When Anil Atmaramani resumed as Antler’s new partner for Africa in 2024, he was looking to make bets that some of the world’s most disciplined, resilient, and execution-focused founders were on the continent. Now, that bet is live.

Antler, the global investment network that focuses on early-stage investments, has launched and selected the first cohort of its Nigerian accelerator program. In a space crowded with accelerators and pitch competitions, Antler’s proposition is simple: don’t just back startups, create them from scratch. And do it with people who live the problems they’re trying to solve. The firm’s 8-week in-person sprint teaches founders the fundamentals of startup building.

Antler’s first Nigerian cohort saw over 7,500 applications, with only 24—less than 1% —making the final cut. Founders who made it were battle-tested operators with lived experience in fintech, AI, food security, and edtech, according to Lola Masha, a Partner at Antler. Antler will invest $100,000 for a 10% stake in any selected Nigerian companies and double down on a few startups until Series C. Antler did not disclose the selected founders for the cohort at the time of the reporting.

“These aren’t outsiders theorising African problems,” says Masha. “They’ve lived them. And that gives them a sharp edge in execution.”

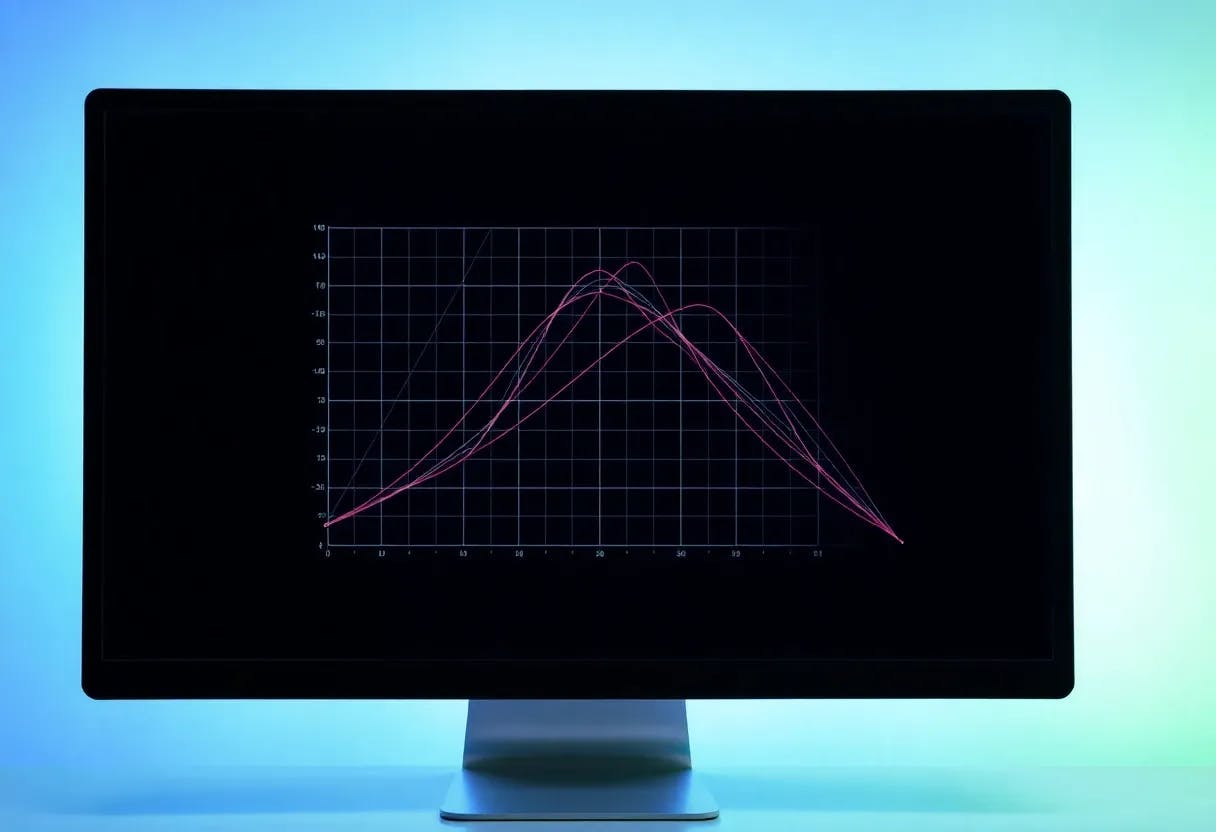

The choice to expand into Lagos wasn’t accidental. Nigeria is Africa’s fourth-largest economy, its biggest consumer market, and arguably its biggest startup laboratory. Lagos, where Anter’s accelerator runs from, ranks highest nationally for startup activity and is among the top 100 globally, with 605 startups and over $261.39 million in total funding as of 2025. 73% of Nigeria’s startups are Lagos-based, especially in fintech, ecommerce, and transport sectors. But it’s also where the margin for error is razor-thin.

“Here, there’s no safety net,” Atmaramani notes. “One misstep and it’s over. That’s exactly why Antler exists: to remove those early barriers.” By providing capital, structure, and hands-on support from day one, Antler gives founders the chance to fail fast, pivot smart, and build with resilience.

While the firm remains sector-agnostic, a common thread runs through its first cohort: “We’re seeing bold ideas across fintech, AI, food security, and edtech sectors where African context isn’t just relevant, it’s a competitive edge. These founders are building solutions that are deeply rooted in local realities, but with clear potential to scale globally.”

“These founders are focused on building profitable, sustainable businesses,” Atmaramani adds. “That maturity at such an early stage is rare.”

From zero to venture in eight weeks

Antler Africa’s accelerator is focused on speed, clarity, and execution. “We bring together top talent from across Africa: operators, domain experts, and repeat founders,” says Atmaramani. “From day one, they’re building, pressure-testing ideas, validating pain points, and chasing signs of traction.”

By week four, founders who haven’t yet formed teams are guided into co-founder pairings based on chemistry and complementary skills. By the end, the top-performing teams—the ones with the clearest signals of execution and product-market resonance—receive $100,000 pre-seed investments.

In short, it’s inception-to-investment in 56 days.

Antler’s venture-building approach is paired with a global edge. The firm operates in over 30 countries and brings the weight of international capital, networks, and insights into each local market. In Nigeria and across Africa, that hybrid model is especially potent.

What Antler looks for and what it doesn’t

Unlike some programs that expect a polished product or pitch-ready startup, Antler’s Nigeria accelerator starts earlier in the funnel. Antler does not require founders to have a company or a co-founder. The company considers “deep domain knowledge, obsession with real pain points, and the ability to move fast,” Atmaramani explains. The firm values “founder–problem fit” over flashy credentials, and “cognitive diversity” across technical and commercial backgrounds.

“What we care about is capacity,” Masha emphasises. “Can this person build something meaningful in Africa and go the distance?”

While Antler’s default investment is pre-seed equity, the firm will also offer tailored debt offerings for portfolio companies entering capital-intensive growth stages.

“Equity isn’t always the right tool,” says Masha. “As companies scale and need working capital or asset financing, we offer debt without compromising ownership too early.”

It’s part of a broader effort to help founders think strategically about their capital stack, particularly in ecosystems where traditional banking remains cautious and early-stage equity is rare.

Applications are currently open for Antler’s second Nigerian cohort and the Kenyan cohort. “You just need the drive to solve real problems and build something that matters,” says Atmaramani. “We’ll back your ambition and help turn it into a venture.”

Mark your calendars! Moonshot by is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot..com