Updated with corrected guidance and related changes (details below):

Networking company Arista Networks Inc. delivered strong earning results today, but its stock fell after it warned that both its gross margin and operating margin are set to decline on a sequential basis.

The warning, which came after Arista delivered strong first-quarter results, caused the company’s stock to retreat by almost 4% in extended trading.

The cloud networking company reported earnings before certain costs such as stock compensation of 64 cents per share, easily beating the analyst forecast of 56 cents. Revenue for the period rose 27%, to $2 billion, just ahead of the $1.98 billion projection by analysts. Meanwhile, net income came to $813.8 million, up from $637.7 million in the year-ago quarter.

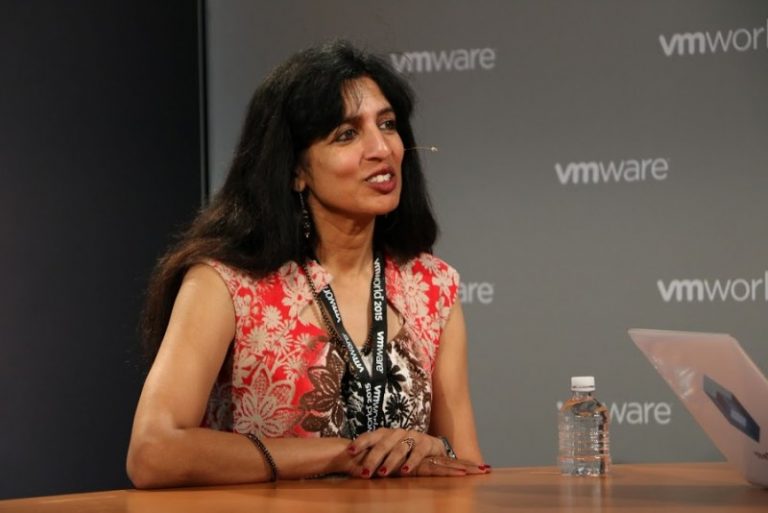

Arista Chairperson and Chief Executive Jayshree Ullal (pictured) said the rise of artificial intelligence and cloud computing continues to drive network transformation. “We surpassed $2 billion in revenue for the first time in Q1 2025 despite the unknowns around tariffs,” she said.

For the current quarter, Arista said it expects to generate $2.1 billion in sales, ahead of Wall Street’s target of $2.03 billion. However, the company also said its gross margin and operating margin numbers are likely to decline in the current quarter on a sequential basis. Gross margin came to 64.1% in the first quarter, while operating margin was 47.8%, but it’s forecasting numbers of just 63% and 46% for the current quarter.

That was likely a disappointment for investors, who were hoping for more after two of Arista’s biggest customers – Meta Platforms Inc. and Microsoft Corp. – said last week they’re doubling down on their commitments to spend billions of dollars on AI infrastructure. The tech giants’ plans had eased concerns that AI spending budgets might be slashed in response to U.S. President Donald Trump’s tariff policies.

Arista has been one of the biggest beneficiaries of the AI boom, as it sells premium networking gear such as switches and routers that facilitate high-speed communications between racks of servers in corporate data centers. AI data centers need this, as the biggest workloads are powered by huge clusters of connected graphics processing units.

During the quarter, Arista strengthened its AI network offerings, adding new capabilities to its EOS Smart AI Suite that aim to improve AI cluster performance and efficiency. The new features included a Cluster Load Balancing tool that helps to maximize AI workload performance with more consistent, low-latency network flows, and CloudVision Universal Network Observability, to aid in troubleshooting AI network workloads.

In addition to its results, Arista’s board of directors said it has approved an additional $1.5 billion in share repurchases.

In the wake of today’s after-hours decline, Arista’s stock has now lost 17% of its value in the year to date.

The original story used an incorrect figure for the company’s guidance, leading to erroneous analysis. News regrets the error.

Photo: News

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU