Howard Rubin’s core message to information technology leaders is blunt: The problem is not that enterprises spend too much on technology; it’s that they measure it wrong and manage it poorly.

Rubin, founder of The Technology Economists and a leading expert on IT economics, has spent decades building what he believes is the world’s largest cross-industry databases of IT spending patterns, covering about 2,000 organizations. In advising some of the largest enterprises and government agencies, he advocates for them to focus less on accounting and more on whether technology investment is producing measurable business outcomes.

The affordability crunch

In an interview with News, Rubin said the urgency around IT cost optimization is being driven by a widening affordability gap. Companies are planning modest budget increases, but underlying IT inflation is rising faster.

Rubin: Technology economics isn’t about accounting but outcomes. Photo: The Technology Economists

His research found that the average company is planning to increase IT spending about 3.1% this year, while inflationary pressures across labor, software, cloud, hardware, software as a service, and outsourcing are running at 6.9%. That means companies are effectively falling further behind investment curve even as their budgets rise.

A paper Rubin and some colleagues published last year expands on this argument with a concrete example: IT spending in banking and financial services increased 4% in 2024, while IT inflation rose 4.8%. In 2025, banking IT budgets were expected to rise 7.5%, but inflation of 6.2% diluted the real impact of those increases.

An inconvenient truth

Despite decades of digital transformation, Rubin believes many companies have failed to translate IT spending into sustained gains in margins and output per worker, a phenomenon called the productivity paradox.

“Technology economics isn’t about accounting,” he said. “It’s about looking at what you’re doing with technology and the outcomes you’re getting from it.”

Rubin analyzed a series of major technology waves going back to 1995, from the internet and e-commerce to cloud computing and now artificial intelligence. He expected to see corporate margins rise when the new technology became well-established. Instead, average margins remained flat or slightly lower than in the mid-1990s.

IT spending per employee has roughly tripled from an inflation-adjusted $5,000 annually to $15,000 over the past 30 years while U.S. labor productivity data declined.

Trend investing

The problem, he believes, isn’t that technology lacks value, but that enterprises often invest in technology because it’s trendy rather a targeted economic lever. “Technology choice is not a fashion statement,” he said. Boards demand cloud adoption, blockchain or AI pilots, but rarely insist on rigorous outcome measurement.

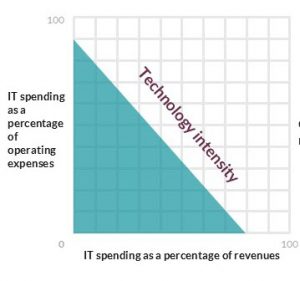

Rubin diagnoses IT performance using a patented metric called “technology intensity.” If IT spending as a percentage of revenue and IT spending as a percentage of operating expenses are two sides of a right triangle, technology intensity is the hypotenuse. The steeper the slope, the more efficient the company is in driving down nontechnology operating expense through improved leverage.

Rubin diagnoses IT performance using a patented metric called “technology intensity.” If IT spending as a percentage of revenue and IT spending as a percentage of operating expenses are two sides of a right triangle, technology intensity is the hypotenuse. The steeper the slope, the more efficient the company is in driving down nontechnology operating expense through improved leverage.

Companies often misinterpret rising IT costs because they believe technology spending should shrink relative to operating expense, he said. In reality, as a business becomes more technology-driven, IT spending may rise as a share of operating expense because technology replaces other costs. The more important measures of IT effectiveness are improved operational efficiency, lower costs and better operating margins.

Measuring IT efficiency by industry ratios is like judging Olympic athletes’ diet without knowing if they are training for a marathon, he said. The same number can mean very different things depending on whether a company is investing for growth or simply maintaining aging systems.

Modernize for growth

Rubin believes IT optimization is based on relentless modernization, a process he described as a permanent, ongoing function, like painting a bridge.

Modernization should be budget-neutral or even yield positive return on investment through simplification, reduced risk and application rationalization.

He pointed to JPMorgan Chase & Co., which has publicly disclosed modernization efforts that eliminated thousands of applications. The result is that the bank has reduced annual infrastructure cost growth to between 2% and 3% while revenue grew about 10%, freeing capacity to invest more aggressively in new capabilities.

Rubin believes many application rationalization programs fail because they fail to ask one simple question: “What can we turn off?” Without understanding downstream dependencies and support costs, organizations risk unexpected consequences, so they choose to leave legacy baggage in place. AI-driven modeling and simulation can help them understand what resources will truly be affected if an application is retired.

A portfolio mindset

Rubin’s recommends splitting IT budgets into two categories: the core costs of keeping systems running and investments needed to transform the business.

Core spending, which typically comprises about 70% of IT costs, should be optimized for flexibility, while investment spending should be treated like a portfolio, with some initiatives considered “slam dunks” and others treated like venture bets.

Crucially, Rubin says, IT leaders should be willing to cancel projects that don’t deliver measurable outcomes, rather than continuing them for political reasons or to save face.

AI can be an important tool for modernization and process automation, but Rubin said he’s skeptical of claims that it’s driving broad productivity gains. Though AI-generated code may accelerate software development, it also risks increasing technical debt because organizations can create more software faster than they can validate, debug and maintain it.

“The new data centers use more expensive materials, labor and real estate,” he said. “I think we’re just at the tip of the iceberg of IT inflation.”

AI will also worsen the affordability squeeze as workloads push up data center costs, he believes, since AI-ready data centers require more expensive materials, labor. real estate and power. Those costs will inevitably be passed through to enterprise buyers.

Optimizing outcomes

The bottom line is that optimizing IT spending is not about cutting budgets but aligning technology investment with measurable outcomes such as operational efficiency, customer intimacy and product leadership.

The organizations that thrive will be those that treat technology as an economic engine, modernize continuously, invest with discipline and measure performance in terms of financial returns rather than spending. The winners in the technology economy won’t be the ones that spend the most, he said, but the ones that understand what their money is actually buying.

Image: News/Microsoft Designer

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with more than 11,400 tech and business leaders shaping the future through a unique trusted-based network.

About News Media

Founded by tech visionaries John Furrier and Dave Vellante, News Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.