What does it take to build infrastructure that works across fundamentally incompatible blockchain systems?

The decentralized finance sector crossed $100 billion in total value locked during its 2021 peak, only to fragment across dozens of incompatible networks as the market matured. Apex Fusion is attempting to address this fragmentation through a tri-chain architecture that unifies Bitcoin-style UTXO execution, Ethereum-compatible smart contracts, and now extends into Coinbase’s Base network through its newly deployed bAP3X token.

The deployment represents more than a simple bridge connection. By linking its Vector (UTXO), Nexus (EVM Layer 2), and Prime chains with Base’s $4.37 billion Total Value Locked (TVL), Apex Fusion is testing whether different blockchain execution models can interoperate without forcing users to choose between security models, transaction costs, or network effects. The infrastructure provider Skyline executed the deployment using LayerZero’s Omnichain Fungible Token standard, creating bidirectional value flow between architectures that previously required multiple intermediary steps to connect.

With liquidity already live on Aerodrome and QuickSwap, and incentives distributed through Merkl, the question becomes whether technical interoperability translates into the kind of seamless user experience that could reunify DeFi’s fragmented liquidity. If successful, this model suggests a path for the sector to reclaim and exceed its $100 billion peak while maintaining the security and decentralization benefits of multiple underlying architectures.

The Architecture Problem Holding Back DeFi’s Growth

Decentralized finance operates across fundamentally different blockchain execution models, each with distinct security assumptions and transaction mechanisms. Bitcoin and Cardano use UTXO (Unspent Transaction Output) models, where each transaction consumes specific previous outputs and creates new ones, similar to physical cash exchanges. Ethereum and its Layer 2 networks use account-based models, where balances update in place like traditional bank accounts. These aren’t merely technical details but represent different approaches to state management, transaction verification, and security guarantees.

This architectural divide creates real friction for capital movement. A user holding assets on Cardano who wants to access liquidity pools on Base faces multiple conversion steps, each introducing delay, cost, and potential security vulnerabilities. According to Chainalysis research, bridge exploits accounted for $2 billion in stolen funds during 2022, representing the single largest attack vector in DeFi. Users choosing between ecosystems often pick one and stay there, fragmenting liquidity across networks and reducing capital efficiency across the sector.

Apex Fusion’s approach involves running three parallel chains with different execution models rather than forcing all activity through a single architecture. Vector handles UTXO-based transactions, providing the transaction model familiar to Bitcoin and Cardano users. Nexus operates as an EVM-compatible Layer 2, enabling standard Ethereum smart contract deployment. Prime coordinates between these systems. The theory holds that by supporting multiple execution models natively rather than through emulation layers, the system can optimize for each architecture’s strengths while maintaining interoperability.

The Base deployment extends this vision beyond Apex Fusion’s internal architecture. Base processed over $450 million in weekly transactions as of November 2024 and benefits from direct integration with Coinbase’s fiat on-ramps, lowering barriers for retail capital entry. By connecting Apex Fusion’s tri-chain system to Base, the project creates a pathway between Cardano’s UTXO ecosystem and the deep liquidity of Ethereum Layer 2s, with Coinbase serving as a potential retail distribution channel.

Apex Fusion has been systematically addressing these liquidity barriers across multiple fronts. The project recently unlocked USDC liquidity on Cardano through Stargate integration, establishing critical stablecoin rails between ecosystems. The Base deployment represents the next phase of this cross-architecture liquidity strategy.

How Skyline’s Infrastructure Enables Multi-Architecture Interoperability

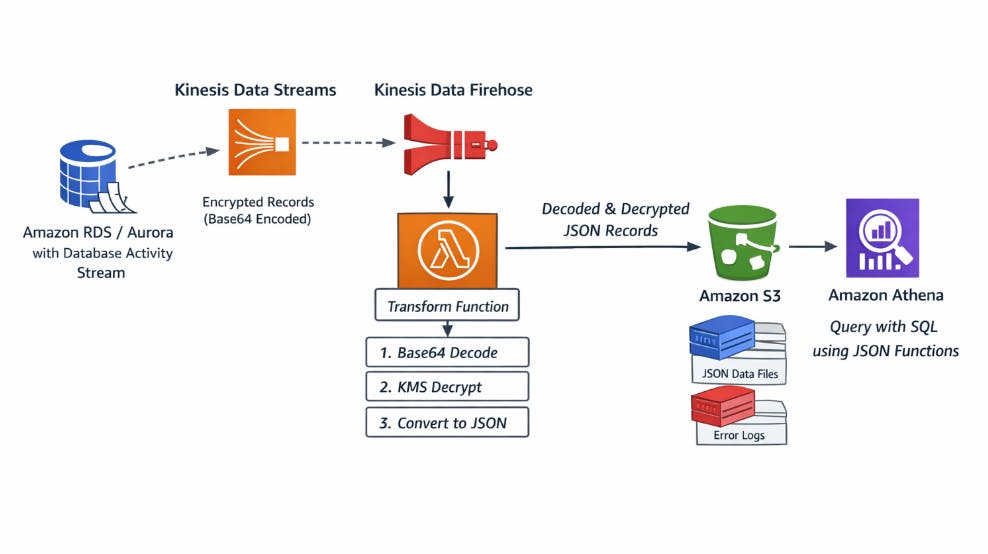

Skyline’s Blade EVM technology functions as a translation layer between blockchain execution environments. When bAP3X moves from Apex Fusion’s UTXO-based Vector chain to Base’s EVM environment, Blade EVM handles conversion between transaction formats and verification methods without requiring users to understand technical differences.

