stocks may want to take a closer look at the fund.

Image source: Getty Images.

Going beyond the biggest tech stocks

The iShares U.S. Technology ETF is heavily concentrated in megacap tech-focused companies — with a staggering 44.5% weighting in Nvidia, Appleand Microsoft. By comparison, the iShares Expanded Tech Software Sector ETF is less top-heavy and provides greater exposure to software stocks that may have small weightings in a general tech ETF.

iShares Expanded Tech Software Sector ETF

|

Company |

Weight |

|

Microsoft |

9% |

|

Palantir Technologies |

8.9% |

|

Oracle |

8% |

|

Salesforce |

7.6% |

|

AppLovin |

5.6% |

|

Intuit |

5.3% |

|

Palo Alto Networks |

4.4% |

|

Adobe |

4.4% |

|

CrowdStrike Holdings |

4% |

|

ServiceNow |

3.8% |

Data source: BlackRock.

iShares U.S. Technology ETF

|

Company |

Weight |

|

Nvidia |

16.9% |

|

Apple |

14.5% |

|

Microsoft |

13.1% |

|

Alphabet |

4.8% |

|

Meta Platforms |

3.2% |

|

Broadcom |

3.1% |

|

Palantir Technologies |

2.6% |

|

Micron Technology |

2.5% |

|

Advanced Micro Devices |

2.5% |

|

Oracle |

2.2% |

Data source: BlackRock.

The software slowdown

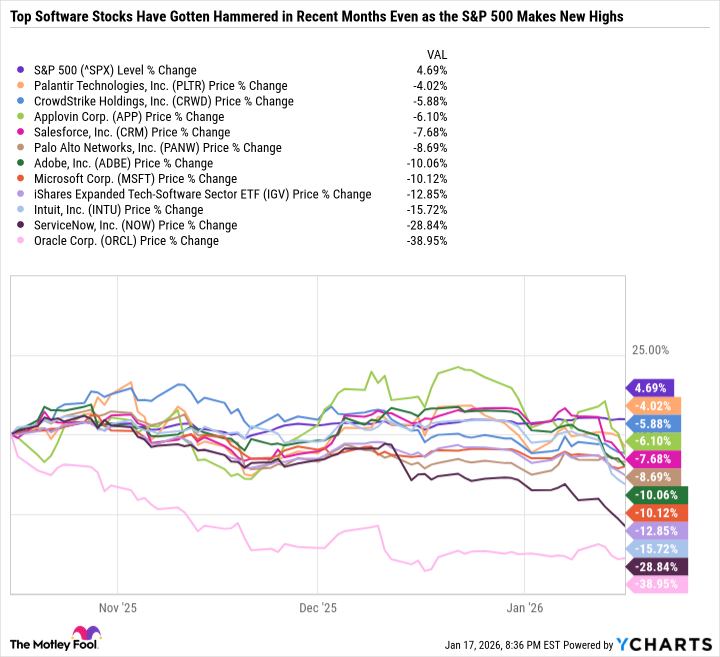

While the broader market continues to make new all-time highs, there’s been a noticeable slowdown in software stocks. The iShares Software ETF is down 12.9% in the past three months. And all of its top 10 holdings, including Palantir, have lost value in that period even as the S&P 500 has gained 4.7%.

^SPX data by YCharts

Microsoft has been under pressure mainly due to its association with OpenAI, which is being challenged by Alphabet’s Gemini. OpenAI’s large language models power Microsoft’s AI tools, such as Copilot. But Microsoft needs to eventually convert its high AI capital expenditures into earnings. Investors should have better visibility into OpenAI’s finances if it goes public in 2026.

Like Microsoft, Oracle is also closely associated with OpenAI because it makes up the bulk of its remaining performance obligations (order backlog). Oracle’s cloud business, called Oracle Cloud Infrastructure, is growing at a breakneck pace and could overtake its legacy database software business as the main cash cow in the coming years. But for now, investors are concerned about Oracle’s balance sheet, which is being drained by debt used to build AI data centers.

Palantir’s results, growth rate, and stock price soared in 2025. So the recent pullback is likely more a result of valuation concerns — as Palantir sports a nosebleed price-to-sales ratio of 112 and a forward price-to-earnings (P/E) ratio of 169.

Investors care more about where a company is going than where it has been. Just a few years ago, enterprise software stocks like Salesforce and Adobe were red-hot, high-growth stocks trading at premium valuations. Fast-forward to today, and Salesforce sports a 19.3 forward P/E ratio while Adobe is at just 12.6 compared to 23.9 for the S&P 500. The discount may seem strange given that Salesforce’s and Adobe’s earnings are at all-time highs. But their low valuations suggest investors expect earnings growth to slow dramatically or even turn negative in the coming years.

Salesforce and Adobe have fallen by 29% and 30%, respectively, over the last year. But other enterprise software giants like ServiceNow, Monday.comand Atlassian are down even more — between 40% and 53%.

iShares Trust – iShares Expanded Tech-Software Sector ETF

Today’s Change

(-4.93%) $-4.79

Current Price

$92.27

Key Data Points

Day’s Range

$90.65 – $94.49

52wk Range

$76.68 – $117.99

Volume

23M

Cybersecurity stocks have generally held up better amid the broader software sell-off, but SentinelOne, Fortinetand Datadog have all lost value over the past year, OktaPalo Alto Networks, and Zscaler have underperformed the S&P 500, and CrowdStrike stands out as an exception, having outperformed the S&P 500 over the past year.

Wall Street despises uncertainty. And right now, the software industry is chock-full of it. Enterprise software businesses with subscription models depend on a growing number of subscribers (human users). But if AI tools allow a single user to handle the former workload of several users, then an enterprise may not need as many subscriptions.

There’s also the concern that free or inexpensive AI tools, like text-to-image and video generation, will replace some of the workflows that used to be done by, say, a graphic designer using the Adobe Creative Cloud suite.

On the cybersecurity front, AI is increasing the complexity of cyberattacks, which is pressuring cybersecurity companies to improve their defenses through network security, firewalls, data encryption, etc. The challenge for cybersecurity companies is adapting to more sophisticated threats while passing along those costs to customers.

The ETF wrapper makes a lot of sense in the software space

There are plenty of ways to buy the dip in software stocks, whether that’s going with a former highflier like Palantir, software/cloud hybrids like Microsoft and Oracle, enterprise software companies, cybersecurity, etc. But when an entire industry is under pressure, one of the simplest options is to buy an ETF. This is a good way to bet on an industrywide recovery, even if leadership changes, rather than investing in a single stock and hoping it recovers.

Although I do believe the sell-off in software stocks is overblown, I could see a major reshuffling in which former leaders falter, some recover, and new companies emerge. Given the speed and scale of the disruption, the iShares Expanded Tech Software Sector ETF seems like one of the best ways to invest in software stocks in 2026 and beyond.

Daniel Foelber has positions in Adobe, Nvidia, and Oracle and has the following options: long January 2028 $300 calls on Adobe and short March 2026 $240 calls on Oracle. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Alphabet, Apple, Applied Materials, Atlassian, CrowdStrike, Datadog, Fortinet, Intuit, Lam Research, Meta Platforms, Microsoft, Monday.com, Nvidia, Okta, Oracle, Palantir Technologies, Salesforce, SentinelOne, ServiceNow, and Zscaler. The Motley Fool recommends BlackRock, Broadcom, Micron Technology, and Palo Alto Networks and recommends the following options: long January 2026 $395 calls on Microsoft, long January 2028 $330 calls on Adobe, short January 2026 $405 calls on Microsoft, and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.