As cybercriminals develop increasingly sophisticated techniques, elderly individuals have become prime targets for fraud. Addressing this growing concern, Sanchayan Chakraborty explores how artificial intelligence (AI) and network security innovations are revolutionizing elder fraud prevention. His research highlights cutting-edge security measures that create robust digital defenses tailored for senior citizens.

Advanced Threat Detection: AI as a Digital Guardian

One of the most transformative aspects of AI-driven cybersecurity is its ability to detect threats in real-time. Modern security systems monitor transaction patterns and login behaviors to identify anomalies that could indicate fraudulent activity. By leveraging machine learning, these systems establish unique behavioral baselines for elderly users, ensuring that deviations from normal activity are quickly flagged. This approach not only prevents financial loss but also aids law enforcement in tracking scam networks.

Additionally, these AI systems continuously evolve their detection capabilities through advanced neural networks that analyze vast datasets of known scam patterns. The technology can detect subtle manipulation tactics commonly used against vulnerable populations, automatically implementing safeguards when suspicious patterns emerge. Some platforms now incorporate voice pattern analysis to identify potential impersonation attempts during phone banking, while others utilize natural language processing to scan communications for linguistic markers associated with social engineering attacks.

Behavioral Analysis: Personalizing Security for Seniors

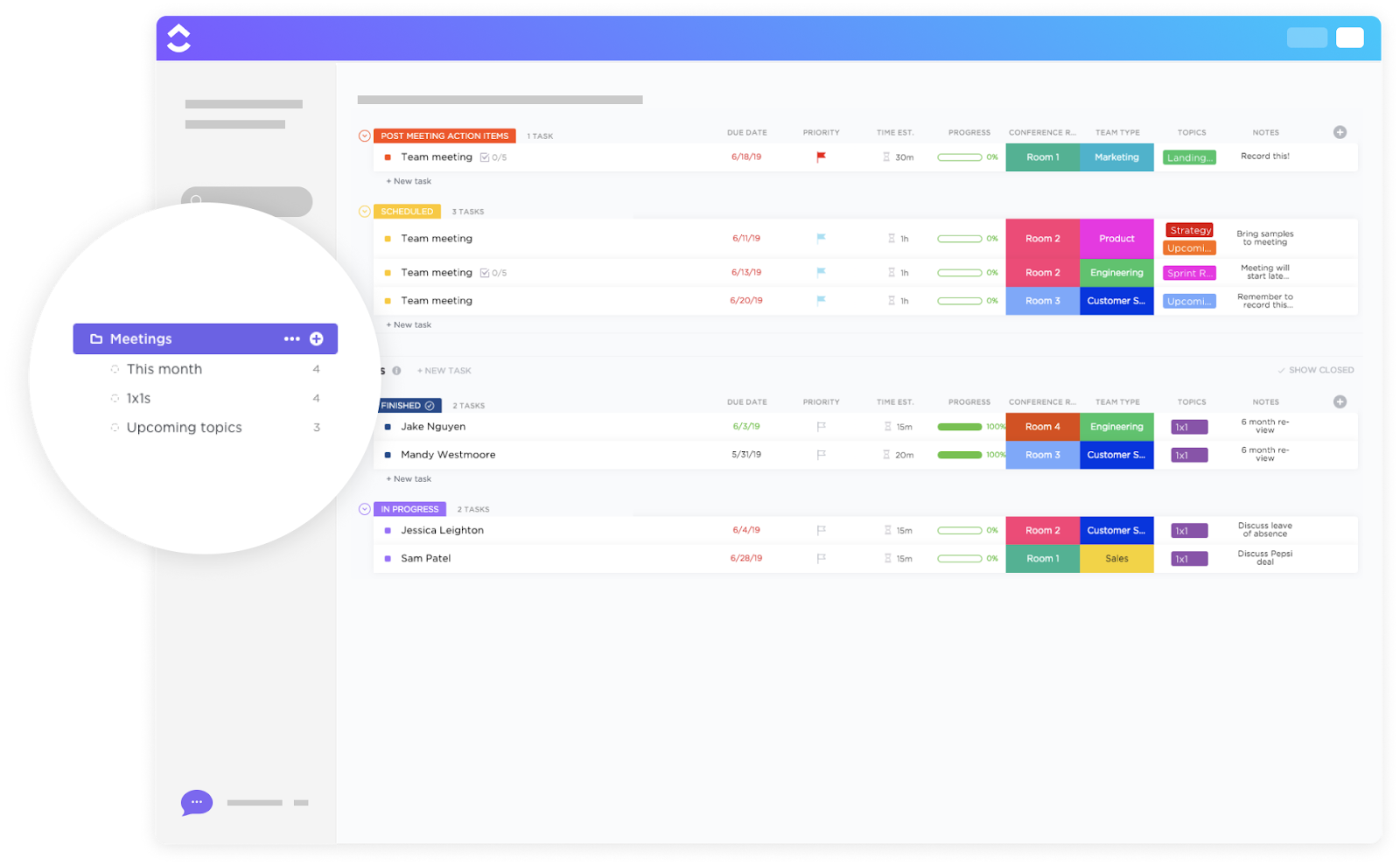

Unlike traditional security measures that apply broad, one-size-fits-all fraud detection, behavioral analysis creates personalized security models. AI continuously observes an individual’s habits, from mouse movements to transaction timing, allowing it to detect even subtle irregularities. By integrating real-time anomaly detection with broader fraud intelligence, these systems significantly reduce false alarms while offering tailored protection for elderly users.

This personalized approach extends to contextual authentication, where AI evaluates multiple risk factors simultaneously before determining security responses. Advanced systems now incorporate seasonal behavior patterns and life event changes, distinguishing between genuine behavior evolution and suspicious activity. Some platforms leverage federated learning to improve protection while maintaining privacy, enabling cross-institutional security collaboration without exposing sensitive data. The technology also adapts intervention methods based on user technology comfort levels, offering simplified security interfaces for less tech-savvy elderly individuals while maintaining robust protection beneath the user-friendly surface.

