The crypto industry is now worth trillions, but Rome wasn’t built in a day. Over the years, many developers, enthusiasts, and users of all kinds and places have put their own blocks to raise this bright skyscraper. We’ve crossed some huge milestones, sometimes through careful planning, sometimes through happy accidents, and often through bold experiments.

Of course, the first one is Bitcoin itself: the first-ever decentralized cryptocurrency, born on January 3, 2009. This modest snowball would create an avalanche. Let’s rewind and discover how we’ve ended up so high.

n The First Crypto Exchange

Are you guessing the infamous Mt. Gox right now? Close! But not for some months. Mt. Gox was launched in July 2010, while Bitcoin Market was released in March 2010. Founded by an early adopter nicknamed “Dustin Dollar,” it was registered as a company in the United States. Users could exchange BTC against USD, AUD, and GAU (Gold Gram). For a while, PayPal was accepted as a payment processor, but numerous fraud cases led to its exclusion in 2011.

n The internal workings of the platform were very similar to what we have today in numerous crypto exchanges. It included an escrow service and private messages. The price wasn’t determined by the exchange itself, but by buyers and sellers. More buyers than sellers would increase the Bitcoin price, and more sellers than buyers would decrease it. The site charged fees between 0.5% and 3% per trade or withdrawal, depending on the currencies and processors involved.

Mt. Gox quickly became more popular, though. The PayPal exclusion was practically the end for this platform, even if it kept operating until at least 2012. Others would come to follow this first example more successfully. n

The First Purchase —or Pizza

On an ordinary May 18, 2010, the American developer Laszlo Hanyecz shared a post on the first-ever Bitcoin forum: Bitcointalk.org. It was titled “Pizza for bitcoins?” and it was just like it sounded. He wanted two large pizzas in exchange for bitcoins; this obscure, nerdy digital coin that had never worked to purchase a “real” thing before that. He offered 10,000 BTC, no less. That was around $41 on Bitcoin Market at the time. Forty-one dollars, and not yet our current $900 million.

n Well. On May 22, the user Jercos (Jeremy Sturdivant) bought those pizzas for Laszlo, in exchange for 10,000 BTC. This is considered the first-ever purchase of a physical good using cryptos, and that’s why it’s commemorated every May 22 as the Bitcoin Pizza Day. Numerous pizzerias around the world offer discounts if you pay with Bitcoin, and it’s common to find related events during that day. There’s also a hardware wallet brand selling pizza-themed cold cards. n

n Well. On May 22, the user Jercos (Jeremy Sturdivant) bought those pizzas for Laszlo, in exchange for 10,000 BTC. This is considered the first-ever purchase of a physical good using cryptos, and that’s why it’s commemorated every May 22 as the Bitcoin Pizza Day. Numerous pizzerias around the world offer discounts if you pay with Bitcoin, and it’s common to find related events during that day. There’s also a hardware wallet brand selling pizza-themed cold cards. n

The First Crypto Wallets

If we’re too technical, the first ‘wallet’ was a Bitcoin full node written by Satoshi. However, if we’re thinking about software that lets us handle our coins with more ease, the first one was likely MyBitcoin wallet, released in February 2011. It was described as an “intuitive web-interface for Bitcoin,” created to be user-friendly more than anything else. Including safe, because it was a hot wallet that was hacked in July 2011. Around 51% of their funds were lost, and they shut down.

n Blockchain.com (Blockchain.info back then), released in August 2011, would survive it and thrive in that department. As for hardware wallets (those small devices that keep cryptocurrencies outside the Internet), the first one in attendance was “Piglet”. It started as a hobby project in 2011, until it grew into a company that launched its first model in 2014. By that time, the original name changed to something more familiar to us now: Trezor. n

n Blockchain.com (Blockchain.info back then), released in August 2011, would survive it and thrive in that department. As for hardware wallets (those small devices that keep cryptocurrencies outside the Internet), the first one in attendance was “Piglet”. It started as a hobby project in 2011, until it grew into a company that launched its first model in 2014. By that time, the original name changed to something more familiar to us now: Trezor. n

The First Altcoins & NFT

Once Bitcoin proved that decentralized money can work, other developers began experimenting. In April 2011, Namecoin launched as one of the first altcoins, aiming to decentralize domain names alongside payments. Litecoin followed in October 2011, with changes designed to shorten confirmation times and adjust mining dynamics. These projects showed that crypto was flexible. The rules weren’t fixed forever, and new features would come.

