Afriex, the Lagos- and San Francisco-based money transfer startup, has expanded into Asia’s three biggest remittance markets—China, India, and Pakistan—to tap into growing demand for fast and affordable cross-border payments. The move positions the company to serve a growing number of African merchants and diaspora communities involved in foreign trade or sending money back home.

“Our money transfers to India and Pakistan are instant, just like sending money to a friend or paying your Uber driver, and 90% of our transactions are completed in under two seconds,” said Tope Alabi, Afriex’s co-founder and CEO. “Although on China’s side we are not yet at the same level of instant, but we’re getting close.”

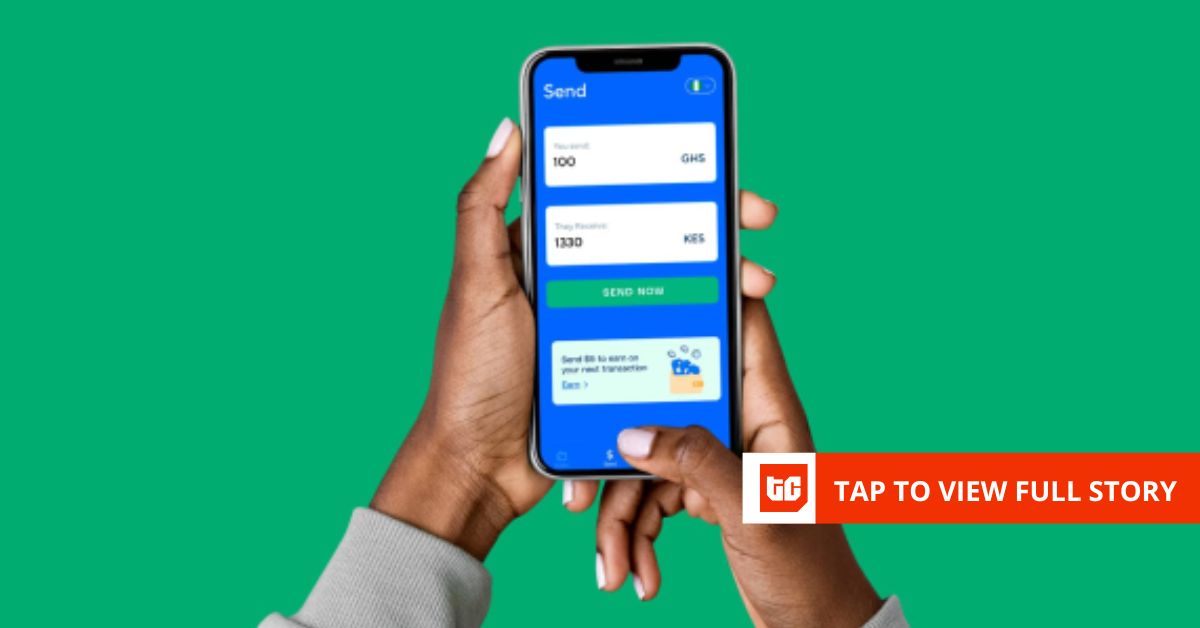

Founded in 2019 by Alabi and John Obirije, Afriex allows users to send and receive money in local currencies between Africa and other regions, bypassing traditional payment rails like SWIFT. The company has built a multi-currency payment infrastructure that settles transactions in real time, offering services through its mobile app with local banking integrations.

The expansion comes as cross-border payments surge globally, driven by migration, international trade, and remote work. The Asia-Pacific region accounted for about 26% of the global $190 trillion in cross-border transactions in 2024, according to market data. India alone received $120 billion in remittances in 2023, followed by China with $50 billion and Pakistan with $27 billion—three of the top five recipient countries globally.

Afriex’s offering is targeted at African traders and global diaspora populations who import goods or support families across these markets. Alabi told that African businesses are increasingly importing goods from Asian countries, particularly China, India, and Pakistan, making fast and reliable cross-border payments that settle in real-time essential. He noted that high remittance costs and underdeveloped infrastructure have long hindered smooth money transfers between borders.

To drive adoption, Afriex waives transaction fees on transfers above $10 and earns revenue from foreign exchange spreads.

“We find the very best exchange rates from local currency to foreign currency, and then give that to our customers at a reasonable margin, and that makes sense for both the customers and for the business,” he said. ”If the exchange rates go up and down, the rates on our platforms will also go up and down to match the market and to match the reality.”

However, Alabi pointed to key challenges in the new markets, including regulatory compliance and interoperability. While Pakistan shares similarities with Nigeria’s banking system, such as parallel FX markets and low SME digitisation, China poses tougher hurdles, particularly around regulation, name verification, and documentation.

“Sending money to China is not as seamless as sending money to the person next to you,” he said. “There are multiple challenges around Chinese remittances like documentation, name verifications, and the language, because everything is written in Mandarin and needs to be translated. Also, multiple businesses can have the same name or a bank account name with the vendor you wanted to send to.”

Despite the challenges, Afriex is optimistic it will enable instant payments to China by the end of 2025, matching the speed of transactions in India and Pakistan. Alabi added that the company partners with local firms in all three countries to navigate regulatory requirements and access critical information efficiently.

The startup, which raised $1.2 million in seed funding in 2020 and followed up with a $10 million Series A round in 2022 at a $60 million valuation, is gearing up for another fundraising push.

“We are constantly speaking with investors and are likely to raise a new round, possibly early next year,” Alabi said. “And any new round would basically be used to expand our growth.”

Afriex joins a growing cohort of African fintechs expanding globally to capture new remittance and trade corridors. In 2023, fintech unicorn Flutterwave expanded into India with a partnership with a local bank. Remittance startup LemFi raised $53 million in early 2025 to accelerate its expansion into Asia and Europe.

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com