Enhanced Authentication: Security Without Complexity

A significant challenge in cybersecurity is balancing robust security with user-friendliness, particularly for seniors who may struggle with complex authentication processes. Innovations such as voice biometrics, fingerprint recognition, and stress detection technology have emerged as effective solutions. These systems ensure that authentication remains both accessible and secure, reducing the risks associated with password-based systems while improving fraud detection accuracy.

Scam Call and Message Filtering: Stopping Fraud at the Source

Scam calls and fraudulent messages are among the most common tactics used to exploit seniors. AI-driven call screening systems analyze call metadata, identify fraudulent scripts, and block known scam numbers before they reach potential victims. Additionally, message filtering technologies scan for patterns in phishing attempts, preventing seniors from being exposed to deceptive links and financial scams.

Predictive Fraud Prevention: Anticipating Threats Before They Happen

Predictive fraud prevention represents a shift from reactive to proactive security measures. By analyzing vast datasets of historical fraud patterns, AI can identify emerging scam trends before they become widespread. This allows financial institutions and security systems to implement protective measures preemptively, reducing the risk of elder fraud before individuals are even targeted.

Collaborative Protection Networks: Strengthening Security Through Cooperation

Isolated security measures often fail to address coordinated fraud operations. Collaborative protection networks enable institutions to share fraud intelligence in real-time, allowing AI systems to recognize patterns across multiple organizations. This collective approach significantly enhances the ability to detect and dismantle large-scale fraud campaigns targeting seniors, offering a more comprehensive level of protection.

In conclusion,the integration of AI and network security technologies is reshaping the landscape of elder fraud prevention. By implementing advanced threat detection, behavioral analysis, enhanced authentication, and predictive analytics, cybersecurity solutions are becoming more effective and proactive. As Sanchayan Chakraborty emphasizes, these innovations not only safeguard elderly individuals but also foster a digital environment where security and accessibility coexist. Looking ahead, continued advancements in AI-driven fraud prevention will be crucial in protecting vulnerable populations from evolving cyber threats.