Make better investment decisions with Simply Wall St’s simple, visual tools that give you a competitive advantage.

AppFolio (APPF) comes into focus as investors look ahead to the January 29 earnings release, with the company expected to report earnings per share of US$1.22, up 32.61% year-on-year.

This earnings spotlight will be followed by a virtual KeyBanc meeting on Jan. 30 on AppFolio, which will provide investors with a series of events that could shape how they think about the company’s real estate software business and its recent share price performance.

Check out our latest analysis for AppFolio.

At a share price of US$219.43, AppFolio has seen a one-month share price decline of 7.53% and a three-month share price decline of 10.54%, even though its three-year total shareholder return of 106.99% is in stark contrast to a 12.24% total shareholder return decline over the past year. This suggests that momentum has cooled recently as attention turns to the upcoming earnings release, the KeyBanc event and the recent board overhaul, including the appointment of Saori Casey.

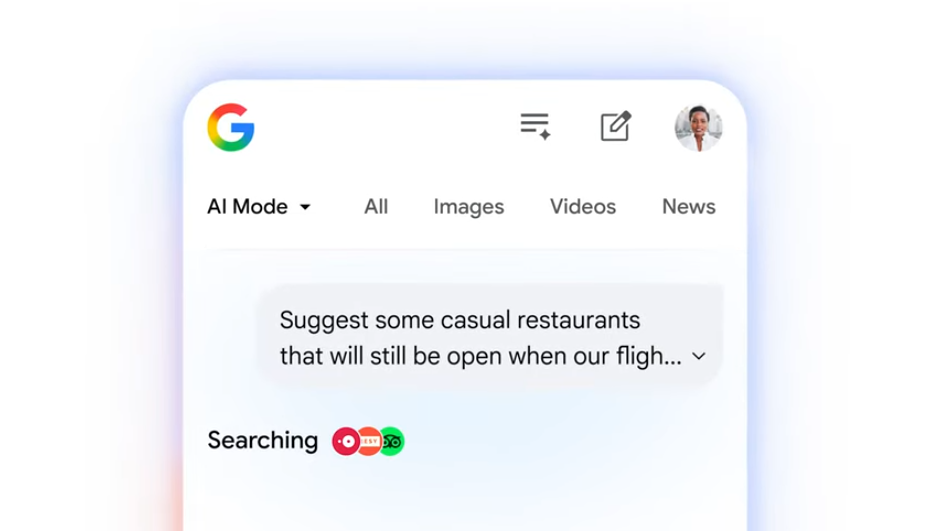

If you’re looking at the broader sector in AppFolio’s real estate software story, this could be a useful time to scan fast-growing tech and AI stocks as a source of other ideas.

With shares having fallen off recent highs but still below the average analyst price target, the real question is whether AppFolio is quietly undervalued here or whether the market is already pricing in future growth?

With AppFolio’s last close at $219.43 and the most followed fair value estimate at $311.83, the current gap between price and story is hard to ignore.

Analysts’ updated price target for AppFolio is slightly lower from around $317 to around $312, as analysts fine-tune fair value, discount rate, growth, margin and forward price-to-earnings assumptions, while still pointing to unchanged fundamentals and multiple growth opportunities highlighted at the recent Investor Day.

Read the full story.

Curious about which revenue trajectory, margin profile and future profit multiples should align to close that gap? The story revolves around a specific mix of growth, profitability, and valuation assumptions that you may or may not agree with. The only way to test your own vision is to see exactly how those moving parts fit together.

Result: Fair value of $311.83 (UNDERVALUE)

Read the story completely and understand what is behind the predictions.

However, if AI investments fall flat, or if regulatory costs around payments and screening rise sharply, the profit and price-earnings assumptions behind that story could quickly be reset.