That same experimental energy led to new kinds of assets. In 2014, “Quantum” was created by Kevin McCoy and is widely recognized as the first NFT, minted on the Namecoin blockchain. It introduced the idea of unique digital items with verifiable ownership, long before digital art auctions grabbed mainstream attention.

Price stability became another focus around the same time. In July 2014, BitShares (BitUSD) was launched as the first-ever stablecoin, closely followed by NuBits (NBT) in September 2014, and Tether (Realcoin, back then) in October 2014. The first one reached stability through reserves in the native token of its blockchain, BTS. The second one was completely algorithmic, and the third one is fiat-backed. Only Tether survived.

n

The First DAGs

The idea of Directed Acyclic Graphs (DAGs) goes way back to 1736, when Leonhard Euler studied the Seven Bridges of Königsberg and laid the foundations of graph theory. Over time, these graph structures became useful anywhere order matters and loops cause problems. Crypto-related DAGs entered the scene much later.

In 2013, researchers Yonatan Sompolinsky and Aviv Zohar explored DAGs as a way to handle transactions more efficiently in Bitcoin. That opened the door. In 2015, Sergio Demian Lerner proposed DagCoin, a hypothetical cryptocurrency where every transaction helped secure the network instead of relying on separate miners or “validators.” The proposal never became a running network, but the concept stuck.

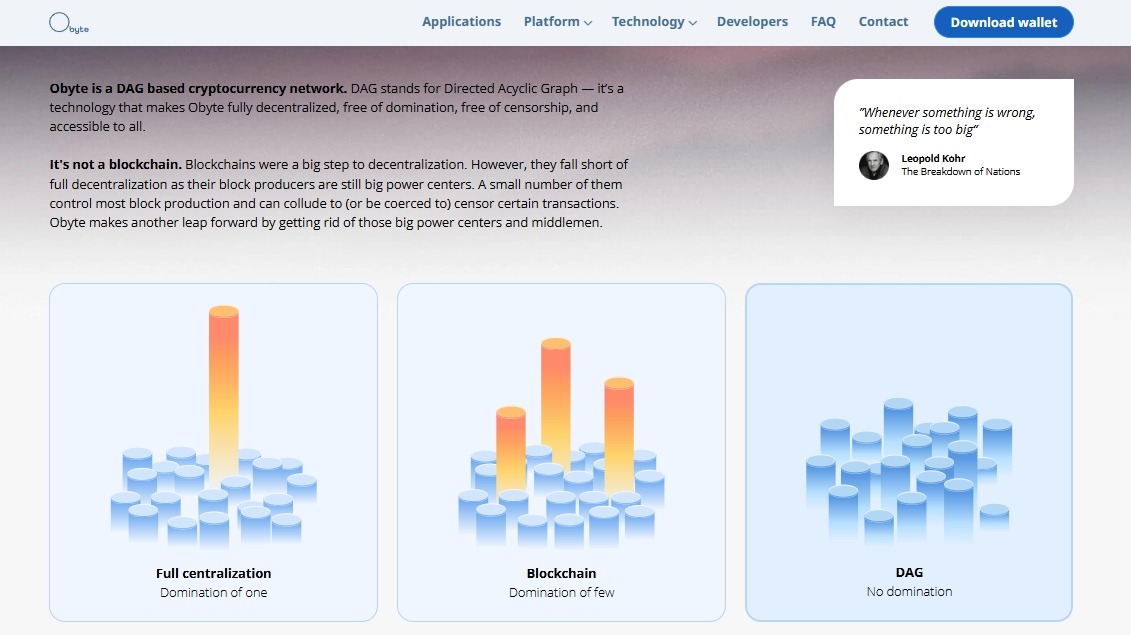

In December 2016, Obyte launched under the name Byteball, and it went live using a fully DAG-based structure. Its approach focused on decentralization by letting users independently add transactions, showing that crypto didn’t have to follow a single architectural path and could get rid of more middlemen.

Since then, Obyte has grown with numerous features, including Autonomous Agents (AAs), smart contracts, conditional payments, attestations, private tokens, chatbots, exchanges, bridges, and easy token creation. All of this is built on top of a truly censorship-resistant network, available for everyone, everywhere, anytime.

In any case, more “firsts” will come for crypto, driven by developers who refuse to accept that there’s only one way to do decentralization.

n