If there’s one word Wall Street doesn’t like, it’s “down.” And Tesla is down.

For the first time in recent history, the EV maker reported a yearly sales decline. Though it’s only a 1% drop, it’s the automaker’s first since it introduced the Model S in 2012, according to Barron’s.

That said, Tesla actually set a quarterly delivery record in Q4, with 495,570 vehicles going out to customers globally. But that’s only up 2% from the same time period in 2023. And the annual number could be more telling since it covers a longer period of time.

Investors and analysts are entering whirling dervish mode, spinning up various explanations of what’s going on. After years of reporting on Tesla’s every move, my best guess is that the decline has less to do with Elon Musk’s politics or his constant stream of questionable X posts (he’s tweeted more than 100 times in the past 24 hours alone) and more to do with Tesla’s stale lineup.

(Credit: Tesla)

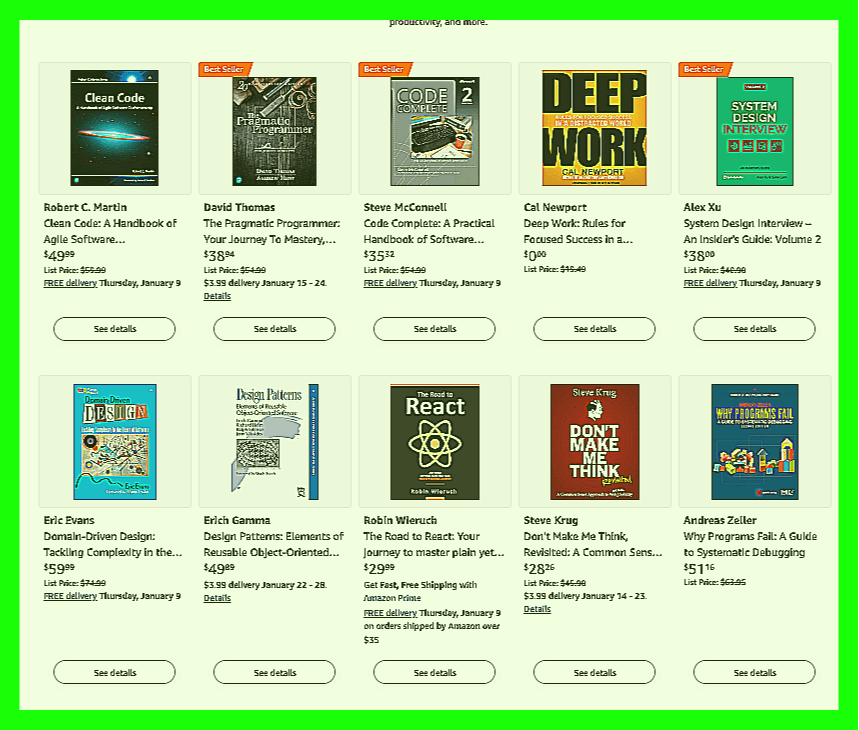

If you look at the 2024 numbers, they show waning interest in Tesla’s core vehicles, the Model 3 and Model Y, which are lumped together in the reporting. These are the affordable models and account for 95% of Tesla’s sales. That means Tesla must sell more of them for its business to grow. But it sold 35,000 fewer Model 3s and Ys than the previous year and didn’t have anything new for budget-minded EV shoppers. As wasteful as it is, the market runs on newness, and we all know what the Model 3 and Model Y look like.

After years of delays, the Cybertruck was Tesla’s big 2024 offering. It falls in the “Other Models” reporting bucket, which is code for “luxury” and also includes the more expensive Model X and Model S. The Cybertruck sold well, becoming the best-selling EV pickup on the market. That likely contributed to Tesla selling 16,000 more vehicles in the “Other” category, but that’s not enough to supplant the Model 3 or Y.

Tesla Model S and X (Credit: Bloomberg / Contributor / Bloomberg via Getty Images)

A $25,000 Tesla would likely have been a big hit, but that’s on the back burner as Musk focuses on robotaxis. There are rumors of a new Tesla Model Q launching next year, priced around $37,000—or below $30,000 after the federal tax credit. Tesla has not confirmed anything, however, and it has a habit of delaying launches, so there’s a big Q over the Q’s launch timeline.

So, for most of 2024, Tesla’s core lineup remained the same, pushing buyers to consider other brands, especially now that all EVs will be able to use Tesla’s Supercharging network.

Some great Tesla alternatives launched in 2024, such as the Honda Prologue, Chevy’s $35,000 Equinox EV, and the value-packed Kia EV9 for larger families. All are selling well. Ford continues to update the best-selling Mustang Mach-E, and the 2025 Hyundai Ioniq 5 was the first non-Tesla to have a built-in NACS port for Supercharging without an adapter.

In PCMag’s Readers’ Choice survey of the top EVs and hybrid auto brands, BMW came out on top for EVs and hybrids, while Ford won for EVs alone. Tesla was in eighth place, though it did get high marks for its charging innovations and GPS navigation.

Brain Implants, Beefing on X, Politics: Is Musk Distracted?

Is Musk too busy to keep a steady stream of attractive models coming? Even before he jumped into politics as co-leader of Trump’s Department of Government Efficiency (DOGE), investors were worried he was overcommitted across his many companies.

Recommended by Our Editors

Here’s how I imagine his day: In the morning, he approves the launch of a SpaceX rocket, and in the afternoon, he instructs the team to implant a Neuralink chip into someone’s brain. Before dinner, he checks on the delivery of Starlink dishes to a new remote island before settling in for an evening of firing government workers and reviewing his ongoing lawsuit against OpenAI. When his private jet is wheels up, he feeds the beast on X with angsty political content and hot takes.

Even if he had more time to dedicate to Tesla product development, making cars might not be enough to satisfy him anymore. He’s already turned his automotive dreams to “solving” self-driving, as he told investors on earnings calls throughout 2024. He put on a cinematic robotaxi launch party in October, and many suspect he’s trying to convince Trump to relax autonomous driving regulations to allow for nationwide robotaxi fleets.

Musk supports Trump despite the president-elect’s plans to eliminate the $7,500 federal EV tax credit, which Tesla advertises prominently on its website as a marketing tool for eligible models. Musk claims that getting rid of the credit would hurt Tesla only “slightly” in the short run but help it in the long run by crippling its rivals. I’m not sure investors would agree after these latest numbers.

Musk’s political involvement has tangentially helped Tesla, boosting its stock by more than 60% since the Nov. 5 presidential election. But Tesla can’t run on hype (or tweets) forever. In 2025, it needs to be more grounded and deliver fresh EV models that appeal to a wider audience.

Get Our Best Stories!

This newsletter may contain advertising, deals, or affiliate links.

By clicking the button, you confirm you are 16+ and agree to our

Terms of Use and

Privacy Policy.

You may unsubscribe from the newsletters at any time.

About Emily Dreibelbis Forlini

Senior Reporter

/cdn.vox-cdn.com/uploads/chorus_asset/file/25810340/ugreen_2.jpg)