The implementation uses LayerZero’s OFT standard, which burns tokens on the source chain and mints equivalent amounts on the destination chain. This eliminates locked collateral pools that have proven vulnerable to exploits, with LayerZero handling cross-chain messaging through independent oracles and relayers.

Srdjan Vukmirovic, CEO of Skyline, explains,

bAP3X on Base demonstrates what Blade EVM is designed for: seamless, production-ready interoperability across ecosystems. Apex Fusion is pioneering a multi-chain future, and we’re proud to support their expansion with the infrastructure that makes cross-chain mobility simple and secure.

Base-native projects can now deploy into Apex Fusion’s environment and access its connections to Cardano, while Cardano-adjacent protocols gain access to Base’s established DeFi ecosystem. The integrations with Aerodrome, which processes over $8 billion in monthly trading volume, and QuickSwap provide initial liquidity venues.

Christopher Greenwood, COO of the Apex Fusion Foundation, explains,

Bringing AP3X to Base is a major step in the growth of the Apex Fusion ecosystem. Our goal is to empower partners to extend Apex Fusion into new networks, and Skyline has delivered exactly that. Their work expands access to AP3X and strengthens the interoperability that now links Apex Fusion, Cardano, and the wider EVM ecosystem.

The technical implementation addresses a specific gap in existing bridge solutions. Most cross-chain protocols optimize for EVM-to-EVM transfers, treating UTXO chains as secondary concerns. Skyline’s focus on UTXO-EVM translation positions it to serve ecosystems like Cardano that represent substantial value but remain relatively isolated from Ethereum’s DeFi infrastructure.

The Vision for Reunified DeFi Liquidity

Current DeFi fragmentation creates inefficiencies across the ecosystem. According to L2Beat, Ethereum Layer 2s collectively hold over $40 billion in TVL, but this capital rarely moves between networks despite serving similar DeFi functions. Liquidity dispersed across dozens of networks means reduced depth for large trades and capital sitting idle.

Apex Fusion’s multi-architecture approach enables capital to flow based on opportunity rather than being trapped by technical limitations. A user might hold assets in Cardano’s UTXO model for security properties, deploy them into yield strategies on Base for low transaction costs, and settle back to Cardano without navigating multiple bridge interfaces.

The regulatory dimension adds strategic depth. Apex Fusion structured its tokenomics under guidance from Switzerland’s FINMA, providing clear classification frameworks for digital assets. This compliance focus becomes increasingly relevant as traditional financial institutions evaluate blockchain integration.

Base’s connection to Coinbase’s 8 million monthly active users creates distribution advantages. Coinbase’s exchange provides fiat on-ramps in over 100 countries, simplifying the path from traditional finance to DeFi positions. For Apex Fusion, this integration potentially channels retail users who might not otherwise discover Cardano-adjacent protocols.

However, DeFi users have proven resistant to complexity. Apex Fusion’s success depends on abstracting its tri-chain complexity behind interfaces simple enough for retail users while maintaining the architectural benefits that justify the system’s complexity.

Market Context and Competitive Landscape

The cross-chain interoperability sector has attracted substantial development resources. Wormhole focuses on message passing, Axelar provides general message authentication, and Synapse Protocol emphasizes liquidity network optimization.

Apex Fusion’s differentiation centers on UTXO-EVM bridging rather than attempting to serve all cross-chain scenarios. This addresses a market gap because Cardano represents approximately $13 billion in market capitalization but remains relatively isolated from Ethereum’s DeFi ecosystem.

Base’s rapid growth provides tailwinds for early movers. The network surpassed Arbitrum in daily active addresses during multiple periods in 2024, driven by consumer applications and social tokens. The integration with Aerodrome carries strategic importance because the DEX uses vote-escrowed tokenomics that create sticky liquidity persisting beyond incentive programs.

Yet competitive pressures remain intense. LayerZero has become infrastructure for dozens of cross-chain applications, meaning Apex Fusion’s technical foundation isn’t unique. The project’s value proposition depends on execution quality and whether its tri-chain architecture delivers tangible benefits over simpler single-chain approaches.

Final Thoughts

Apex Fusion’s tri-chain architecture represents a genuine attempt to solve DeFi’s fragmentation problem through infrastructure that respects different blockchain execution models. The Base deployment extends this vision into a network with demonstrated user engagement and institutional backing through Coinbase.

The regulatory clarity from FINMA guidance positions Apex Fusion for potential institutional adoption. The early liquidity establishment on Aerodrome and QuickSwap creates foundations for sustained trading activity. The connection to Coinbase’s user base solves distribution problems that purely decentralized networks struggle to address.

However, the vision’s success depends on factors beyond technical execution. Will Cardano’s 4 million wallet users actually bridge capital to Base in meaningful volume? Can Apex Fusion abstract the complexity of managing positions across three different execution models behind interfaces simple enough for mainstream adoption?

The infrastructure exists to reunify fragmented DeFi liquidity across different blockchain architectures. Whether the market wants this reunification enough to overcome the inertia of existing single-chain positions remains unclear. Apex Fusion has built the rails. The next phase determines whether anyone wants to travel on them.

Don’t forget to like and share the story!

:::tip

This author is an independent contributor publishing via our business blogging program. HackerNoon has reviewed the report for quality, but the claims herein belong to the author. #DYO

:::